Global Weight Loss and Diet Management Market Size, Share, Trends & Growth Analysis Report – Segmented By Diet (Food & Beverages and Diet Supplements), Equipment (Fitness Training Equipment and Surgical Equipment), Services and Region – Industry Forecast From 2025 to 2033

Global Weight Loss and Diet Management Market Size

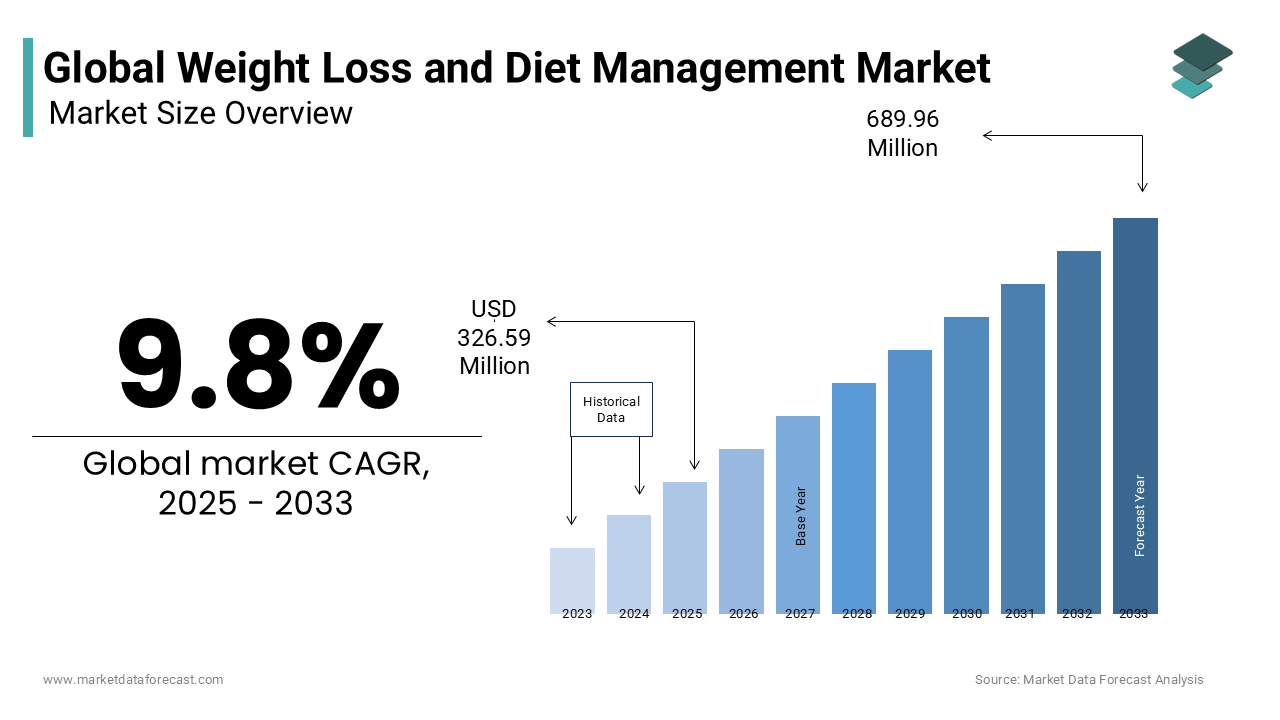

The size of the global weight loss and diet management market was valued at USD 297.44 million in 2024 and is estimated to reach USD 689.96 million by 2033, from USD 326.59 million in 2025, registering a CAGR of 9.8% from 2025 to 2033.

Maintaining weight at a healthy level can be challenging for some people due to the body's complex genetic system. In addition, medical conditions, lifestyle, and diet, among others, are some of the factors that may contribute to weight gain in people.

The awareness among people regarding the adverse health effects of obesity has increased significantly in recent years and resulted in the rapid adoption of weight loss and diet management solutions, and the market has had prominent growth in recent years. This trend is likely to accelerate further during the forecast period and fuel the growth rate of the weight loss and diet management market due to the growing prevalence of obesity, metabolic disorders, and related chronic conditions. As per the statistics published by the World Health Organization (WHO), obesity rates have nearly tripled since 1975 and an estimated more than 1.9 million adults are overweight and 650 million adults are obese worldwide. Considering the scenario, several people, healthcare providers and governments of various countries have been focusing on boosting the adoption of healthier lifestyles and implementing effective weight management strategies to reduce the incidence of obesity-related diseases such as diabetes, cardiovascular ailments, and certain cancers.

Countries that have high rates of obesity and related health issues such as such as the United States, Mexico, and the United Kingdom are the major adopters of weight loss and diet management solutions. In such countries, the adoption of weight loss programs, demand for dietary supplements and the presence of specialized clinics offering personalized diet plans and lifestyle interventions are high, which confirms the trend of the growing adoption of weight loss and diet management services. To address the growing demand for weight loss and diet management services, the market participants have been investing on developing digital health platforms, wearable technologies, and telemedicine solutions to offer remote weight management support and facilitate behavioral change. These scenarios are expected to promote growth in the global weight loss and diet management market during the forecast period.

MARKET DRIVERS

The growth of the global weight loss and diet management market is majorly driven by factors such as the increasing obese population.

As per the World Health Organization, the obese population has doubled since 1980. In 2014, approximately 13% of the world's population was, and more than 600 million adults were obese. Additionally, obesity is linked to more deaths worldwide than underweight. However, obesity is preventable, and diet changes and fitness/physical activities can help reduce extra fat. Severe obesity can be treated through weight loss surgery (Gastric Bypass Surgery and Laparoscopic Sleeve Gastrectomy).

The rising prevalence of obesity among children globally is also contributing to the global weight loss and diet management expansion.

The prevalence of childhood obesity is increasing worldwide due to a lack of physical activity and unhealthy eating habits, which is anticipated to result in the growth of the weight loss and diet management market. Child obesity has increased manifold over the years. According to the Childhood Obesity Foundation, approximately 150 million children are obese, and the number of obese children may alarmingly rise to 206 million by 2025. Cases of childhood obesity due to hormonal problems are sporadic. In children, the total number of hours of inactivity increases as they spend a lot of time watching television and playing computer games. Overweight or obese children are more likely to be obese as adults and are more prone to developing diabetes and cardiovascular disease early. Worldwide, the number of overweight children (under five years) is estimated to be more than 41 million; about half of these children live in Asia. As a result of this trend, the demand for healthier diets is expected to increase worldwide. It is expected to provide significant growth opportunities for actively operative stakeholders in the market for weight-loss products and services.

The growing concern among people regarding health and wellness also fuels the growth of the weight loss and diet management market.

The COVID-19 pandemic taught people the importance of being healthy and increased awareness of weight loss, obesity, and diet. During the COVID-19 pandemic, due to the announced lockdowns and travel bans, physical activity was lacking among people, resulting in weight gain. In addition, factors such as the growing number of bariatric surgeries, rising adoption of weight loss and weight management programs, increasing disposable income in developing economies, sedentary living, and growing government initiatives to educate obese people are anticipated to showcase a favorable impact on the market growth. Furthermore, the increasing number of bariatric surgeries in major markets worldwide is expected to increase the number of bariatric surgery equipment and other products needed for these procedures. The promotional strategies of the market participants, rise in disposable income, affordable cost of surgeries, and an increase in the diabetic population are supporting the growth of the weight loss and diet management market.

MARKET RESTRAINTS

High costs associated with weight loss and diet management are primarily hindering the global market growth.

High costs associated with low-calorie food & beverages, misleading promotional strategies, adverse effects of weight-loss supplements (liver damage), and side effects of weight-loss surgery (dizziness, nausea, bowel obstruction, and diarrhea) are a few of the factors hindering the market growth. Despite less stringent regulatory guidelines, the weight loss and weight management industry faces challenges in adhering to regulatory guidelines for producing and marketing weight-loss products, particularly nutritional supplements. Because of the additional processing required for low-calorie products, low-calorie foods and beverages are generally more expensive than high-calorie foods. Besides, a low-calorie product contains vitamins and minerals, making the diet rich in nutrients. These factors add little value to the weight loss and weight management market, and the increasing adoption of low-cost/no-cost alternative products may slow down the growth of this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Production Technologies, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Kellogg Company, Atkins Nutritionals, Inc., Herbalife Ltd., NutriSystem, Inc., Johnson Health Technology Cd., Ethicon, Inc., Weight Watchers International, Inc., VLCC Healthcare Ltd., eDiets.com, and Olympus Corporation. |

SEGMENTAL ANALYSIS

By Diet Insights

The food & beverages segment held 60.7% of the global market share in 2024 and is expected to grow at a healthy CAGR during the forecast period. The growing consumer awareness of low-calorie foods and beverages in developing countries and the rising population of obese people in the APAC region fuels the segment growth. The rising awareness among people of the importance of maintaining a healthy diet and the expansion of product portfolios by key market players are further promoting the growth of the food and beverages segment in the global market. For instance, approximately 62% of health-conscious consumers are keen on purchasing diet food and beverage products that have low calories.

The diet supplements had a substantial share of the global market in 2024 and is expected to witness the fastest CAGR during the forecast period. The awareness among people of the benefits of dietary supplements and their role in supporting weight management goals has increased exponentially in recent years and led to increased consumption. This trend is predicted to continue during the forecast period and propel the expansion of the dietary supplements segment. For instance, as per the Council for Responsible Nutrition (CRN) survey, an estimated 77% of American adults have been consuming dietary supplements. The rapid adoption of e-commerce platforms to purchase dietary supplements is further boosting the growth of the segment in the global market. The strategic marketing campaigns by the manufacturers and sellers of dietary supplements to promote awareness of the efficacy and safety of dietary supplements are also contributing to the segmental expansion.

By Equipment Insights

The fitness training equipment segment had the major share of 61.9% of the worldwide market in 2024 and is projected to continue witnessing significant growth during the forecast period based on the equipment. In addition, people are getting more health-conscious; therefore, the demand for weight loss supplements and the performance of outside activities have significantly increased. An increase in awareness about the importance of regular exercise for overall well-being and growing disposable income in developing countries is resulting in the adoption of fitness-related products and services and technological advancements such as wearable fitness trackers, smart home gym equipment, and virtual fitness platforms are further supporting the growth of the fitness equipment segment in the global market.

The surgical equipment segment is estimated to witness a steady CAGR during the forecast period in the worldwide market. The growing patient population suffering from severe obesity that is demanding surgical interventions for weight management is driving the growth of the surgical equipment segment. Technological advancements in surgical equipment and an increasing number of collaborations between medical device manufacturers and healthcare providers to develop innovative surgical solutions are further promoting the growth of the surgical equipment segment in the global market.

By Services Insights

The fitness centers segment dominated the market in 2023 and is expected to register a noteworthy CAGR during the forecast period. Y-O-Y growth in the number of gym memberships globally is primarily driving the growth of the fitness centers segment in the worldwide market. The expansion of fitness franchises is further propelling the growth of the fitness centers segment in the global market. For instance, the number of fitness centers globally reached 210,000 in 2023.

The consulting services segment is expected to grow significantly during the forecast period. The segment growth is primarily attributed to the increasing prevalence of obesity, growing health concerns, and rising awareness about maintaining healthcare. The growing number of fitness applications, increasing number of online programs and rising demand for preventing healthcare conditions such as diabetes and heart diseases are propelling the expansion of the consulting services segment in the global market.

REGIONAL ANALYSIS

The North American region is anticipated to hold the largest share of the global market over the forecast period, followed by the European region. Factors such as increased obesity and chronic diseases, increased awareness of nutrition and healthy lifestyles, rising number of gyms, and increased disposable income support this market.

Europe is expected to account for a substantial global market share during the forecast period. Growing disposable income in the European region and increasing concern among people are promoting the focus of people toward weight loss and diet management and driving market growth in this region. In addition, the YOY rise in the obese population further contributes to the market's growth rate. Countries such as France, Italy, Spain, Germany, and the UK are expected to hold the leading share of the EU market during the forecast period.

The Asia Pacific is one of the promising regions in the global market. It is likely to have the highest CAGR over the forecast period. The factors contributing to this growth are the rise in the population of obese people, an increase in the prevalence of diabetics, increasing awareness to take care of personal health, unhealthy lifestyles of people in this region, an increase in disposable income, and a low cost of bariatric surgery in the area.

The Latin American region is anticipated to hit a steady CAGR during the forecast period.

The market in MEA is gaining traction and is expected to register a healthy CAGR in the coming years.

KEY PLAYERS IN THE GLOBAL WEIGHT LOSS AND DIET MANAGEMENT MARKET

Kellogg Company, Atkins Nutritionals, Inc., Herbalife Ltd., NutriSystem, Inc., Johnson Health Technology Co., Ltd., Ethicon, Inc., Weight Watchers International, Inc., VLCC Healthcare Ltd., eDiets.com, and Olympus Corporation are some of the significant companies in the global weight loss and diet management market.

RECENT HAPPENINGS IN THE MARKET

- In December 2023, WW International, Inc., also known as Weight Watchers International, Inc., a U.S.-based company that offers weight loss and maintenance, fitness, and mindset services, announced their plans to launch WeightWatchers Clinic. WeightWatchers Clinic is a telehealth platform for weight management, and doctors can prescribe weight loss drugs to consumers.

- In April 2023, Herbalife Ltd., a renowned player in the global weight loss and diet management market, announced the launch of 106 new wellness products in Q1 2023 across 95 markets.

MARKET SEGMENTATION

This research report on the global weight loss and diet management market is segmented and sub-segmented based on the diet, equipment, services, and region.

By Diet

- Food & Beverages

- Diet Supplements

By Equipment

- Fitness Training Equipment

- Surgical Equipment

- Minimally Invasive/Bariatric Surgical Equipment

- Non-Invasive Surgical Equipment

By Services

- Fitness Centers

- Consulting Services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What region had the leading share in the global weight loss and diet management market in 2023?

North American region led the global weight loss and diet management market in 2023.

Which segment by diet type led the diet management market in 2023?

Based on the diet type, the F&B segment dominated the weight loss and diet management market in 2023.

Who are the key players in the weight loss and diet management market?

Companies playing a key role in the global weight loss and diet management are Kellogg Company, Atkins Nutritionals, Inc., Herbalife Ltd., NutriSystem, Inc., Johnson Health Technology Co., Ltd., Ethicon, Inc., Weight Watchers International, Inc., VLCC Healthcare Ltd., eDiets.com, and Olympus Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]