Global Fitness App Market Size, Share, Trends & Growth Forecast Report By Type (Exercise and Weight Loss, Diet and Nutrition and Activity Tracking), Platform, Device and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Fitness App Market Size

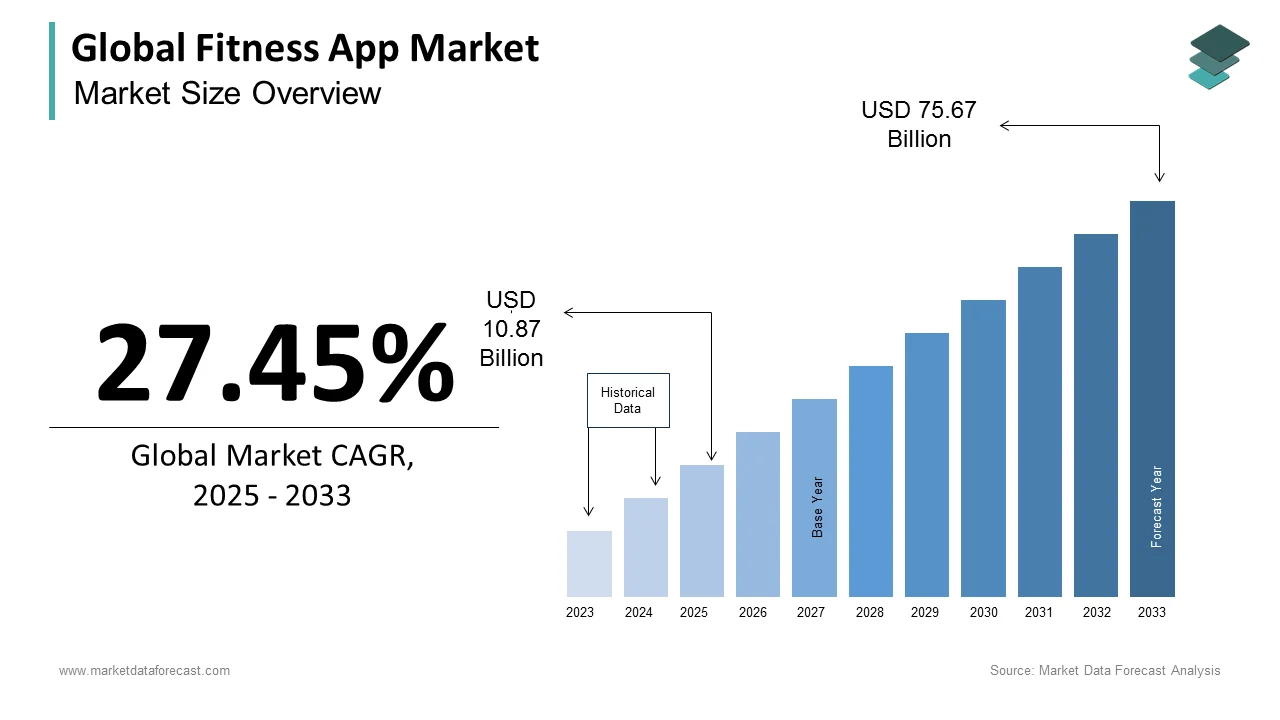

The global fitness app market was worth USD 8.53 billion in 2024 and is anticipated to reach a valuation of USD 75.67 billion by 2033 from USD 10.87 billion in 2025. It is predicted to register a CAGR of 27.45% during the forecast period 2025-2033.

The usage and adoption of fitness apps are rapidly growing in all parts of the world. The growing health consciousness among people, increasing adoption of technological advances in human lives, and growing penetration of the internet and mobiles contribute to the adoption of fitness apps. People can track various health metrics comfortably using these fitness apps. The number of fitness applications that cater to the needs of all kinds of audiences is growing significantly. The developers of these applications have come up with continuous innovations in terms of capabilities and integrations.

The fitness app helps users set fitness goals according to their preferences. These apps are built in a way that allows user to seek fitness goals and avail themselves of progress over their workout sessions. The feasibility of using these apps makes the users focus more on their fitness goals and proper diet. In today’s world, the rising number of chronic diseases is the biggest concern for all people across the world. Irrespective of age, it is highly important to do regular exercise and check the vital signs at regular intervals. Fitness apps can also detect the unusual behavior of vital signs and send signals appropriately, which can save lives. The demand for these apps especially increased in 2020 when people showed interest in maintaining proper health and staying fit due to lockdown restrictions during the pandemic period. Reportedly, over 300 million people use fitness applications across the world with the incorporation of social features into the fitness app. The growing number of smartphone users and increasing awareness of installing fitness applications to monitor regularly are ascribed to bolstering the market's growth rate.

MARKET DRIVERS

The growing aging population is one of the key factors propelling the fitness app market growth.

The population suffering from various chronic diseases is increasing significantly worldwide. People with these diseases must regularly monitor their health and disease management. To such people, fitness apps provide great help by providing a convenient and easy-to-use way to keep track of their health metrics. People can track physical activity levels, calorie intake, and other fitness applications, and these apps further help with providing relevant health recommendations. Out of various chronic diseases, CVDs, cancer, and diabetes are considered the leading diseases. As per WHO, the patient population suffering from CVDs is growing rapidly, and an estimated 17.9 million died of cardiovascular diseases worldwide in 2019. According to the statistics published by the American Cancer Society, an estimated 1.9 million new cancer cases were populated in the United States in 2022. As per the data shared by the American Diabetes Association, 37.3 million Americans have diabetes, which is also 11.3% of the American population. Likewise, the growing number of people suffering from chronic diseases is expected to boost the demand levels for fitness applications. These applications help patients lead a healthy life and are effective for disease management.

The growing usage of fitness apps among the patient population suffering from chronic diseases is accelerating the fitness app market growth.

In addition, increasing adoption of sedentary lifestyles among people, increasing disposable income, and the availability of customized health & fitness applications are predicted to boost the fitness app market growth. Furthermore, the rapid adoption of technological advancements in developing advanced fitness apps is estimated to contribute to the fitness app market growth. In addition, the rising adoption of gamification in the development of fitness apps is anticipated to fuel the market's growth rate.

MARKET RESTRAINTS

Many people notice that some fitness apps do not give accurate information, whereas many people do not find changes in their fitness by using the fitness apps.

This information can directly impede the growth rate of the fitness app market. An increasing number of people showing a preference to go to gyms rather than online applications is likely to impede the growth rate of the market. Along with this, the personal data in the application can easily be hacked using various software, where the concern arising over privacy is likely to hinder the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Platform, Device, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

MyFitnessPal Inc., Motorola Mobility LLC, Azumio, WillowTree, Inc., Under Armour, Dom and Tom, Grandapps, Fitbit, ASICS, WillowTree, Inc., and Appster |

SEGMENTAL ANALYSIS

By App Type Insights

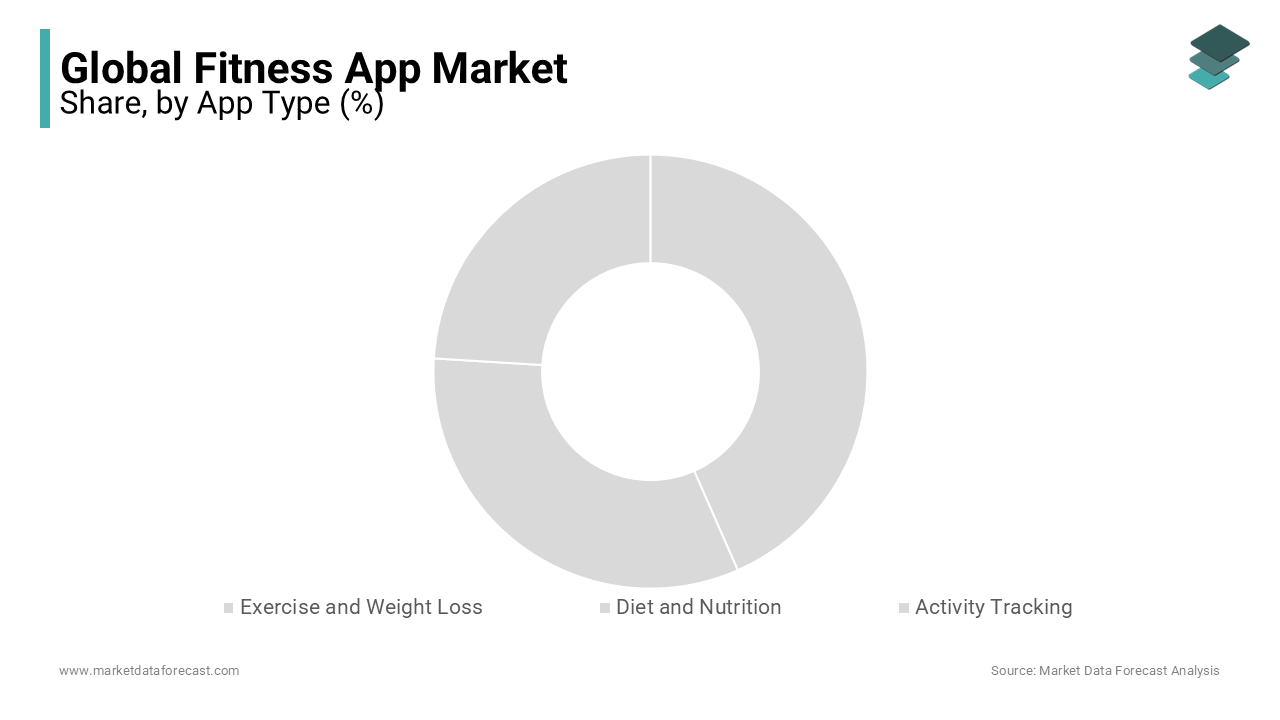

The exercise and weight loss segment held more than 50% of the fitness app market share in 2024, and the domination of the segment is likely to continue during the forecast period owing to the growing awareness levels among people regarding these applications. In addition, the advantages of applications such as customized workout plans, diet charts, and tracking systems are another major factor fuelling the adoption and boosting segmental growth.

The diet and nutrition apps segment captured a considerable share of the global market in 2024 and is expected to witness a promising CAGR during the forecast period. People's understanding levels regarding the significance of a balanced diet in leading a healthy life have improved considerably in recent years, which has also resulted in segmental growth. These applications assist users with a wide range of information, such as healthy recipes, meal plans, and nutrition information; consumers can make their own food choices with the provided information.

The activity tracking segment is estimated to register a healthy CAGR during the forecast period due to its limited reach, as people are not so concerned about their activities management.

By Platform Insights

The Android segment led the market and is expected to hold the most significant share of the global fitness app market during the forecast period. The larger user base for Android devices is one key factor propelling the segmental growth.

The iOS segment captured a considerable share of the global market in 2024 and is anticipated to register a notable CAGR during the forecast period. The iOS devices are known for their high-quality user experience and strict app store guidelines.

By Device Insights

The smartphone segment accounted for the largest share of the fitness app market in 2024 and is also expected to grow at the fastest CAGR over the forecast period. The growing usage of smartphones and rising penetration of smartphones in underdeveloped and developing countries propel segmental growth. The trend of developing fitness applications compatible with smartphone features, such as video calls, alarms, and others, can provide a better user experience. Factors like these are expected to be the cause for the domination of the smartphone segment over the others.

The tablets segment had the second-largest share of the fitness apps market in 2024. Fitness apps on tablets work similarly to smartphones and are compatible. During the forecast period, the tablets segment is anticipated to witness a noteworthy CAGR and hold a considerable share of the worldwide market.

The wearable devices segment is expected to grow rapidly during the forecast period owing to the increasing adoption of wearable fitness devices. The trend of using wearable fitness devices among people to track their health metrics such as heart rate, pulse rate, BP, and others has been accelerating over the last few years, which requires compatible fitness applications to view the related data on mobile devices. In addition, some wearable fitness devices also report when they detect any unusual activity in the body, such as boosting the trust levels of devices among people, leading to increased adoption.

REGIONAL ANALYSIS

North America had the largest global market share in 2024, and the region's domination is expected to continue during the forecast period. Factors such as increasing awareness among the North American population regarding health and fitness and increasing dependency on technology for solutions propel the fitness app market growth in North America. In addition, the growing number of fitness applications entering the market, increasing efforts from market participants to stay up to date with consumer preferences, and promoting the efficiency and effectiveness of fitness applications are fuelling the growth rate of the North American market. Furthermore, the fitness app market in North America has experienced a spike in application developments and usage due to the recent COVID-19 pandemic. People have limited access to gyms and fitness centers during the COVID-19 pandemic, so many have shown interest in using fitness apps to stay healthy and fit.

Europe accounted for the second-largest worldwide market share in 2024 and is forecasted to showcase a healthy CAGR during the forecast period. The growing usage of smartphones and wearable devices majorly drives the growth of the fitness app market in the European region. In addition, the rising demand for easy and convenient fitness solutions from the European population is another notable factor contributing to the regional market growth. The U.K. fitness app market is one of the hot spots in the European region as more and more people have been adopting online fitness solutions.

The trend of fitness apps is picking up pace in the Asia-Pacific region and the market in this region is anticipated to grow at the highest CAGR during the forecast period. China and India are countries with most of the populations, and the awareness among people to stay healthy and fit is growing, which is expected to favor regional market growth.

During the forecast period, Latin America is expected to occupy a considerable share of the worldwide market, owing to the rising awareness among people regarding the benefits associated with fitness apps.

The market in the Middle East and Africa is expected to grow at a moderate CAGR in the coming years.

KEY MARKET PLAYERS

MyFitnessPal Inc., Motorola Mobility LLC, Azumio, WillowTree, Inc., Under Armour, Dom and Tom, Grandapps, Fitbit, ASICS, WillowTree, Inc., and Appster are some of the major companies leading the global fitness app market.

MARKET RECENT HAPPENINGS

- In February 2023, Supernatural, a VR Fitness App company, joined hands with Oculus Studios.

- In February 2023, Zwift, a company that operates in the space of at-home fitness apps, raised USD 620 million from investors Amazon's Alex Fund, KKR and Co., and Permira Holdings.

MARKET SEGMENTATION

This market research report on the global fitness app market has been segmented and sub-segmented based on the type, platform, device, and region.

By App Type

- Exercise and Weight Loss

- Diet and Nutrition

- Activity Tracking

By Platform

- Android

- iOS

- Others

By Device

- Smartphones

- Tablets

- Wearable Devices

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the global fitness app market worth in 2024?

The global fitness app market size was worth USD 8.53 billion in 2024.

What is the anticipated growth rate of the fitness app market for the coming future?

The global fitness app market is estimated to be growing at a CAGR of 27.45% from 2025 to 2033.

Which region will lead the fitness app market in the future?

The North American region is predicted to lead the fitness app market in the coming future and Asia-Pacific is expected to grow among all the regions.

Who are the major players in the fitness app market?

Companies playing a key role in the global fitness app market are MyFitnessPal Inc., Motorola Mobility LLC, Azumio, WillowTree, Inc., Under Armour, Dom and Tom, Grandapps, Fitbit, ASICS, WillowTree, Inc., and Appster.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com