Global Commercial Vacuum Sealer Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Chamber Vacuum Sealer, External Vacuum Sealer), Usability, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2025 to 2033)

Global Commercial Vacuum Sealer Market Size

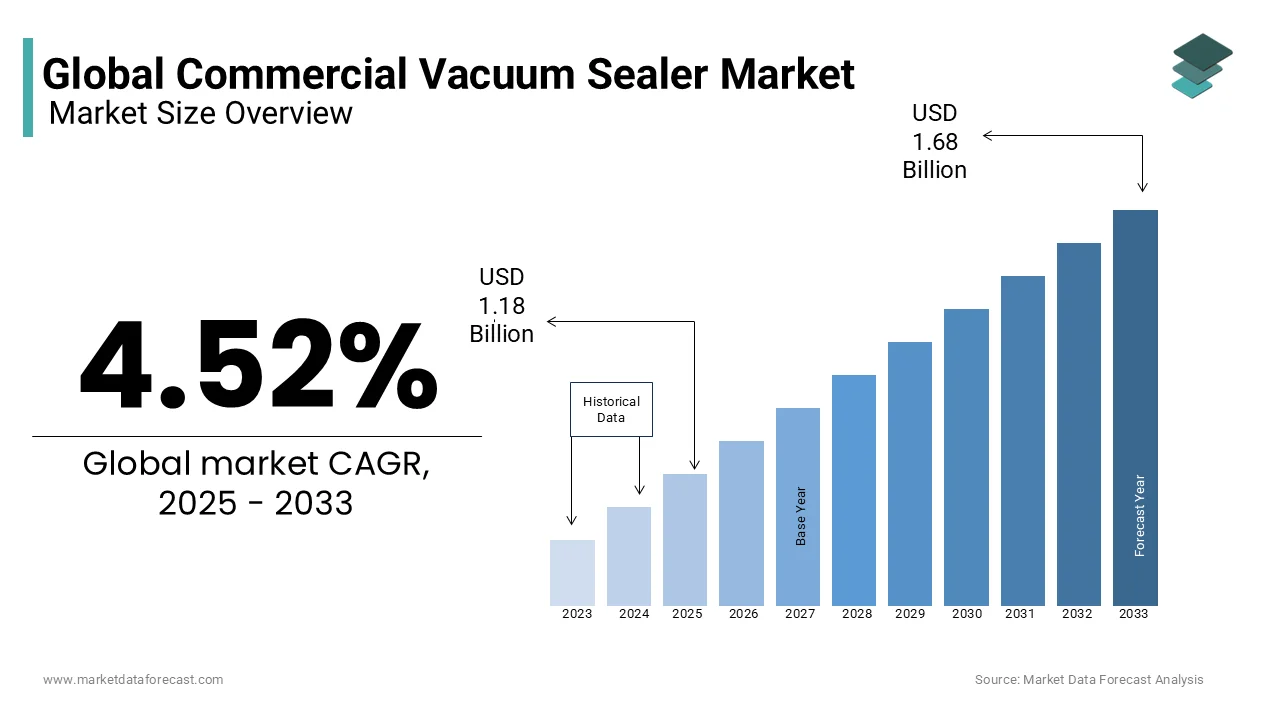

The global commercial vacuum sealer market size was valued at USD 1.13 billion in 2024 and the global market size is expected to reach USD 1.68 billion by 2033 from USD 1.18 billion in 2025. The market is growing at a CAGR of 4.52% during the forecast period.

The Commercial Vacuum Sealer Market refers to the segment of industrial packaging equipment designed to remove air from a package before sealing it, primarily used in food processing, pharmaceuticals, hospitality, and logistics industries. These machines help extend product shelf life, prevent spoilage, and maintain hygiene standards, making them indispensable for businesses that prioritize long-term storage and transport efficiency.

Technological advancements, including automated and multi-chamber vacuum sealers, are increasingly being integrated into production lines, particularly in Japan and South Korea.

MARKET DRIVERS

Surge in Demand from the Food Processing Industry

One of the primary drivers of the Commercial Vacuum Sealer Market is the exponential growth of the global food processing industry, which demands efficient packaging solutions to ensure product longevity and safety. As per the Food and Agriculture Organization (FAO), approximately one-third of all food produced globally is wasted annually, amounting to roughly 1.3 billion tons. This has prompted food processors to adopt vacuum sealing technology to reduce spoilage and enhance shelf stability.

In the Asia-Pacific region, countries like Thailand, Vietnam, and Indonesia have seen a sharp increase in processed food exports. According to the ASEAN Secretariat, the total value of processed food exports from ASEAN nations reached USD 46 billion in 2023, a 14% increase from 2022. This surge directly correlates with increased procurement of commercial vacuum sealers by food manufacturers aiming to meet international quality standards and export requirements.

Moreover, consumer preferences are shifting toward ready-to-eat and minimally processed foods, especially in urban centers across India and China. This behavioral shift necessitates robust packaging infrastructure, where vacuum sealers play a critical role in maintaining freshness and preventing microbial contamination.

In addition, regulatory bodies are tightening hygiene norms, compelling food producers to invest in high-efficiency packaging equipment. For instance, the Food Safety and Standards Authority of India (FSSAI) revised packaging guidelines in 2023, mandating enhanced protective measures for all packaged food products.

Expansion of E-commerce and Cold Chain Logistics

Expansion of E-commerce and Cold Chain Logistics

A further catalyst behind the growth of the Commercial Vacuum Sealer Market is the rapid expansion of e-commerce and cold chain logistics, particularly in emerging markets. This unprecedented growth has intensified the demand for reliable packaging solutions that can preserve product integrity during transit.

Vacuum sealing plays a crucial role in ensuring that perishable goods—especially seafood, meat, and dairy—remain fresh during extended delivery periods. In China, JD.com and Alibaba reported a 22% year-on-year increase in chilled and frozen food deliveries in 2023, according to their annual sustainability report. To support this trend, logistics companies are investing heavily in vacuum sealing technology to minimize spoilage and reduce returns.

Cold chain infrastructure development is also accelerating across Southeast Asia. These machines not only protect against oxidation and moisture but also optimize storage space, enhancing overall supply chain efficiency.

Furthermore, the rise of direct-to-consumer (D2C) models in the food and pharma sectors has created an urgent need for scalable packaging solutions. This trend underscores the integral role of commercial vacuum sealers in supporting modern logistics ecosystems.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

A significant restraint in the Commercial Vacuum Sealer Market is the high initial capital required for purchasing and installing advanced vacuum sealing systems, particularly among small and medium-sized enterprises (SMEs).

Moreover, maintenance and operational costs add to the burden. Regular servicing, replacement of seals, and energy consumption contribute to ongoing expenses. This becomes a concern for companies operating under tight margins, especially in price-sensitive markets like India and Bangladesh.

Apart from these, training employees to operate advanced vacuum sealing systems requires time and investment. A report from Deloitte indicates that workforce retraining for new packaging technologies can increase operational costs by up to 15%. These cumulative financial pressures deter many smaller players from upgrading their packaging infrastructure, thereby limiting market penetration of high-end vacuum sealers.

Also, access to financing remains a hurdle. This further exacerbates the issue of affordability and slows down the adoption rate of commercial vacuum sealing equipment.

Regulatory and Environmental Compliance Challenges

Regulatory scrutiny and environmental compliance issues pose another major restraint to the Commercial Vacuum Sealer Market. Governments worldwide are imposing stricter regulations on plastic usage and carbon emissions, impacting how packaging equipment is manufactured and operated. For example, the European Environment Agency reports that the EU’s Single-Use Plastics Directive has led to a reduction in plastic-based packaging materials since its implementation in 2021. Although this applies more directly to Europe, similar trends are emerging in Asia, particularly in Singapore and South Korea.

In response, vacuum sealer manufacturers must adapt their products to accommodate biodegradable or recyclable films, which often require different sealing parameters. This increases R&D expenditures. According to McKinsey & Company, companies in the packaging industry spent nearly USD 1.2 billion collectively in 2023 on sustainable material innovation, adding pressure on manufacturers to redesign existing vacuum sealing systems without compromising performance.

Moreover, energy efficiency standards are becoming more stringent. In Japan, the Ministry of Economy, Trade and Industry (METI) introduced updated energy-saving benchmarks for industrial machinery in 2023, requiring vacuum sealers to meet specific power consumption thresholds. Compliance with such standards increases production complexity and costs for manufacturers.

In addition, waste management protocols for vacuum-sealed packaging are evolving. In India, the Plastic Waste Management Rules now mandate that all industrial packaging be labeled with recyclability information, increasing administrative burdens for users of vacuum sealing systems. These regulatory dynamics, while environmentally necessary, act as a drag on market growth by complicating operations and raising costs.

MARKET OPPORTUNITIES

Integration with Smart Manufacturing and IoT Technologies

The most promising opportunities in the Commercial Vacuum Sealer Market lies in the integration of smart manufacturing and Internet of Things (IoT) technologies. As industries move toward digitization, vacuum sealing equipment is increasingly being embedded with sensors, cloud connectivity, and predictive maintenance capabilities.

Manufacturers are now offering vacuum sealers equipped with real-time monitoring systems that allow remote diagnostics and performance tracking. Such innovations improve operational efficiency and reduce downtime, making them highly attractive to large-scale producers.

In Asia, companies like Panasonic and Sharp have launched IoT-enabled vacuum sealing systems tailored for commercial kitchens and food processing plants. According to Nikkei Asia, Japanese food manufacturers using these systems reported a 25% improvement in packaging line productivity within six months of deployment. Similarly, Chinese firms are leveraging AI-powered vision systems to detect packaging defects in real time, reducing waste and improving compliance.

The integration of vacuum sealers into broader smart factory ecosystems also aligns with Industry 4.0 initiatives. This presents a substantial opportunity for vacuum sealer vendors to offer connected, data-driven solutions that enhance traceability, reduce energy consumption, and support predictive maintenance—thereby strengthening their market position.

Growth in Plant-Based and Alternative Protein Markets

The burgeoning plant-based and alternative protein market is creating a new wave of demand for commercial vacuum sealing solutions. With rising health consciousness and environmental concerns, consumers are increasingly shifting towards plant-based meats, lab-grown proteins, and insect-based food products.

Unlike traditional meat products, alternative proteins often have unique preservation needs due to differences in texture, moisture content, and susceptibility to oxidation. Vacuum sealing helps maintain the structural integrity and freshness of these products during storage and transport. For instance, Beyond Meat and Impossible Foods both rely heavily on vacuum packaging to extend the shelf life of their plant-based burgers, which are often shipped internationally.

In Asia, startups like Next Gen Foods (Singapore) and GoodDot (India) are scaling production capacities, leading to increased procurement of commercial vacuum sealers. According to the Singapore Economic Development Board, investments in alternative protein startups in the country surged significantly in 2023, with packaging infrastructure forming a critical part of their supply chain strategy.

In addition, government-backed initiatives are promoting alternative proteins. The combination of consumer preference shifts and policy support makes the alternative protein sector a strong growth avenue for the Commercial Vacuum Sealer Market.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

A major challenge currently facing the Commercial Vacuum Sealer Market is persistent supply chain disruptions and shortages of critical components, particularly semiconductors and industrial sensors. The global semiconductor shortage, exacerbated by geopolitical tensions and logistical bottlenecks, has significantly impacted the production timelines of industrial equipment. According to Gartner, in 2023, 75% of industrial equipment manufacturers experienced delays of up to 12 weeks due to unavailability of microchips and electronic control units.

This situation has been especially acute in Asia, where countries like Malaysia and Vietnam serve as key manufacturing hubs for electronic components. Factory shutdowns and labor shortages during the pandemic disrupted local supply chains, causing ripple effects across the vacuum sealer industry. As per the Malaysian Investment Development Authority (MIDA), semiconductor output declined in Q1 2023 compared to the previous year, affecting downstream manufacturing sectors including packaging equipment.

Moreover, inflationary pressures have driven up the cost of raw materials such as stainless steel, aluminum, and engineering plastics, which are essential for vacuum sealer construction. The World Bank reported that global steel prices increased, directly impacting the pricing of commercial vacuum sealing machines. This has made it difficult for manufacturers to maintain profit margins while keeping products affordable for end-users.

Logistical constraints are another pain point. These challenges collectively slow down the production and delivery cycles of vacuum sealers, hampering market expansion and delaying adoption in key industries.

Technological Complexity and Skilled Labor Shortage

Another pressing challenge in the Commercial Vacuum Sealer Market is the technological complexity of modern systems and the concurrent shortage of skilled labor to operate and maintain them. As vacuum sealing equipment becomes more sophisticated—with features like programmable logic controllers (PLCs), touchscreen interfaces, and IoT integration—the demand for technically proficient operators has surged.

According to the International Labour Organization (ILO), there is a growing skills gap in the manufacturing sector across Asia, particularly in countries like India and Indonesia. In India, as per the National Skill Development Corporation, only 4.7% of the workforce in the food processing industry had formal training in advanced packaging technologies in 2023. This lack of expertise leads to inefficient machine utilization and increased downtime.

Furthermore, the integration of AI and automation into vacuum sealing systems requires specialized knowledge in software configuration and data analysis. As per a study by PwC, 68% of industrial equipment buyers in Asia cited operator readiness as a major obstacle to adopting smart machinery. Many small-scale food processors and pharma firms struggle to find personnel capable of managing these advanced systems effectively.

Training programs remain limited, especially in rural and semi-urban areas where much of the food processing activity occurs. Without adequate training infrastructure, the adoption of next-generation vacuum sealers will continue to lag behind technological advancements, posing a significant barrier to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.52% |

|

Segments Covered |

By Type, Usability, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Henkelman, Henkovac, Sammic, VacMaster, ZeroPak, Accu-Seal SencorpWhite, Berkel, FoodSaver, Star Universal, UltraSource, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The chamber vacuum sealer segment grabbed the maximum share of the global commercial vacuum sealer market, accounting for 58.4% of total market revenue in 2024. This dominance is primarily driven by the high efficiency and superior performance offered by chamber vacuum sealers, particularly in industrial settings where consistent sealing quality and large-volume processing are essential.

One key factor behind the dominance of this segment is the increasing adoption of chamber vacuum sealers in food processing plants. According to the Food Processing Ministry of India, over 60% of large-scale food packaging units in the country have transitioned to chamber vacuum systems due to their ability to handle multiple product types simultaneously while maintaining airtight integrity. Moreover, these machines offer better moisture control, which is critical for preserving perishable goods like seafood and dairy products.

Another driving factor is the growing demand from the pharmaceutical industry. The rise in cold-chain logistics and export-oriented pharma production has further solidified the position of chamber vacuum sealers as the preferred choice across regulated industries.

The external vacuum sealer segment is projected to grow at the fastest CAGR of 9.7%. This rapid growth is attributed to the rising demand from small and medium-sized enterprises (SMEs) that require cost-effective and flexible packaging solutions without the need for large capital investments.

One of the primary factors fueling this growth is the surge in direct-to-consumer (D2C) food businesses. These machines are ideal for startups and niche producers who prioritize portability and minimal setup requirements.

Additionally, advancements in technology have made external vacuum sealers more efficient and durable. For instance, Anova Culinary introduced an IoT-enabled external vacuum sealer in 2023 that allows users to monitor vacuum pressure and cycle times via smartphone apps. Such innovations are attracting a broader customer base, including gourmet food producers and online retailers, thereby accelerating the adoption rate of this segment.

By Usability Insights

Floor standing vacuum sealers were the top performing usability-based segment, representing 63.3% of the global market share in 2024. These machines are predominantly used in large manufacturing and packaging facilities due to their high throughput capacity and durability.

A major driver of this segment's dominance is the expansion of centralized food processing units, especially in North America and Europe. These machines can process hundreds of packages per hour, making them indispensable for mass production lines.

Moreover, the pharmaceutical and chemical sectors are increasingly relying on floor-standing models for bulk packaging needs. Their compatibility with GMP-certified environments and ability to integrate seamlessly into automated packaging lines further reinforce their market leadership.

Countertop vacuum sealers are anticipated to grow at the highest CAGR of 11.2% during the forecast period. This rapid growth stems from the rising adoption among small-scale food producers, restaurants, and specialty food stores that require compact yet efficient packaging solutions.

One of the leading drivers is the proliferation of microbreweries and artisanal food businesses. These machines offer flexibility in usage without requiring significant infrastructure changes.

Another key factor is the growing popularity of meal prep services and boutique catering businesses. The affordability and space-saving design of these devices make them ideal for urban kitchens and pop-up food ventures, contributing significantly to their accelerated adoption.

REGIONAL ANALYSIS

North America

North America remained the largest regional contributor to the global commercial vacuum sealer market, holding 28.3% of total market revenue in 2024. The United States leads this region’s growth due to its well-established food processing industry and stringent food safety regulations. This regulatory requirement has spurred widespread adoption of commercial vacuum sealers across meat, seafood, and ready-to-eat food manufacturers.

In addition, the presence of major equipment manufacturers such as Weston Pro and Vacuvin has strengthened the domestic supply chain. With rising health awareness and a preference for longer-lasting packaged foods, North America continues to dominate the global landscape.

Europe – Second-Largest Market with ~22% Share

Europe – Second-Largest Market with ~22% Share

Europe is steadily moving ahead in the global commercial vacuum sealer market , driven largely by strong demand from Germany, France, and the Netherlands, according to Statista. The region benefits from advanced food safety protocols and a robust cold chain infrastructure.

Germany, in particular, is a key player, contributing nearly 35% of Europe’s vacuum sealer demand. France has also witnessed a shift toward sustainable packaging, with vacuum sealers being adapted to work with biodegradable films. These developments ensure Europe’s continued prominence in the commercial vacuum sealer market.

Asia Pacific – Fastest-Growing Region with ~20% Market Share

Asia Pacific is growing at the fastest pace, driven by countries like China, India, and Japan. The region is expected to witness a CAGR of 10.5% through 2033, outpacing other regions due to rapid industrialization and changing consumer behavior.

China remains the largest market within APAC. This necessitates advanced packaging technologies to meet international quality benchmarks.

India’s food processing sector is expanding rapidly, with the government aiming to double its contribution to GDP by 2030. Coupled with rising e-commerce activity, these factors are propelling the adoption of commercial vacuum sealers across APAC.

Latin America – Emerging Market with ~10% Share

Latin America – Emerging Market with ~10% Share

Latin America is emerging commercial vacuum sealer market , with Brazil and Mexico emerging as key players. Brazil, in particular, is leveraging vacuum sealing to enhance the shelf life of beef and poultry exports. The Brazilian Association of Animal Protein (ABPA) reported that the country exported over 2.3 million tons of chicken in 2023, with vacuum packaging playing a crucial role in maintaining product freshness during long-haul transport.

Mexico has also seen a rise in foreign investment in food processing zones, particularly near U.S. borders. These trends indicate growing potential for the commercial vacuum sealer market in Latin America.

Middle East and Africa –

Middle East and Africa –

The Middle East and Africa collectively hold a notable share of the global commercial vacuum sealer market, with Saudi Arabia and South Africa leading adoption rates. In Saudi Arabia, the Vision 2030 initiative includes strengthening food security and reducing reliance on imports. South Africa, on the other hand, is focusing on enhancing its cold chain logistics network. While still an emerging market, MEA presents promising opportunities for vacuum sealer vendors targeting niche export markets and urban food hubs.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the global commercial vacuum sealer market are Henkelman, Henkovac, Sammic, VacMaster, ZeroPak, Accu-Seal SencorpWhite, Berkel, FoodSaver, Star Universal, UltraSource, and others.

The competition in the Commercial Vacuum Sealer Market is characterized by a mix of established global players and emerging regional manufacturers striving to capture market share through differentiation and innovation. While dominant companies leverage their extensive R&D capabilities, global distribution networks, and brand reputation to maintain leadership positions, smaller firms are increasingly focusing on niche applications and cost-effective solutions to gain traction. Companies are differentiating themselves by offering customizable vacuum sealing systems that cater to specific industry verticals such as food processing, pharmaceuticals, and logistics. Additionally, customer support, after-sales service, and training programs have become critical differentiators in a market where technical expertise is essential for optimal machine utilization. As demand continues to evolve across regions, competitive pressures are intensifying, prompting firms to explore strategic mergers, technology licensing, and localized manufacturing to strengthen their foothold and respond more effectively to dynamic market conditions.

TOP PLAYERS IN THE MARKET

One of the leading players in the global commercial vacuum sealer market is MULTIVAC SE & Co. KG. Headquartered in Germany, MULTIVAC is renowned for its comprehensive range of packaging solutions tailored for food, pharmaceuticals, and industrial applications. The company has consistently focused on innovation, offering advanced chamber and external vacuum sealers that integrate seamlessly into automated production lines. Their commitment to sustainability and digitalization has positioned them as a trusted partner for large-scale manufacturers seeking reliable and efficient packaging systems.

Another key player is Illinois Tool Works Inc. (ITW) , an American multinational corporation with a strong presence across various industrial sectors. Through its Food Equipment segment, ITW delivers high-performance vacuum sealing technologies designed for demanding commercial environments. The company's emphasis on durability, precision, and after-sales service has made its products popular among food processors and logistics providers globally. ITW’s continuous investment in R&D and strategic acquisitions has enabled it to maintain a competitive edge in the market.

Sealed Air Corporation is also a dominant force in the commercial vacuum sealer industry. Known for its Cryovac brand, Sealed Air offers a wide array of vacuum packaging systems aimed at extending product shelf life and reducing food waste. With a global distribution network and a focus on customized packaging solutions, the company plays a crucial role in shaping industry standards. Sealed Air’s integration of smart packaging technologies and sustainable materials further reinforces its leadership position in the sector.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

TOP STRATEGIES USED BY KEY MARKET PLAYERS

A major strategy adopted by key players in the Commercial Vacuum Sealer Market is product innovation and technological advancement. Companies are continuously investing in R&D to develop smart, energy-efficient, and fully automated vacuum sealing systems that meet evolving industry demands. Integration of IoT-enabled features allows real-time monitoring and predictive maintenance, enhancing operational efficiency for end-users.

Another prominent strategy is strategic partnerships and collaborations . Leading manufacturers are forming alliances with packaging material suppliers, logistics firms, and software developers to offer integrated solutions. These collaborations help in expanding product capabilities and ensuring compatibility with diverse supply chain requirements, thereby strengthening customer relationships.

Lastly, market expansion through regional diversification is being actively pursued. Companies are focusing on emerging markets in Asia-Pacific, Latin America, and Africa by setting up local manufacturing units, distribution centers, and service hubs. This approach enables them to cater to localized needs while reducing logistical costs and improving response times to customer demands.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, MULTIVAC launched a new line of fully automated chamber vacuum sealers equipped with AI-driven diagnostics, enhancing performance tracking and reducing downtime for large-scale food producers.

- In August 2023, Sealed Air Corporation expanded its manufacturing facility in Singapore to better serve the growing demand from the Asia-Pacific region, particularly in food export and cold chain logistics.

- In March 2024, Illinois Tool Works Inc. (ITW) introduced a cloud-connected vacuum sealing system that integrates with enterprise resource planning (ERP) platforms, enabling real-time data analytics for improved packaging efficiency.

- In November 2023, Dover Corporation acquired a European-based packaging automation startup to enhance its portfolio of smart vacuum sealing technologies and accelerate digital transformation efforts.

- In June 2024, GEA Group AG partnered with a leading biodegradable film manufacturer to develop eco-friendly vacuum packaging solutions, aligning with global sustainability trends and regulatory mandates.

MARKET SEGMENTATION

This research report on the global commercial vacuum sealer market has been segmented and sub-segmented based on type, usability, and region.

By Type

- Chamber Vacuum Sealer

- External Vacuum Sealer

By Usability

- Floor standing Vacuum Sealer

- Countertop Vacuum Sealer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected market size and CAGR for the commercial vacuum sealer market?

The global commercial vacuum sealer market is expected to reach USD 1.68 billion by 2033 from USD 1.18 billion in 2025, growing at a CAGR of 4.52%.

2. What key trends are shaping the commercial vacuum sealer market?

Automation, eco-friendly packaging solutions, and integration of smart technologies are key trends in this market.

3. Which industries are driving demand for commercial vacuum sealers?

Food processing, hospitality, healthcare, and electronics industries are major drivers of demand for vacuum sealing solutions.

4. What technological innovations are influencing market growth?

Innovations like sensor-based vacuum control, energy-efficient models, and IoT integration are propelling market growth.

5. What are the main challenges faced by the commercial vacuum sealer market?

High initial investment costs and maintenance issues are key challenges for market expansion.

6. What factors are fueling the adoption of vacuum sealers in the food industry?

Increased focus on food safety, shelf-life extension, and reduced food waste are driving adoption in the food sector.

7. Which regions are expected to show the highest growth in this market?

Asia-Pacific is anticipated to experience the fastest growth due to urbanization and the booming foodservice sector.

8. What are the opportunities for manufacturers in this market?

Opportunities lie in offering customizable sealing solutions, expanding into emerging markets, and enhancing energy efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com