Global Connected (Smart) Street Lights Market Research Report - Segmentation By Component (Hardware, Sensors, Controllers, Software, Services, Others), By Application (Traffic Monitoring, Environmental Monitoring, Video Surveillance & Other Applications), By Region and Global Industry Analysis on Size, Growth, Investment, Strategy, Demand & Forecast Report | 2024 to 2032

Connected (Smart) Street Lights Market Size (2024-2032):

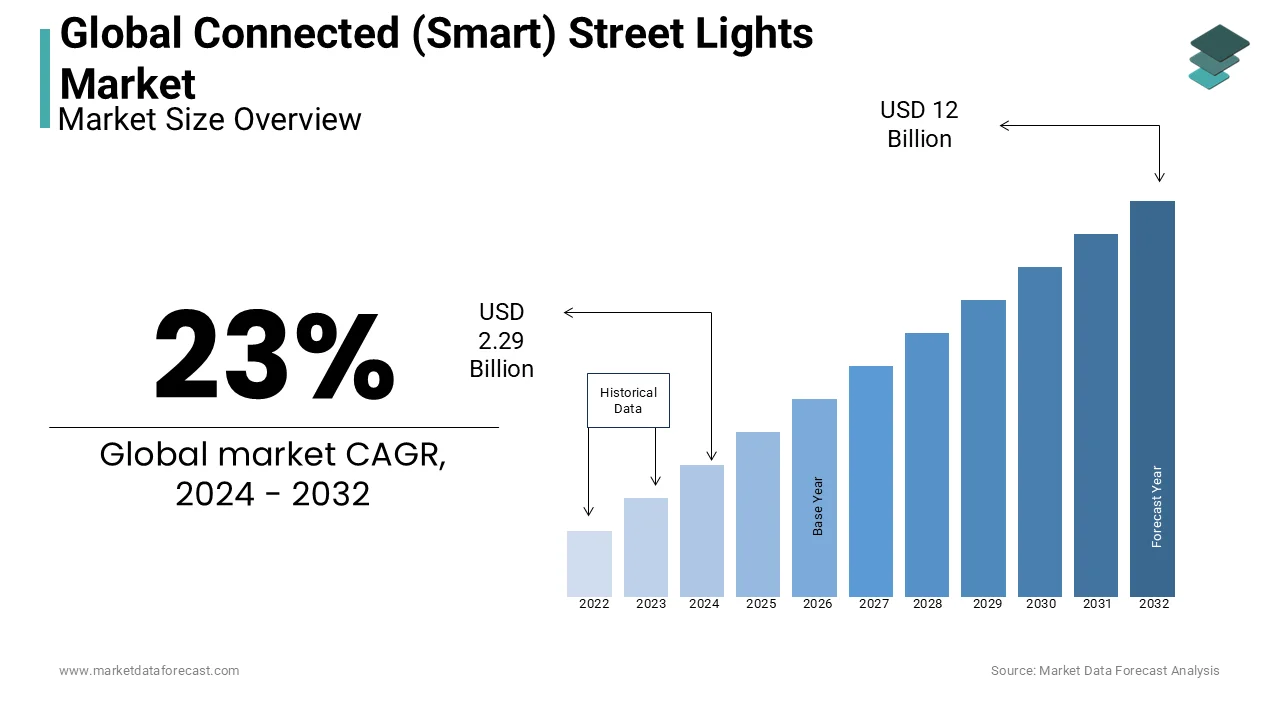

The Global Connected (Smart) Street Lights Market was worth US$ 1.86 billion in 2023 and is anticipated to reach a valuation of US$ 12 billion by 2032 from US$ 2.29 billion in 2024. It is predicted to register a CAGR of 23% during the forecast period 2024-2032.

MARKET SCENARIO

Streetlights are typically engaged with advanced technologies that auto-connect them with the help of outdoor lamp controllers, Internet of Things devices, and/or sensors. These lights are connected in parallel connections that automatically radiate according to the light intensity that differs with sunrise or sunset timings. These are completely applicable to saving energy and reducing maintenance costs. The light operates according to the information received from the external sensors, whether to switch on or off. The lights get off if there is sunrise and on during sunset according to the light intensity. This system can be easily controlled by the operator without even visiting the place. There is a wide range of systems used in this technology, and it is gaining popularity in this modern era.

MARKET DRIVERS

Increasing importance for the safety of the people, especially during nighttime, is majorly driving the growth rate of the connected streetlights market. Government investments in installing streetlights to reduce crime, especially during the night, are likely to enhance the growth rate of the market to an extent.

· According to the Association for the Advancement of Automotive Medicine, more than 25% of automobiles travel during the night. Approximately 70% of pedestrian deaths occur during dark driving times, which is a serious concern to take into consideration by the government authorities.

The government plans to reduce all the fatalities due to the lack of proper light facilities and shall put efforts into installing streetlights, especially in both developed and emerging countries. High investments from the public sector for installing these lights shall increase the growth rate of the market.

Also, according to the US Department of Justice, the proper installation of streetlights can reduce crimes by up to 20%, which is majorly to level up the growth rate of the market. In metropolitan cities, the demand for streetlights is very high as there will be huge traffic congestion during night times that provide visibility.

Another factor that makes it definite to install connected streetlights is to save energy. In recent times, it has become crucial to conserve energy at possible times due to the growing prominence of reducing the impact of greenhouse gas emissions. Installing these lights can conserve energy by 60% when compared with traditional systems. The reduced usage of electricity means contributing to a green environment that is greatly influencing the growth rate of the market.

The growing focus on increasing global warming and its effects due to environmental pollution is subjected to the adoption of renewable energy, which is quietly important in street lightning. Traditional street lighting systems consume high electricity, which is not a best practice in the recent era. Adopting new technologies can help reduce greenhouse gas emissions, which further escalates the growth rate of the market.

MARKET RESTRAINTS

The high cost of installation is one of the factors that is restraining the growth rate of the connected(smart) streetlights market. These lights are integrated with the most advanced technologies, where a lack of complete knowledge among the operators can also simultaneously

hinder the growth rate of the market. Smart streetlights are much more expensive than traditional lights, which is clearly slowing the growth rate of the market. Key players face difficulties in creating the popularity of this lighting system in rural or remote areas due to a lack of proper internet facilities, which may also act as a barrier to the growth of the market in these particular areas.

MARKET OPPORTUNITIES

The swift adoption of various advanced technologies and the launch of innovative lighting systems to overcome the challenges with vigorous R&D activities shall pose huge growth opportunities for the connected street lighting market in the future. Smart city services are also focusing on expanding new opportunities for the connected street lighting market. There are multiple benefits to installing smart street lighting systems, especially in smart cities, as there is huge progress in mobile broadband connectivity. The rising importance of video surveillance by traffic police has also elevated the need for these systems in the past few years and has accounted for escalating the growth rate of the market.

MARKET CHALLENGES

Though the connected street lightings are described to have low maintenance costs, the complexity of maintaining the installed systems is slightly difficult for the operator if there is any error. The batteries required for these lights need to be replaced more often during the entire life cycle, which is one of the factors that increases the cost of maintenance. Problems with the controllers and sensors every now and then can also cause degraded growth opportunities for the market in the coming years.

Alongside, there is a high risk of vandalism or theft, which causes a huge loss for government organizations, which need to fix it again with huge installation costs.

All these factors pose severe challenges for the connected street lighting market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

23% |

|

Segments Covered |

By component, connectivity, application, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Signify, Itron, Telensa, Echelon Corp, Rongwen, Current- powered by GE, DimOnOff, Flashnet, Sensus, GridComm. and Others. |

SEGMENTAL ANALYSIS

Global Connected (Smart) Street Lights Market Analysis By Component

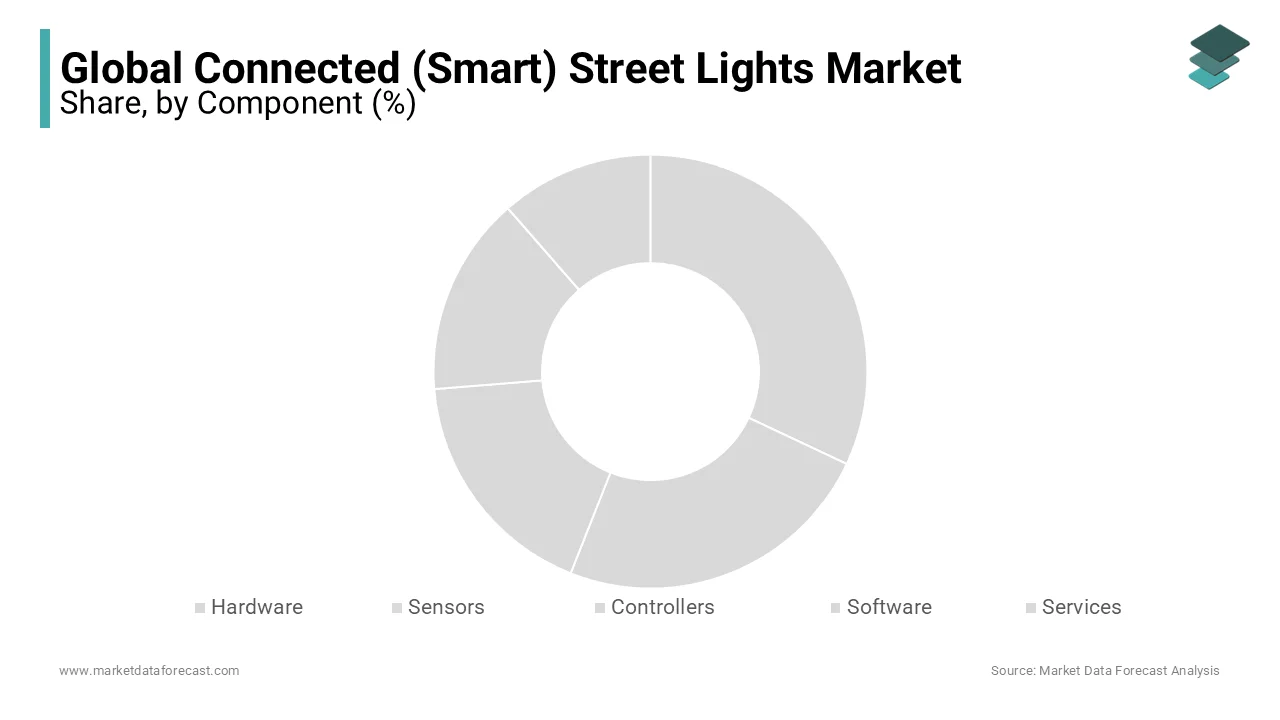

The sensors and controllers segment is leading with the dominant share of the connected street lighting market. The sensor helps the system to turn on/off according to the light intensity, which has a prominent role in the overall application. They usually detect the darkness and then activate the system to switch on/off respectively. Controllers have their own functionality, which is easy to install and helps control or monitor the public lighting remotely.

The hardware segment is likely to have the fastest growth rate during the forecast period. The rising importance of operating the street lighting system without even visiting the place for monitoring is especially raising the need for the installation of these systems.

Global Connected (Smart) Street Lights Market Analysis By Connectivity

The wireless segment is gaining huge popularity in today's world, with the growing prominence of operating systems from wherever in the world that use internet connectivity. The launch of high-speed internet connectivity, even in remote areas, is propelling the need for wireless connected street lighting, which is likely to enhance the growth rate of the market accordingly.

The wired segment is exceptionally to have a prominent share of the connected street lighting market. These connections are highly accurate and have effective lighting when compared with wireless connectivity systems, which therefore highlights the potential to still adopt these technologies irrespective of new technologies.

Global Connected (Smart) Street Lights Market Analysis By Application

Traffic monitoring is gearing up to quietly adopt all the new technologies, and the connected street lighting systems are one of those. Using street lighting to reduce accidents during darkness is attributed to bolstering the growth rate of the market. Video surveillance is another segment that has held a significant share of the market for the past few years and is expected to continue with the same growth rate during the forecast period. In many countries, there are systems to continuously monitor public areas, which are exceptionally raising the need for smart street lighting. The environmental monitoring segment is ascribed to have prominent growth opportunities in the coming years.

REGIONAL ANALYSIS

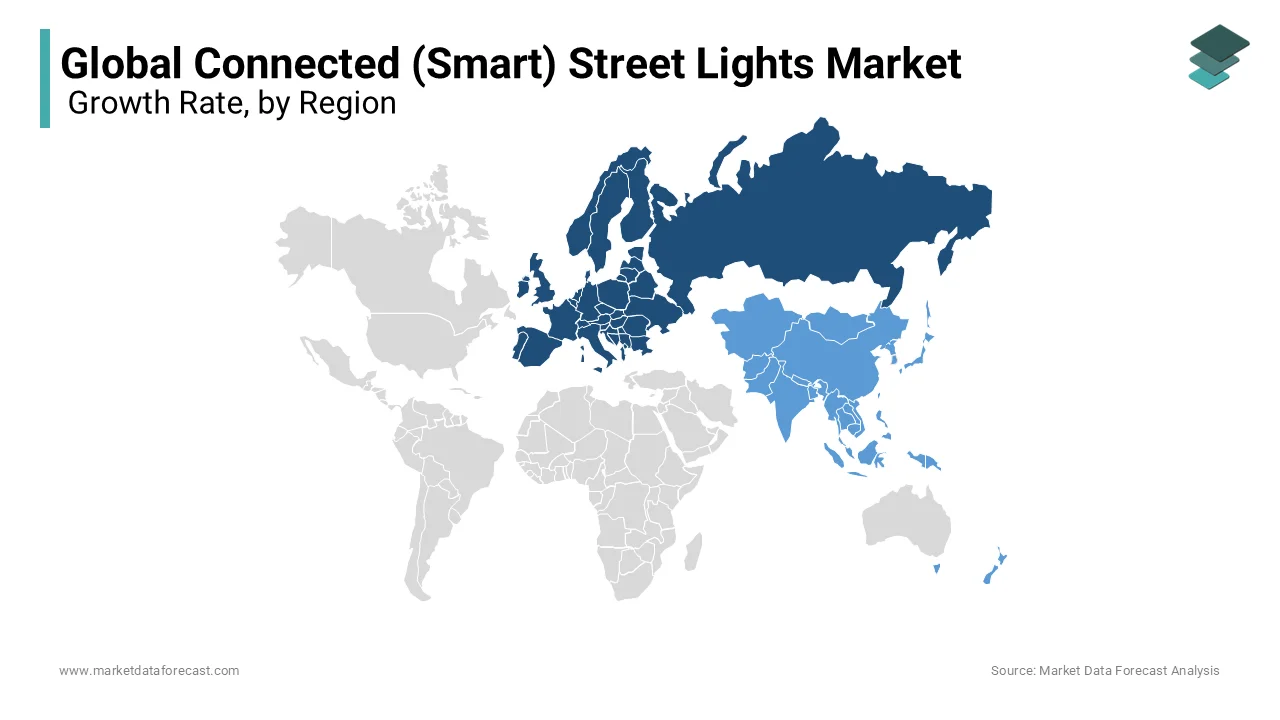

North America is leading with the dominant share of the connected street lighting market. The growing preference to reduce environmental pollution is sustained by adopting various technologies, especially in street lighting systems. LED-connected street lighting will reduce energy usage, thereby resulting in a growth rate for the market during the forecast period. In addition, increasing per capita income is attributed to elevating the growth rate of the connected street lighting market. Stringent traffic rules insist on actively adopting new technologies, including monitoring public areas 24/7 without any interruption due to dark light, which is exceptionally important to propel the growth rate of the market.

Asia Pacific connected street lighting market is anticipated to follow North America in holding a significant share of the market. A growing population is one of the common factors for the market expansion in this region. India and China are the topmost countries contributing the highest share of the market. These emerging countries are making strong efforts to lower environmental pollution

due to the serious increase in concern over global warming. Along with this, support from the private sector over solar grid systems that are connected with street lighting is quietly contributing to the expansion of the market during the forecast period in this region. The rising urban population in these countries is finding a way to transform smart cities with the latest technologies.

Europe's connected street lighting market growth rate is expected to reach the highest CAGR by the end of the forecast period. European country's pledge to make net zero emissions by the end of 2050 is subject to creating new opportunities to install solar-connected street lighting systems, which are highly efficient and regularize the release of carbon emissions as expected. Also, huge support from the government authorities in the UK, Germany, Italy, Spain, and France is estimated to level up the growth rate of the market.

Middle East Africa, Africa, and Latin America are likely to grow at a steady pace during the forecast period. The launch of various street lighting systems according to the climatic conditions in UAE and Saudi Arabia only to reduce the consumption of energy is subjected to elevate the growth rate of the market in the coming years. In 2024, Dubai announced its new project named Dh278 to improve safety through street lighting. Under this project, Emirates will install energy-efficient street lighting systems across 40 previously unlit areas.

KEY PLAYERS IN THE GLOBAL CONNECTED (SMART) STREET LIGHTS MARKET

Companies playing a prominent role in the global connected (smart) street lights market include Signify, Itron, Telensa Echelon Corp, Rongwen, Current- powered by GE, DimOnOff, Flashnet, Sensus, GridComm, and Others.

RECENT HAPPENINGS IN THE GLOBAL CONNECTED (SMART) STREET LIGHTS MARKET

-

In 2024, Signify got a project from the UK tower company Cornerstone to deploy cellular-connected luminaries across the cities in this country. Cornerstone is taking steps to build an outdoor neutral host with 5G and IoT platforms along with the street lighting infrastructure. The company's radio infrastructure is managed by Telefonica and Vodafone. The firm already manages more than 15,500 radio sites in the UK and is now agreeing on a deal with Signify to promote or develop a neutral host for municipal and consumer connectivity services.

DETAILED SEGMENTATION OF THE GLOBAL CONNECTED (SMART) STREET LIGHTS MARKET INCLUDED IN THIS REPORT

This research report on the global connected (smart) street lights market has been segmented and sub-segmented based on component, connectivity, application, and region.

By Component

- Hardware

- Sensors

- Controllers

- Software

- Services

- Others

By Connectivity

-

Wired

- Wireless

By Application

- Traffic Monitoring

- Environmental Monitoring

- Video Surveillance

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com