Global Cranes Rental Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Fixed Crane and Mobile Crane), End-Use (Building & Construction, Marine & Offshore, Mining & Excavation, Oil & Gas, Transportation, Others (Industrial and Municipal)), Weight Lifting Capacity (Low, Low-Medium, Heavy, Extreme Heavy) & Region - Industry Forecast From 2024 to 2032

Global Cranes Rental Market Size (2024 to 2032)

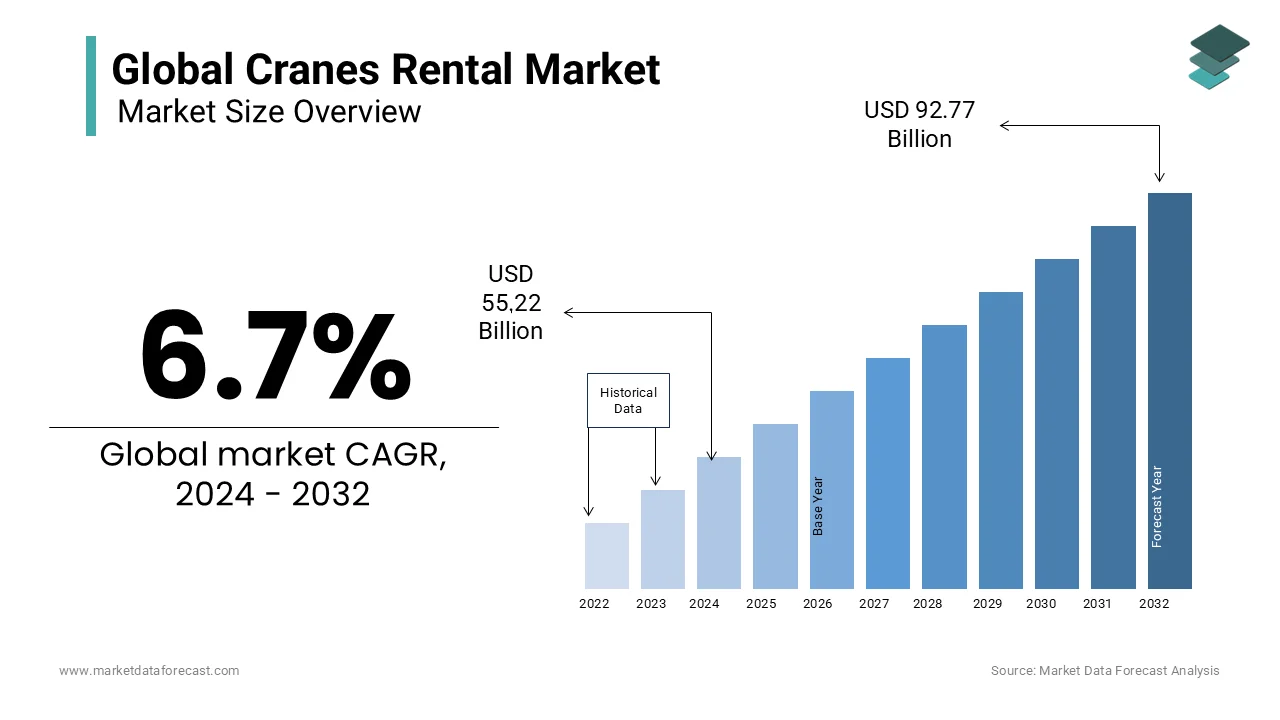

The global cranes rental market was worth USD 51.75 billion in 2023. The global market is expected to be worth USD 92.77 billion by 2032 from USD 55.22 billion in 2024, growing at a CAGR of 6.7% during the forecast period.

Current Scenario of the Global Cranes Renta Market

Cranes are becoming a common sight in modern constructions such as large commercial and residential zones, and their optimum production speeds are often required. Cranes are commonly used in the transportation industry, shipyards, and freight depots. Cranes are also a common element of the manufacturing business, where combining heavy equipment in one location for a single purpose sometimes needs crane rental.

MARKET DRIVERS

The huge influx will occur in the coming years, resulting in significant building of airports, ports, and motorways, among other projects.

The usage of cranes on a rental basis rather than purchasing them, together with increased investments in various end-use industries such as building and construction, transportation, and oil and gas, among others, is fuelling crane rental market growth. The global cranes rental market is projected to be fuelled by new trends in developing economies for the construction of new projects. For instance, India's finance minister, Nirmala Sitharaman, announced a $1.4 trillion infusion into the economy to enhance the country's infrastructure. During the forecast period, the global cranes rental market will experience significant growth in terms of volume, scale, and intensity, particularly in the Asia Pacific region.

During the forecast period, Asia-Pacific is expected to be a critical market, with a high demand for rental cranes due to increased development and construction activities.

Government initiatives, construction spending, and favorable policies are all essential factors driving the global crane rental market forward. Furthermore, the growing popularity of mobile cranes is a key factor in propelling the cranes rental market.

The factors driving demand for Cranes Rental Market expansion are rapid urbanization and increased building and infrastructure development in emerging countries because of a growing focus on smart city development. Increased investment in transportation, commercial infrastructure, and energy also contributes to a rise in the demand for rental equipment to meet seasonal needs. With the simple availability of customized construction equipment, the desire to hire equipment as needed will rise, boosting the demand for crane rentals.

MARKET RESTRAINTS

The lack of skilled and qualified crane operators is one of the primary problems limiting the Cranes Rental Market share. One of the industry's major issues is providing sufficient training to crane operators. Leading crane rental companies, on the other hand, are focusing on providing regular training programs for operators to overcome this difficulty. This is predicted to drastically reduce occupational accidents and catastrophes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.7% |

|

Segments Covered |

By Type, End-use, Weightlifting, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sarens NV (Belgium), Mammoet (Netherlands), ALL Erection & Crane Rental Corp. (US), Lampson International LLC (US), Action Construction Equipment Ltd. (India), Maxim Crane Works, L.P. (US), ALE (US), Sanghvi Movers Limited (India), Deep South Crane and Rigging (US) |

SEGMENTAL ANALYSIS

Global Cranes Rental Market By Type

Based on type, Mobile cranes are likely to occupy the largest share in the cranes rental market during the outlook period due to their wide acceptance in various end-use industries like building & construction, and transportation.

Global Cranes Rental Market By Weightlifting Capacity

By weightlifting capacity, Low weight segment accounted for the largest portion of cranes rental business and will have prominent growth over the determined period. This growth is contributing to the increase in various types of activities for construction, repairs, and maintenance around the globe, which is predicted to drive the market boom.

Global Cranes Rental Market By End-Use Industry

By end-use industry, the market is isolated or divided into building & construction, marine & offshore, mining & excavation, oil & gas, transportation, industrial and municipal. Building & construction be consistent with commercial & residential buildings and infrastructure is an important consumer in the market.

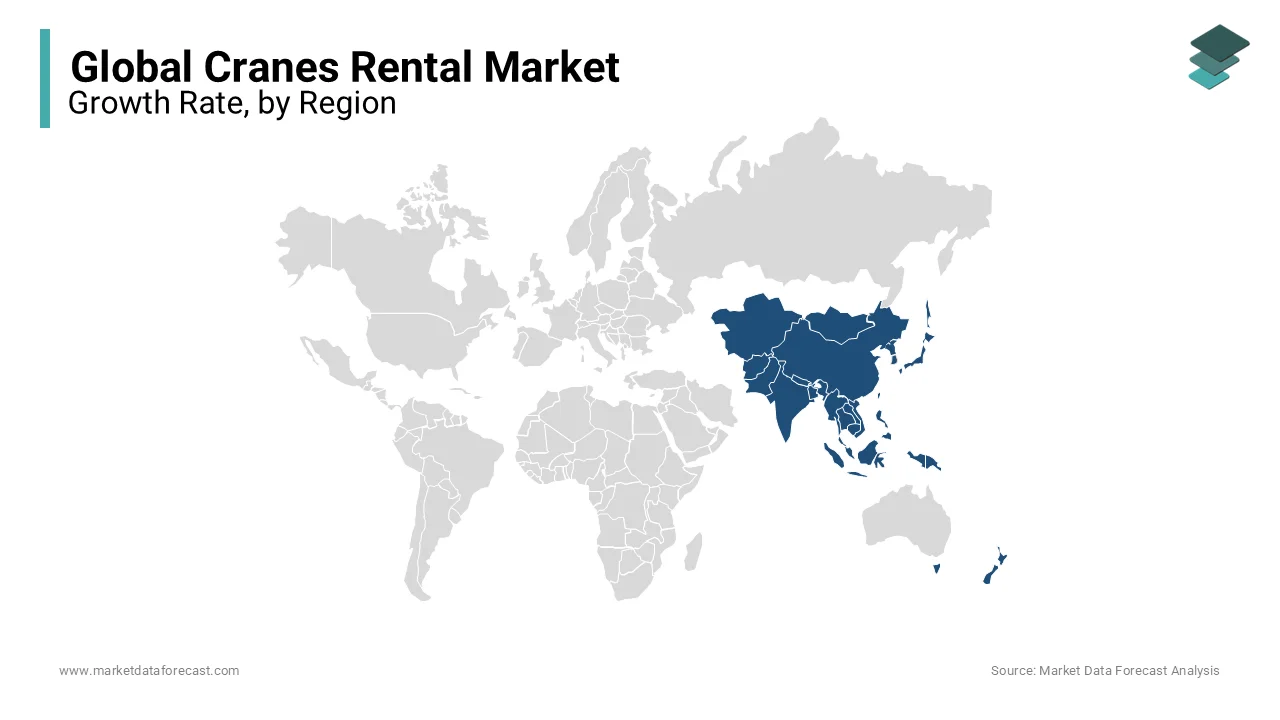

REGIONAL ANALYSIS

The Asia Pacific region leads the global cranes rental market that is estimated to grow at a significant rate due to the increasing call for cranes on a rental basis in a particular region like China, Japan, India, Australia, and other countries. Furthermore, rising population levels and increasing investments from domestic & foreign investors are expected during the conjecture period to drive the growth of the APAC cranes rental market.

KEY MARKET PLAYERS

Companies playing a major role in the global cranes rental market include Sarens NV (Belgium), Mammoet (Netherlands), ALL Erection & Crane Rental Corp. (US), Lampson International LLC (US), Action Construction Equipment Ltd. (India), Maxim Crane Works, L.P. (US), ALE (US), Sanghvi Movers Limited (India) and Deep South Crane and Rigging (US).

RECENT HAPPENINGS IN THE MARKET

- Mammoet Introduces Sk6,000 Crane to Improve Fpso Modularization Strategies- 6,000t Crane Capacity Allows Modules to Be Built Bigger Than Ever Before.

- Sarens Provides Wind Clients with Transportation, Crane, And Installation Services - Sarens has always been well-equipped to deliver global crane services ranging from 50 to 3.200 tonnes. Sarens began creating its in-house installation team a few years ago, anticipating changes in the wind business, and strengthened its transportation capabilities by cooperating with major transportation companies across several locations.

DETAILED SEGMENTATION OF THE GLOBAL CRANES RENTAL MARKET INCLUDED IN THIS REPORT

This research report on the global cranes rental market has been segmented and sub-segmented based on type, end-use, weightlifting, and region.

By Type

- Mobile Cranes

- Fixed Cranes

By Weightlifting Capacity

- Low

- Low-Medium

- Heavy

- Extreme Heavy

By End-Use Industry

- Building & Construction

- Marine & Offshore

- Mining & Excavation

- Oil & Gas

- Transportation

- Others (Industrial and Municipal)

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What are the primary factors driving the growth of the global cranes rental market?

The primary factors driving the growth include the increasing number of infrastructure development projects, urbanization, and industrialization. Additionally, the rising demand for cranes in various industries such as construction, mining, and oil & gas contributes significantly to the market growth.

What types of cranes are most commonly rented in the market?

The most commonly rented cranes include mobile cranes, tower cranes, crawler cranes, and rough terrain cranes. Mobile cranes are particularly popular due to their versatility and ease of transportation.

What technological advancements are influencing the cranes rental market?

Technological advancements such as the integration of telematics, GPS tracking, and IoT in cranes are significantly influencing the market. These technologies enhance efficiency, safety, and maintenance capabilities, leading to better management and operation of rental fleets.

What is the future outlook for the global cranes rental market?

The future outlook for the global cranes rental market is positive, with expected growth driven by ongoing and upcoming infrastructure projects worldwide. Emerging markets in Asia-Pacific, Africa, and Latin America present significant opportunities. Additionally, advancements in crane technology and increasing focus on sustainability will further propel market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com