Global Dairy Cattle Feed Market Size, Share, Trends, & Growth Forecast Report - Segmented By Additive Type (Vitamins, Trace Minerals, Amino Acids, Feed Antibiotics, Feed Acidifiers, Feed Enzymes, Antioxidants And Other Additives), Ingredient Type (Corn, Soybean Meal, Wheat, Oilseeds And Grains And Others), Application (Dairy Cattle Growth Phase Divided Into Heifers And Dairy Cows And Others) And Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Dairy Cattle Feed Market Size

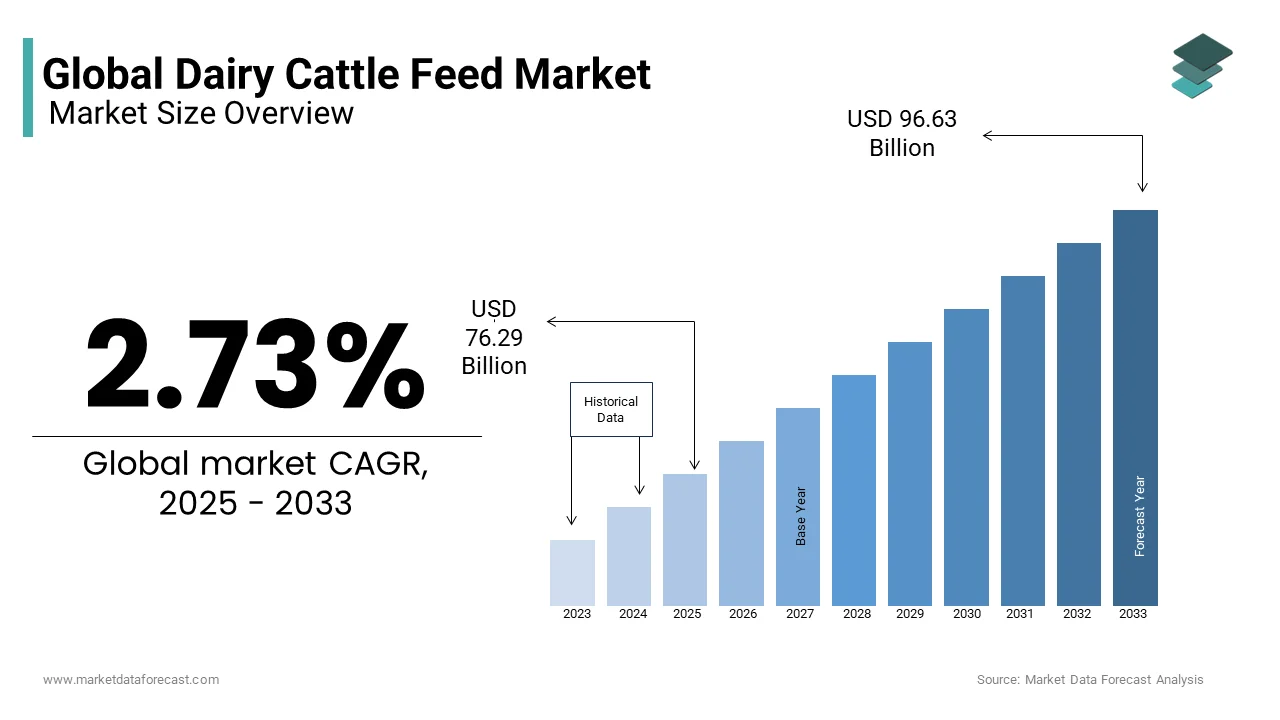

The global dairy cattle feed market was valued at USD 74.26 billion in 2024 and is anticipated to reach USD 76.29 billion in 2025 from USD 96.63 billion by 2033, growing at a CAGR of 2.73% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL CATTLE FEED MARKET

Dairy cattle have a higher metabolism than normal cattle. Dairy cattle feed includes a variety of forage, which includes grass, silage, and legumes, as well as an assortment of grain, soy, and other high-energy density diets. Dairy feed is mainly used in cattle farms and animal feeding units. Dairy cattle feed is made specifically with the aim of improving the production of milk. Dairy cattle feed is especially rich in carbohydrates, proteins, fats, vitamins, and minerals which are needed for the healthy growth of a milking animal. Common ingredients of cattle feed include corn-fed, soy feed, rice bran, oilseeds, alfalfa, and wheat which is a major ingredient in almost all varieties of cattle feed due to its property of maintaining proper digestion of dairy cattle. The global dairy cattle feed market accounted for the most significant growth in the past few years and is anticipated to grow substantially during the forecast period. Products like vitamin A and minerals such as Availa-4 and 20-10 Plus Mineral are most frequently used to boost cattle's immune system, reproductive ability, and vision.

- According to data provided by United Nations Food and Agriculture Organization (FAO) estimates that by 2050, the demand for food will grow by 60%, and for that, animal proteins are estimated to grow by 1.7% per year. It also mentioned that meat production is projected to rise by nearly 70%, aquaculture by 90%, and dairy by 55%.

MARKET DRIVERS

The major factor affecting the dairy cattle feed market is the obvious increase in demand for milk products. So, the rising populations and changing consumption patterns of the people can be considered indirect growth factors resulting in an increased demand for dairy products. Maintaining a healthy diet also prevents metabolic diseases in the herd and this serves as another growth factor for the market.

- For Instance, in 2023, the worldwide production of cow’s milk is over 549 million metric tons and over 22 million metric tons of cheese and over 11 million metric tons of butter.

The growing awareness among the people regarding the health benefits of quality meat and dairy products is influencing farmers to provide high-quality feed for dairy cattle, which enhances milk production and quality, leading to substantial market growth. Consumer awareness is acting as the key driver for demand for premium cattle feed, which increases animal health and products. The rising environmental factors such as floods, droughts, or other conditions limit the natural foraging options, which influences the farmers to depend on more formulated cattle feed, which propels the global market growth rate. The increasing demand for sustainable and organic farming practices among farmers owing to the consumer demand for those food products is enhancing the adoption of sustainable, organic, and free from genetically modified organisms (GMOs) and high-quality organic cattle feed, which promotes the market growth rate.

MARKET RESTRAINTS

As for the restraints for the market, the higher cost of specialized feed is the main one. The prospective advantages of using dairy cattle feed are also unknown to several regions, and farmers still use traditional diets for their cattle. This lack of awareness among farmers is another restraining factor for the market. The limitations in the feeding standards are that some cows receive too much feed, and some may not receive enough energy, which may hinder the market growth. The addition of fat to the dairy cattle diet may enhance the energy balance, but it possesses negative effects on milk production, and the climatic changes may impact the quality of fodder and nutrition due to poor storage conditions, which affects dairy production and impacts negatively on the market growth.

- For Instance, in 2023, the North American region reported a reduced number of feed mills, where the feed tonnage was down by 1.1% in 2023.

MARKET OPPORTUNITIES

The increasing investments by the market players and various government authorities in the research and developmental activities to enhance the innovations and develop efficient and safe feed products that provide high nutrition to the animal along with increased dairy production. This significant factor is estimated to provide market growth opportunities during the forecast period. The rising consumption of dairy products and expanding industrialization of livestock production in the merging nations are significant factors contributing to market growth opportunities in the coming years.

MARKT CHALLENGES

The presence of stringent regulations regarding the approval of cattle feed products and the national regulations for imports and exports of dairy cattle feed will act as challenges to the market growth owing to its complexity. The rising concerns regarding the rise of rumen acidosis with increased consumption of many cereals, which are provided through cattle feed. Dairy cows fed with many cereals may lead to an imbalance of bacteria in the rumen, which causes acidosis in the animals, and this hinders the market growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.73% |

|

Segments Covered |

Trace Minerals, Amino Acids, Feed Antibiotics, Feed Acidifiers, Feed Enzymes |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Royal DSM NV, Nutreco NV, Amul, Kent Nutrition Group, Hi-Pro Feeds LP |

SEGMENTATION ANALYSIS

Global Dairy Cattle Feed Market Analysis By Additives Type

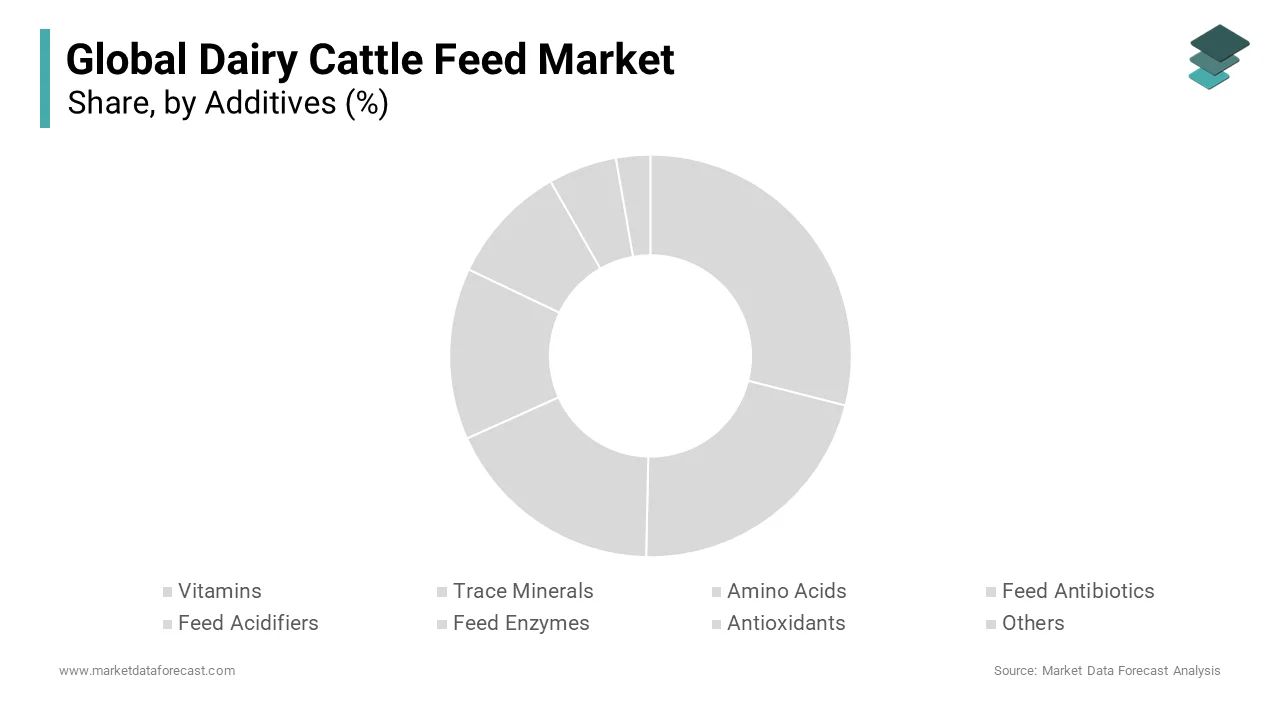

The feed enzymes segment dominated the global dairy cattle feed market revenue and is expected to record a notable market share during the forecast period. Feed enzymes are widely utilized as additives as they enhance the consistency and nutritional value of the feed, augmenting the segment growth rate. The enzymes improve the digestibility d and reduce the effect of antinutrients, which fuels their adoption of cattle feed, which boosts the segment expansion.

The vitamins segment is predicted to account for considerable growth during the forecast period. The necessity of vitamin E for the livestock as it helps in improving the efficiency of other vitamins and the presence of antioxidant properties is propelling the segment revenue growth. The requirement of various other vitamins such as Vitamin D, A, biotin and others is contributing to the segment expansion.

Global Dairy Cattle Feed Market Analysis By Ingredient Type

The corn segment accounted for the largest share in the global dairy cattle feed market and is projected to register the highest CAGR during the forecast period. The high carbohydrate content of the corn acts as the primary source of energy for the cattle, which drives the segment growth. It is generally easy to digest and is frequently added in the form of whole grain, cracked corn, or cornmeal, which is fueling the segment growth rate. Corn is considered a high-energy protein supplement with essential nutritional value, leading to healthy growth of the cattle and boosting the segment revenue growth.

- According to the Agricultural Market Information System (AMIS), maize production in 2024 will be 1.2% lower than in 2023. Additionally, it also stated that utilization in 2024/25 is estimated to increase by 0.7% due to growth in feed use.

The soybean meal segment is estimated to register notable growth during the forecast period. The soybean meal is the byproduct of soyabean oil extraction, which serves as a high-protein supplement in cattle feed, as the soybean meal is rich in amino acids which help in the development of muscles, tissues, and enzymes in the cattle which is contributing to the segment growth opportunities.

Global Dairy Cattle Feed Market Analysis By Application Type

The dairy cows segment held the most significant share in the dairy cattle feed market and is anticipated to have notable growth during the forecast period. Dairy cattle require a high and specialized diet, which supports milk production and enhances the reproductive system of the cattle, driving the segment growth rate. Dairy cattle feed involves a high protein content, which is often supplied through soybean meal, alfalfa, and canola meal, which fuels the segment expansion. The increased addition of essential nutrients such as calcium and phosphorous supports bone health and enhances the milk quality.

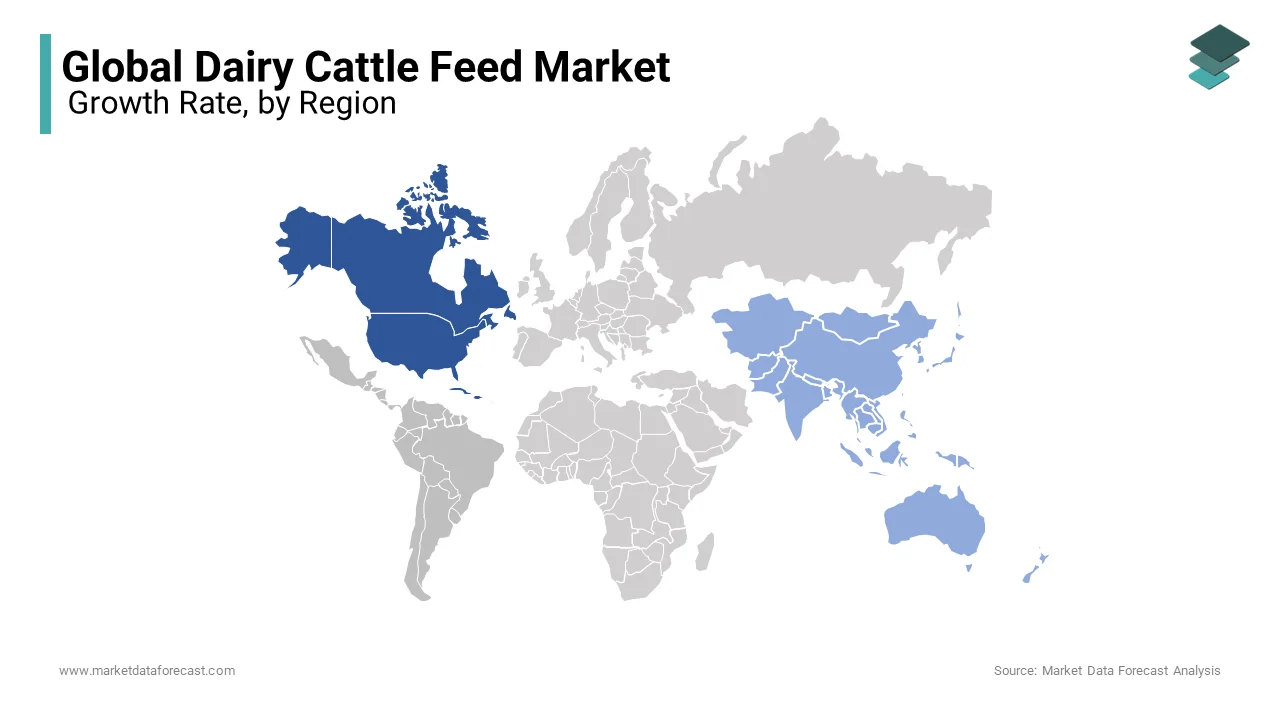

REGIONAL ANALYSIS

The North American region accounted for the significant growth and is anticipated to witness a notable growth rate during the forecast period. The increasing population and the escalating awareness among the people regarding the benefits of dairy products and wide consumption of dairy-based products are contributing to the expansion of the regional market share growth. The United States held the largest share in the regional market as it is one of the world’s largest producers and exporters of cattle feed, owing to the highest demand for livestock, which contributes to regional market growth.

- According to USDA ERS, as of April 2024, there were 11.8 million cattle and calves on feed in the United States, which is 1% higher than the previous year. And this includes 7.27 million steers and steer calves and 4.56 million heifers and heifer calves.

The Asia Pacific region is projected to exhibit substantial growth during the forecast period with rapid growth rate. The expanding dairy industry in the region is escalating the adoption of various advanced technologies is propelling the market growth. The increased demand for meat and dairy products across the region is fueling the regional market growth. The growing health-conscious among the people and the growing population is augmenting the market growth opportunities.

- For Instance, in 2023, the dairy production in China is recorded to be 30.6 million tonnes.

The European region is estimated to record notable growth during the forecast period. Germany held the largest share in the European market due to the presence of major market players in the country. The presence of free trade agreements between the European Union countries is estimated to have a positive influence on European market growth.

RECENT HAPPENINGS IN THIS MARKET

- In May 2024, Elanco announced the completion of an FDA review for Bovaer, a methane-reducing feed ingredient for dairy cattle. The company is expanding the commercialization of Bovaer across North America, Canada and Mexico.

- In May 2024, Lisavaird Co-Op announced its investment in its feed mill facility and then launched a new range of premium feeds for cattle, sheep, pigs, and poultry.

- In August 2023, Gramik, a peer commerce platform, announced the launch of three cattle feed supplements known as Doodh Sagar, Heifer Mix, and Urja Pashu Poshak Aahar. These supplements are developed through comprehensive research and discussions with farmers to produce high-quality supplements that can be affordable and accessible to farmers.

- In 2023, De Heus Animal Nutrition started its first De Heus Animal Feed Factory in Ivory Coast with an initial capacity of 120.000 MT per annum.

KEY MARKET PLAYERS

The Dairy Cattle Feed Market is highly competitive with a large number of players. Key market players dominating the market with their products include Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Royal DSM NV, Nutreco NV, Amul, Kent Nutrition Group, Hi-Pro Feeds LP, Purina Animal Nutrition LLC, Kapila Krishi Udyog Limited and Agro Feed Solutions.

MARKET SEGMENTATION

This research report on the global cattle feed market is segmented and sub-segmented based on Additives Type, Ingredient Type, Application Type, and Region.

By Additives Type

- Vitamins

- Trace Minerals

- Amino Acids

- Feed Antibiotics

- Feed Acidifiers

- Feed Enzymes

- Antioxidants

- Others

By Ingredient Type

- Corn

- Soybean Meal

- Wheat

- Oilseeds

- Grains and Others

By Application Type

- Heifers

- Dairy Cows and Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global dairy cattle feed market?

The current market size of the global dairy cattle feed market was valued at USD 76.29 billion in 2025

What are the market drivers that are driving the global dairy cattle feed market?

An increase in demand for milk products and maintaining a healthy diet also prevent metabolic diseases in the herd, which serves as another growth factor for the market.

Who are the market players that are dominating the global dairy cattle feed market?

Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Royal DSM NV, Nutreco NV, Amul, Kent Nutrition Group, Hi-Pro Feeds LP, Purina Animal Nutrition LLC, Kapila Krishi Udyog Limited and Agro Feed Solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com