Global Compound Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By Ingredients (Cereals, Cereals By-Product, Oilseed Meal, Oil, Molasses, Supplements And Others), Supplements (Vitamins, Antibiotics, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers And Others), Animal Type (Ruminant, Swine, Poultry, Aquaculture And Others), And Region (North America, Europe, Aisa-Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Compound Feed Market Size

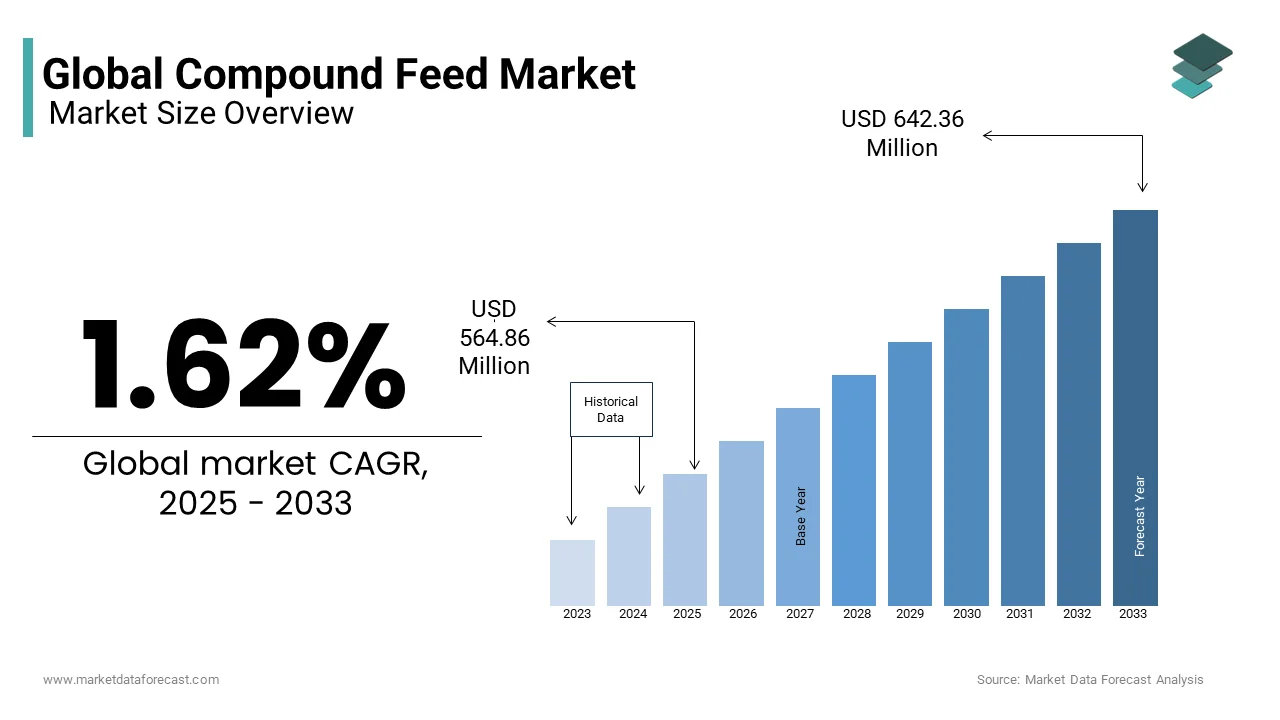

The size of the global compound feed market was valued at USD 555.86 million in 2024, and it is anticipated to reach USD 564.86 million in 2025 from USD 642.36 million by 2033, growing at a CAGR of 1.62% during the forecast period from 2025 to 2033.

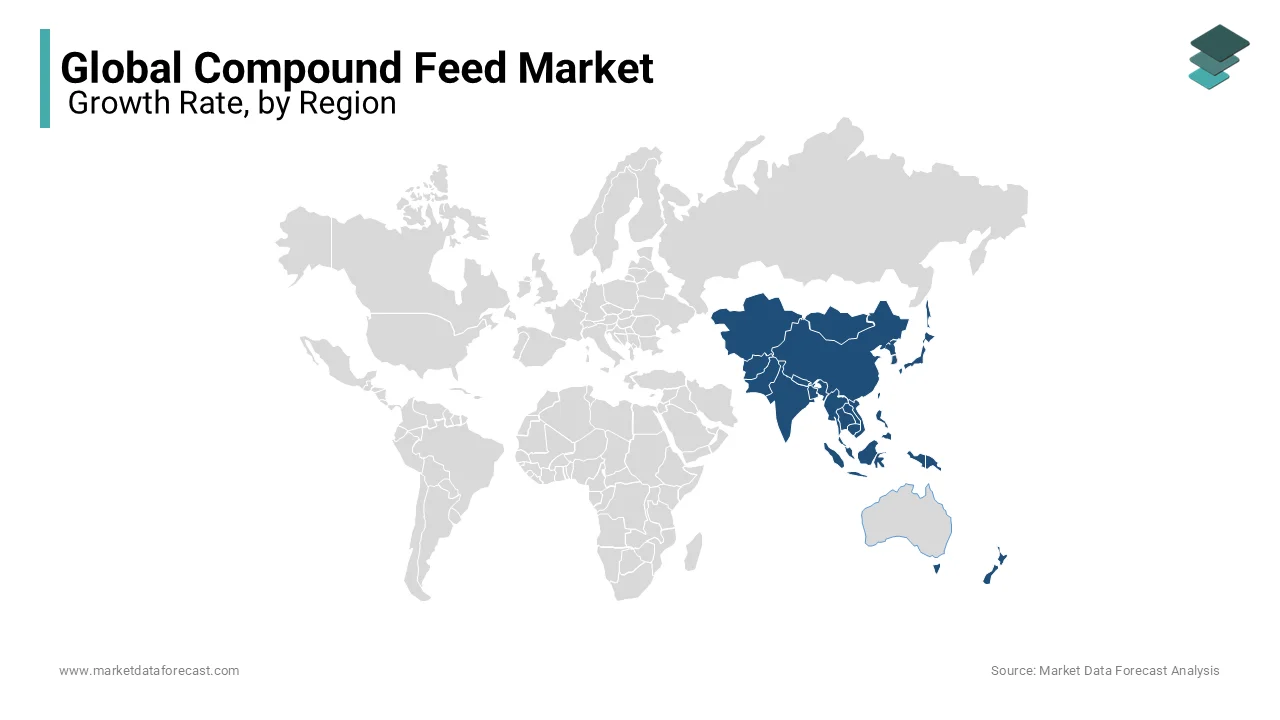

Compound feed plays a vital role in the global agriculture industry by serving as the backbone for livestock farming and animal husbandry. The rising demand for meat, dairy, and poultry products, increasing urbanization, and shifting dietary preferences toward protein-rich diets are contributing to the growing demand for compound feed worldwide. For instance, global meat consumption is expected to reach 376 million metric tons by 2030, up from 340 million metric tons in 2021. Asia-Pacific is dominating the market worldwide, while Europe and North America maintain steady growth.

MARKET DRIVERS

Rising Global Demand for Animal Protein

The escalating demand for animal protein, particularly in developing regions, is primarily driving the growth of the global compound feed market. As per the International Livestock Research Institute, meat consumption in emerging economies like India and Brazil has surged by 15% over the past decade, owing to the rising disposable incomes and urbanization. Compound feed ensures optimal nutrition for livestock, enhancing growth rates and productivity. For example, poultry farming accounts for 40% of global compound feed usage and relies heavily on specialized formulations to meet the nutritional needs of broilers and layers. According to the USDA, global poultry production increased by 2.5% annually between 2015 and 2022, further boosting demand for compound feed. Additionally, the dairy industry contributes significantly to this trend. The International Dairy Federation states that global milk production reached 906 million metric tons in 2022, with high-yielding breeds requiring nutrient-dense feed. This symbiotic relationship between compound feed and animal protein production highlights the market's potential for sustained growth.

Technological Advancements in Feed Formulation

Technological advancements have revolutionized compound feed production, making it more efficient and tailored to specific livestock needs. Precision nutrition, enabled by innovations such as near-infrared spectroscopy (NIRS), allows manufacturers to analyze feed ingredients accurately. For instance, the use of precision technologies in feed formulation has reduced production costs by 10-15% while improving feed conversion ratios. Furthermore, biofortified feed additives, such as probiotics and enzymes, have gained traction, with the demand for feed additives is projected to grow significantly over the forecast period. These innovations not only enhance animal health but also address sustainability concerns, appealing to environmentally conscious stakeholders.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

The volatility of raw material prices, such as corn, soybean meal, and wheat, is one of the major restraints to the global compound feed market. As per the World Bank, global food prices surged by 31% in 2022, driven by supply chain disruptions and geopolitical tensions. Corn, a primary ingredient in compound feed, accounted for nearly 60% of feed costs in some regions, squeezing profit margins for manufacturers and farmers alike. For instance, during the Russia-Ukraine conflict, wheat exports plummeted, causing a ripple effect on feed grain availability. Such price fluctuations create uncertainty, forcing small-scale producers to scale back operations or exit the market entirely.

Stringent Regulatory Standards

Regulatory frameworks governing feed safety and quality are further hindering the growth of the global compound feed market. In the European Union, the European Food Safety Authority mandates rigorous testing for contaminants like mycotoxins and heavy metals, increasing compliance costs. These regulations have led to a 12% increase in operational expenses for feed manufacturers since 2020. Similarly, the U.S. Food and Drug Administration’s guidelines on antibiotic use in animal feed have compelled companies to reformulate products, often at higher costs. While these measures ensure consumer safety, they also create barriers for smaller players unable to afford compliance investments.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets are providing lucrative opportunities for the compound feed industry owing to the rapid urbanization and rising protein consumption. According to the United Nations, Africa’s urban population is projected to double by 2050, creating a surge in demand for meat and dairy products. Countries like Nigeria and Ethiopia are investing in commercial livestock farming, with the Nigerian government allocating USD 500 million in 2022 to boost agricultural productivity. Additionally, Latin America, home to some of the world’s largest beef and poultry exporters, offers untapped potential. The Brazilian Association of Animal Protein states that the country’s poultry exports grew by 8% in 2022, underscoring the need for high-quality feed solutions.

Sustainability Initiatives

An increasing number of sustainability initiatives are also providing growth opportunities in the compound feed market, offering new avenues for innovation. As per the FAO, adopting sustainable practices could reduce greenhouse gas emissions from livestock farming by 30% by 2030. Companies are increasingly incorporating alternative protein sources, such as insect meal and algae, into feed formulations. For example, the demand for insect feed is expected to grow at a promising CAGR from 2023 to 2030. These eco-friendly alternatives not only address environmental concerns but also cater to consumers demanding ethically sourced animal products.

MARKET CHALLENGES

Climate Change Impact on Feed Supply Chains

Climate change is a significant threat to the compound feed market by disrupting raw material supply chains. As per the Intergovernmental Panel on Climate Change (IPCC), extreme weather events have reduced global crop yields by 5-10% over the past decade. Droughts in key agricultural regions like the U.S. Midwest and Australia have severely impacted corn and wheat production, leading to shortages and price spikes. For instance, Australia’s wheat output dropped by 20% in 2022 due to prolonged droughts, affecting feed availability in Asia-Pacific. Such disruptions challenge manufacturers to secure consistent supplies, threatening market stability.

Resistance to Biofortified Feed Adoption

While biofortified feeds offer numerous benefits, resistance to their adoption remains a challenge. Farmers in rural areas often lack awareness about the advantages of fortified feed, preferring traditional formulations despite lower efficiency. For instance, only 30% of smallholder farmers in Sub-Saharan Africa have adopted biofortified feeds, citing affordability as a barrier. Additionally, misinformation about genetically modified feed ingredients fuels skepticism, hindering widespread acceptance. Addressing these barriers requires targeted education campaigns and financial incentives to encourage adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.62% |

|

Segments Covered |

By Ingredients, Supplements, Animal type and region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc. Charoen Pokphand Foods Archer Daniels Midland Company Land o’ lakes, Inc. Nutreco, ALLTECH, INC New Hope Group Co. Ltd Wen’s Group ForFarmers B.V Agribusiness Holding Miratorg Kyodo Shiryo Company Sodrugestvo Group S.A DeKalb Feeds, Inc |

SEGMENT ANALYSIS

By Ingredients Insights

The cereals segment occupied the leading share of 41.2% of the global market in 2024. The dominating position of the cereals segment in the global market is driven by their widespread availability, affordability, and nutritional value, making them a staple in livestock diets. Corn, wheat, and barley are the most commonly used cereals, with corn alone contributing to 60% of cereal-based feed formulations globally, according to the Food and Agriculture Organization (FAO). The rising global demand for poultry products is also contributing to the dominating position of the cereals segment in the global market. For instance, the global poultry production reached 133 million metric tons in 2022, with cereals forming the primary energy source in broiler and layer diets. Additionally, advancements in crop breeding technologies have increased cereal yields, reducing costs for feed manufacturers. For instance, the global average corn yield improved by 25% over the past decade, as reported by the USDA, ensuring a steady supply of affordable feedstock. The rising support from governments for cereal farming is further boosting the domination of the cereals segment in the global market. In 2022, the Indian government allocated significant funds under its Pradhan Mantri Fasal Bima Yojana to promote cereal cultivation, indirectly boosting the compound feed market.

The supplements segment is projected to grow at a CAGR of 8.3% over the forecast period, owing to the increasing awareness of animal health and productivity optimization. Amino acids, a critical sub-segment, are witnessing heightened adoption due to their role in improving feed conversion ratios. For instance, amino acid usage in feed formulations grew by 12% annually between 2020 and 2022. Feed enzymes also contribute significantly to this growth. The demand for feed enzymes is expected to expand as farmers adopt these additives to enhance nutrient absorption and reduce waste. For example, phytase enzymes help break down phytic acid, improving phosphorus utilization in monogastric animals. Furthermore, the European Union’s ban on antibiotic growth promoters has accelerated the shift toward natural supplements, creating opportunities for biofortified alternatives.

By Supplements Insights

The amino acids segment held 36.7% of the global market share in 2024. The promising position of amino acid segments in the global market is attributed to the critical role that amino acids play in protein synthesis and muscle development, particularly in poultry and swine farming. Methionine and lysine are the most widely used amino acids, with methionine accounting for 60% of the total amino acid market, according to Evonik Industries. The growing focus on precision nutrition is also boosting the expansion of the amino acids segment in the global market. As per the International Livestock Research Institute, supplementing feed with amino acids can reduce crude protein levels by 2-3% without compromising animal performance, lowering costs and environmental impact. Additionally, stringent regulations on nitrogen emissions in Europe have encouraged farmers to adopt low-protein diets enriched with amino acids, further propelling demand. Global meat consumption trends also play a pivotal role. The USDA estimates that pork production will grow by 1.5% annually through 2030, driving the need for high-quality amino acid supplements to meet the nutritional demands of swine.

The feed enzymes segment is set to expand at a CAGR of 9.8% over the forecast period, owing to their ability to improve digestibility and reduce feed costs. Phytase and carbohydrase enzymes are particularly popular, with phytase alone accounting for 45% of the enzyme market, as per Novozymes. The rising emphasis on sustainability is driving the expansion of the feed enzymes segment in the global compound feed market. According to the FAO, feed enzymes can reduce phosphorus excretion by up to 50%, aligning with global efforts to minimize agricultural pollution. Moreover, the increasing adoption of plant-based proteins in feed formulations creates a niche for enzymes that enhance nutrient absorption. For example, carbohydrases break down complex carbohydrates in wheat and barley, improving energy utilization in poultry diets. Government incentives further accelerate the adoption of feed enzymes and support the expansion of the feed enzymes segment in the global market. In 2022, China launched a USD 200 million initiative to promote enzyme use in livestock farming, underscoring its commitment to sustainable agriculture.

By Animal Type Insights

Largest Segment: Poultry

The poultry segment accounted for the leading share of 36.1% of the global compound feed market in 2024. The dominance of the poultry segment in the global market is attributed to the soaring global demand for poultry products, including meat and eggs. The International Egg Commission reports that egg production exceeded 85 million metric tons in 2022, with compound feed playing a vital role in maintaining flock health and productivity. The rapid urbanization worldwide is also boosting the expansion of the poultry segment in the global compound feed market. For instance, urban populations consume 20% more poultry products than their rural counterparts, creating robust demand for high-quality feed. Additionally, advancements in poultry genetics have increased growth rates, necessitating nutrient-dense feed formulations. For instance, modern broilers reach market weight in just 35 days, compared to 50 days two decades ago, as per Cobb-Vantress. Government initiatives are also promoting the growth of the poultry segment in the global market. In 2022, Brazil invested USD 1 billion in poultry farming infrastructure, solidifying its position as a global leader in poultry exports.

The aquaculture segment is another promising segment and is projected to grow at a CAGR of 8.8% over the forecast period, owing to the increasing popularity of seafood and declining wild fish stocks. The FAO states that aquaculture now accounts for 52% of global fish production, up from 26% in 2000, highlighting its growing importance. The growing health consciousness among consumers is also propelling the growth of the aquaculture segment in the global market. Seafood is a rich source of omega-3 fatty acids, with global per capita consumption rising by 1.2% annually, as per the FAO. Additionally, technological advancements in aquafeed formulations, such as microencapsulation, enhance nutrient delivery and absorption.

REGIONAL ANALYSIS

Asia-Pacific accounted for the lion's share of 39.7% of the global market in 2024 and is also predicted to witness the fastest CAGR over the forecast period. China dominates the market in this region, producing over 210 million metric tons of compound feed annually, fueled by its massive livestock and aquaculture sectors. The Chinese Ministry of Agriculture highlights that pork production alone accounts for 50% of the country’s total meat output, creating immense demand for feed. India follows closely, with its poultry industry expanding at a CAGR of 10% from 2023 to 2030, as per the Indian Poultry Federation. Government initiatives, such as the USD 1 billion Pradhan Mantri Kisan Sampada Yojana, support the modernization of feed mills and supply chains. Meanwhile, Southeast Asia’s aquaculture boom, particularly in Vietnam and Thailand, further propels growth. Vietnam’s seafood exports surpassed USD 11 billion in 2022, driven by shrimp and pangasius farming, both reliant on specialized feeds.

Europe is another promising market for compound feed globally. Germany is the largest contributor, producing nearly 25 million metric tons of compound feed annually, as per the German Feed Industry Association. The region’s growth is shaped by strict regulations governing feed safety and environmental impact, alongside rising demand for organic and sustainably produced animal products. The European Union’s ban on antibiotic growth promoters has accelerated the shift toward natural supplements, with probiotics and phytogenics gaining popularity. France and Spain also play pivotal roles, with their dairy and pork industries driving feed demand. The French Ministry of Agriculture reports that dairy exports exceeded EUR 5 billion in 2022, underscoring the importance of nutrient-rich feed in maintaining productivity.

North America held a substantial share of the global compound feed market in 2024. The availability of advanced agricultural practices, robust livestock farming, and stringent regulatory frameworks ensuring feed quality are majorly driving the growth of the North American compound feed market. The United States leads the market in North America, accounting for over 80% of North America’s compound feed production, with poultry and swine being the primary consumers. According to the USDA, U.S. poultry production reached 24 billion pounds in 2022, creating steady demand for high-quality feed formulations. One key factor is the integration of technology into feed production. Precision nutrition tools, such as near-infrared spectroscopy (NIRS), are widely adopted, enabling manufacturers to optimize ingredient usage and reduce costs. Additionally, sustainability initiatives have gained traction, with California passing legislation in 2022 mandating a 30% reduction in methane emissions from livestock by 2030. This has spurred the adoption of biofortified feeds and alternative protein sources like insect meal. Canada complements this growth with its focus on aquaculture, particularly salmon farming, which contributes CAD 1.2 billion annually to its economy.

Latin America secured a notable position in the compound feed market in 2024. Brazil leads the region, producing over 75 million metric tons of compound feed annually, primarily for poultry and beef cattle. The Brazilian Association of Animal Protein states that poultry exports grew by 8% in 2022, making the country a global leader in chicken production. Argentina complements this growth with its thriving beef industry, which relies heavily on corn-based feed formulations. The Argentine Beef Promotion Institute reports that beef exports generated USD 3 billion in 2022. Mexico’s dairy sector also plays a critical role, with milk production exceeding 12 million metric tons annually. Government programs, such as the USD 500 million Livestock Development Fund, encourage investments in feed quality and innovation, ensuring sustained regional expansion.

The Middle East and Africa represent an emerging segment in the compound feed market, capturing approximately 5% of the global share, according to Transparency Market Research. South Africa dominates this region, producing over 6 million metric tons of compound feed annually, primarily for poultry and dairy farming. The South African Poultry Association notes that poultry consumption reached 2.2 million metric tons in 2022, driving feed demand. Egypt’s aquaculture sector is another key contributor, with tilapia farming generating USD 1.5 billion annually. However, limited access to affordable raw materials and outdated milling technologies hinders widespread adoption. To address these challenges, the African Development Bank launched a USD 200 million initiative in 2022 to modernize agricultural infrastructure. Meanwhile, Saudi Arabia’s Vision 2030 program emphasizes self-sufficiency in food production, encouraging investments in livestock farming and compound feed manufacturing.

Top Players In The Market

Cargill Incorporated

Cargill is a global leader in the compound feed market, renowned for its innovative solutions and extensive distribution network. The company specializes in producing high-quality feed tailored to livestock, poultry, aquaculture, and dairy farming. Cargill’s focus on precision nutrition has enabled it to develop customized formulations that enhance animal health and productivity. It leverages advanced technologies like artificial intelligence and data analytics to optimize feed production. Additionally, Cargill emphasizes sustainability by incorporating alternative protein sources such as insect meal into its products, aligning with global environmental goals.

Archer Daniels Midland (ADM)

ADM is a key player in the compound feed industry, offering a diverse range of feed ingredients and supplements. The company’s expertise lies in sourcing raw materials like cereals, oilseeds, and by-products, ensuring consistent quality and affordability. ADM’s NutriOpt platform provides farmers with real-time insights into feed performance, enabling better decision-making. Its commitment to research and development has led to innovations like biofortified feeds and enzyme-enhanced formulations. Furthermore, ADM actively collaborates with governments and NGOs to promote sustainable farming practices, reinforcing its leadership role.

BASF SE

BASF SE contributes significantly to the compound feed market through its focus on nutritional additives and supplements. The company produces essential vitamins, amino acids, and enzymes that improve feed efficiency and animal health. BASF’s Lucrimal brand, for instance, offers methionine solutions widely used in poultry and swine diets. By integrating digital tools like its Nutrition Calculator, BASF helps farmers optimize feed formulations while reducing costs. Its investments in eco-friendly additives, such as phytase enzymes, align with regulatory trends and consumer demand for sustainable agriculture, solidifying its position as an industry innovator.

Top Strategies Used By Key Market Participants

Expansion of Production Facilities

Key players are expanding their manufacturing capacities to meet rising global demand. For example, companies like Cargill have established new feed mills in emerging markets such as India and Brazil, catering to localized needs. This strategy not only reduces logistical costs but also strengthens relationships with regional farmers. Expanding facilities also allow manufacturers to incorporate advanced technologies, improving product quality and efficiency. By focusing on underserved regions, these companies tap into untapped potential, driving revenue growth and enhancing their competitive edge.

Adoption of Digital Tools for Precision Nutrition

Digital transformation is reshaping the compound feed market, with leaders investing heavily in precision nutrition platforms. Companies like ADM use AI-powered tools to analyze feed composition and predict animal performance, enabling farmers to make informed decisions. These platforms reduce wastage and improve feed conversion ratios, addressing cost concerns for livestock producers. Moreover, digital tools facilitate compliance with stringent regulations by providing traceability and transparency in supply chains. This strategy enhances customer trust while positioning companies as pioneers in innovation.

Sustainability Initiatives and Alternative Ingredients

Sustainability is a cornerstone of modern feed production, with companies adopting eco-friendly practices to align with consumer preferences. BASF, for instance, develops biofortified additives that minimize environmental impact while improving animal health. Similarly, Cargill incorporates alternative proteins like insect meal and algae into its formulations, reducing reliance on traditional crops. These initiatives address challenges like climate change and resource scarcity, appealing to environmentally conscious stakeholders. By prioritizing sustainability, companies not only comply with regulations but also differentiate themselves in a competitive market.

COMPETITION OVERVIEW

The compound feed market is highly competitive, characterized by the presence of multinational giants like Cargill, ADM, and BASF, alongside numerous regional players. These companies leverage their R&D capabilities, global reach, and technological advancements to maintain dominance. However, the market is witnessing increased fragmentation due to the entry of smaller firms offering cost-effective and specialized solutions. Regulatory pressures, particularly in Europe and North America, have forced companies to innovate and adopt sustainable practices, intensifying rivalry.

Key players differentiate themselves through product quality, technological integration, and customer support. For instance, Cargill’s focus on precision nutrition and BASF’s emphasis on sustainability set them apart from competitors. Meanwhile, emerging markets in Asia-Pacific and Latin America present lucrative opportunities, prompting companies to expand their geographic footprint. Strategic acquisitions, partnerships, and investments in alternative ingredients are common tactics to strengthen market position. Overall, the compound feed market remains dynamic, with innovation and sustainability serving as critical success factors.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Cargill announced the launch of its new line of insect-based protein feeds designed for aquaculture. This move aims to address the growing demand for sustainable feed alternatives and strengthen Cargill’s position in the eco-friendly feed segment.

- In May 2023, ADM partnered with the Indian government to establish a state-of-the-art feed mill in Maharashtra. This initiative supports local farmers by providing affordable, high-quality feed while expanding ADM’s presence in South Asia.

- In August 2022, BASF acquired a startup specializing in phytase enzyme production, enhancing its portfolio of feed additives. This acquisition enables BASF to offer more efficient nutrient absorption solutions, appealing to livestock producers worldwide.

- In November 2021, Cargill introduced its digital platform, DairyFeed+, which uses AI to optimize dairy cattle feed formulations. This tool improves milk yield and reduces costs, reinforcing Cargill’s reputation as a tech-driven innovator.

- In July 2020, ADM launched a joint venture with a Brazilian agtech firm to develop biofortified feed for poultry. This collaboration focuses on improving feed efficiency and aligning with Brazil’s sustainability goals, strengthening ADM’s foothold in Latin America.

MARKET SEGMENTATION

This research report on the global compound feed market is segmented and sub-segmented into the following categories.

By Ingredients

- Cereals

- Cereals by-Product

- Oilseed Meal

- Oil

- Molasses

- Supplements

- Others

By Supplements

- Vitamins

- Antibiotics

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

By Animal Type

- Ruminant

- Swine

- Poultry

- Aquaculture

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

Middle East and Africa

Frequently Asked Questions

What is the current market size of the global compound feed market?

The size of the global compound feed market was valued at USD 564.86 million in 2025

What is the compound feed market growth?

The compound feed market is expected to grow at a compound annual growth rate of 1.62% from 2025 to 2033.

Who are the market players that are dominating the global compound feed market?

Cargill Inc., Charoen Pokphand Foods, Archer Daniels Midland Company, Land o’ Lakes, Inc., Nutreco, ALLTECH, INC., New Hope Group Co. Ltd., Wen’s Group, ForFarmers B.V., Agribusiness Holding Miratorg, Kyodo Shiryo Company, Sodrugestvo Group S.A., DeKalb Feeds, Inc., De Heus B.V., Ballance Agri-Nutrients Ltd., J.D. Heiskell & CO, Kent Feeds, Weston Milling Animal Nutrition and EWOS GROUP.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com