Global Feed Enzymes Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Phytase, Carbohydrase and Protease), Livestock (Poultry, Swine, Ruminants, and Aquatic Animals), Source (Microorganism, Plant, Animal), Form (Dry and Liquid), and Region (North America, Europe, Aisa-Pacific, Latin America, Middle East And Africa) – Industry Analysis From (2025 to 2033)

Global Feed Enzymes Market Size

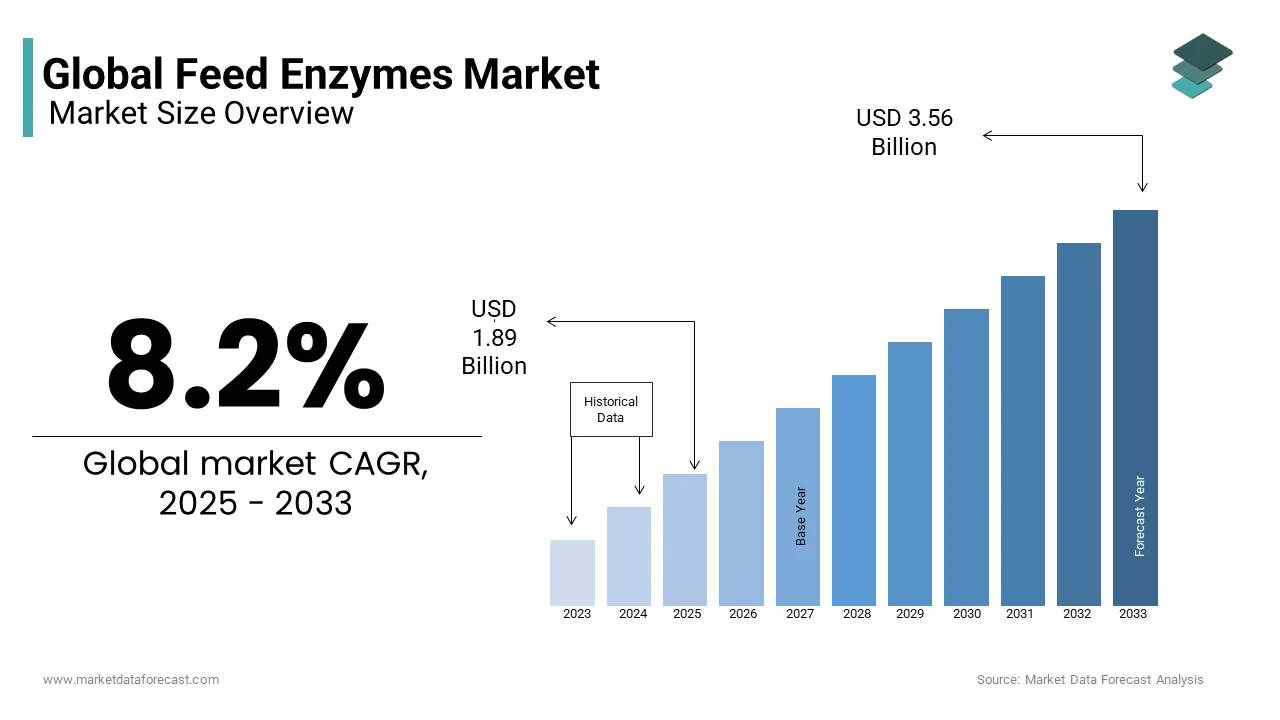

The global feed enzyme market was valued at USD 1.75 billion in 2024 and it is anticipated to reach USD 1.89 billion by 2025 from USD 3.56 billion by 2033, growing at a CAGR of 8.2% during the forecast period from 2025 and 2033.

CURRENT SCENARIO OF THE GLOBAL FEED ENZYMES MARKET

Feed enzymes are enzymes that are used as additives in animal feed in order to increase the nutritional value of the feed ingredients. The enzymes in the feed act as a catalyst to improve the digestion of important fibers or other elements present in the feed. The enzymes can be extracted from microbes, plants and other animals. The enzymes that are used to give animals are Phytase, Carbohydrase, and protease. Enzymes are the kind of protein that helps with the metabolic reactions in the body. The supplementation of enzymes improves the digestion in the animals and increases the profitability of the farm. Enzyme innovation has empowered animals to extract nutrients from their feed effectively, allowing them to utilize the feed more effectively and improving the general well-being of the animals. Enzymes promote good health among livestock, help in the weaning process in young animals, boost weight gain and health, increase egg production in hens and help animals to properly digest their feed in order to produce more manure. Owing to these factors, the use of enzymes in livestock feed is increasing, which is driving the growth of the market from 2023 to 2028.

MARKET DRIVERS

The driving force of the feed enzyme market is the rising demand for animal-based products.

The food consumption pattern is changing; people are now opting for more nutritious and healthy products. Therefore, the demand for protein-based products such as dairy, eggs, and meat is increasing in the market, which further increases the demand for animal feed enzymes, which directly fuels the growth of the feed enzyme market.

The feed enzymes help in improving the digestion of the animal and also increase the productivity of the livestock. Also, it helps increase the weaning process in young animals; therefore, the demand for feed enzymes increases the growth of the global market. The increasing awareness of the well-being of livestock among farmers is boosting the demand for feed enzymes in order to maintain the digestion of the feed in animals as well as help in the efficient utilization of nutrients from the feed. The increasing trend of meat production and consumption in various countries around the world is fueling the demand for animal feed compounds, which in turn boosts the growth of the feed enzyme market in the near future.

MARKET RESTRAINTS

Excessive levels of the feed enzyme could affect the endogenous enzymes in the gastrointestinal tract and may lead to adverse effects on animal health. Feed enzymes may trigger several side effects such as vomiting, diarrhea, gas, and swelling on legs and feet, etc.

Though the feed enzyme helps promote the livestock's health and the livestock industry's profitability, physiological limits are imposed by the conditions to enzyme response in the digestive tract of the livestock., depending on the various factors associated with livestock and feed, such as age, type of diet, and enzyme inclusion rates in feed products. All these factors restrict the growth of the animal feed enzyme market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.2% |

|

Segments Covered |

By Type, Livestock, Source, Form, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, Incorporated (US), BASF SE (Germany), DuPont (US), Bluestar Adisseo Co., Ltd. (China), Koninklijke DSM NV (Netherlands), Kemin Industries, Inc, Novus International, BEC Feed Solutions, BioResource International, Inc, Bioproton Pty Ltd and Others. |

SEGMENTAL ANALYSIS

Global Feed Enzymes Market By Type

Based on Type, the feed enzyme market is segmented into Phytase, carbohydrate, and Protease. The carbohydrate segment is expected to hold the largest market share during the forecast period. The carbohydrase breaks down carbohydrates in several regions of the digestive system inside the animal body. The two most used carbohydrase enzymes are the amylase and xylanase enzymes. Carbohydrase is a kind of commercial enzyme preparation that attacks carbohydrates, releasing energy that would otherwise be lost for the animal. The carbohydrates in the animal feed improve the digestibility of carbohydrates in animals. The protease segment is also going to boost in coming years owing to its property to act as a catalyst in the digestion of protein and quickly break down it into usable nutrients once it is ingested by the animal.

Global Feed Enzymes Market By Livestock

Based on Livestock, the feed enzyme market is segmented into Poultry, Swine, Ruminants, and Aquatic Animals. The swine segment is anticipated to hold the steady market share during the forecast period as swine are unable to utilize all components of the diet fully, so specific kinds of enzymes used to be added in their feed in order to help break down complex carbohydrates protein and phytate through carbohydrase, protease, and phytase. Carbohydrate enzymes are most effective in the diet of starters or young swine. The main carbohydrate in the swine diet is glucose which is provided by corn. Most of the starch present in corn is easily digestible, but the more complex carbohydrates, such as fiber, are not well utilized by the pigs. So enzymes are given to the swine in order to enable the digestion of such unutilized fibers.

Global Feed Enzymes Market By Source

Based on Source, the feed enzyme market is segmented into microorganisms, Plants, and Animals. The microorganism segment is expected to boost the feed enzyme market during the forecast period as this source is highly used in order to extract feed enzymes. Microbial enzymes are produced by using various fermentation techniques like solid-state and submerged fermentations. The large-scale production of microbial or microorganism enzymes is easier as compared to plant and animal enzymes. Moreover, this source of enzymes can be easily modified through various molecular and biochemical approaches to increase their specificity.

Global Feed Enzymes Market By Form

Based on Source, the feed enzyme market is segmented into Dry and Liquid. The dry form of feed enzyme is going to dominate the market as it is easier to handle, store, and transport than the liquid form. The liquid form of feed enzyme has less shelf life, so manufacturers and livestock farmers generally prefer a dry form of feed enzyme.

REGIONAL ANALYSIS

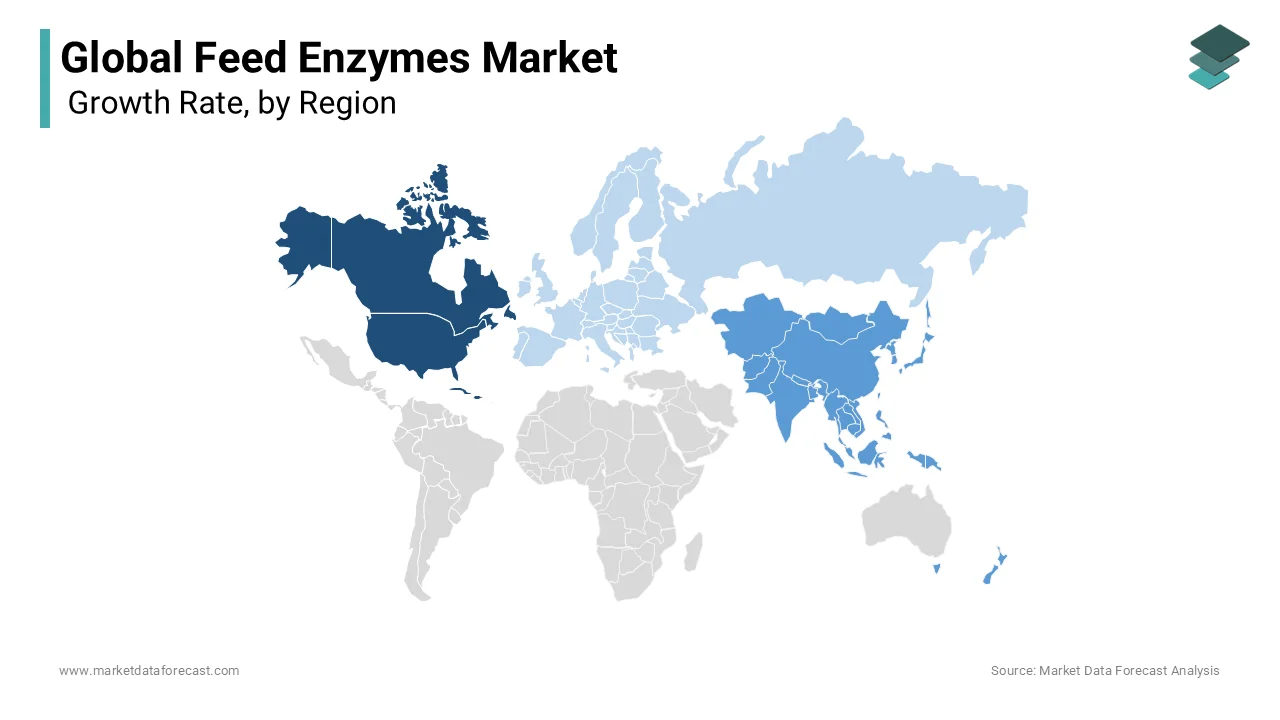

North America holds the largest market share of the feed enzyme market. In this region, the United States is the largest feed producer, with a production of 215 million tons, followed by Mexico and Canada. The increasing production of meat is driving the demand for the feed enzyme in order to produce more meat, propelling the demand of the market. Also, people are becoming more conscious about health and have spent large amounts on nutritional food products, including meat and dairy products, which will propel the demand for the feed enzyme market during the projected period between 2022 and 2027.

Asia-Pacific market is expected to witness the highest growth rate during the forecast period between 2022 and 2027. Countries like India and China are the largest markets in the region due to their large populations. The increasing demand for meat-based products in this region is driving the demand for the animal feed enzyme. Moreover, the two major economies in this region are India and China, which are estimated to have 7200 feed mills and produce 227 million metric tons of compound feed. China alone contributes to almost 18% of the feed compound production globally. Also, the demand for feed enzymes for livestock is increasing due to increasing awareness among livestock farmers about the well-being of the livestock and the benefits of the enzymes. The growing demand and the production of feed compounds are driving the growth of the feed enzyme market in this region.

Europe is expected to have a steady growth rate during the forecast period owing to the increasing demand for meat. For this reason, according to the organization for economic co-operation and Development, Russia is recorded to be the country with the highest poultry meat consumption in this region. The growing meat consumption trend is driving the growth of the feed enzyme market in this region in order to increase the productivity and quality of the livestock.

KEY MARKET PLAYERS

Some of the leading companies operating in the global feed enzyme market are Cargill, Incorporated (US), BASF SE (Germany), DuPont (US), Bluestar Adisseo Co., Ltd. (China), Koninklijke DSM NV (Netherlands), Kemin Industries, Inc, Novus International, BEC Feed Solutions, BioResource International, Inc., Bioproton Pty Ltd. Cargill had the largest share of the world’s feed enzyme market in terms of sales revenue in 2020.

RECENT HAPPENINGS IN THIS MARKET

- In June 2021, DSM and Novozymes alliance together introduced its second generation protease, i.e., ProAct 360. ProAct 360 reflects a 360° understanding of the needs of poultry producers and also the challenges that poultry production can face with regard to environmental footprint.

- In Jan 2021, Novus International, Inc. announced its partnership with U.S technology company, Agrivida. This alliance combines Novu's nearly 30 years of research, sales and marketing experience with Agrivida’s novel technology through which both companies could use the customer base as well as explore new innovative products through research & development collaboration.

MARKET SEGMENTATION

This market research report on the global feed enzymes market is segmented and sub-segmented into the following categories.

By Type

- Phytase

- Carbohydrase

- Protease

By Livestock

- Poultry

- Swine

- Ruminants

- Aquatic Animals

By Source

- Microorganism

- Plant

- Animal

By Form

- Dry

- Liquid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the feed enzyme market growth?

The global feed enzyme market is expected to be valued at USD 1.89 billion in 2025, and it is anticipated to reach a valuation of USD 3.56 billion by the end of 2033.

Which type of enzyme is largely adopted in the market?

.Phytase holds the largest market share of the feed enzyme market as it is mostly preferred by most animal feed manufacturers and livestock producers to be used as an enzyme. The addition of phytase in the feed offers many advantages to the livestock such as the highest activity at low pH; also, it improves bone health, enables body weight gain, and also improves digestive efficiency.

What is the competitive scenario of the top players in feed enzyme market?

There is an increase in new product developments, expansions, and mergers & acquisitions by key players such as DowDuPont and BASF SE

Which is the current market size of the global feed enzymes market?

The current size of the feed enzyme market size is estimated at USD 1.89 billion in 2025.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com