Europe Feed Enzymes Market Size, Share, Trends & Growth Forecast Report By Type Of Ingredient, Type Of Animals and Country (U.K, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands and Rest of Europe), Industry Analysis (2025 to 2033)

Europe Feed Enzymes Market Size

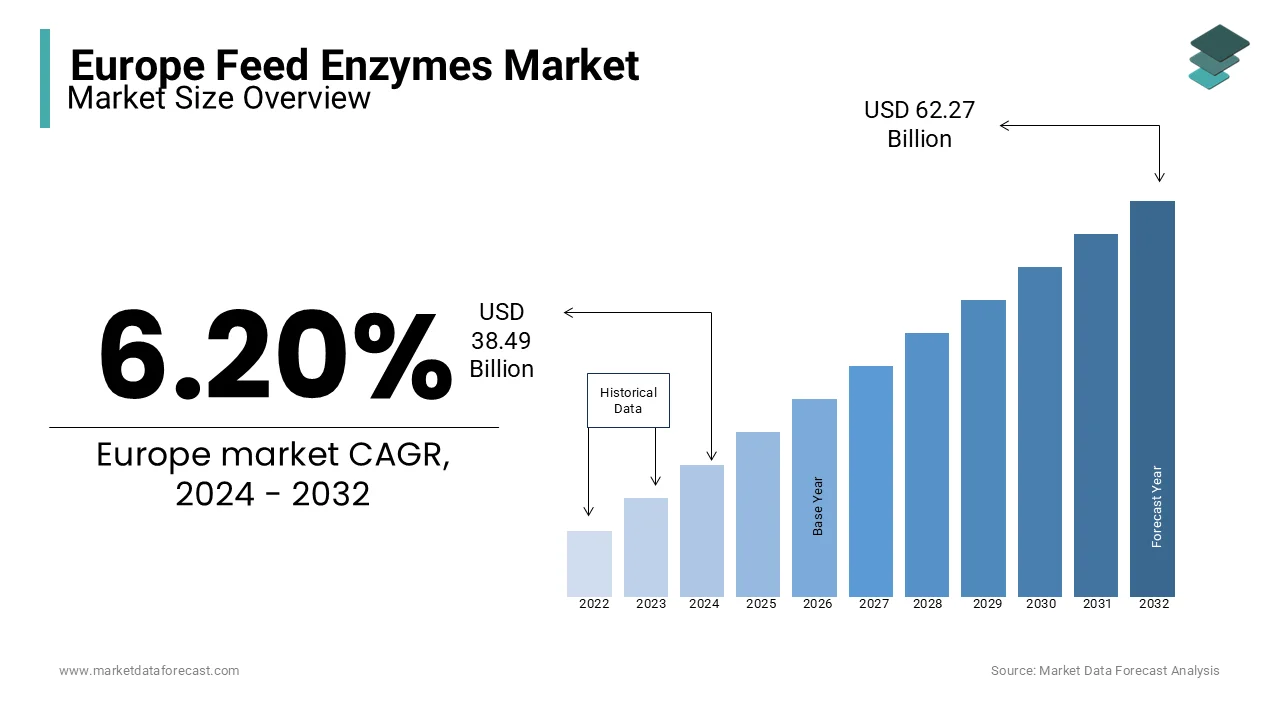

The feed enzymes market size in Europe was valued at USD 62.27 Billion in 2024 and is projected to reach USD 66.13 Billion by 2025 from USD 107.00 billion by 2033, growing at a CAGR of 6.20% during the forecast period from 2025 to 2033.

Feed enzymes are a crucial segment of the animal nutrition industry and focus on the production and use of enzymatic additives to improve the digestibility and nutritional value of animal feed. Europe has led the adoption of feed enzymes due to its advanced livestock industry, stringent regulations on feed additives, and a focus on sustainable agricultural practices. According to the European Food Safety Authority, Europe prioritizes enzyme use to reduce reliance on antibiotics and mitigate phosphorus and nitrogen emissions in manure to address environmental concerns.

MARKET DRIVERS

Growing Focus on Sustainable Livestock Farming in Europe

The rising emphasis on sustainability in livestock farming is a significant driver for the Europe feed enzymes market. The European Union’s Farm to Fork Strategy aims to reduce environmental impacts from agriculture, including a 50% reduction in nutrient loss by 2030. Feed enzymes, such as phytase and carbohydrase, play a critical role in achieving these goals by enhancing nutrient absorption and reducing phosphorus and nitrogen emissions in manure. According to the Food and Agriculture Organization, Europe’s compound feed production exceeded 150 million tons in 2021, with enzymes increasingly incorporated to meet sustainability targets. This focus on eco-friendly practices continues to boost enzyme adoption.

Increasing Demand for High-Quality Animal Protein

Rising consumer demand for high-quality animal protein products is another key driver for the Europe feed enzymes market. The European Commission reported that per capita meat consumption in the European Union reached approximately 68 kg in 2022, driven by preferences for premium-quality poultry, pork, and beef. Feed enzymes improve livestock productivity and health, ensuring optimal growth rates and feed conversion efficiency. Protease enzymes, for example, enhance protein utilization, directly supporting the production of high-quality meat and dairy products. This growing demand for superior animal protein is propelling the adoption of feed enzymes, enabling farmers to meet market expectations efficiently.

MARKET RESTRAINTS

High Cost of Feed Enzymes

The high cost of feed enzymes is a significant restraint in the Europe feed enzymes market. Advanced enzymes such as protease and multi-enzyme complexes often require sophisticated production processes, resulting in elevated prices. According to the European Commission, feed costs account for up to 70% of total livestock production expenses, and the additional cost of enzyme inclusion further increases financial burdens for farmers, particularly small-scale producers. While enzymes provide long-term benefits, their upfront costs can deter adoption, especially in economically constrained regions. This price sensitivity limits the penetration of advanced enzyme solutions, slowing overall market growth.

Variability in Feed Ingredient Quality

The inconsistent quality of raw feed ingredients across Europe poses another challenge for the feed enzymes market. The European Food Safety Authority notes that variations in nutrient content, particularly in cereals and oilseeds, impact the effectiveness of enzyme applications. For instance, differences in phytate levels can affect the performance of phytase enzymes, reducing their ability to enhance phosphorus digestibility. Such variability requires tailored enzyme formulations, increasing production complexity and costs. Additionally, fluctuating ingredient quality complicates the predictability of enzyme efficiency, making farmers hesitant to adopt enzyme-based feed solutions, thereby restraining the market’s growth potential.

MARKET OPPORTUNITIES

Advancement in Enzyme Technologies

Technological advancements in enzyme development present a significant opportunity for the European feed enzymes market. Innovations such as genetically engineered enzymes and multi-enzyme complexes are enhancing feed efficiency and broadening application potential. For instance, tailored enzyme formulations improve nutrient digestibility across diverse feed types, including those with variable raw material quality. According to the European Food Safety Authority, the adoption of advanced enzyme solutions is expected to increase as livestock producers prioritize cost efficiency and sustainability. These innovations enable manufacturers to offer precise, high-performing products, meeting the evolving needs of livestock farmers and contributing to market growth.

Growing Adoption of Enzymes in Aquaculture

The increasing adoption of feed enzymes in Europe’s expanding aquaculture industry represents another promising opportunity. The Food and Agriculture Organization highlights that aquaculture production in Europe reached 2.7 million tons in 2021, driven by rising demand for fish and seafood. Enzymes such as protease and carbohydrase improve the digestibility of plant-based feed ingredients, addressing the nutritional challenges of fish diets. Additionally, the European Union’s efforts to promote sustainable aquaculture, aligned with the Green Deal objectives, are encouraging the incorporation of feed enzymes. This trend opens new avenues for enzyme manufacturers to cater to the aquaculture segment, diversifying their product offerings and boosting market growth.

MARKET CHALLENGES

Regulatory Complexity and Approval Processes

Stringent regulatory frameworks governing feed additives in Europe pose a significant challenge to the feed enzymes market. The European Food Safety Authority mandates rigorous safety assessments and efficacy evaluations for enzyme products before approval. These lengthy and complex processes increase time-to-market and development costs for enzyme manufacturers. For example, the European Commission reported that approvals for new feed enzymes can take up to three years, delaying innovation. Additionally, compliance with region-specific regulations across different European Union member states adds operational complexity, creating barriers for small and medium-sized manufacturers attempting to enter the market.

Lack of Awareness Among Small-scale Farmers

Limited awareness about the benefits of feed enzymes among small-scale farmers hinders market growth in Europe. While large-scale livestock producers are adopting enzymes to enhance feed efficiency and sustainability, smaller farms often lack the knowledge or resources to implement these solutions. According to Eurostat, small farms (less than 10 hectares) account for approximately 65% of all agricultural holdings in the European Union. These farmers frequently rely on traditional feed practices, unaware of the cost-saving and productivity-enhancing potential of enzymes. This knowledge gap restricts the widespread adoption of feed enzymes, particularly in rural areas, creating challenges for market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.20% |

|

Segments Covered |

By Ingredients, Animal Type and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Germany, France, Italy, UK, Spain, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Rest of Europe |

|

Market Leaders Profiled |

DuPont, DSM, BASF Corporation, Alltech, Novozymes, Adisseo, France AB Enzymes, GmbH Advanced Enzymes Technologies Limited, Amano Enzyme Inc, Bio-Vet JSC Biocatalysts ltd Chr. Hansen Inc, |

REGIONAL ANALYSIS

Germany emerged as the most dominating country for feed enzymes in Europe and is expected to continue its dominating position in the European market throughout the forecast period. The growth of the German feed enzymes is majorly driven by its advanced livestock sector and emphasis on sustainability. According to the German Federal Statistical Office, the strong livestock industry of Germany produces over 25 million tons of compound feed annually and which makes Germany one of Europe’s largest consumers of feed enzymes. The commitment of Germany to reduce greenhouse gas emissions and nutrient waste has spurred the adoption of enzymes like phytase and protease to enhance feed efficiency. Additionally, government initiatives supporting environmentally friendly farming practices further bolster the market, positioning Germany as a key contributor to the region’s feed enzyme industry.

The Netherlands is a prominent player in the Europe feed enzymes market and is predicted to account for a notable share of the European market over the forecast period due to its intensive livestock farming and aquaculture sectors. The Dutch Ministry of Agriculture reports that the country produces over 70% of its agricultural exports, with livestock and fish farming heavily reliant on enzyme-integrated feed. Phytase and carbohydrase enzymes are widely used to improve nutrient absorption and reduce phosphorus emissions, aligning with the Netherlands’ sustainability goals. The Netherlands also serves as a hub for feed innovation, supported by strong research institutions and collaborations between academia and the agricultural sector, reinforcing its leadership in enzyme adoption and development.

France is prominent player in the European feed enzymes market. The large livestock population and progressive agricultural practices in France are boosting the French market growth. According to the French Ministry of Agriculture, France is the leading producer of beef in the European Union, generating substantial demand for enzyme-enhanced feed to optimize productivity. The country’s policies promoting reduced antibiotic use in animal farming have further driven enzyme adoption to maintain animal health and performance. With an annual compound feed production exceeding 20 million tons, France continues to prioritize enzyme integration, contributing significantly to the advancement of sustainable farming practices and environmental conservation in Europe.

KEY MARKET PLAYERS

DuPont, DSM, BASF Corporation, Alltech, Novozymes, Adisseo, France AB Enzymes, GmbH Advanced Enzymes Technologies Limited, Amano Enzyme Inc, Bio-Vet JSC Biocatalysts ltd Chr. Hansen Inc, Enmex Sa De Cv Lesaffre Group, PURATOS GROUP Rossari Biotech Limited, Shenzhen Leveling, and Bio-Engineering Co. Ltd. are some of the major key players involved in the European feed enzymes market.

MARKET SEGMENTATION

This market research report on the European feed enzymes market is segmented and sub-segmented into the following categories.

By Ingredients

- Carbohydrase

- Phytase

- Others

By Animal Type

- Ruminant

- Swine

- Poultry

- Aquaculture

- Others

By Country

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

what is the current size of the Europe feed enzymes market?

The current size of the European feed enzymes market is worth USD 66.13 billion in 2024.

what is the expected growth value of the Europe feed enzymes market?

Europe's feed enzymes market is expected to grow by USD 107.00 billion by 2033.

which segment has a highest majority in Europe feed enzyme market?

Poultry and swine segments comprise the majority of the feed enzyme market share, followed by ruminants. Carbohydrases are the most widely used enzyme.

what region holds the largest share market in Europe feed enzyme market?

Geographically, the European market for Feed Enzymes is segmented into Spain, Russia, Germany, Italy, the UK, France, and Others. Europe dominates the market with a share of 33%. Spain, Germany, and Russia are the largest markets within the region. Meat is the top export commodity in Spain.

what are the key market players involved in Europe feed enzyme market?

DuPont, DSM, BASF Corporation, Alltech, Novozymes, Adisseo, France AB Enzymes, GmbH Advanced Enzymes Technologies Limited, Amano Enzyme Inc, Bio-Vet JSC Biocatalysts ltd Chr. Hansen Inc, Enmex Sa De Cv Lesaffre Group, PURATOS GROUP Rossari Biotech Limited, Shenzhen Leveling, and Bio-Engineering Co. Ltd. are some of the major key players involved in the Europe feed enzymes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com