Global Data Lake Market Size, Share, Trends, & Growth Forecast Report By Software (Data Integration and Management, Data Discovery, Data Visualization, and Data Lake Analysis), Service (Management and Professional), Deployment Mode (Cloud and On-Premise), Business Function (Marketing, Sales, Operations, Finance and Human Resources), Industry Vertical (IT and Telecommunications, Retail, Healthcare, Government and Defense, Manufacturing and Energy, BFSI, Research and Education, and others), and Regional - (2025 to 2033)

Global Data Lake Market Size

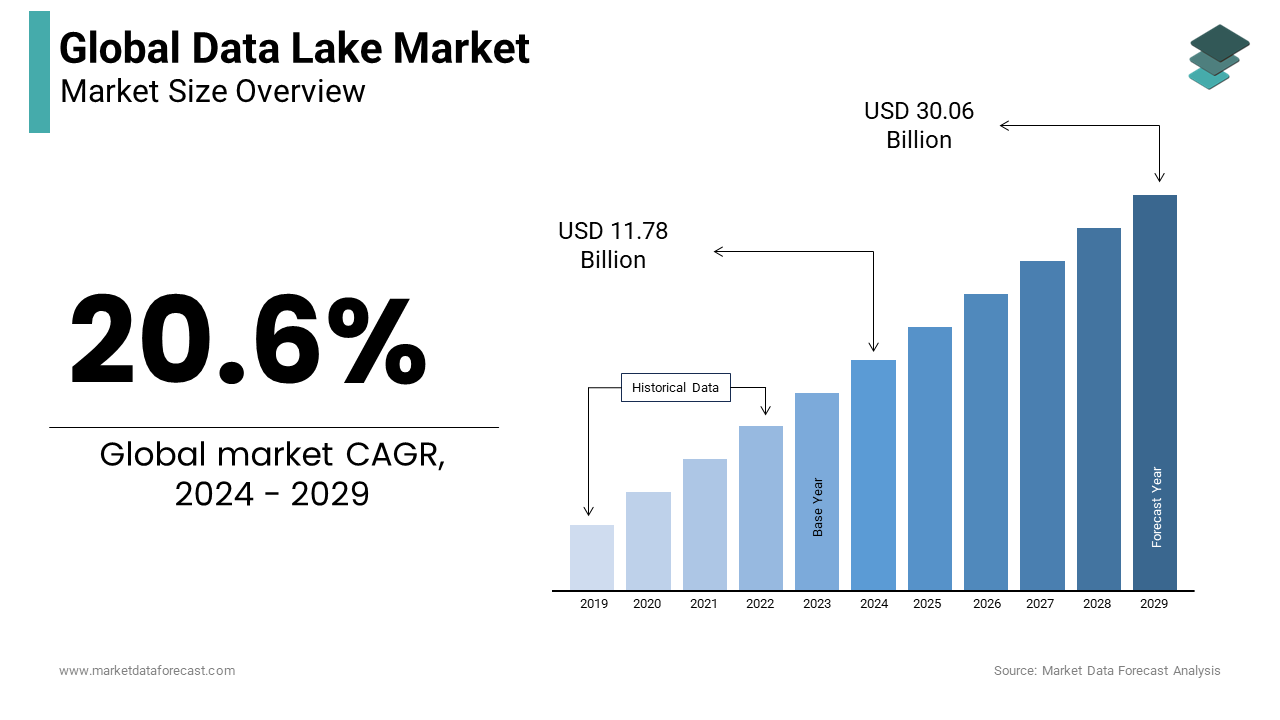

The global data lake market was worth USD 11.78 billion in 2024. The global market size is projected to reach USD 14.21 billion in 2025 and USD 63.57 billion by 2033, growing at a CAGR of 20.6% during the forecast period.

The term data lake is increasingly used to describe any large group of data in which data requirements are not defined until the data is queried. Data lakes offer several advantages, such as scalability, and can accommodate data at high speed. It also offers advanced analytics using the availability of large amounts of consistent data. Data Lake also helps improve business agility, as this storage model supports multiple distributions and workloads of different sizes and types. This allows the data scientist to centralize mass data from multiple applications into a single logical storage pool. It can contain different types of data, including files, audio, video files, and databases. There is a kind of complexity in understanding the difference between the data lake and the data warehouse among people, owing to the common factor of data storage in both of them. Data Lake is a repository of stored data, where data can be structured, semi-structured, unstructured, and raw. The structure and requirement of the data are not specified until it is necessary.

MARKET DRIVERS

The main reason why the global market for data lakes is growing is due to the low cost of storage. Data warehouses and data lakes perform the same function but in a different way. Data lakes, in general, require less expenses for data storage, which is the crucial aspect driving the expansion of the global market for data lakes. A highly agile nature is also a key factor in the global market for data lakes. Additionally, the ability to configure and reconfigure as needed drives growth in the global data lake market. Other factors that favor the growth of the world market are the low cost of labor, the low cost of maintenance, and the low cost of raw materials.

Banks have increased the use of data lakes to integrate data across multiple domains to create a central database. The Australian and New Zealand Banking Group (ANZ) has implemented a project to aggregate all of the data pools in their domains to create a central data lake for banking that will allow the bank to change the data storage architecture that is normally used. Banks are funding data engineers to offer responsive data lakes to meet the needs of consumers and are trying to improve the utility of data for solutions on the go. The State Bank of India (SBI) provided data lakes, in addition to the commonly used data warehouse, to bank executives, the deputy managing director, and the head of news to provide analytics on the go. The increase in digital transactions across the globe is increasing the amount of data stored in banks for each activity. Therefore, opportunities related to Big Data analytics are expanding.

MARKET RESTRAINTS

However, data lakes face certain challenges, including slow boarding and data integration, as well as high costs after boarding and maintenance. This is why many organizations are reluctant to adopt data lakes, making it difficult for the data lake market to grow.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.6% |

|

Segments Covered |

By Software, Service, Deployment Mode, Business Function, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Informatica Corporation, Microsoft Corporation, Teradata, EMC Corporation, Capgemini, SAP SE, Oracle Corporation, Atos, Hitachi, SAS Institute, and Others. |

SEGMENTAL ANALYSIS

By Software Insights

The global data lake market is categorized by software type into data integration and management, data discovery, data visualization, and data lake analysis.

By Service Insights

Depending on the type of service, the global market is diverse in terms of management and professionals. In addition, the professional branch is buried as data lake services, support and maintenance, and systems integration and deployment.

By Industry Vertical Insights

Based on industry verticals, the global data lake market is segmented into IT and telecommunications, retail, healthcare, government and defense, manufacturing and energy, BFSI, research and education, and others.

By Business Function Insights

Depending on the business functions, the global market is divided into marketing, operations, sales, human resources, and finance.

By Deployment Mode Insights

Based on the deployment mode, the global data lake market is segmented into cloud and local.

REGIONAL ANALYSIS

The global data lakes market is spread across the regions in North America, Europe, Asia-Pacific, South America, the Middle East, and Africa. The United States of North America and European countries like Germany are also playing a vital role in driving growth in the global data lake market. On the other hand, South America will lead the world market for data lakes in the near future. Asia-Pacific is said to be the fastest-growing network for the global market as countries like China and India are embracing new technologies.

KEY MARKET PARTICIPANTS

The major players operating in the global data lake market include Informatica Corporation, Microsoft Corporation, Teradata, EMC Corporation, Capgemini, SAP SE, Oracle Corporation, Atos, Hitachi, and SAS Institute.

RECENT MARKET HAPPENINGS

-

In April 2019, Temenos, a leading banking software provider, introduced Temenos Data Lake, which is considered the first robust and productive data lake that integrates big data analysis into its banking software. Temenos Data Lake offers ready-to-use data integration, availability, and optimization to power AI-based banking applications.

-

In January 2019, Tata Consultancy Services entered the market with its enterprise data lake solutions on the AWS Marketplace. The recently released software captures and manages all kinds of data in a central Hadoop repository.

-

In November 2019, Cloudera announced the Cloudera data platform (CDP) powered by Microsoft Azure. CDP is an integrated data platform that is easy to protect, manage, and implement. CDP on Azure includes Cloudera's Shared Data Experience (SDX), which helps to protect the Data Lake in hours compared to weeks in the earlier days. It also replaces monotonous scripts with the convenience of defining and forgetting.

-

In October 2019, Teradata launched its novel offerings to help companies use Vantage to simplify their existing analytical ecosystems as they shift towards the cloud. Teradata Vantage now unifies analysis, Data Lakes, and cloud computing warehouses.

-

In August 2019, AWS launched a fully managed service known as AWS Lake Formation to offer convenience to customers in creating, securing, and managing data lakes.

MARKET SEGMENTATION

This research report on the global data lake market has been segmented and sub-segmented based on the software, service, deployment mode, business function, industry vertical, and region.

By Software

-

Data Integration and Management

-

Data Discovery

-

Data Visualization

-

Data Lake Analysis

By Service

-

Management

-

Professional

By Industry Vertical

-

IT and Telecommunications

-

Retail

-

Healthcare

-

Government and Defense

-

Manufacturing and Energy

-

BFSI

-

Research and Education

By Business Function

-

Marketing

-

Sales

-

Operations

-

Finance

-

Human Resources

By Deployment Mode

-

Cloud

-

On-Premise

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How does security and compliance impact the global data lake market?

Security and compliance concerns remain critical challenges for the data lake market. The implementation of robust data governance frameworks and advanced security measures is pivotal for addressing these issues and fostering market growth.

How are emerging technologies like AI and machine learning influencing the data lake market?

Emerging technologies, particularly AI and machine learning, are driving innovation in the data lake market. These technologies enhance data processing capabilities, facilitate predictive analytics, and contribute to the overall intelligence of data lake solutions.

What is the role of open-source platforms in the global data lake landscape?

Open-source platforms play a significant role in the data lake market, fostering innovation and collaboration. Hadoop, Apache Spark, and other open-source tools are widely adopted, providing cost-effective solutions for managing and analyzing large volumes of data.

How is the competitive landscape evolving within the global data lake market?

The global data lake market is witnessing increased competition with major players such as Amazon Web Services (AWS), Microsoft, and Google dominating. Additionally, niche players focusing on specific industry verticals are gaining traction, contributing to a diverse and dynamic market landscape.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com