Global Dental Bone Graft Substitutes Market Size, Share, Trends & Growth Forecast Report By Product (Synthetic Bone Graft, Xenograft, Allograft and Demineralized Allograft), Type (Bio OSS, Osteograf, Grafton and Others), Application and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Dental Bone Graft Substitutes Market Size

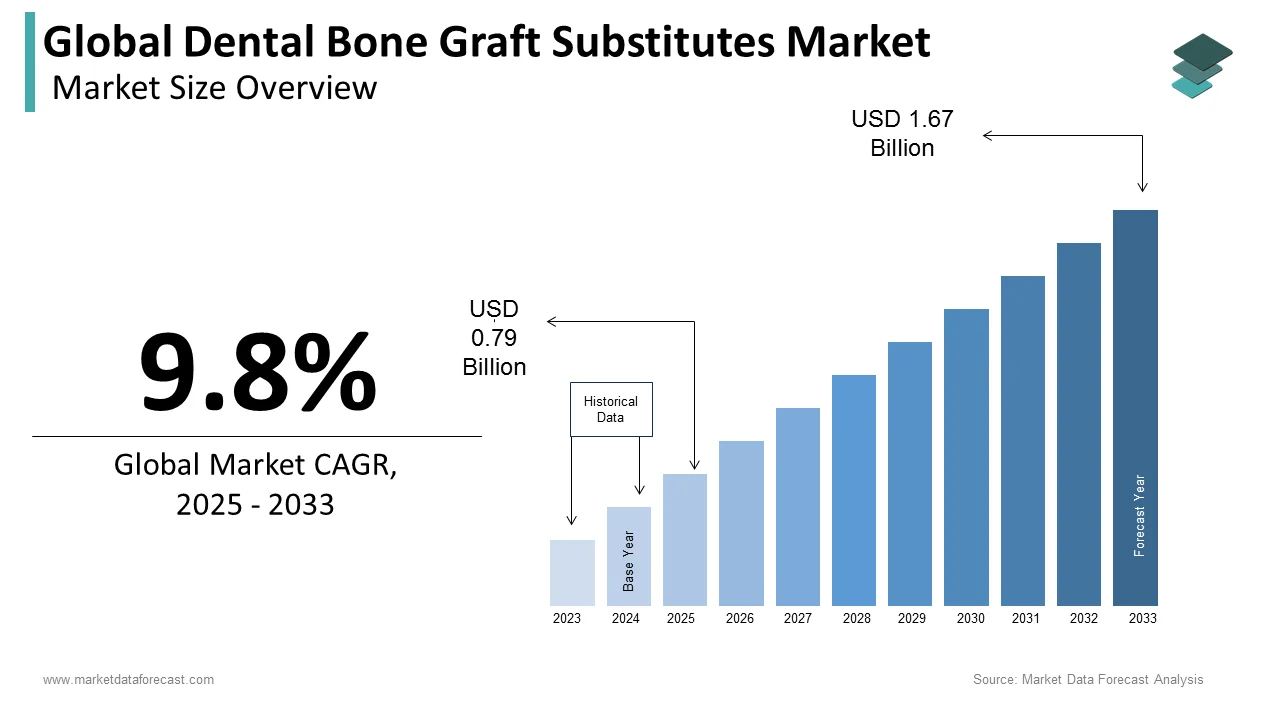

The size of the global dental bone graft substitutes market was valued at USD 0.72 billion in 2024. The global market size is further forecasted to grow to USD 1.67 Billion by 2033 from USD 0.79 Billion in 2025, growing at a CAGR of 9.8% from 2025 to 2033.

Bone graft substitutes are used to repair bone loss using the bone graft procedure. Bone grafting can be performed during periodontal procedures to save a tooth or during a dental implant to replace a tooth. Bone graft substitutes are widely used in plastic surgery and have many uses. Dental bone graft substitutes are used to pack the space left by missing bone and stimulate the growth of new bone.

MARKET DRIVERS

YoY Growth in Dental Practitioners

The growing number of general dental practitioners dealing with implants majorly promotes the global dental bone graft substitutes market growth. As per the American Dental Association, as of 2017, a 95% to 98% success ratio has been reported for dental implant surgeries. About 5 million implants are performed in the United States each year. New players are suspected of taking advantage of enormous opportunities to drive market growth, especially synthetic materials.

YoY Growth in the Aging Population

The growing geriatric population suffering from dental-related disorders is boosting the growth rate of the global dental bone graft substitutes market. According to the United Nations Ministry of Population & Economy, the population aged 60 and over in 2013 was 841 million, reaching 2 billion by 2050. Thus, as the elderly population increases, the number of dental surgeries is supposed to increase. Therefore, there is a high demand for dental bone graft substitutes during the forecast period. Furthermore, increased use of implants in the dental field will likely provide significant growth opportunities for dental applications during the forecast period. Implants are primarily used as scaffolds and fillers to promote bone formation and healing.

Growing Incidences of Dental Problems and Increasing Prevalence of Teeth Implants

With advanced surgical techniques such as bone grafting and bone regeneration, the increased use of surgical procedures for dental implants is presumed to drive market growth. Also, increasing the success rate of dental implants contributes to global dental bone graft substitute market growth. In addition, the growing number of patients with dental and oral diseases has increased the demand for dental surgery and, as a result, expanded the market for dental membranes and bone graft substitutes. Worldwide, older people over 65 have a periodontal score of 5 to 70%. In addition, chronic oral disorders are higher in older people, promoting bone graft substitutes.

MARKET RESTRAINTS

High Costs

The major restraint for the global dental bone graft substitutes market is the length of dental treatment, which usually determines surgery cost and affects market expansion. In addition, the costs associated with these advanced procedures and treatments are also increasing. These increased costs can be attributed to the rise in the price of materials used, such as implants, membranes, graft materials, and replacements and customizations daily for each patient. These factors restrain the global dental bone graft substitutes market boom.

MARKET OPPORTUNITIES

The emerging trends in the progressive advancement of bio-composite materials for bone reconstruction and substitution are present in the latest strategies of the European Union, particularly within the goals of Cluster 1-HEALTH under the Horizon Europe program. One of the primary goals of the scientific study of bio-composites is to assist the development of innovative technologies and methods to lower, to the fullest extent, in-vivo testing and the application of animals for scientific research. The discussions include omics-based approaches and various high-throughput processes on the basis of micro-physiological systems, organoids, human-derived cells, and in silico models.

Experts in various disciplines, including engineering, biology, and medicine, are working together to create new minimally invasive treatment options. Also, artificial intelligence is essential for this initiative to analyze data and make algorithms for predicting tumor progression in a personalized manner. The aim of EU’s research policies is to enhance understanding of rare bone cancers, improve prevention tactics and measures, optimize diagnosis and treatment accessibility, and elevate the quality of life for patients and families. Finite element modeling (FEM) is employed to simulate the mechanical behavior of bio-composites under specific conditions, aiding in the selection of optimal materials for bone substitutes.

Additionally, composite grafts merge scaffolding qualities with biological components to encourage cell differentiation and growth and, ultimately, osteogenesis. Autograft is regarded as perfect for insertion processes, enabling osteoinductive proliferation factors, an osteoconductive scaffold, and osteogenic cells. Synthetic graft substitutes provide structural reinforcement, but they do not exhibit osteogenic or osteoinductive effects. Calcium sulfate has an osteoconductive crystalline form or framework that quickly reabsorbs (1 to 3 months), resulting in porous capillaries that facilitate the growth of perivascular mesenchymal tissue. In total, these advancements depict a significant step towards better outcomes in this market.

MARKET CHALLENGES

Safety and Clinical Efficacy

Individual patient aspects like health status, age, and essential conditions can influence how well an implant substitute functions. This instability increases the complexity of the examination of the effectiveness of a product in a diverse population. Moreover, difficulties in bone healing are another factor under this challenge that affects the market growth. Bone regenerative is a multifaceted biological procedure involving different cellular and molecular mechanisms. Implant replacements must not only assist osteoconductive but also preferably offer osteoinductive properties. Several substitutes fall short in one or both aspects, making it tough to show overall efficiency in clinical environments. Besides these, the bone-inserting process carries inherent risks, including infection at the surgical site. So, the introduction of foreign materials can raise this threat, necessitating rigorous testing to make sure that substitutes do not have pathogens or provoke immune responses.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2024 to 2033 |

|

Segments Analysed |

By Type, Application, Product, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Key Market Players |

Institut Straumann AG (Switzerland), Geistlich (Switzerland), DENTSPLY International (U.S.), Zimmer Biomet (U.S.), Medtronic (Ireland), BioHorizons IPH, Inc. (U.S.), ACE Surgical Supply Company, Inc. (U.S.), RTI Surgical, Inc. (U.S.), LifeNet Health (U.S.) and Dentium (Korea). |

SEGMENTAL ANALYSIS

By Type Insights

The xenograft segment accounted for the largest share of the dental bone graft substitutes market based on type in 2024. Advantages such as easy availability, sterility, reduced morbidity, long shelf life, and reduced risks of disease transfer offered by synthetic grafts lead to increased usage as dental bone graft substitutes. Therefore, Synthetic Bone graft is anticipated to be the fastest-growing segment during the forecast period.

By Application Insights

The socket prevention segment shows the highest growth over the forecast period. The factors driving growth in this segment of the dental bone graft substitutes market are increasing numbers of dental implant procedures and rising awareness among people about oral care. In addition, growing awareness of the latest products that promote better outcomes is surging the growth rate of the dental bone graft substitutes market.

By Product Insights

The Bio-Oss segment is estimated to account for the largest share of the global dental bone graft substitutes market during the forecast period. Bio-Oss is one of the top products on the substitute market for dental bone grafting. It is made from organic components of bovine bone, similar to human bone. It is, in nature, porous and non-antigenic. Increasing demand for eco-friendly materials to follow environmental safety measures is lavishing the market's need. As a result, the Bio-Oss segment is anticipated to show the fastest growth during the forecast period.

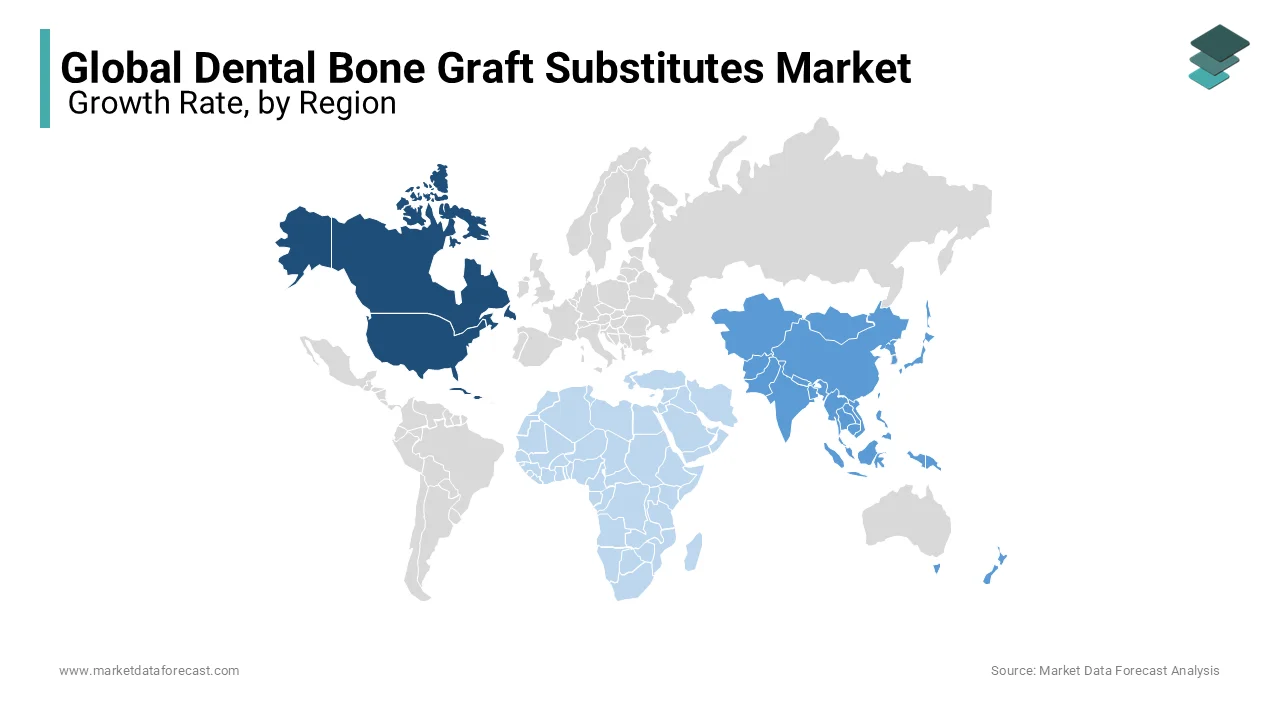

REGIONAL ANALYSIS

Due to the origin of implant dentistry in this region and the high penetration of dental bone graft substitutes, Europe is anticipated to register the highest CAGR and dominate the market during the forecast period. Furthermore, market growth in this region is growing due to the increased governmental spending on oral healthcare and the increasing aging population in the area.

North America is positioned second in accounting for a significant share of the global market in 2024. Growth in medical tourism and favorable actions from the governments primarily drive market growth in North America.

Asia-Pacific accounted for a substantial share of the global market in 2024. The growing disposable income among the urban population is the primary growth driving force for the market in this region. In addition, rapid industrialization, urbanization, and rising economic strength in major countries like India and China boost the market growth.

Latin America is predicted to hold a considerable share of the worldwide market during the forecast period. In Latin American market, countries like Brazil, Mexico, and Argentina are lucrative regions for the bone graft substitute and dental membranes market. It is due to the advanced technology available in this region. Mexico played the leading in Latin America and expected its dominance due to the growing occurrence of dental tourism in this country. Also, Brazil stands for the second-largest share market.

The market in MEA is expected to witness a moderate CAGR during the forecast period due to the rising aging population in this region.

KEY MARKET PARTICIPANTS

Notable market participants leading the global dental bone graft substitutes market profiled in the market report are Institut Straumann AG (Switzerland), Geistlich (Switzerland), DENTSPLY International (U.S.), Zimmer Biomet (U.S.), Medtronic (Ireland), BioHorizons IPH, Inc. (U.S.), ACE Surgical Supply Company, Inc. (U.S.), RTI Surgical, Inc. (U.S.), LifeNet Health (U.S.) and Dentium (Korea). Medtronic, Stryker, and Depuy Synthes have a significant revenue share in the bone transplant and replacement market. New product launches are expected to increase market competitiveness and drive further growth in the coming years.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, NovaBone, a prominent biotechnology company, reported via press release the start of its new website, which is an interactive and tailored digital resource for its consumers. The website update signifies a significant milestone in the existing development and an essential preparation for the introduction of ground-breaking innovations in 2024. Moreover, the renewed website serves as a hub for key opinion leaders, customers, and distributors to explore the technology and discover the company’s extensive range of regenerative bio-glass grafting solutions. The bio-active bone graft devices of NovaBone have been employed for more than 2 decades in millions of clinical usages with extraordinary growth, confirming the protection and efficiency of their technology.

- In April 2023, ZimVie Inc., a worldwide leader in life sciences specializing in dental and spine solutions, announced through the press release the new introductions of two additions to its range of bio-materials, including the RegenerOss CC Allograft Particulate and the RegenerOss Bone Graft Plug. Moreover, the RegenerOss CC Allograft Particulate is an organic mix of cancellous and cortical bone particles that can be utilized to bridge the bony gap in a class of dental use. Additionally, the RegenerOss Bone Graft Plug is a user-friendly grafting solution for stuffing periodontal defects and extraction sockets. Across North America, both of these grafts are available. These new offerings strengthen the position of ZimVie in the market for dental bio-materials and broaden its comprehensive selection of bone graft options, which encompasses the acclaimed Puros Allograft line.

- In October 2019, Medtronic's Valiant TAAA stent graft system received Breakthrough Device Certification from the US FDA.

- In April 2018, AlloSource launched ProChondrix CR for articular cartilage repair to increase penetration.

- In September 2019, Kuros BioSciences announced MagnetOs. It's foreseen to promote bone regeneration in spinal fusion and other surgeries.

MARKET SEGMENTATION

This research report on the global dental bone graft substitutes market has been segmented and sub-segmented into the following categories.

By Type

- Synthetic Bone Graft

- Xenograft

- Allograft

- Demineralized Allograft

By Product

- Bio OSS

- Osteograf

- Grafton

- Others

By Application

- Socket Preservation

- Ridge Augmentation

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Sinus Lift

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the expected value of global dental bone graft substitutes market in 2032?

As per our research report, the global dental bone graft substitutes market is estimated to value USD 1.67 Billion in 2033

Which segment by type accounted for the leading share in the market in 2022?

Based on type, the xenograft segment led the global dental bone graft substitute market in 2024.

Which region is expected to grow the fastest in the market in the coming years?

As per our research report, the European region is predicted to be the fastest-growing regional market worldwide from 2025 to 2033.

Which are the companies playing a key role in the dental bone graft substitutes market?

Companies such as Institut Straumann AG (Switzerland), Geistlich (Switzerland), DENTSPLY International (U.S.), Zimmer Biomet (U.S.), Medtronic (Ireland), BioHorizons IPH, Inc. (U.S.), ACE Surgical Supply Company, Inc. (U.S.), RTI Surgical, Inc. (U.S.), LifeNet Health (U.S.) and Dentium (Korea) are playing a key role in the global dental bone graft substitutes market.

What is the driving factor for the Dental Bone Graft Substitutes Market?

Growth in the Aged population suffering from dental-related disorders is expected to drive the global dental bone graft substitutes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]