Global Electroplating Market Size, Share, Trends, & Growth Forecast Report – Segmented By Metal Type (Gold, Silver, Copper, Nickel, Chromium, Zinc and Others), End Use Industry (Automotive, Electrical and Electronics, Aerospace and Defense, Jewellery, Machinery Parts and Components and Others), & Region - Industry Forecast From 2024 to 2032

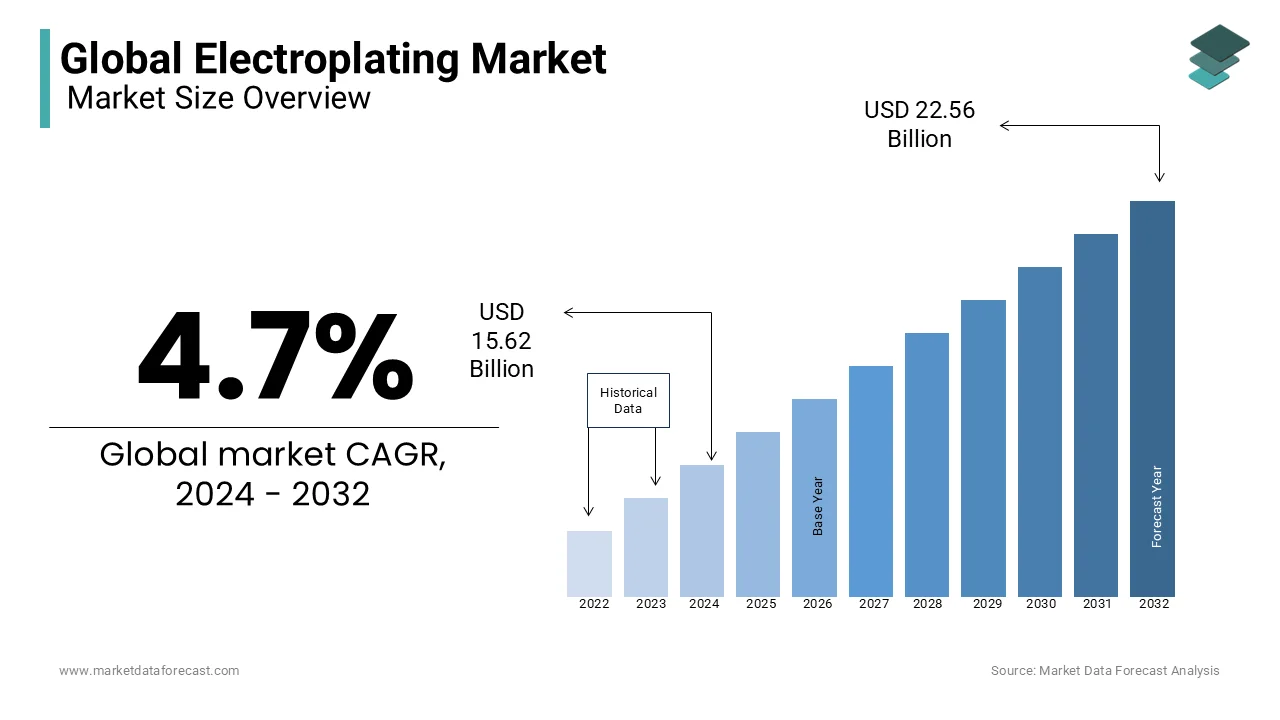

Global Electroplating Market Size (2024-2032):

The Global Electroplating Market was estimated to be worth USD 14.92 billion in 2023. It is predicted to be worth USD 22.56 billion by the end of 2032 from USD 15.62 billion in 2024 and to register a CAGR of 4.7% during the forecast period 2024-2032.

Current Scenario of the Global Electroplating Market

Electroplating is a type of metal finishing that has been found in many applications among various end-user products, such as electrical and electronic, automotive, machinery parts and components, and aerospace and defense. Rapid urbanization and rapid industrialization are likely to play a crucial role in the rise of the worldwide electroplating market in the coming years. Emerging economies are experiencing intense industrialization and construction activity as various manufacturers try to profit by investing in the untapped region. Electroplating helps manufacturers to use inexpensive metals, for example, steel or zinc, for almost any product, and then to protect the product, the metallic coating of other metals is employed to protect it from corrosion, improve its prospects, and others according to the customer's choice. Electroplating or electroplating is defined as an electrochemical metal finishing process in which metal ions dissolved in a solution are deposited onto a substrate using electricity. This process creates a protective layer on the substrate that provides resistance to corrosion and improves the overall appearance of the product. Under the mechanism, the electric current passes through a solution of dissolved metal ions and the metal object is coated in the mechanism.

During the forecasted period, the worldwide electroplating market is expected to grow at a significant rate. Electroplating is most typically used for ornamental purposes or to keep metal from corroding. The hydrolysis procedure is used to plate one metal plate on top of another. Silver, copper, and chrome are some of the specific varieties of electroplating. Automotive, aerospace, and defense, electrical and electronic, and machine parts are all industries that use electroplating. The electrical and electronics industry's strong need for electroplating, particularly in the fabrication of components for televisions, refrigerators, and air conditioners, is expected to propel the global electroplating market forward. Several manufacturers are modifying their electroplating processes, such as using the dry process instead of the wet process, to limit worker exposure and waste. Furthermore, throughout the forecasted period, manufacturers' preference for water-based cleaning chemicals over organic agents is expected to increase the global electroplating market share in the next six years.

MARKET TRENDS

Various objects made of ferrous and non-ferrous metals, as well as plastics, are coated with different electroplating metals such as tin, zinc, silver, copper, chrome, gold, palladium, platinum, and aluminum. This is likely to promote the demand for electroplating in the coming years.

MARKET DRIVERS

The driving need for the electroplating of various metals to avoid corrosion in automotive industry is particularly leveraging the growth rate of the market. It is typical and key technique in the automotive industry. The process of coating one metal with another metal that completely reduces the risk of corrosion which is highly essential for various parts in the automotive is substantially to increase the growth rate of the market. In these days, there is a huge demand or the electric vehicles where the requirement of electroplating is highly needed in the manufacturing that is accelerating the growth rate of the market.

- For instance, China registered over 8.1 million electric cars only in 2023 which is 35% higher registrations than in 2022.

- According to China Association of Automobile Manufacturers (CAAM) survey in 2023 revealed that the vehicle sales are rising by 12% year-on-year.

The rising disposable income in both developed and developing countries is attributed in leveraging the growth rate of the electroplating market. The increasing prominence to protect various parts from the environmental factors is incredibly elevating the popularity for the process of electroplating to extend their shelf lifetime is attributed to promote the growth rate of the market. The process is effectively used to protect from corrosion and wear resistance. Electroplating is actually a traditional process but with the penetration of the advanced technologies, the innovation of new techniques has even more elevated the demand for various applications in many industries.

MARKET RESTRAINTS

Increasing environmental pollution is one of the major concerns to adopt electroplating process. The rising pollution related issues hamper the effectivity of the overall process where the lifespan of the metal decreases. However, scientists are performing research and development activities to design the process effectively that can withstand with the hazardous environmental conditions. Also, the availability of the alternate process at affordable price is to hinder the growth rate of the electroplating market. Lack of skilled workers in the manufacturing industries is also one of the factors that is quietly degrading the growth rate of the market.

MARKET OPPORTUNITIES

Growing number of people spending more on innovative and significant process with the latest technologies in every industry is certainly to promote new opportunities for the electroplating market to grow during the forecast period. High investments from both private and public sectors to level up the significance of process that has high resistance over corrosion is levelling up the growth rate of the market to the extent. The advancements in electroplating technology have increased efficiency and reduced waste which is one of the most important factors in recent times to manage the harmful emissions at the same time. Shifting trends towards processes that are completely safe and effective and do not harm the environment are likely to enhance the growth rate of the market in the coming years.

MARKET CHALLENGES

Stringent rules and regulations by government bodies pose great challenge for the market key players. Some studies reveal that this plating process releases many hazardous chemicals

which is a serious concern especially for the people who closely work under this procedure. The complete process may release hazardous air pollutants and volatile organic compounds which are dangerous that causes cancer and other health related issues. For this reason, US Environmental Protection Agency is promoting to adopt alternate procedures to reduce the environmental pollution.

In addition, the overall electroplating process is a time-consuming process to make numerous coats on the metal to make it high effective over corrosion. However, proper management of the overall process may relatively reduce the release of harmful pollutants that is eventually to elevate the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.7% |

|

Segments Covered |

By Metal Type, End Use Industry, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Superchem Finishers, Metalor Technologies International SA, Heimerle+meule GmbH, Sharrets Plating Co., Inc., Peninsula Metal Finishing, Inc., J&N Metal Products LLC, Bajaj Electroplaters, Roy Metal Finishing, Inc., Pioneer Metal Finishing, Kuntz Electroplating, Inc., Interplex Holdings, Pte. Ltd., Atotech Deutschland GmbH, and Allied Finishing, Inc and Others. |

SEGMENTAL ANALYSIS

Global Electroplating Market Analysis By Metal Type

Copper segment is leading with the dominant share of the whereas silver segment is likely to hold significant growth rate of the market. Copper is one of the finest metals used as a standalone coating process on any other metals. The excellent adhesion property makes the electroplating process more preferrable that easily adds many layers of metal coating. Silver is being used more in many of the applications especially in automobiles. The rising prominence to launch luxurious cars with most effective applications in automobile industry that has high wear resistance is likely to elevate the growth rate of the market. The ultimately rising cost of the gold is likely to pose slow growth opportunities for the segment during the forecast period.

Global Electroplating Market Analysis By End-Use Industry

Automotive industry is one of the major end users of electroplating process. Electroplating is one of the significant and effective process for the vehicles to avoid corrosion that extends the lifespan of the vehicles. It is highly recommended that the parts of the automotive should be corrosion resistant for long years where the vehicle performance

depends on it. This is improving the need for the electroplating in innovative ways. Electricals and electronics segment is next in holding the prominent share of the electroplating market. The growing demand for the smartphones and laptops with the advanced technologies is rising the demand for the electroplating process which is attributed in leveraging the growth rate of the market.

Aerospace and defense segment is ascribed to hit the highest CAGR by the end of the forecast period. The extending use of electroplating process in manufacturing aircrafts and many defense vehicles with the innovative technological process is likely to escalate the growth rate of the market during the forecast period.

REGIONAL ANALYSIS

Asia-Pacific contributed the largest market share in 2023 and is predicted to show remarkable expansion over the foreseen period. Due to the expansion of production facilities in various industrial sectors, especially in the electronics and semiconductor industry, coupled with rapid urbanization, the market call is estimated to increase significantly in the region over the next few years. Analysts expect the worldwide electroplating market in Western Europe and North America to be mature compared to the APAC region. Countries like China, South Korea, and India are likely to be the top contributors to the APAC region. This is likely to attract a number of investors, which will grow the worldwide electroplating market at an exponential rate. On the other hand, Latin America is predicted to grow at a stable CAGR during the conjecture period.

Asia-Pacific is predicted to dominate the electroplating market with the emergence of China as a leading consumer, due to the strong presence of the growing automotive, consumer goods, and electrical and electronics industries. The Asia-Pacific region is predicted to have a significant share of the high-consumption electronics production market account, along with rapid industrialization in major developing countries and the presence of very large manufacturing industries in large countries like China and India, among others. Furthermore, a large automobile manufacturing base in countries such as China, India, and Japan also contribute to the significant call for electroplating in this area. Escalated investment in terms of production expansion will further contribute to market expansion in the Asia-Pacific region during the outlook period. North America and the European region are also supposed to have a notable market share due to well-established infrastructure and the presence of large luxury car manufacturers such as Mercedes, BMW, and Volkswagen in the locale.

KEY PLAYERS IN THE GLOBAL ELECTROPLATING MARKET

Companies playing a prominent role in the global electroplating market include Superchem Finishers, Metalor Technologies International SA, Heimerle+meule GmbH, Sharrets Plating Co., Inc., Peninsula Metal Finishing, Inc., J&N Metal Products LLC, Bajaj Electroplaters, Roy Metal Finishing, Inc., Pioneer Metal Finishing, Kuntz Electroplating, Inc., Interplex Holdings, Pte. Ltd., Atotech Deutschland GmbH, and Allied Finishing, Inc and Others.

RECENT HAPPENINGS IN THE GLOBAL ELECTROPLATING MARKET

- Uyemura launches new electrolytic nickel technology. Each year, FABTECH provides opportunities to meet suppliers, see the latest finishing products and technologies, learn from industry experts, and network with others.

- LPKF launches a desktop electroplating system. LPKF Laser & Electronics introduced the MiniContac RS, a desktop plating system.

DETAILED SEGMENTATION OF THE GLOBAL ELECTROPLATING MARKET INCLUDED IN THIS REPORT

This research report on the global electroplating market has been segmented and sub-segmented based on metal type, end-use industry, and region.

By Metal Type

- Gold

- Silver

- Copper

- Nickel

- Chromium

- Zinc

- Others

By End-Use Industry

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Jewellery

- Machinery Parts & Components

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the global electroplating market?

The key drivers include the increasing demand for corrosion-resistant materials in the automotive and electronics industries, the growing need for aesthetics and durability in consumer goods, and advancements in electroplating technologies that improve the efficiency and quality of the process.

What are the common applications of electroplating?

Electroplating is widely used in industries such as automotive, aerospace, electronics, jewelry, and machinery. Common applications include the coating of automotive parts for corrosion resistance, the enhancement of electronic components for better conductivity, and the plating of jewelry for aesthetic appeal.

What are the latest trends in the electroplating market?

The latest trends in the electroplating market include the rise of green electroplating techniques that reduce the use of toxic chemicals, the adoption of automation and digitalization in plating processes, and the growing demand for nanocoatings and thin films in electronics and medical devices.

How are technological advancements influencing the electroplating market?

Technological advancements such as the development of advanced plating materials, improved plating equipment, and automation systems are enhancing the efficiency and precision of electroplating. These innovations are leading to higher-quality coatings, reduced waste, and cost-effective processes, fueling market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com