Global Emergency Ambulance Vehicle Market Size, Share, Trends & Growth Forecast Report By Vehicle Type, Equipment, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Emergency Ambulance Vehicle Market Size

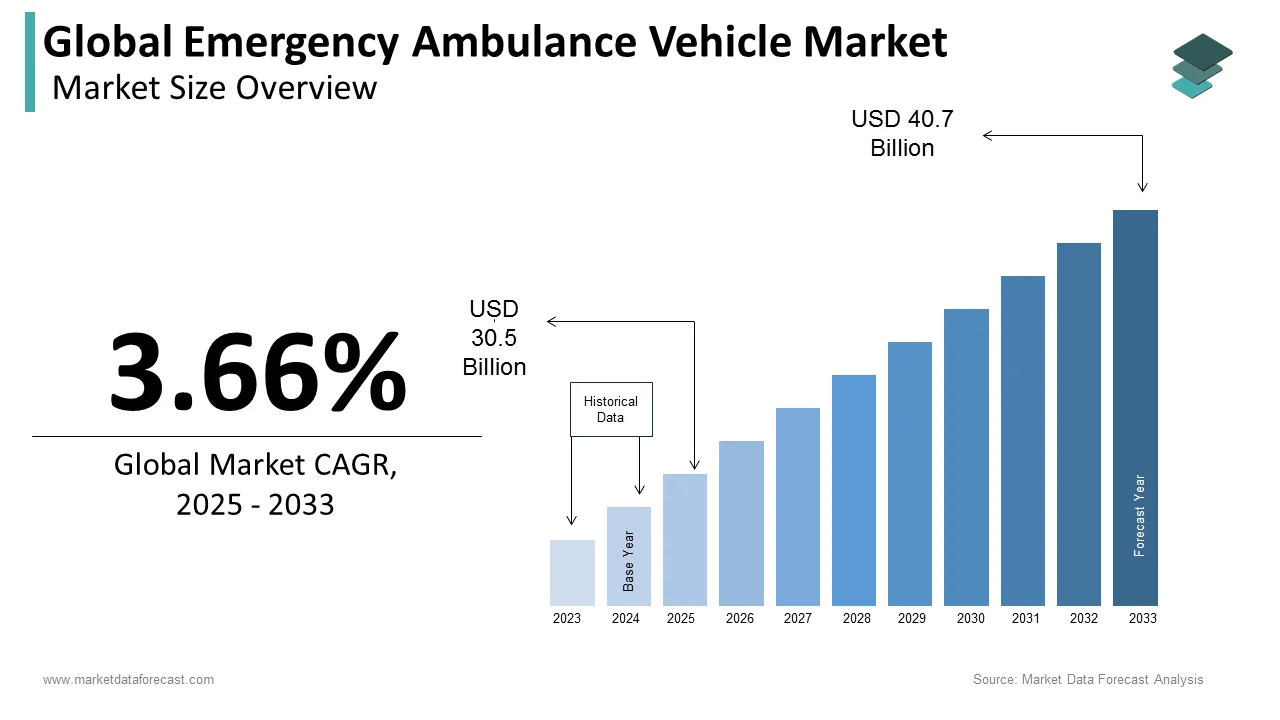

The size of the global emergency ambulance vehicle market was worth USD 29.5 billion in 2024. The global market is anticipated to grow at a CAGR of 3.66% from 2025 to 2033 and be worth USD 40.7 billion by 2033 from USD 30.5 billion in 2025.

MARKET DRIVERS

The growing number of people suffering from acute diseases propels the growth of the emergency ambulance vehicles market.

There has been a tremendous increase in patients suffering from acute diseases due to a sedentary lifestyle, a lack of physical activity, and a poor diet. Also, cardiovascular diseases, especially cardiac arrests, are becoming increasingly prevalent as the population ages. If acute illnesses are not treated right away, they might be fatal. The quick response required to treat these illnesses is therefore driving the demand for the market for emergency ambulance vehicles. The rising incidence of accidents is another major factor fueling market growth.

Every year, a significant number of people die in accidents. Rash driving, drinking and driving, and poor enforcement of traffic laws and regulations have contributed to an exponential rise in accidents and civilian fatalities. Primary patient care given at the scene of an accident can save patients' lives before they obtain the necessary hospital treatment. As more accidents and trauma cases occur worldwide, emergency ambulance vehicles will be used more frequently for early patient care and transportation. EAV market technological developments will present profitable chances for market participants. Government rules will also provide market possibilities during the projected period by making healthcare institutions maintain 24-hour emergency ambulance services.

Moreover, the COVID-19 pandemic has had a substantial impact on the global market for emergency medical transport. COVID-19's long persistence has fueled the need for emergency medical transportation. In addition, government initiatives to support the healthcare sector and reimbursement programs for healthcare services promote market expansion. For example, the demand for ambulance services is growing faster than the supply because of the rise in medical tourism and the expansion of healthcare infrastructure.

MARKET RESTRAINTS

On the other hand, the growth of the emergency ambulance vehicle market is anticipated to be hampered by the high cost of production and maintenance. Additionally, the lack of knowledge about emergency ambulance vehicles in developing and underdeveloped nations hinders the market's expansion. Several major companies are involved in developing and producing emergency medical services vehicles. Still, the global market for these vehicles is ultimately constrained by strict government regulations implemented in some regions and a need for more funding for their development.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2033 |

|

Segments Covered |

By Device, Technique, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Envision Healthcare, London Ambulance Service NHS Trust, BVG India Limited |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

During the forecasted period, the vans segment had the most significant share of the global market in 2024 and is expected to witness a healthy CAGR during the forecast period. This is because vans are adaptable in size, making them ideal for installing cutting-edge medical equipment, which is anticipated to drive the segment's growth. In addition, vans provide more room than automobiles and motorcycles, allowing paramedics to work undisturbed.

By End Use Insights

The hospital segment dominated the emergency ambulance vehicle market in 2024. During the forecast period, the hospital segment is expected to showcase a steady CAGR due to the growing hospital admissions. Also, there is a growing emphasis on upgrading healthcare infrastructure, which is expected to boost the expansion of this segment.

By Equipment Insights

The Advanced Life Support (ALS) ambulance services segment had the leading share of the global emergency ambulance vehicle market in 2024, owing to the growing number of people experiencing cardiac arrest. In addition, the increasing number of COVID-19 patients has also contributed to the growth of the ALS segment. Moreover, continuous cardiac monitoring is necessary if a person has additional comorbidities. Therefore, along with an emergency medical technician, ALS offers patients constant cardiac monitoring and ventilator support. The sector is therefore anticipated to dominate the market due to the factors mentioned earlier.

REGIONAL ANALYSIS

In 2024, North America was the regional market leader for emergency ambulance vehicles worldwide. The market for emergency ambulance services in North America is anticipated to grow owing to numerous significant market players, a well-established healthcare infrastructure, rising demand for high-quality healthcare services, and favorable healthcare policies and regulatory frameworks in the healthcare sector.

On the other hand, Asia-Pacific is predicted to experience the fastest growth during the forecast period. The market in the Asia-Pacific region is expected to grow owing to the growing healthcare infrastructure and YOY growth in the number of accidents. Emerging economies in this region are expected to account for a significant share of this region during the forecast period.

The European market had a substantial share of the global market in 2024. The growth of the emergency ambulance vehicle in the European region is driven by the increase in the number of market players and recent developments in the reforms and reimbursement policies of the healthcare industry.

The market in Latin American, Middle Eastern, and African regions is also expected to grow significantly during the forecasted period owing to the improving healthcare infrastructure and the increasing demand for rapid access to medical treatment by patients.

KEY MARKET PLAYERS

Envision Healthcare, London Ambulance Service NHS Trust, BVG India Limited, Acadian Ambulance Service, America Ambulance Services, Inc., AIR MEDICAL GROUP HOLDINGS, INC. (AMGH), Falck Denmark A/S, Air Methods Corporation, Ziqitza Healthcare Limited and MEDIVAC AVIATION are a few of the notable companies operating in the emergency ambulance vehicles market and profiled in this report.

RECENT HAPPENINGS IN THE MARKET

- AEV® ambulances with Traumahawk Telematicstm powered by ACETECH now include vehicle-to-vehicle digital warnings. In addition, the Safety Cloud digital alerting capabilities of HAAS Alert have been integrated into AEV Traumahawk Telematics' vehicle intelligence system. ACETECHTM is an award-winning global manufacturer of Vehicle Intelligence Systems for emergency service fleets. As a result, AEV ambulances with an active ACETECH Vehicle Intelligence software subscription that responds to emergencies or carries out high-priority transfers will now have the potential to broadcast real-time safety alerts to nearby motorists' navigation apps and in-vehicle entertainment systems.

- In July 2023, Volkswagen, a storied German automaker, introduced a Crafter vehicle to rescue and emergency services. The Crafter is a cutting-edge vehicle with helpful solutions that will make the work of rescue organizations easier. It is spacious, secure, and comfy. Moreover, it is a model that is especially well suited to being equipped as an ambulance because it has a remarkably comfortable gearbox for patients who would experience vibrations during transport, particularly in crises.

- In April 2023, Airtel is all set to launch a 5G-connected ambulance in association with the Apollo group of hospitals and Cisco. The ambulance will be custom designed and equipped with the latest medical instruments, patient monitoring applications, and telemetry devices which will help transmit patient data in real time to the hospital.

- In March 2024, an All-electric ambulance joins the fleet of a mobile healthcare provider with its first all-electric ambulance model. Last-mile mobile medical care service DocGo has joined forces with Lightning eMotors and Leader Emergency Vehicle to launch a green project that will see all of its vehicles go electric with the addition of an all-electric ambulance to its fleet in New York. The electric ambulance, which marks the beginning of DocGo's aim to have an all-electric fleet by 2033, is said to be the first to be registered in the US.

- In July 2024, AmeriPro Health announced the acquisition of CareMed EMS. CareMed EMS, a Mississippi-based provider of emergency and non-emergency ambulance services serving Mississippi and Tennessee, has been acquired by AmeriPro Health LLC, a recently established portfolio of healthcare companies committed to improving patient logistics and last-mile healthcare delivery. By doing this, AmeriPro Health plans to significantly expand its capabilities and footprint in Southeast America and Georgia, and Florida. In addition, it gives current CareMed EMS access to additional infrastructure and financial resources to support ongoing expansion and satisfy increasing service demand.

MARKET SEGMENTATION

This market research report on the global emergency ambulance vehicle market has been segmented and sub-segmented based on vehicle type, equipment, end-user, and region.

By Vehicle Type

- Vans

- Cars

- Motorcycles

- Others

By End Use

- Hospitals

- Emergency centers

- Home healthcare settings

- Others

By Equipment

- Advance life support ambulance services (ALS)

- Essential life support ambulance services (BLS)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global emergency ambulance vehicle market?

The global emergency ambulance vehicle market was valued at USD 29.5 billion in 2024.

What is the growth rate of the emergency ambulance vehicle market?

The global emergency ambulance vehicle market is expected to grow at a compound annual growth rate of 3.66% from 2025 to 2033.

Which region had the dominant share in the global emergency ambulance vehicle market in 2024?

North America accounted for the largest share of the global emergency ambulance vehicle market in 2024.

What are some of the notable players in the emergency ambulance vehicle market?

A few of the major companies operating in the emergency ambulance vehicle market are Envision Healthcare, London Ambulance Service NHS Trust, BVG India Limited, Acadian Ambulance Service, America Ambulance Services, Inc., AIR MEDICAL GROUP HOLDINGS, INC. (AMGH), Falck Denmark A/S, Air Methods Corporation, Ziqitza Healthcare Limited, and MEDIVAC AVIATIO.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]