Global Enterprise Routers Market Size, Share, Trends, & Growth Forecast Report By Connectivity type (Cabling and Without strings), Port type (Fixed port, Modular), Type (Main routers, Multi-service advantage, Access router, Other types), End User Vertical (BFSI, IT and Telecom, Health care, Retail sale, Manufacturing, and Other end-user verticals), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Enterprise Routers Market Size

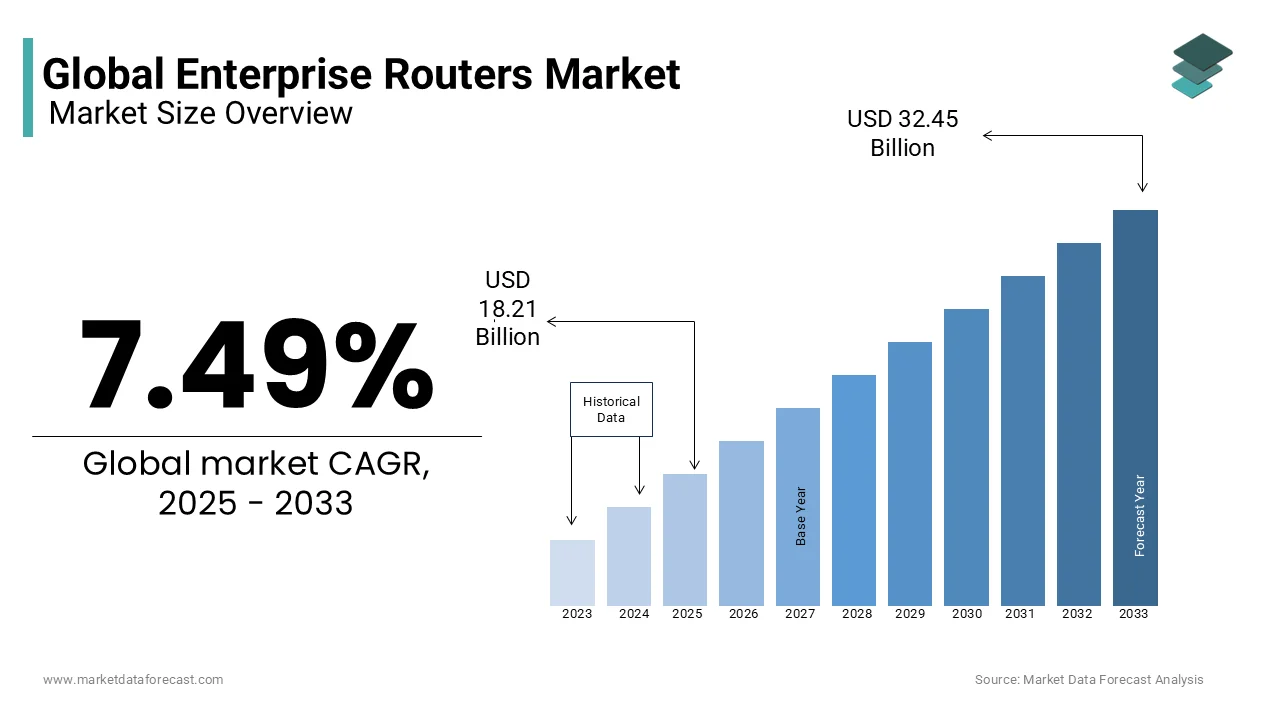

The global enterprise routers market was valued at USD 16.94 billion in 2024. The global market is predicted to reach USD 18.21 billion in 2025 and USD 32.45 billion in 2033, growing at a CAGR of 7.49% during the forecast period 2025 to 2033.

The industry is expected to experience growth due to ongoing technological innovations in wireless LAN technology and high-speed Ethernet switches. This technology leads to development of smaller and more efficient chipsets and modules with additional functions. The growing need for high-speed Ethernet switch deployment will provide new avenues for growth over the next eight years. Organizations are reorganizing their networks to improve business efficiency and responsiveness, mobile productivity, and leveraging big data. The market is migrating from a single vendor environment to one where discrete decisions for different network building blocks are quickly becoming the norm. This new approach for network architects should lead to network solutions that meet business requirements and save money without adding operational complexity.

MARKET DRIVERS

Development of the IT Industry

The vigorous development of the IT industry and the considerable appetite for technologically advanced devices in the Chinese market are expected to drive regional growth over the next seven years. Increasing trends toward adopting the 802.11ac wireless standard are also expected to drive growth in the Asia-Pacific and Latin American regions. An ordinary wireless router only supports access for about 10 to 20 users. In contrast, the wireless access router point allows access to more than 50 or even hundreds of users, with the potential ability to send and receive signals. According to Cisco, the expected penetration of business Internet traffic over a fixed wireless connection in 2021 will be 125,988 petabytes per month. With the increase in internet and device traffic, the average fixed broadband speed and average internet users will increase exponentially during the forecast period. The average speed of fixed broadband is expected to increase from 5.1 Mbps in 2015 to 12.9 Mbps in 2020.

For example, Cradlepoint launched the industry's first 5G-optimized wireless WAN edge router for enterprise branch deployments in May 2020. The Cradlepoint E3000 series, according to the company, optimizes investment in performance and protection and enables customers to implement a wireless network (wireless WAN) using the latest LTE and Wi-Fi technologies and seamlessly upgrade to 5G in the future. The COVID-19 pandemic has fueled a growing demand for agile and rapidly deployable LTE-based wireless WANs for backbone connectivity. Cradlepoint said that the E3000 series is intended to target this market directly. Typically, the signal transmission range of a wireless router can only cover tens of meters. A wireless access router includes additional distances, up to 100-300 meters, allowing users to move freely within the network. Especially for businesses, office space is often more critical, and some even need to communicate across buildings. The number of users accessing the network is so large that they need more network coverage from the wireless router. Also, the network model of the wireless router is unique, with little flexibility. In contrast, a wireless access point offers various modes such as simplex AP, wireless client, wireless bridge, multipoint bridge, etc. It can be managed centrally with cooperation.

Impact of COVID on the Global Enterprise Routers Market

In a situation where many employees are currently working from home due to a COVID-19 pandemic or accessing working Wi-Fi networks at the corporate security level, devices such as routers can be hacked to implant various malicious software on portable devices used by employees. Subex has been tracking trends in cyber-attacks and malware activity that may be correlated with the outbreak. The enterprise routers market shares are projected to grow more in 2021.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.49% |

|

Segments Covered |

By Connectivity Type, Port Type, Type, End User Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cisco Systems, Juniper Networks, Inc., Hewlett Packard Enterprise, and Others. |

REGIONAL ANALYSIS

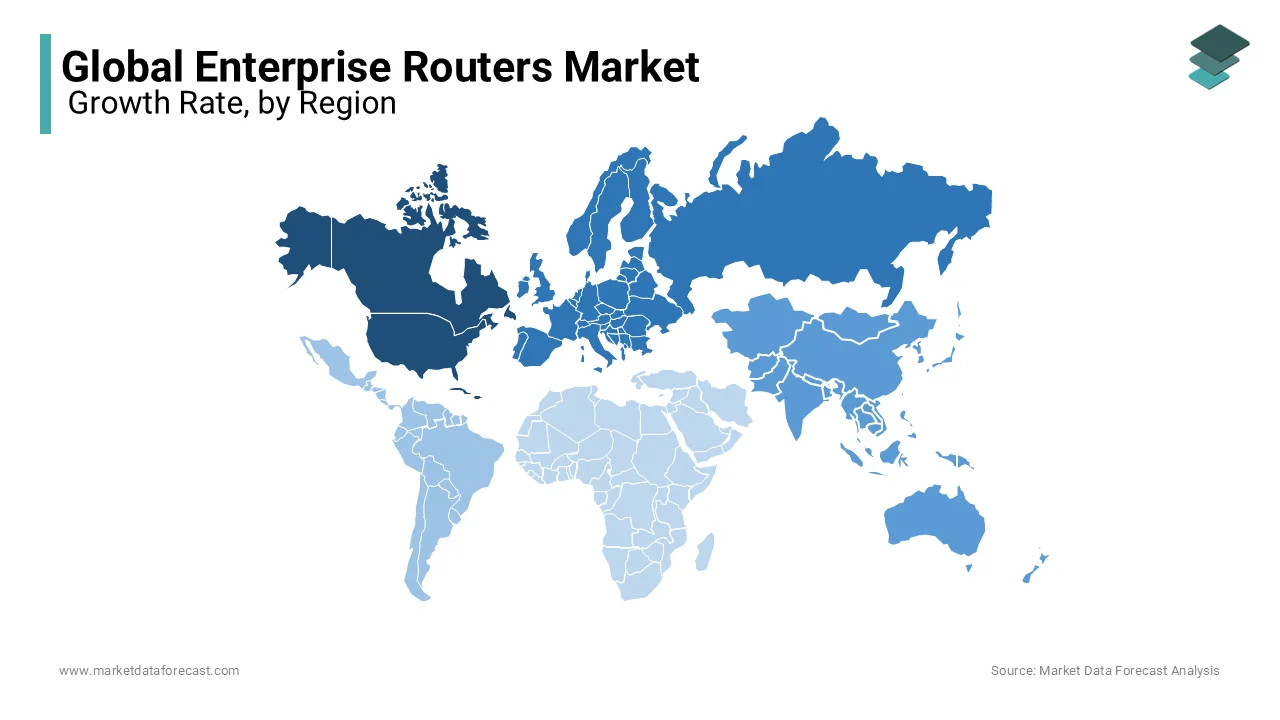

North America is expected to have a significant global enterprise router market share in 2024. Also, the region has a strong presence of network router providers. Some include Cisco Systems, Inc., Dell EMC, and Juniper Networks, Inc., helping the market grow. It is estimated that by 2022, in the United States, the network router market will grow to USD 11.95 billion, which includes the market for Ethernet service edge routers, multi-service edge routers, service provider main routers, and the router of Internet exchange (source Cisco), where expectations of strong market growth will potentially be carried over to an Internet exchange router in 2023.

Europe is following in leading the dominant shares of the enterprise routers market. Growing funds from private organizations is one of the common factors leveraging the demand of the market. Asia Pacific is to have the fastest growth rate in the enterprise router market with the growing number of IT companies.

KEY MARKET PLAYERS

The major companies operating in the enterprise routers market include Cisco Systems, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise, etc., course by strategic objective.

RECENT HAPPENINGS IN THE MARKET

-

In March 2020, Huawei confirmed that its next-generation NetEngine AR600 and AR6000 enterprise routers have passed the verification test from the Tolly Group, which is an approved international testing and validation provider. The results showed that Huawei's NetEngine AR routers are equipped to handle the growth of digital transformation traffic over the next three to five years, ushering in a new era of ultra-fast interconnect for enterprise WANs.

-

In December 2019, the Q100 processor was based on Cisco Silicon One and 8000 series routers. Cisco will allow ecosystem actors to separately purchase processors, XR7 router software, 8000 series routers without software, modules optical (QSFP -DD and QSFP28), or 8000 series integrated solutions. The 8000 series router and Q100 processor are intended for service providers and data center operators ranging from large aggregations to basic applications.

-

In 2015, HP announced the acquisition of Aruba Networks. This acquisition further strengthens HP's positioning to accelerate and enable the business transition to a converged campus network.

MARKET SEGMENTATION

This research report on the global enterprise routers market has been segmented and sub-segmented based on the connectivity type, port type, type, end-user vertical, and region.

By Connectivity Type

-

Cabling

-

Without Strings

By Port Type

-

Fixed Port

-

Modular

By Type

-

Main Routers

-

Multi-Service Advantage

-

Access Router

-

Other Types

By End User Vertical

-

BFSI

-

IT and Telecom

-

Health care

-

Retail Sale

-

Manufacturing

-

Other End-User verticals

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What factors are driving the growth of the global enterprise routers market

The growth of the enterprise routers market is primarily driven by the increasing adoption of cloud-based services, the proliferation of IoT devices, and the rising demand for high-speed internet connectivity in businesses worldwide.

What role do 5G technologies play in the growth of the enterprise routers market?

The integration of 5G technologies significantly contributes to the growth of the enterprise routers market by providing faster and more reliable connectivity, supporting the increasing demand for high-bandwidth applications in enterprises.

How is the increasing cybersecurity concern impacting the enterprise routers market?

The growing cybersecurity threats have led to a surge in demand for secure networking solutions, driving the adoption of advanced enterprise routers with robust security features, including intrusion prevention systems and encrypted communication protocols.

How are advancements in edge computing influencing the enterprise routers market?

Edge computing advancements are driving the demand for enterprise routers, as businesses seek to process data closer to the source, reducing latency and enhancing the performance of applications and services in a distributed computing environment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com