Global Big Data Market Size, Share, Trends & Growth Forecast Report By Type (Hardware, Software and Services), Deployment Mode (On-Premises and Cloud), Organization Size (Large Enterprise and SMEs), Business Function (Operations, Finance, and Marketing and Sales), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Big Data Market Size

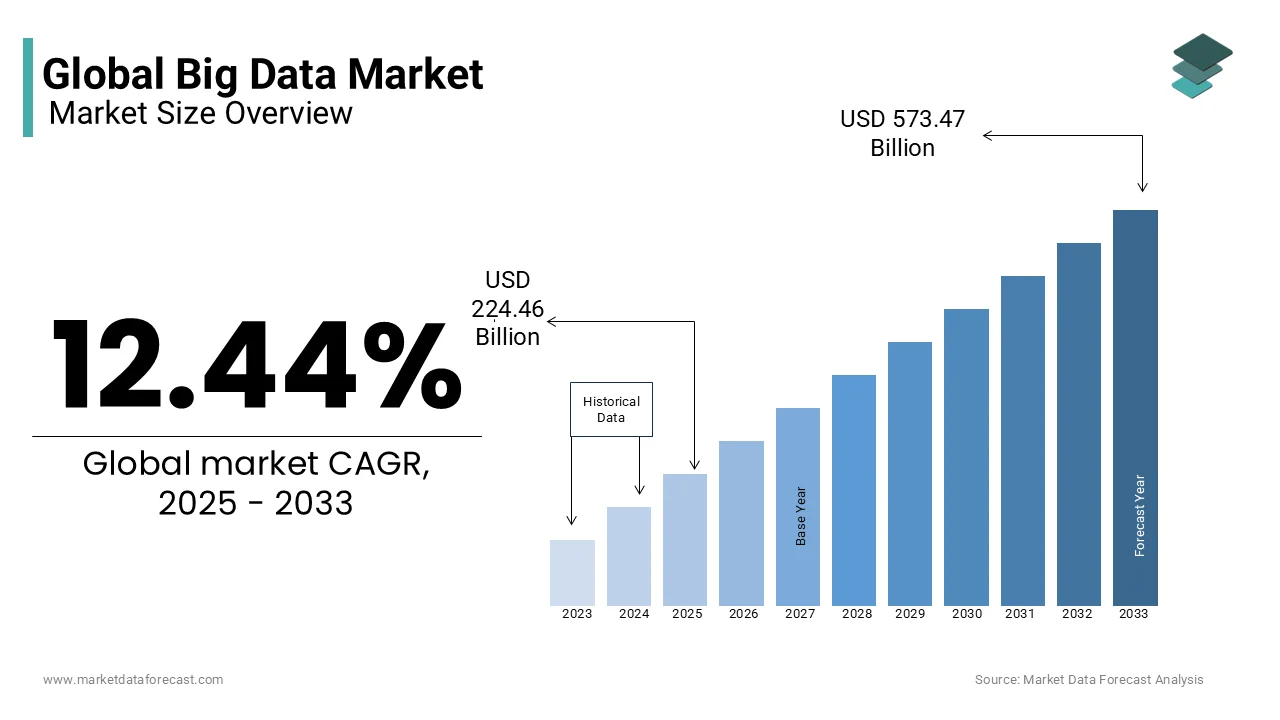

The global big data market was worth USD 199.63 billion in 2024. the global market size is expected to grow from USD 224.46 billion in 2025 to USD 573.47 billion by 2033, growing at a CAGR of 12.44% from 2025 to 2033.

Big data comprises large data volumes, the size of which (petabytes and exabytes) exceeds the capacity of commonly employed software tools to purchase, manage and process data over time. Although big data does not refer to explicit amounts, the term is nonetheless commonly used when it comes to handling large amounts of data. There has been an acceleration in the Big Data and AI ecosystem with many large and small companies in recent years. As a result, India is set to become among the largest markets for big data and data analytics worldwide, with improved use cases and significant options for data scientists in the coming years. Big Data can enable businesses to increase operational efficiency and reduce costs. Many companies are implementing Big Data solutions and services to assess their internal processes and improve their operations. The implementation of Big Data helps companies find the right balance between operational costs, speed, flexibility and quality.

The global big data market has had remarkable growth in recent years and is anticipated to grow at a healthy CAGR during the forecast period. Many organizations across various industries have realized the potential of data-driven insights and adopted big data solutions to gain the advantage of data. The increased demand for big data solutions and services in recent times is primarily attributed to the increased usage of big data solutions for the purpose of strategic decision-making. Technological advancements such as the proliferation of IoT devices, improvements in the cloud computing infrastructure, and machine learning algorithms have played a big role in the adoption of big data over the past few years. Using these advancements, several companies captured, stored and analyzed vast amounts of data and used the extracted insights from the data for the development of their organizations.

During the forecast period, the global big data market is anticipated to experience notable growth. The rapid adoption of data sources, emerging technologies such as artificial intelligence and edge computing and increasing emphasis on data privacy and security are expected to boost the demand for big data solutions and services worldwide in the coming future. Several companies worldwide are trying to harness the power of data to gain competitive advantage, which is turning out to drive the global big data market growth.

MARKET DRIVERS

Significant Increase in Consumer and Machine-Generated Data Worldwide

The growth of the global big data market is majorly driven by the significant increase in consumer and machine-generated data worldwide. On a daily basis, a vast amount of data is being generated by consumers worldwide in the form of social media posts, online transactions, and sensor data from IoT devices. On the other hand, the rapid adoption of connected devices and sensors in various industries that range from manufacturing and healthcare to transportation and retail is resulting in a gigantic volume of machine-generated data. For instance, the global datasphere is anticipated to reach 175 zettabytes by 2025, according to IDC. According to sources, the number of connected devices is expected to cross 41 billion by 2027 globally. Companies worldwide know the potential of data that is being generated by their consumers and machines and use it for strategic decision-making by applying big data solutions.

Usage of Social Media and Rapid Adoption of IoT

The growing usage of social media and rapid adoption of IoT across various industries worldwide are likely to fuel the growth of the global big data market. The number of users of social media is growing rapidly worldwide. According to Statista, the number of social media users worldwide is estimated to reach 4.41 billion by 2025. Social media generates vast amounts of data that includes user interactions, preferences, and sentiments on a daily basis, and organizations are using the data generated by their users to understand consumer behavior, trends, and preferences, which is driving the demand for big data services and contributing to the global market growth. The IoT market is growing at a significant pace, which has led to an increase in the number of smart devices interconnected via the Internet, which, in turn, has contributed to the data explosion. According to the 2018 Ericsson Mobility Report, total mobile data usage in India is expected to increase by 26% year on year from 2018 to 2024.

Increasing Usage of the Internet

The increasing usage of the Internet and the growing volume of data being generated worldwide are propelling the growth of the global big data market. The Internet is the major reason why we are experiencing this data boom. According to the Cisco VNI report, there will be approximately 4.8 billion Internet users in 2022, or 60% of the global population. The rise in average Wi-Fi speed is further contributing to data consumption worldwide. According to the Cisco VNI Global IP Traffic Forecast, the data consumption statistics in the Asia-Pacific increased by 100% in 2022 compared to 2017. The need for big data has evolved to manage relational database management systems, desktop statistics, and visualization packages to manage large amounts of data. For large organizations, managing huge volumes of data requires an effective data management solution.

MARKET RESTRAINTS

Privacy Concerns

Data security and privacy concerns, lack of skilled big data professionals and high implementation and maintenance costs are primarily hampering the growth of the global big data market. Challenges in integrating disparate data sources, limited awareness and understanding of big data, and inconsistent data quality and integrity are inhibiting the growth rate of the worldwide market.

MARKET OPPORTUNITIES

Sensors and IoT Devices

The big data market is predicted to achieve major milestones in the forecast period. One of the key supporters in this global market are sensors and IoT devices. According to research, the world data is foreseen to reach as far as 175 zettabytes by 2025. Like, a stack of 0.29 dense iPad may extend to 18 folds the distance between the Moon and Earth. Also, it is predicted that there will be a huge increase in the volume of data, i.e. about 60 per cent of the big data, for analysis in the coming years. Moreover, the market is also expected to see 70 per cent of the companies transition their emphasis to small and wide data. Enterprises are looking to be less dependent on artificial intelligence for data and furnishing background to data analytics, the companies are anticipated to create data analytics more strong for the market players to be less information-oriented and still give great insights from the unstructured data channels.

MARKET CHALLENGES

Heavy Data Volumes & Decreased Data Usability

The persistently growing volume and speed of data being created and gathered, the restricted variety of that information, along with the demand for more precise and credible data will be the key issues for the companies operating in this market. The challenges include heavy data volumes, data security, decreased data usability and delays, and unavailability of suitable and quality data are hindering the expansion of the market. As per a 2023 study, big data is more exposed or susceptible to cyber or online attacks, and the worldwide average cost of every data breach has come up to 4.45 million US dollars, which is higher than 4.35 million US dollars in 2022. There has been an equivalent surge in the hacking abilities or competencies of cyber attackers with the emergence of big data. The bypassing of conventional security steps like signature-driven security tools is no longer relevant. Fake data generation is another major problem in big data security due to its application for manipulating and tricking big data systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.44% |

|

Segments Covered |

By Type, Deployment Mode, Organization Size, Business Function, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Microsoft (United States), Teradata (United States), IBM (United States), Oracle (United States), SAS Institute (United States), Google (United States)), Adobe ( United States), Talend (United States), Qlik (USA), TIBCO Software (USA), Alteryx (USA), Sisense (USA), Informatica (USA), Cloudera (USA), Splunk (USA)), Palantir Technologies (USA), 1010data (USA), Hitachi Vantara (USA), Fusionex (Malaysia), Information Builders ( United States), AWS (United States), SAP (Germany), Salesforce (United States) United States), Micro Focus (United Kingdom), HPE (United States), MicroStrategy (United States) and ThoughtSpot (United States). |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the services segment held 41.7% of the global big data market share in 2024 and the domination is expected to continue throughout the forecast period. The growth of the services segment is due to the complexity of big data projects, the shortage of skilled professionals, and the demand for customized solutions tailored to specific business requirements. The rising adoption of cloud-based analytics platforms and managed services for data integration and governance is further boosting the growth rate of the services segment in the global market. Accenture, Deloitte, and IBM are some of the major players that offer big data services to organizations worldwide.

The software segment was the second biggest segment and is estimated to grow at a promising CAGR during the forecast period. The need for data-driven decision-making, predictive analytics, and real-time insights across various industries is growing significantly worldwide and is propelling the expansion of the software segment. The emergence of cloud-based big data platforms and the integration of AI and machine learning technologies are further contributing to the growth of the software segment. Companies such as Microsoft, Oracle, and SAP offer big data software, and these players together hold 50% of the share in the global big data software market.

The hardware captured a considerable share of the global market in 2023 and is predicted to grow at a healthy CAGR during the forecast period. The growth of the hardware segment is majorly driven by the proliferation of Internet of Things (IoT) devices and edge computing technologies and increasing demand for high-performance computing systems, storage solutions and networking equipment. Companies such as Dell Technologies, Hewlett Packard Enterprise (HPE) and IBM are playing a leading role in the global big data hardware market.

By Deployment Mode Insights

Based on deployment mode, the on-premises segment had 59.8% of the global market share in 2023 and is expected to grow at a healthy CAGR during the forecast period. Data privacy regulations such as GDPR in Europe and HIPAA in the United States are promoting the adoption of on-premises solutions among the organizations that handle sensitive information, which is one of the key factors propelling the growth of the on-premises segment. The growing usage of on-premises solutions by organizations that operate in banking, healthcare, and government supports the expansion of the on-premises segment in the global market.

The cloud segment is estimated to showcase a notable CAGR during the forecast period. The scalability and agility that cloud platforms to quickly deploy and scale big data solutions is one of the key factors driving the growth of the cloud segment. Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP) are playing the leading role in the cloud big data market.

By Organization Size Insights

Based on the organization size, the large enterprises segment dominated the big data market worldwide in 2023 with 66.7% of the global market share and is estimated to grow at a prominent CAGR during the forecast period. Large enterprises leverage big data for various purposes that include optimizing operations, improving customer experiences, and gaining insights for strategic planning. The regulatory compliance requirements such as GDPR and CCPA have been further prompting large enterprises to invest in robust data management and security solutions, which is one of the key factors propelling the expansion of the large enterprises segment in the global market. Large enterprises from industries such as finance, healthcare, and retail sectors are top spenders in implementing big data solutions. For instance, an estimated 80% of Fortune 500 companies have been gaining the advantage of big data solutions to drive business growth.

The SMEs segment is anticipated to grow at the fastest CAGR of 13.22% during the forecast period. Small and medium-sized enterprises (SMEs) have been increasingly adopting big data solutions to gain insights and improve operational efficiency. High adoption of big data solutions by SMEs in emerging markets such as India, China, and Brazil can be noticed.

Global Big Data Market Analysis By Business Function

Based on business function, the operations segment led the market in 2023, accounting for 60.8% of the worldwide market share and is expected to register the fastest CAGR during the forecast period. The adoption of Internet of Things (IoT) devices is growing rapidly worldwide, and these devices generate vast amounts of data that can be analyzed to improve operational workflows. This factor is majorly driving the expansion of the operations segment in the global big data market. An increase in the number of advancements in data analytics technologies, such as machine learning and artificial intelligence, which help businesses to extract actionable insights from large datasets, is further boosting the growth rate of the operations segment in the global market. Manufacturing, transportation, and healthcare are the leading adopters of big data solutions to improve their operational workflows.

The finance segment is predicted to witness a notable CAGR during the forecast period owing to the growing usage of big data solutions by financial institutions such as banks, insurance companies, and investment firms to manage risk, detect fraud, and personalize services. The growing need for real-time analytics and AI in finance is further propelling the growth of the finance segment. Financial institutions have been using emerging technologies to make faster and more accurate decisions in areas such as credit scoring, fraud detection and algorithmic trading.

By Industry Verticals Insights

Based on industry verticals, the BFSI segment played the dominating role in the global big data market and held 21.6% of the global market share in 2023. The growing need to analyze vast amounts of transactional data in real-time to detect fraud, mitigate risks, and personalize customer services is primarily driving the growth of the BFSI segment in the global market.

REGIONAL ANALYSIS

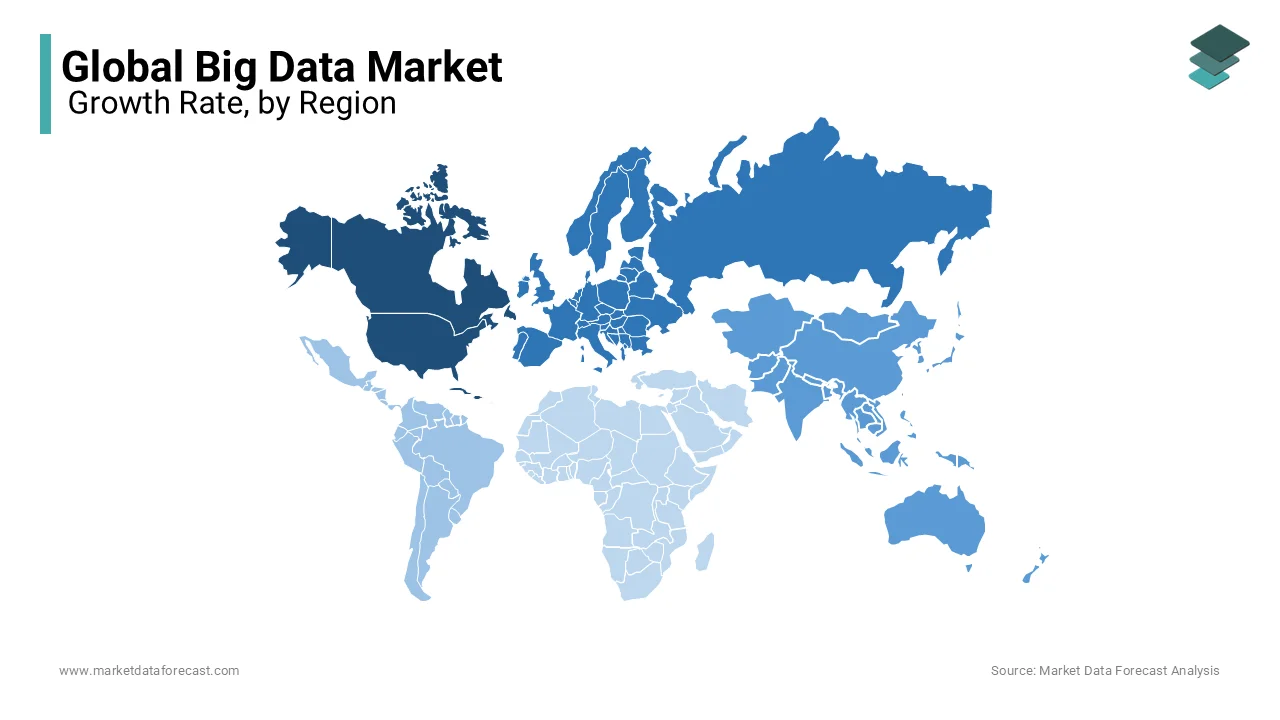

North America had 41.2% of the global market share in 2023 and emerged as the most dominating regional segment in the worldwide market. The domination of North American is likely to continue during the forecast period owing to the presence of technology giants such as Google, Amazon, and Microsoft, who offer robust cloud-based big data solutions. The presence of well-established IT infrastructure coupled with favorable government initiatives that promote digital transformation are further boosting the growth of the North American big data market. The U.S. is playing a vital role in the North American market and has major hubs in Silicon Valley and Seattle for big data solutions. In North America, industries such as BFSI, healthcare, and technology are the primary adopters of big data solutions.

Europe is another top-performing regional segment in the global market. It captured a share of 25.8% of the worldwide market in 2023 and is predicted to grow at a notable CAGR during the forecast period. Europe has stringent data protection regulations such as GDPR, which focus on the importance of data privacy and security, which boosts the usage of big data solutions among organizations and drives European big data market growth. The rising adoption of advanced analytics in various industries in Europe is further promoting the growth of the European market. In Europe, the United Kingdom, Germany, and France are the front runners in driving innovation in big data, and these countries are likely to account for the major share of the European market during the forecast period.

Asia-Pacific is the most lucrative region and is projected to register the fastest CAGR over the forecast period. The presence of rapidly growing economies such as China, India, and Southeast Asian countries and an increasing number of initiatives by the governments of Asia-Pacific countries that promote smart city development are boosting the growth rate of the Asia-Pacific market. China and India are predicted to play a leading role in the Asia-Pacific big data market.

KEY PLAYERS IN THE MARKET

Companies playing a leading role in the worldwide big data market include Microsoft (United States), Teradata (United States), IBM (United States), Oracle (United States), SAS Institute (United States), Google (United States)), Adobe ( United States), Talend (United States), Qlik (USA), TIBCO Software (USA), Alteryx (USA), Sisense (USA), Informatica (USA), Cloudera (USA), Splunk (USA)), Palantir Technologies (USA), 1010data (USA), Hitachi Vantara (USA), Fusionex (Malaysia), Information Builders ( United States), AWS (United States), SAP (Germany), Salesforce (United States) United States), Micro Focus (United Kingdom), HPE (United States), MicroStrategy (United States) and ThoughtSpot (United States).

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Oracle reported that it is integrating network APIs and AT&T IoT connection, for managing and controlling, into its Enterprise Communications Platform (ECP).

MARKET SEGMENTATION

This research report on the global big data market has been segmented and sub-segmented based on type, deployment mode, organization size, business function, industry verticals and region.

By Type

- Hardware

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Large Enterprises

- SMEs

By Business Function

- Operations

- Finance

By Industry Vertical

- BFSI

- Manufacturing

- Healthcare and Life Sciences

- Telecommunications

- Energy and Natural Resources (Oil and Gas)

- Business

- Logistics and Distribution

- Transportation

- Research and Education

- Consumer and Retail

By Region

- Asia Pacific

- Europe

- Middle East and Africa

- North America

- Latin America

Frequently Asked Questions

What is the current size of the global big data market?

The global big data market is expected to be worth USD 224.46 billion in 2025.

Which industries contribute the most to the global big data market share?

Industries such as IT and telecommunications, healthcare, finance, manufacturing, and retail are among the major contributors to the global big data market share.

What are the key factors driving the growth of big data in the retail industry globally?

In the retail industry, factors driving the growth of big data include demand forecasting, personalized marketing, customer analytics, and the enhancement of the overall customer experience.

How has the COVID-19 pandemic impacted the adoption of big data solutions globally?

The COVID-19 pandemic has accelerated the adoption of big data solutions globally, particularly in areas such as healthcare, remote work optimization, and supply chain resilience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com