Europe Application Modernization Services Market Size, Share, Trends & Growth Forecast Report By Services (Cloud Application, Migration Replatforming), Organization Size, Vertical and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Application Modernization Services Market Size

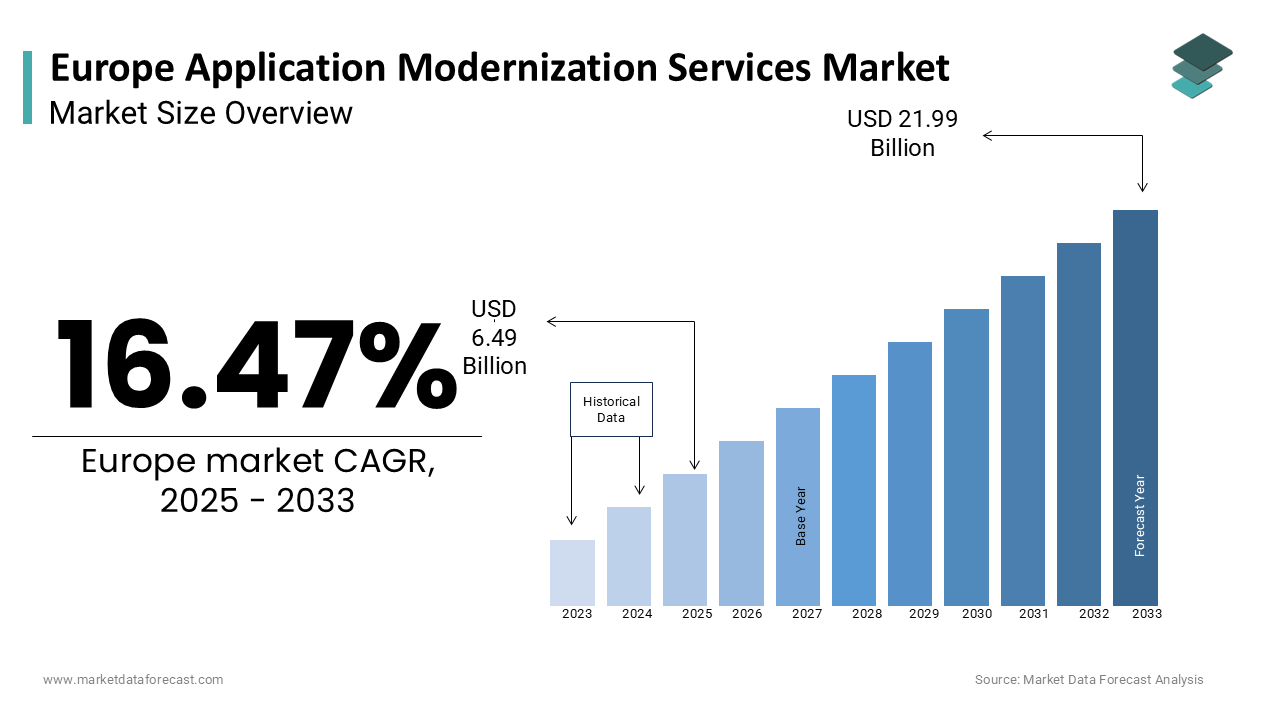

The europe application modernization services market was worth USD 5.57 billion in 2024. The European market is estimated to grow at a CAGR of 16.47% from 2025 to 2033 and be valued at USD 21.99 billion by the end of 2033 from USD 6.49 billion in 2025.

The market for application modernization services in Europe is growing quickly, mainly due to the region’s strong push for digital transformation. A McKinsey study found that over 60% of European companies have made updating their old IT systems a key part of their technology plans. Countries like Germany, the UK, and France are leading this trend, investing heavily in moving to the cloud and using microservices. One major reason for this shift is strict data privacy laws like the GDPR, which force businesses to replace outdated systems. Another factor is the growing complexity of business applications, making it harder to manage older technologies. Recent reports show that about 75% of businesses in Europe are either already working on or planning to start application modernization projects within the next three years, showcasing the strong demand for these services.

MARKET DRIVERS

Increasing Adoption of Cloud Computing

Cloud computing has emerged as a pivotal driver for the Europe application modernization services market. As per the findings, the European cloud services landscape is expected to exceed a key milestone by 2025, with enterprises migrating legacy systems to cloud platforms. This shift is primarily fuelled by the need for scalability, cost efficiency, and enhanced security. For instance, nearly 65% of European SMEs have adopted hybrid cloud models which is enabling seamless integration of modernized applications. Also, a study by Capgemini reveals that cloud-based modernization reduces operational costs by up to 30%, making it an attractive option for businesses. The demand for Software-as-a-Service (SaaS) solutions is also surging. So, enterprises are leveraging cloud-native architectures to enhance agility, which in turn fuels the demand for modernization services.

Rising Need for Enhanced Customer Experience

Customer experience (CX) optimization is another critical factor propelling the market forward. According to a study, companies investing in CX improvements witness a revenue uplift of up to 20%. Industries in Europe like retail and BFSI are heavily investing in modernizing customer-facing applications to deliver personalized experiences. For example, a survey by PwC indicates that 73% of European consumers consider CX a key factor in brand loyalty. To meet these expectations, organizations are adopting AI-driven analytics and real-time data processing capabilities necessitating the modernization of underlying applications. Furthermore, investigation notes that over 50% of European enterprises are prioritizing CX-focused modernization projects, spotlighting its significance as a market driver.

MARKET RESTRAINTS

High Initial Investment Costs

A significant barrier to the adoption of application modernization services is the high upfront investment required. Based on a report by KPMG, over 40% of European SMEs cite budget constraints as a primary restraint. Modernizing legacy systems often involves expenses related to infrastructure upgrades, software licensing, and workforce training. This financial burden deters smaller organizations from pursuing modernization initiatives. Additionally, a study by Accenture highlights that 35% of enterprises face difficulties in justifying ROI during the initial phases of modernization, further complicating decision-making processes.

Complexity and Risk of System Downtime

The technical complexity associated with modernization poses another major restraint. As per a survey by BCG, nearly 60% of European enterprises encounter challenges such as system downtime and data loss during modernization projects. Migrating legacy systems to new platforms requires meticulous planning and execution, and any misstep can disrupt business operations. For example, a failed modernization attempt by a leading European bank in 2022 resulted in a downtime of over 48 hours which is costing the institution approximately €10 million. Furthermore, integrating modernized applications with existing systems adds another layer of complexity. A report by EY notes that 45% of organizations face compatibility issues, which prolong project timelines and increase costs.

MARKET OPPORTUNITIES

Growing Demand for IoT Integration

The proliferation of Internet of Things (IoT) devices presents a lucrative opportunity for the Europe application modernization services market. According to Cisco, the number of connected devices in Europe is expected to reach 5 billion by 2025, that is creating a surge in demand for scalable and secure application infrastructures. Modernizing legacy systems to support IoT integration enables real-time data processing and analytics, which are critical for industries like manufacturing and healthcare. For instance, a study by Siemens reveals that IoT-enabled modernization can improve operational efficiency by up to 25%. Moreover, the European Commission estimates that IoT investments will contribute €250 billion to the regional economy by 2030, further amplifying the market potential.

Expansion of 5G Networks

The rollout of 5G networks across Europe is another key opportunity driving the market. Ericsson predicts that 5G coverage will reach 70% of the European population by 2026 which is enabling ultra-fast connectivity and low latency. This technological advancement necessitates the modernization of applications to leverage 5G capabilities fully. For example, industries such as telecom and media are investing in modernized platforms to support immersive experiences like augmented reality (AR) and virtual reality (VR). A report by Nokia bring to light that 5G-enabled modernization projects can enhance application performance by up to 40%. Additionally, the European Investment Bank forecasts that 5G-related investments will exceed €200 billion by 2030, exhibiting its transformative impact on the market.

MARKET CHALLENGES

Lack of Skilled Workforce

One of the most pressing challenges in the Europe application modernization services market is the shortage of skilled professionals. According to a survey by LinkedIn, there is a 30% gap in the availability of experts proficient in modern technologies like microservices and containerization. This skills deficit is particularly acute in Central and Eastern Europe, where only 45% of IT professionals possess the necessary expertise, as per a report by Tech.eu. The lack of qualified personnel not only delays modernization projects but also increases dependency on external consultants, driving up costs. Furthermore, a study by Boston Consulting Group reveals that 50% of European enterprises struggle to train their existing workforce, exacerbating the problem.

Resistance to Change

Resistance to change within organizations poses another significant challenge. A report by Harvard Business Review (HBR) indicates that 70% of digital transformation initiatives fail due to employee pushback. In the context of application modernization, employees accustomed to legacy systems often resist adopting new workflows and tools. For instance, a survey by Deloitte found that 60% of European enterprises face internal resistance during modernization projects which is leading to delays and reduced efficiency. Besides these, cultural barriers in traditional industries like manufacturing and government hinder the adoption of modernized solutions. An ex study by Bain & Company highlights that overcoming resistance requires comprehensive change management strategies, which many organizations lack.

SEGMENTAL ANALYSIS

By Services Insights

The cloud application migration segment dominated the Europe application modernization services market by accounting for 36.1% of the total market share in 2024. The growth of this segment is driven by the increasing adoption of hybrid and multi-cloud strategies. For example, a survey by VMware reveals that 80% of European enterprises utilize multiple cloud platforms, necessitating seamless migration solutions. Furthermore, the European Union's Digital Decade initiative aims to achieve 75% cloud adoption by 2030, further boosting demand. Another driving factor is the cost efficiency of cloud migration, with IBM reporting a 25% reduction in IT expenditures post-migration.

The Replatforming segment is the rapidly evolving category, with a CAGR of 18.3% during the forecast period. This rapid development is attributed to the rising need for optimizing application performance without altering core functionalities. For instance, a report by Oracle shows that replatforming reduces downtime by 30% while enhancing scalability. Additionally, the increasing adoption of containerization technologies like Docker and Kubernetes is fueling demand. According to Red Hat, over 60% of European enterprises plan to adopt containerized solutions by 2025, spotlighting the segment's growth potential.

By Organization Size Insights

The large enterprises segment accounted for 60.1% of the Europe application modernization services market in 2024. Their position in this market is due to the substantial budgets and the need to maintain competitive advantages through advanced technologies. For example, a study by PwC reveals that large enterprises allocate 15% of their IT budgets to modernization projects. Also, regulatory compliance requirements like GDPR drive adoption, with Capgemini estimating that 70% of large enterprises prioritize compliance-driven modernization.

The small & Medium Enterprises (SMEs) segment is the fastest-growing category, with a CAGR of 16.7%. This growth is fueled by affordable cloud-based solutions and government incentives. For instance, the European Commission offers grants worth €500 million annually to support SME digitalization. Furthermore, a survey by Sage indicates that 50% of SMEs view modernization as essential for survival, showcasing the segment's potential.

By Vertical Insights

The BFSI sector led the Europe application modernization services market by holding a 25.3% share in 2024. This is driven by the need for secure and compliant systems. For example, a report by Accenture notes that 80% of European banks are modernizing applications to enhance cybersecurity. Additionally, the rise of fintech startups has intensified competition, pushing traditional players to adopt modernized solutions.

Healthcare is the swiftest expanding vertical, with a CAGR of 17%, according to McKinsey. This progress is influenced by the increasing adoption of telemedicine and electronic health records (EHR). For instance, a study by Philips reveals that 70% of European hospitals are investing in modernized healthcare applications to improve patient outcomes.

REGIONAL ANALYSIS

Germany led by holding a 22.3% share of the Europe application modernization services market in 2024. The strong industrial base and focus on Industry 4.0 drive adoption by the country is contributing this position in the market. For example, a report by Bitkom shows that 75% of German manufacturers are modernizing applications to integrate IoT.

The UK is the fastest-growing market which is projected to grow at a CAGR of 15.8% from 2025 to 2033. It is driven by its robust financial services sector. According to PwC, 65% of UK banks are modernizing legacy systems to comply with open banking regulations.

France is seeing a steady adoption of application modernization, with government initiatives supporting digital transformation. A study by Capgemini reveals that 60% of French enterprises prioritize modernization to enhance operational efficiency.

Spain's market share stands at notable juncture in the market, with SMEs leading adoption. According to IESE, 55% of Spanish SMEs view modernization as critical for growth.

Italy is progressing steadily that is supported by its manufacturing sector. A report by Confindustria notes that 70% of Italian manufacturers are modernizing applications to improve competitiveness.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Accenture, IBM Corporation, Capgemini, Atos, HCL Technologies Limited, Aspire Systems, Bell Integrator, Blu Age, DXC Technology Company, and Micro Focus are some of the key market players in the Europe application modernization services market.

The Europe application modernization services market is highly competitive, characterized by the presence of global giants and regional players. Companies like Accenture, Capgemini, and TCS dominate the landscape, leveraging their expertise in cloud computing and AI to gain a competitive edge. According to a report by Gartner, the top five players collectively hold 45% of the market share. Smaller firms, however, are gaining traction by offering specialized services tailored to niche industries. The market is also witnessing increased collaboration, with players forming strategic alliances to enhance service delivery. For instance, partnerships between technology providers and consulting firms are becoming common. Additionally, pricing pressures and the need for continuous innovation intensify competition, driving companies to adopt aggressive marketing strategies.

Top Players in the Market

Accenture

Accenture is a global leader in application modernization, contributing significantly to the Europe market. The company specializes in cloud migration and microservices architecture, helping enterprises transition to agile platforms. Its proprietary tools and methodologies ensure seamless modernization, earning it a reputation for delivering high-quality solutions.

Capgemini

Capgemini plays a pivotal role in the market by offering end-to-end modernization services. With expertise in AI-driven analytics and IoT integration, the company helps clients optimize legacy systems. Its collaborative approach ensures tailored solutions that align with client objectives.

TCS

TCS leverages its extensive experience in digital transformation to drive application modernization. The company focuses on enhancing customer experience and operational efficiency, making it a preferred partner for European enterprises.

Top Strategies Used by Key Market Participants

Strategic Acquisitions

Key players are acquiring niche firms to expand their service portfolios. For instance, Accenture acquired a cloud-native consultancy firm in 2023 to bolster its cloud migration capabilities.

Partnerships with Technology Providers

Companies like Capgemini are partnering with cloud providers such as AWS and Azure to offer integrated solutions, enhancing their market presence.

Investment in R&D

Firms are investing heavily in research and development to innovate modernization tools. TCS, for example, launched an AI-driven platform in 2023 to automate modernization processes.

RECENT MARKET DEVELOPMENTS

- In April 2024, Accenture acquired a cloud-native consultancy firm to enhance its cloud migration

- In June 2023, Capgemini partnered with AWS to offer integrated modernization solutions.

- In January 2024, TCS launched an AI-driven platform to automate application modernization processes.

- In March 2023, IBM introduced a new suite of tools for replatforming legacy systems.

- In December 2023, Deloitte collaborated with Microsoft to provide GDPR-compliant modernization services.

MARKET SEGMENTATION

This research report on the europe application modernization services market is segmented and sub-segmented based on categories.

By Services

- Cloud Application Migration

- Replatforming

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- BFSI

- Healthcare

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key trends driving this market in Europe?

Key trends include rising adoption of cloud computing, increased demand for agility in application development, and a shift toward containerization and DevOps. Enterprises are modernizing to stay competitive in the digital economy.

What is the future outlook for the Europe application modernization services market?

The market is expected to grow significantly over the coming years due to digital transformation initiatives across industries. Emerging technologies like AI, IoT, and low-code platforms will further boost modernization demand.

Which industries are adopting these services the most in Europe?

Sectors like BFSI, healthcare, manufacturing, and retail are among the major adopters. They seek to enhance operational efficiency, customer experience, and regulatory compliance through modernization.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com