Europe Aquafeed Market Size, Share, Trends And Growth Forecasts Report, Segmented By End Use, Additives, And By Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Aquafeed Market Size

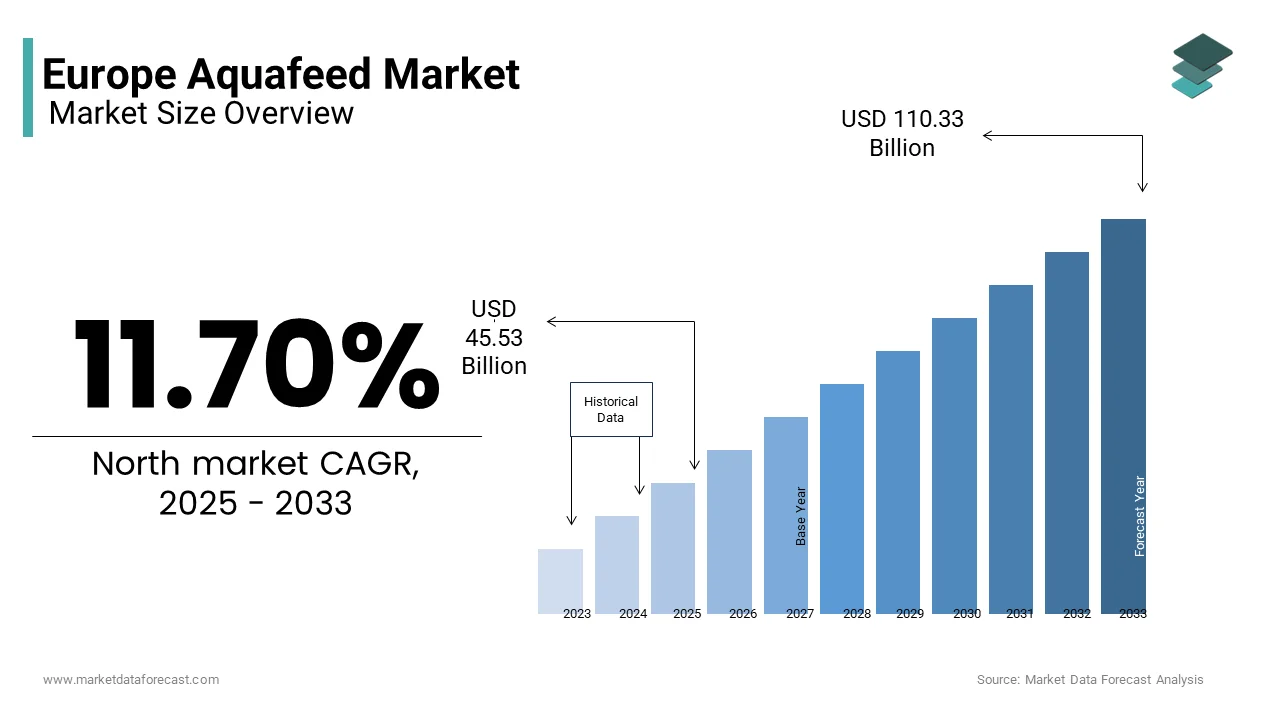

Europe's aquafeed market was valued at USD 40.76 billion in 2024 and is anticipated to reach USD 45.53 billion in 2025 from USD 110.33 billion by 2033, growing at a CAGR of 11.70% during the forecast period from 2025 to 2033.

The Europe aquafeed market growth is driven by increasing demand for sustainable seafood, rising consumer awareness about health benefits, and advancements in feed formulations. Farmed fish in Europe are fed with specialized aquafeed is ensuring optimal growth and nutritional value. Additionally, government initiatives promoting sustainable aquaculture practices have accelerated the adoption of eco-friendly feed solutions.

MARKET DRIVERS

Rising Demand for Sustainable Seafood

A key driver of the Europe aquafeed market is the growing demand for sustainable seafood. According to the European Commission, over 70% of European consumers prioritize sustainably sourced seafood, creating a robust demand for aquafeed that supports environmentally friendly farming practices. The EU’s Common Fisheries Policy mandates sustainable aquaculture practices, driving the adoption of advanced feed formulations.

For example, as per the Norwegian Directorate of Fisheries, over 80% of salmon farms in Norway now use feeds enriched with plant-based proteins and omega-3 fatty acids by reducing reliance on wild-caught fishmeal. These innovations not only enhance sustainability but also improve the nutritional profile of farmed fish that will fuel the growth of the market.

Advancements in Feed Formulations

Technological advancements in aquafeed formulations represent another major driver. According to the European Feed Manufacturers’ Federation, the integration of functional additives like probiotics and antioxidants has improved feed efficiency by 25% since 2020. These innovations appeal to farmers seeking cost-effective solutions that enhance growth rates and disease resistance. Additionally, collaborations between research institutions and manufacturers have led to breakthroughs in precision nutrition, tailoring feeds to specific species and life stages. As per the French National Institute for Ocean Science, feeds customized for mollusks and crustaceans have increased yields by 30% that is positioning this segment as a transformative force in the market.

MARKET RESTRAINTS

High Cost of Raw Materials

A significant restraint facing the Europe aquafeed market is the high cost of raw materials, particularly fishmeal and fish oil. According to the European Fisheries Fund, the price of fishmeal has risen by 40% since 2021 due to declining fish stocks and increased demand. This financial burden is particularly pronounced for small-scale aquaculture operations, which struggle to absorb these costs while maintaining competitive pricing. A survey by the European Aquaculture Technology and Innovation Platform revealed that nearly 30% of farmers consider switching to alternative feeds due to cost pressures. These affordability issues create barriers to market expansion in price-sensitive regions.

Environmental Concerns Over Feed Production

Environmental concerns pose another restraint regarding the carbon footprint of aquafeed production. According to the European Environmental Agency, feed manufacturing contributes to over 15% of aquaculture’s total greenhouse gas emissions. This issue has led to stricter regulations, such as caps on emissions in countries like Germany and Sweden. Additionally, consumer awareness about sustainability has shifted preferences toward feeds with lower environmental impacts. According to a study by the European Green Deal Initiative, over 60% of consumers prioritize eco-friendly options, reducing demand for traditional feeds. These challenges necessitate innovation to maintain competitiveness.

MARKET OPPORTUNITIES

Expansion into Plant-Based and Alternative Proteins

The growing adoption of plant-based and alternative proteins presents a significant opportunity for the Europe aquafeed market. According to the European Plant-Based Foods Association, over 50% of aquafeed manufacturers are investing in formulations that replace fishmeal with soybean, algae, or insect-based proteins. For instance, as per the Danish Technological Institute, feeds using insect meal have reduced production costs by 20% while maintaining nutritional quality. Government subsidies for sustainable aquaculture have further boosted adoption. The UK’s Department for Environment, Food & Rural Affairs reported a 25% increase in eco-friendly feed sales following the introduction of tax incentives.

Growing Demand for Functional Additives

Another major opportunity lies in the demand for functional additives like vitamins, minerals, and probiotics. According to the European Nutrition Society, over 70% of aquafeed formulations now include functional additives to enhance growth rates and disease resistance. For example, as per the Spanish Ministry of Agriculture, feeds enriched with probiotics have increased survival rates in shrimp farming by 35%. Advancements in biotechnology have reduced production costs, driving adoption. Partnerships between manufacturers and research institutions further amplify growth by positioning functional additives as a key driver of market expansion.

MARKET CHALLENGES

Competition from Low-Cost Imports

Competition from low-cost imports poses a significant challenge. According to the European Trade Association, imported feeds account for 25% of the market due to their affordability and availability. This competition is intense in Southern Europe, where farmers prioritize cost savings over premium products. Additionally, inconsistencies in feed quality threaten to erode market share for domestic manufacturers. According to a study by the Italian Ministry of Agriculture, imported feeds often lack essential nutrients is creating a formidable rival for locally produced options.

Stringent Regulatory Standards

Stringent regulatory standards represent another challenge. According to the European Food Safety Authority, feeds must comply with strict safety and environmental regulations is increasing compliance costs by 15%, as per the German Federal Ministry for the Environment. Smaller players face difficulties in meeting these requirements is leading to market consolidation. According to a survey by the European Aquaculture Society, nearly 20% of small-scale manufacturers have exited the market due to regulatory pressures with the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.70% |

|

Segments Covered |

By End-Use, Additives, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Cargill, Inc., Nutreco N.V, Alltech Inc., AllerAqua A/S, Beneo GmbH, Biomar A/S, Charoen Pokphand Foods Public Company Limited, Coppens International B.V., |

SEGMENTAL ANALYSIS

By End Use Insights

The fish segment dominated the market and held a dominant share of the Europe aquafeed market in 2024 owing to the high production volumes of species like salmon, trout, and carp, which account for over 80% of Europe’s aquaculture output. For instance, according to the Norwegian Directorate of Fisheries, salmon farming alone consumes 50% of all aquafeed produced in Europe.

Key factors driving this segment include advancements in feed formulations tailored for fish species. Additionally, government incentives for sustainable aquaculture have increased adoption rates, ensuring sustained growth.

The crustacean’s segment is likely to register a CAGR of 7.2% during the forecast period. The growth of the segment is driven by the rising demand for shrimp and prawns in Southern Europe. According to the Spanish Ministry of Agriculture, feed sales for crustacean farming have increased by 30% annually since 2020. Innovations in feed formulations, such as inclusion of probiotics and antioxidants, have driven adoption. Partnerships between manufacturers and farmers further amplify growth by positioning crustaceans as a key driver of market expansion.

By Additives Insights

The vitamins was the largest and held 30.1% of the Europe aquafeed market share in 2024 with their role in enhancing fish health, growth rates, and immunity. For instance, as per the French National Institute for Ocean Science, feeds enriched with vitamins like A, D, and E have reduced mortality rates by 25% in salmon farming. Key factors driving this segment include advancements in biotechnology that have improved the bioavailability of vitamins in aquafeed formulations. Additionally, government subsidies for sustainable aquaculture practices have increased adoption rates by ensuring sustained growth.

The probiotics segment is likely to register CAGR of 8.5% in the next coming years. This growth is fueled by their ability to enhance gut health, improve feed efficiency, and boost disease resistance in aquatic species. Advancements in microbial fermentation technologies have reduced production costs, driving adoption. Partnerships between manufacturers and research institutions further amplify growth is positioning probiotics as a transformative force in the market.

COUNTRY ANALYSIS

Norway led the Europe aquafeed market with an estimated share of 35.4% in 2024 owing to the country’s dominance in salmon farming, which accounts for over 50% of Europe’s total aquaculture output. Norway’s emphasis on sustainability aligns with EU regulations is driving adoption of eco-friendly feed solutions. For instance, as per the Norwegian Institute of Marine Research, over 80% of salmon farms in Norway use feeds enriched with plant-based proteins and omega-3 fatty acids, reducing reliance on wild-caught fishmeal. Additionally, government incentives for sustainable aquaculture have increased the use of innovative feed formulations.

Turkey is expected to witness a CAGR of 9.5% from 2025 to 2033. This growth is fueled by rapid urbanization, increasing consumer spending, and rising exports of seafood products. Turkey’s aquafeed industry has grown by 40% since 2020 owing to the investments in modern manufacturing facilities, as per the Turkish Exporters Assembly. Additionally, government-led initiatives promoting sustainable aquaculture practices have accelerated adoption is positioning Turkey as a key growth driver in the region. Countries like Spain, France, and Italy are expected to witness steady growth due to their strong aquaculture sectors and export-oriented economies.

KEY MARKET PLAYERS

Cargill, Inc., Nutreco N.V, Alltech Inc., AllerAqua A/S, Beneo GmbH, Biomar A/S, Charoen Pokphand Foods Public Company Limited, Coppens International B.V., are the market players dominating the Europe aquafeed market.

Top 3 Players In The Europe Aquafeed Market

Cargill, Incorporated

Cargill is a leading player in the Europe aquafeed market, contributing significantly to innovations in sustainable and nutritionally balanced feed formulations. The company specializes in producing high-quality aquafeed tailored for fish, mollusks, and crustaceans. Cargill holds an estimated 20% share in the European market, as per the European Feed Manufacturers’ Federation. Its focus on integrating plant-based proteins aligns with Europe’s sustainability goals by enabling it to maintain a competitive edge.

Biomar Group

Biomar Group is another key contributor, renowned for its expertise in premium aquafeed formulations. The company commands approximately 15% of the market, according to the European Aquaculture Society. Biomar’s strategic emphasis on expanding its product portfolio with functional additives has driven growth. Its presence in Europe is strengthened by partnerships with local aquaculture farmers by ensuring widespread adoption of its products.

Skretting (Nutreco N.V.)

Skretting plays a pivotal role in advancing aquafeed technologies, particularly in precision nutrition and sustainable formulations. With a global market share of 12%, as stated by the European Nutrition Society, Skretting has transformed the industry through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market in high-growth regions like Norway and Spain.

Top Strategies Used By Key Players In Europe Aquafeed Market

Key players in the Europe aquafeed market employ strategies such as sustainability initiatives, geographic expansion, and technological advancements to strengthen their positions. Sustainability initiatives are central, with companies investing in eco-friendly formulations to meet EU regulations. For instance, Cargill has increased its use of plant-based proteins by 30% since 2021, enhancing its sustainability profile. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential.

Technological advancements also play a crucial role. Biomar has introduced feeds enriched with probiotics and antioxidants, reducing production costs and improving logistical efficiency. These strategies collectively drive market growth and ensure sustained competitiveness.

Competition Overview

The Europe aquafeed market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Cargill, Biomar, and Skretting dominate the landscape through continuous innovation and strategic collaborations. The market is fragmented yet concentrated at the top, with these three players collectively accounting for over 50% of the market, as per the European Feed Manufacturers’ Federation.

Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic aquaculture or specific species. Regulatory compliance and adherence to sustainability standards further intensify competition, ensuring that only the most reliable products gain traction.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Cargill launched a new line of plant-based aquafeed in Norway by reducing reliance on fishmeal by 40% while maintaining nutritional quality.

- In June 2023, Biomar partnered with Italian aquaculture farmers to develop custom feeds for mollusks by enhancing brand differentiation and market penetration.

- In September 2023, Skretting acquired a leading aquafeed manufacturer in Turkey is strengthening its position in the fast-growing Middle Eastern market.

- In November 2023, Alltech introduced a cloud-based platform in Switzerland is streamlining the customization of feed formulations based on species and life stages.

- In February 2024, Evonik collaborated with tech firms in France to develop enzyme-enhanced feeds by positioning itself as a leader in innovative solutions.

MARKET SEGMENTATION

This research report on the Europe aquafeed market is segmented and sub-segmented into the following categories.

By End Use

- Fish

- Carp

- Salmon

- Tilapia

- Catfish

- Others

- Mollusks

- Shrimp

- Crab

- Others

- Crustaceans

- Oyster

- Mussel

- Others

By Additives

- Vitamins

- Minerals

- Antioxidants

- Amino Acids

- Enzymes

- Acidifiers

- Binders

By Country

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current size of the aquafeed market in Europe?

The aquafeed market in Europe is valued at USD 45.53 billion in 2025.

Which European countries are the major contributors to the aquafeed market in the region?

Norway, Spain, and the United Kingdom are among the major contributors to the aquafeed market in Europe due to their significant aquaculture production.

What are the key trends driving growth in the aquafeed market in Northern Europe?

In Northern Europe, the increasing adoption of sustainable aquaculture practices, rising consumer demand for seafood, and advancements in aquafeed formulations are driving market growth.

Which are the key aquafeed manufacturers dominating the market in Norway?

Companies such as BioMar Group, Skretting, and Cargill Aqua Nutrition are among the key aquafeed manufacturers dominating the market in Norway.

How is the aquafeed market in France addressing concerns about fishmeal and fish oil sustainability?

In France, the aquafeed market is witnessing increased investments in alternative protein sources and omega-3 fatty acid supplements derived from algae and plant-based sources to reduce reliance on fishmeal and fish oil in feed formulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]