Europe Autoinjectors Market Size, Share, Trends & Growth Forecast Report By Product, Usability, Manufacturing Design, Technology, Application, Distribution Channels, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis, From (2025 to 2033)

Europe Autoinjectors Market Size

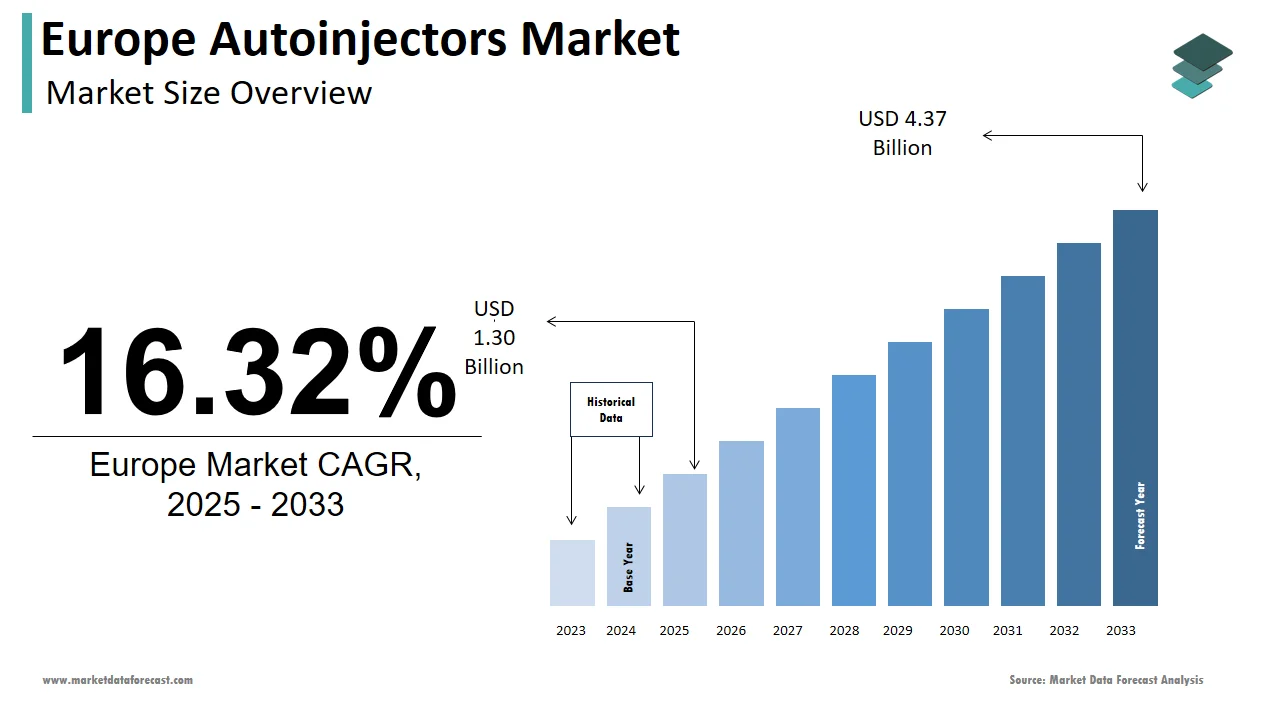

The autoinjectors market size in Europe was valued at USD 1.12 billion in 2024. The European market is estimated to be worth USD 4.37 billion by 2033 from USD 1.30 billion in 2025, growing at a CAGR of 16.32% from 2025 to 2033.

MARKET DRIVERS

Rising Chronic Diseases and Biologics Industry Growth Fuel Market Expansion

The European autoinjectors market is primarily driven by factors such as an increase in the prevalence of chronic diseases, the growth of the biologics industry, the approval of self-injecting devices such as pen injectors, enhanced technology, and patient compliance. An increase in serving to regulate the action of medicines and an increase in the incidence of anaphylaxis. Other factors such as regulatory approval for various devices, such as protected syringes, prefilled syringes, and auto disabled syringes, are expected to fuel the autoinjectors market growth in the European region.

Rising Awareness, Reimbursement Support, and Innovation Drive Market Growth

Increasing patient awareness, potential reimbursements, government financing, and design innovations are further propelling the market forward. In addition, the authorities of EU governments using biologics expiration dates to promote demand for biosimilars creates more market opportunities. Furthermore, autoinjectors are more effective and less uncomfortable than syringes. They allow for greater control and accurate medication administration than manual injection.

Advancements in Drug Delivery Systems and Regulatory Approvals Drive Market Potential

On the other hand, the novel medication formulations and developments in drug delivery systems and regulatory approval are expected to offer additional growth possibilities to the EU autoinjectors market. As a result, staying on top of trends is critical for decision-makers to maximize the available opportunity. Furthermore, the growing elderly population contributes to the growth of the European autoinjectors market during the forecast period.

MARKET RESTRAINTS

Challenges in Autoinjector Usage and Alternatives

However, alternative ways to medicine administration, such as speech and application, safety issues, and the risk of blood injections, are expected to impede the EU autoinjectors market expansion. In addition, exorbitant prices and a lack of understanding about self-medication, as well as rigorous rules and hazards associated with autoinjectors, are further expected to hamper the growth rate of the market. Furthermore, the lack of proper action in having a skill for using autoinjectors and the development of autoinjectors for many drugs with sticky and semi-fluid consistency are a few of the notable challenges that the market faces. Alternatives drug delivery modes, such as epinephrine nasal sprays and oral diabetic agents, and the oral injectors are expected to restrict the expansion rate of the market.

REGIONAL ANALYSIS

Regionally, the European region is always an essential part of the global economy. The growth of the European autoinjectors market is attributed to the rising number of diabetic patients and the growing population. In addition, growing awareness of people’s on autoinjectors and their adoption of sedentary lifestyles are two significant factors driving the autoinjectors market in emerging countries. Growing availability of funding and government clearance for research and development is beneficial for manufacturing companies, supporting the autoinjectors market expansion in the forecast period in the European region. The countries in the region such as Germany, UK, Italy, France, and Spain, significantly contribute to the European regional market growth.

The German autoinjectors market is predicted to lead the European market during the forecast period due to numerous factors such as increased awareness and favorable reimbursement policies, and growing healthcare spending. Furthermore, the presence of market leaders in Germany has a significant impact on market growth. In addition, the German autoinjectors market is being fuelled by innovation in drug delivery systems, increased usage of autoinjectors, diabetes and cancer, and favorable government policies.

KEY MARKET PLAYERS

Companies such as Mylan N.V., Pfizer, Inc., Bayer AG, Becton, Dickinson and Company, Novartis AG, Biogen Idec, Inc., Janssen North America Services, LLC, Sanofi, Unilife Corporation, and Eli Lilly and Company are some of the prominent companies in the European autoinjectors Market.

MARKET SEGMENTATION

This Europe autoinjectors market research report is segmented and sub-segmented into the following categories.

By Product

- Fillable Autoinjectors

- Prefilled Autoinjectors

By Usability

- Disposable Autoinjectors

- Reusable Autoinjectors

By Manufacturing Design

- Standardized Autoinjectors

- Customized Autoinjectors

By Technology

- Automated Autoinjectors

- Manual Autoinjectors

By Application

- Anaphylaxis

- Multiple Sclerosis

- Rheumatoid Arthritis

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com