Europe Biodefense Market Size, Share, Trends & Growth Forecast Report By Product (Anthrax, Botulism, Smallpox, Nuclear, Other Products), End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

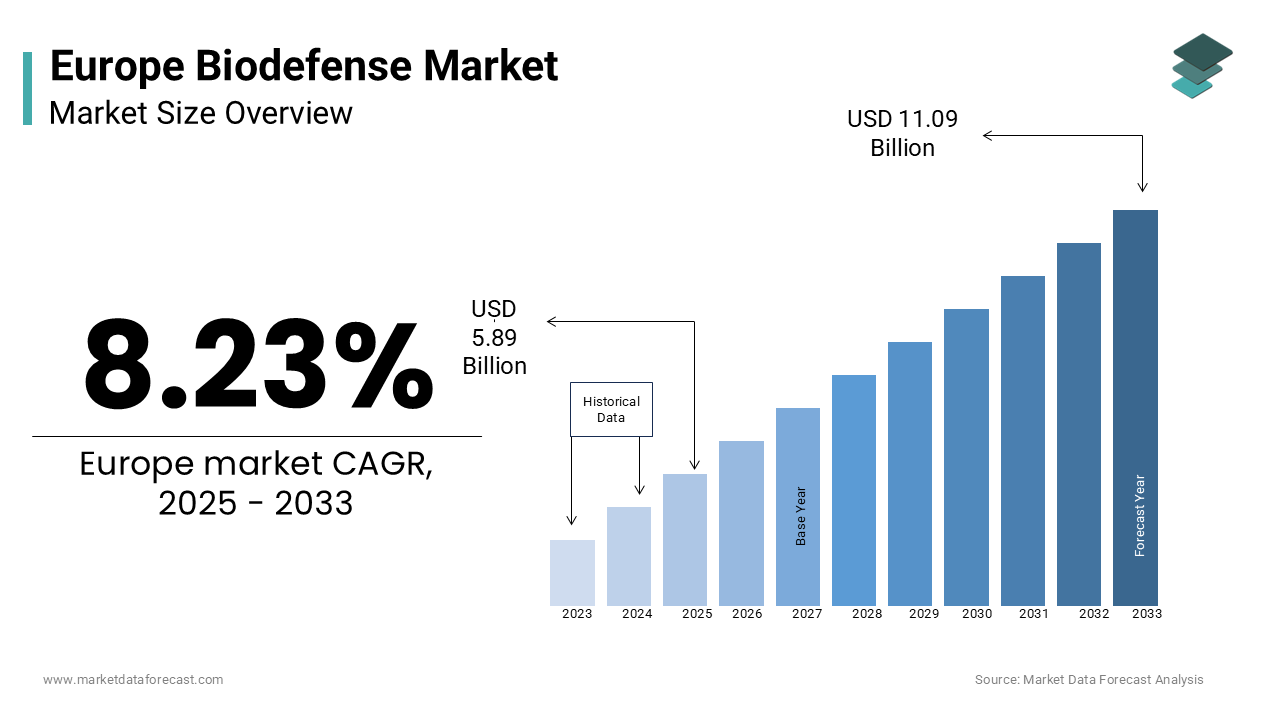

Europe Biodefense Market Size

The europe biodefense market was worth USD 5.44 billion in 2024. The European market is estimated to grow at a CAGR of 8.23% from 2025 to 2033 and be valued at USD 11.09 billion by the end of 2033 from USD 5.89 billion in 2025.

The biodefense is the development and deployment of medical countermeasures such as vaccines, therapeutics, diagnostics, and protective equipment to mitigate the impact of biological agents. According to the European Centre for Disease Prevention and Control (ECDC), Europe has witnessed a 20% increase in biosecurity incidents over the past decade with the growing need for robust biodefense strategies. As per European Commission's Horizon Europe program, innovation in biodefense technologies by allocating over €5 billion annually to research and development initiatives. Additionally, the European Union's Health Emergency Preparedness and Response Authority (HERA) was established in 2021 to strengthen the region's capacity to respond to biological threats. The market continues to expand with the advancements in biotechnology and increasing government investments.

MARKET DRIVERS

Rising Incidence of Biological Threats

The increasing incidence of biological threats, including pandemics and bioterrorism is a major driver for the European biodefense market growth. According to the European Centre for Disease Prevention and Control (ECDC), outbreaks of infectious diseases such as Ebola, Zika, and COVID-19 have evaluated the vulnerabilities in global health systems by prompting governments to prioritize biodefense preparedness. Over 30% of European countries lack adequate stockpiles of medical countermeasures is driving demand for vaccines, therapeutics, and diagnostics, as per ECDC. Additionally, the European Commission's HERA initiative aims to enhance the region's resilience to biological threats, with investments exceeding €10 billion by 2025. Furthermore, according to the World Health Organization (WHO), the economic impact of pandemics in Europe exceeded €1 trillion during the COVID-19 crisis.

Government Investments in Biodefense Infrastructure

The government investments in biodefense infrastructure represent another significant driver for the European biodefense market. According to the European Defence Agency, defense budgets allocated to biodefense programs grew by 15% in 2022 by reflecting heightened awareness of biosecurity risks. According to the European Union's Horizon Europe program, the development of advanced biodefense technologies, with funding exceeding €5 billion annually. The European Commission's HERA initiative further amplifies this trend by fostering collaboration between public and private stakeholders to accelerate the development and deployment of medical countermeasures. These strategic investments ensure Europe's readiness to respond to biological threats by positioning biodefense as a cornerstone of national security.

MARKET RESTRAINTS

High Costs of Research and Development

The high costs associated with research and development (R&D) represent a significant restraint for the European biodefense market. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the average cost of developing a single vaccine exceeds €1 billion by limiting the ability of smaller companies to compete in the market. According to the European Commission, over 60% of biotech firms cite affordability as a primary barrier to innovation in the development of countermeasures for rare or emerging pathogens.

Stringent Regulatory Requirements

The stringent regulatory requirements governing the approval of biodefense products pose another challenge to the European biodefense market. According to the European Medicines Agency (EMA), the approval process for vaccines and therapeutics involves rigorous clinical trials and safety assessments, which can take up to 10 years to complete. According to the European Commission, over 40% of biodefense projects face delays due to these stringent requirements by impacting time-to-market. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), compliance costs for biodefense manufacturers have risen by 25% over the past three years by limiting affordability for small and medium-sized enterprises (SMEs).

MARKET OPPORTUNITIES

Advancements in mRNA Vaccine Technology

The advancements in mRNA vaccine technology present a lucrative opportunity for the European biodefense market. According to the European Commission's Horizon Europe program, mRNA vaccines demonstrated unprecedented efficacy during the COVID-19 pandemic, with over 80% effectiveness in preventing severe disease. As per the European Medicines Agency, the versatility of mRNA platforms in addressing a wide range of biological threats, from viral pandemics to bioterrorism agents. According to the European Defence Agency, the importance of mRNA vaccines in enhancing military readiness. This opportunity positions mRNA technology as a transformative force in the biodefense market by enabling rapid response to emerging biological threats.

Expansion into Pandemic Preparedness Programs

The growing focus on pandemic preparedness programs offers another promising opportunity for the European biodefense market. According to the European Centre for Disease Prevention and Control (ECDC), over 70% of European countries have established national pandemic preparedness plans by creating a favorable environment for biodefense innovations. The European Commission's HERA initiative aims to enhance the region's capacity to respond to pandemics, with investments exceeding €10 billion by 2025.

MARKET CHALLENGES

Supply Chain Vulnerabilities

The supply chain vulnerabilities pose a significant challenge to the European biodefense market growth in the next coming years. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022 by affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key components such as active pharmaceutical ingredients (APIs), which are essential for vaccine and therapeutic production. According to the European Federation of Pharmaceutical Industries and Associations, imports of certain APIs declined by 40% in 2022 by leading to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules by impacting market stability. According to Eurostat, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges.

Limited Availability of Skilled Workforce

The limited availability of skilled professionals trained in biotechnology and life sciences represents another critical challenge for the European biodefense market. According to the European Centre for the Development of Vocational Training, less than 15% of graduates in Europe possess hands-on experience with biodefense technologies by creating a significant skills gap. As per the European Commission, over 50% of biotech firms struggle to find qualified personnel to operate and maintain advanced production systems. This shortage of expertise not only slows the adoption of advanced technologies but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive training initiatives.

SEGMENTAL ANALYSIS

By Product Insights

The anthrax dominated the European biodefense market share of 35.3% in 2024. The widespread use of anthrax vaccines and therapeutics in military and civilian applications due to their high efficacy and reliability is prompting the growth of this segment. According to the European Centre for Disease Prevention and Control (ECDC), over 60% of European countries maintain stockpiles of anthrax countermeasures due to the region's commitment to biodefense preparedness. Additionally, the European Commission's HERA initiative emphasizes the importance of anthrax vaccines in enhancing military readiness that further boosts the demand. The versatility and performance of anthrax countermeasures ensure their sustained dominance in the market for applications requiring rapid response to biological threats.

The nuclear segment is likely to grow swiftly with an estimated CAGR of 12.4% from 2025 to 2033. This rapid growth is fueled by the increasing adoption of radiological countermeasures in military and healthcare settings, where they provide protection against nuclear fallout and radiation exposure. Additionally, the European Commission's Horizon Europe program supports the development of advanced radiological technologies with the rising prominence in enabling innovative and sustainable biodefense solutions.

By End User Insights

The hospitals and clinics segment was the largest by capturing 45.3% of the European biodefense market share in 2024 with the extensive use of biodefense products such as vaccines, diagnostics, and protective equipment in healthcare settings to mitigate the impact of biological threats. The European Commission's HERA initiative promotes the importance of hospitals in responding to pandemics that leverages the demand for biodefense solutions.

The pharmaceutical and biotech segment is likely to experience a CAGR of 11.5% during the forecast period. This rapid growth is driven by the increasing adoption of biodefense technologies in vaccine and therapeutic development, where they enable rapid response to emerging biological threats. The mRNA platforms, for instance, are extensively used in the development of countermeasures for pandemics and bioterrorism agents.

REGIONAL ANALYSIS

Germany was the top performer in the European biodefense market with 25.3% of share in 2024. This prominence is attributed to the country's robust healthcare infrastructure and strong emphasis on biodefense preparedness. According to the German Centre for Infection Research, over 60% of biodefense initiatives in Europe are led by German institutions with the adoption of the new technologies. Additionally, Germany's strategic investments in vaccine manufacturing facilities and diagnostic laboratories create a favorable environment for market growth.

France biodefense market is likely to experience a fastest CAGR of 7.8% during the forecast period. The country's healthcare and defense sectors are key contributors to biodefense adoption. The French National Institute of Health and Medical Research leverages biodefense technologies extensively in pandemic preparedness programs. Furthermore, France's focus on biosecurity boosts the use of advanced countermeasures.

The UK biodefense market is growing steadily in the foreseen years. The country's strong presence in the pharmaceutical and biotech sectors drives biodefense demand. The UK's commitment to pandemic preparedness supports the use of advanced vaccines and diagnostics, ensuring steady market growth.

Italy’s healthcare sector relies heavily on biodefense products for pandemic response and hospital preparedness is enhancing the growth of the biodefense market. Italy's dominance in vaccine development amplifies demand for advanced countermeasures. Furthermore, the Italian government's focus on biosecurity aligns with the growing adoption of sustainable biodefense practices.

MARKET SEGMENTATION

This research report on the europe biodefense market is segmented and sub-segmented based on categories.

By Product

- Anthrax

- Botulism

- Smallpox

- Nuclear

- Other Products

By End-User

- hospitals and clinics

- pharmaceutical and biotech

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How does the Biodefense Market impact public health in Europe?

The market plays a crucial role in enhancing public health by preparing for and mitigating the impact of biological threats, ensuring rapid response through vaccines, diagnostics, and treatments.

What are the technological advancements in the Biodefense Market?

Technological advancements include faster diagnostic tools (e.g., PCR-based testing), new vaccine platforms (e.g., mRNA technology), and advanced biosecurity systems for detecting and mitigating biological threats.

What is the future outlook for the Biodefense Market in Europe?

The market is expected to grow steadily due to the ongoing threat of biological agents, technological advancements, and increased awareness about the importance of preparedness and rapid response to biological threats.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com