Europe Cloud Customer Relationship Management (CRM) Market Size, Share, Trends, & Growth Forecast Report By Vertical (Nonprofit, Higher Education, and Others (Banking, Financial Services and Insurance (BFSI), Consumer Goods and Retail, Healthcare, Telecom and IT, Energy and Utilities, and Transportation and Logistics)), Nonprofit Sub Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Cloud Customer Relationship Management (CRM) Market Size

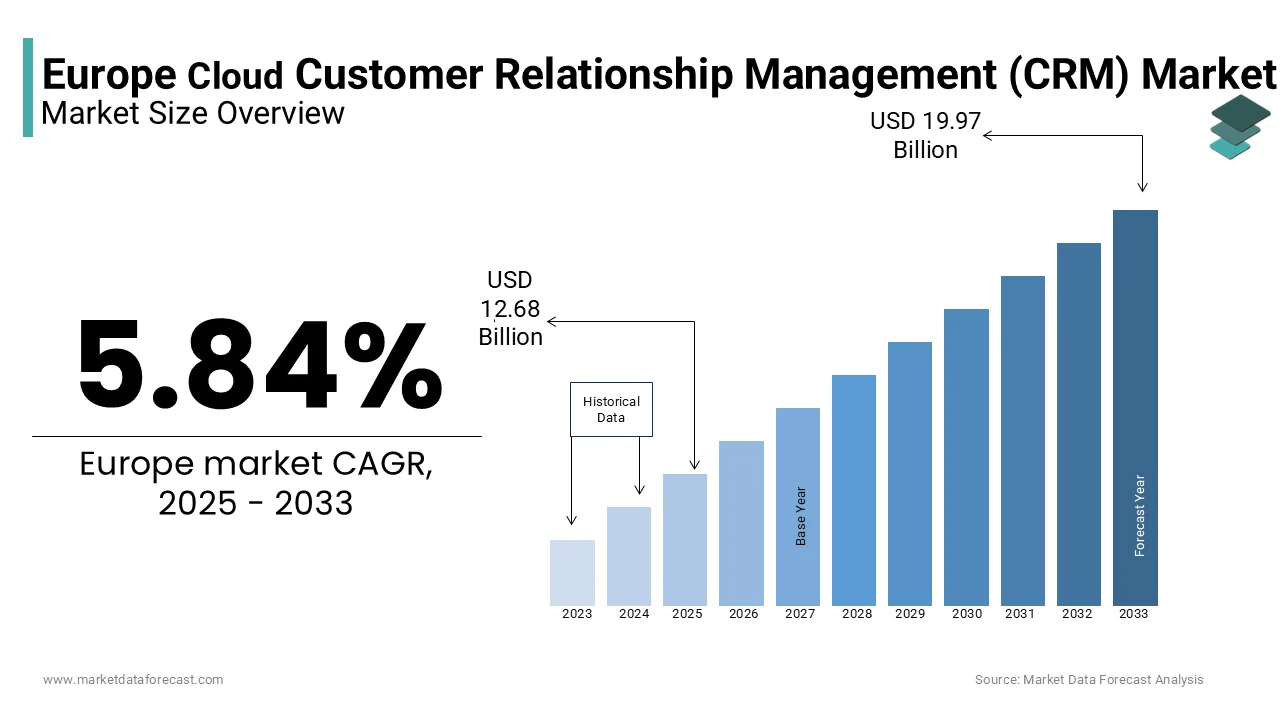

The Europe cloud customer relationship management (CRM) market was valued at USD 11.98 billion in 2024. The European market is estimated to reach USD 19.97 billion by 2033 from USD 12.68 billion in 2025, rising at a CAGR of 5.84% from 2025 to 2033.

The Europe Cloud Customer Relationship Management (CRM) is rapidly evolving within the broader enterprise software landscape, characterized by the adoption of cloud-based platforms to streamline customer interactions, enhance data analytics, and improve operational efficiency. Cloud CRM systems enable businesses to manage sales, marketing, customer service, and support functions through scalable, subscription-based models hosted on remote servers. This eliminates the need for extensive on-premise infrastructure, offering cost savings, flexibility, and real-time accessibility across devices. According to Eurostat, over 65% of European enterprises adopted cloud computing solutions in 2022, with CRM being one of the most widely implemented applications due to its ability to integrate seamlessly with other digital tools.

The European market is witnessing robust growth driven by the increasing emphasis on digital transformation and customer-centric business strategies. This surge is fueled by industries such as retail, healthcare, and financial services, where personalized customer experiences are paramount. For instance, the European Retail Forum study shows that 70% of retailers in Western Europe now rely on cloud CRM to analyze consumer behavior and optimize marketing campaigns. Furthermore, stringent data protection regulations, such as the General Data Protection Regulation (GDPR), have pushed vendors to develop secure and compliant cloud CRM solutions tailored to regional needs.

MARKET DRIVERS

Increasing Adoption of Digital Transformation Strategies

The widespread adoption of digital transformation strategies across industries. According to Eurostat, over 70% of European enterprises have implemented digital tools to enhance operational efficiency and customer engagement by 2022. This shift is particularly prominent in sectors like retail and healthcare, where businesses leverage cloud CRM systems to analyze consumer data and deliver personalized experiences. According to the European Commission, investments in digital technologies reached €145 billion in 2022, with cloud-based solutions accounting for a significant share. According to the International Data Corporation (IDC), organizations adopting cloud CRM witnessed a 20% improvement in customer retention rates.

Stringent Data Protection Regulations and Compliance Needs

Another major driver is the growing emphasis on compliance with stringent data protection regulations, such as the General Data Protection Regulation (GDPR). According to the European Data Protection Board, GDPR compliance has become a top priority for businesses, with non-compliance penalties reaching up to €20 million or 4% of annual turnover. Cloud CRM vendors are responding by offering secure, GDPR-compliant platforms that ensure robust data encryption and privacy controls. For instance, a report by the European Union Agency for Cybersecurity (ENISA) reveals that 60% of organizations upgraded their CRM systems in 2022 to meet regulatory requirements. Furthermore, the European Commission emphasizes that secure cloud solutions reduce data breach risks by 30%, encouraging businesses to adopt trusted providers. This regulatory landscape not only boosts cloud CRM adoption but also fosters trust among enterprises handling sensitive customer information.

MARKET RESTRAINTS

High Initial Implementation Costs and Budget Constraints

The high initial implementation costs, which pose challenges for small and medium-sized enterprises (SMEs) is declining the growth rate of the Europe cloud customer relationship management market. According to the European Investment Bank, over 40% of SMEs in Europe cite budget constraints as a barrier to adopting advanced digital tools, including cloud CRM systems. While subscription-based models reduce upfront expenses, additional costs such as data migration, employee training, and system customization can be substantial. As per Eurostat, nearly 35% of businesses delay digital transformation initiatives due to financial limitations. According to the International Labour Organization, the economic uncertainty caused by global inflation has forced many organizations to prioritize essential expenditures over long-term investments. These financial barriers hinder the widespread adoption of cloud CRM solutions among smaller players with limited resources.

Concerns Over Data Security and Privacy Breaches

The advancements in cloud technology is additional factor that is restraining the growth rate of the Europe cloud customer relationship management market. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks targeting cloud platforms increased by 25% in 2022 by raising apprehensions among potential adopters. A survey by the European Data Protection Supervisor revealed that 60% of organizations remain skeptical about storing sensitive customer data on third-party servers. According to the European Commission, while GDPR mandates strict data protection measures, compliance does not eliminate the risk of sophisticated cyber threats. Such concerns are further amplified in industries like finance and healthcare, where data sensitivity is critical. These security challenges create hesitation among businesses by slowing the pace of cloud CRM adoption despite its evident benefits.

MARKET OPPORTUNITIES

Growing Demand for Personalized Customer Experiences

The increasing demand for personalized customer experiences is driven by evolving consumer expectations. According to the European Consumer Organisation, 78% of consumers are more likely to engage with brands offering tailored interactions with a trend that cloud CRM systems are uniquely positioned to address. According to Eurostat, over 60% of European businesses now leverage data analytics tools integrated into cloud CRM platforms to gain actionable insights into customer behavior. As per the International Data Corporation (IDC), companies using advanced CRM analytics witnessed a 25% increase in customer satisfaction rates in 2022. Cloud CRM providers have a significant opportunity to innovate and offer scalable solutions that enable businesses to meet these demands effectively.

Expansion of Remote Work and Hybrid Business Models

The growing adoption of remote work and hybrid business models across Europe with the shifting trend towards workplace dynamics. According to the European Foundation for the Improvement of Living and Working Conditions, 40% of European workers were engaged in remote work in 2022 is driving the need for cloud-based tools that ensure seamless collaboration and accessibility. Cloud CRM systems provide real-time access to customer data, which is enabling sales and support teams to operate efficiently from any location. According to the European Commission, businesses adopting cloud technologies reported a 30% improvement in operational flexibility. The demand for cloud CRM solutions that support distributed teams and enhance productivity presents a lucrative growth avenue for vendors in the region.

MARKET CHALLENGES

Integration Challenges with Legacy Systems

The difficulty of integrating cloud-based solutions with existing legacy systems is key challenging factor for the market to grow in the coming years. According to the European Investment Bank, complicates the migration process to modern cloud platforms. According to Eurostat, nearly 40% of businesses reported technical incompatibilities as a significant barrier to adopting cloud CRM systems in 2022. These integration issues often lead to data silos, operational disruptions, and increased costs for customization. As per the International Labour Organization, the lack of skilled IT professionals exacerbates the problem with only 30% of companies possessing the expertise required for seamless transitions.

Resistance to Change and Organizational Adaptability

Another key challenge is the resistance to change within organizations among employees accustomed to traditional workflows. According to the European Foundation for the Improvement of Living and Working Conditions, 65% of workers express concerns about adapting to new technologies by fearing job displacement or increased workloads. This resistance is further compounded by inadequate training programs. As per Eurostat, only 25% of European firms provide comprehensive digital upskilling initiatives for their workforce. According to the European Commission, cultural barriers within organizations often delay the implementation of cloud CRM systems by reducing their effectiveness. Such reluctance not only slows down digital transformation efforts but also limits the potential benefits of cloud CRM, such as improved efficiency and customer engagement, creating a significant obstacle for market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.84% |

|

Segments Covered |

By Vertical, Nonprofit Sub Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Microsoft (US), PeopleSoft (US), ELCA (Switzerland), 1CRM (Canada), Cirrus Shield (France), Zoho (Chennai), SAP (Germany), Hubspot (US) Unit4 (Netherlands), Cocomore (Switzerland), Curexus GmbH (Germany), ALISTON Consulting (France), Absys Cyborg (France), SugarCRM Inc. (US), Vtiger (India), Bexio (Switzerland), Bpm’Online (US), TYPO3 (Germany), and eWay CRM (US). |

SEGMENTAL ANALYSIS

By Vertical Insights

The BFSI sector led the Europe cloud CRM market by occupying 28.1% of share in 2024. This dominance is driven by the need for robust customer management systems to handle sensitive data while ensuring GDPR compliance. According to the Eurostat, 60% of European banks adopted cloud CRM to enhance customer service and operational efficiency. According to the International Data Corporation, BFSI firms using cloud CRM achieved a 22% boost in customer retention. As per the European Central Bank, a 30% rise in cyberattacks on financial institutions in 2022 with the importance of secure CRM solutions.

The healthcare segment is experiencing a fastest CAGR of 15.7% from 2025 to 2033. This growth is fueled by the rising demand for patient-centric care and telemedicine, with over 50% of healthcare organizations adopting cloud CRM in 2022, as per European Commission. As per the European Federation of Pharmaceutical Industries and Associations, cloud CRM enables efficient patient interaction tracking. Despite a 25% increase in healthcare data breaches in 2022 with the sector prioritizes innovation to improve outcomes. Cloud CRM’s role in enhancing patient engagement and streamlining operations makes it vital for modern healthcare delivery.

By Nonprofit Sub Vertical Insights

The education sub-vertical segment was the largest and held 30.2% of market share in 2024. The increasing need to manage student data, alumni networks, and fundraising campaigns efficiently is fuelling the growth of the market. According to Eurostat, 55% of European universities adopted cloud CRM systems in 2022 by improving administrative processes and boosting enrollment rates by 18%. According to the European Commission, personalized communication enabled by cloud CRM enhances student engagement. However, budget constraints hinder adoption with 40% of institutions citing financial limitations, according to the International Labour Organization. Despite challenges, cloud CRM remains vital for modernizing education systems and fostering institutional growth.

Research and innovation segment is likely to witness a CAGR of 14.5% from 2025 to 2033. This growth is driven by increased R&D funding by including €100 billion allocated under Horizon Europe by the European Commission. Cloud CRM systems streamline grant management and foster collaboration, improving project efficiency by 25%, as per the Eurostat. Additionally, 60% of research organizations adopted cloud solutions in 2022 to enhance data sharing and operational transparency. The focus on innovation ensures this sub-vertical remains pivotal in advancing Europe’s research ecosystem.

REGIONAL ANALYSIS

Germany led the Europe cloud CRM market by occupying 22.5% of share in 2024. The country’s dominance is driven by its strong industrial base and emphasis on digital transformation in sectors like manufacturing and automotive. According to the Eurostat, over 70% of German enterprises adopted cloud solutions in 2022, with cloud CRM being a key enabler of customer-centric strategies. Additionally, Germany’s commitment to Industry 4.0 initiatives has accelerated the integration of advanced technologies, including AI-driven CRM systems. The International Data Corporation (IDC) notes that German businesses using cloud CRM reported a 20% improvement in operational efficiency.

The United Kingdom is anticipated to register a CAGR of 12.8% during the forecast period. Its growth is fueled by the widespread adoption of cloud technologies in the financial services and retail sectors, where personalized customer experiences are critical. According to tphe British Retail Consortium, 65% of UK retailers rely on cloud CRM to analyze consumer behavior and optimize marketing campaigns. Furthermore, the UK government’s £1.4 billion investment in digital infrastructure in 2022 has enhanced cloud accessibility. As per the European Commission, British enterprises adopting cloud CRM achieved a 25% increase in customer retention rates.

France is likely to have steady pace throughput the forecast period. The country’s prominence is attributed to its large-scale investments in healthcare and public sector digitalization, which drive demand for secure and scalable cloud CRM solutions. According to the European Health Information System, 50% of French healthcare organizations adopted cloud CRM in 2022 to improve patient data management and telemedicine services. Additionally, France’s €30 billion digital transformation fund, announced by the French Ministry of Economy, supports SMEs in adopting cloud technologies. According to the International Labour Organization, French businesses using cloud CRM experienced a 30% reduction in operational costs.

KEY MARKET PLAYERS

The major players in the Europe cloud customer relationship management (CRM) market include Microsoft (US), PeopleSoft (US), ELCA (Switzerland), 1CRM (Canada), Cirrus Shield (France), Zoho (Chennai), SAP (Germany), Hubspot (US) Unit4 (Netherlands), Cocomore (Switzerland), Curexus GmbH (Germany), ALISTON Consulting (France), Absys Cyborg (France), SugarCRM Inc. (US), Vtiger (India), Bexio (Switzerland), Bpm’Online (US), TYPO3 (Germany), and eWay CRM (US).

MARKET SEGMENTATION

This research report on the Europe cloud customer relationship management (CRM) market is segmented and sub-segmented into the following categories.

By Vertical

- Nonprofit

- Higher Education

- Others (Banking, Financial Services and Insurance (BFSI), Consumer Goods and Retail, Healthcare, Telecom and IT, Energy and Utilities, and Transportation and Logistics)

By Nonprofit Sub Vertical

- Education

- Research and Innovation

- Social Affairs

- Children and Youth

- Art and Culture

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Cloud Customer Relationship Management (CRM) market?

The growth is driven by increasing digital transformation, demand for personalized customer experiences, and the adoption of AI-powered CRM solutions across industries.

Which industries are the primary adopters of cloud CRM in Europe?

Key industries include retail, banking and financial services, healthcare, telecommunications, and manufacturing due to their need for customer data management and automation.

What role does artificial intelligence (AI) play in cloud CRM solutions in Europe?

AI enhances CRM capabilities through predictive analytics, automated customer interactions, sentiment analysis, and personalized recommendations.

What future trends will shape the Europe Cloud CRM market?

Future trends include deeper AI and machine learning integration, enhanced omnichannel customer engagement, increased focus on data security, and growing adoption of industry-specific CRM solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]