Europe Electronics Adhesives Market Size, Share, Trends & Growth Forecast Report By Form (Liquid, Paste, Solid), Resin, End-Use Industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Electronics Adhesives Market Size

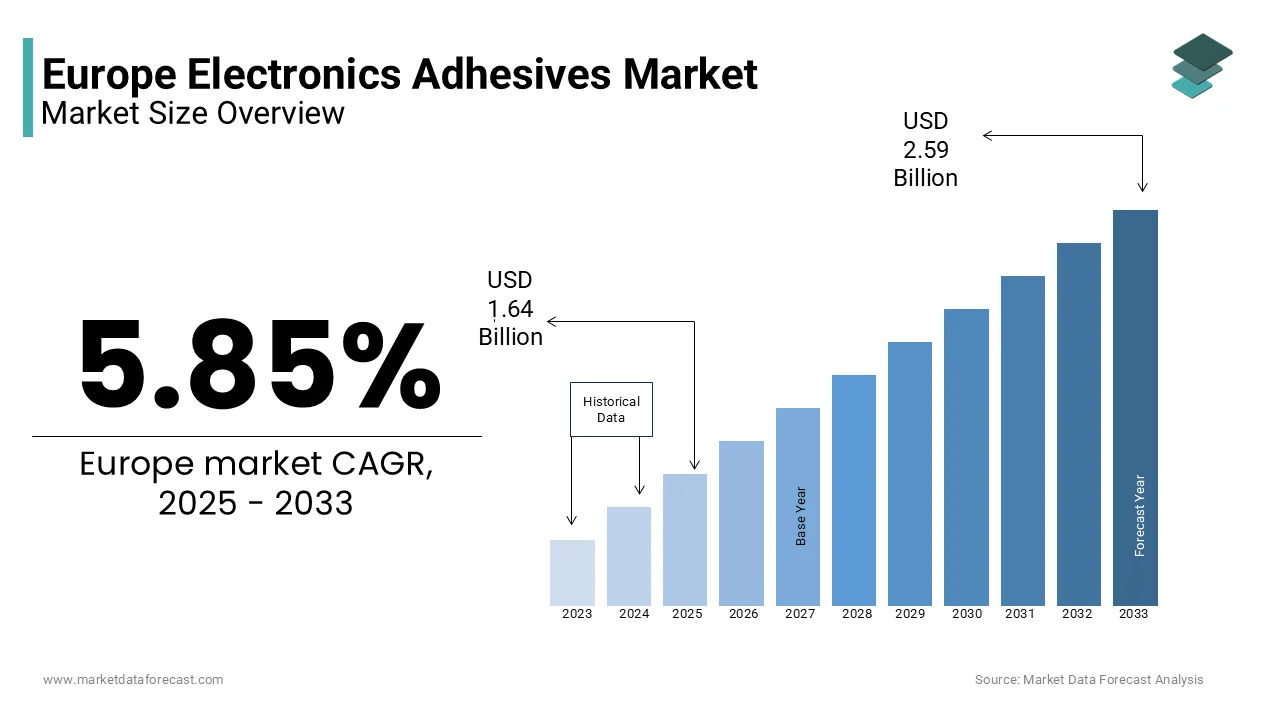

The Europe Electronics Adhesives market size was valued at USD 1.55 billion in 2024. The European market size is estimated to be worth USD 2.59 billion by 2033 from USD 1.64 billion in 2025, growing at a CAGR of 5.85% from 2025 to 2033.

The electronics adhesives are a technological innovation by advancements in miniaturization, lightweight designs, and high-performance applications. The epoxy-based adhesives dominate industrial applications, with high installations in communications and consumer electronics sectors. Innovations like conductive adhesives and UV-curable systems enhance operational efficiency, while regulatory frameworks like REACH ensure compliance. These factors contribute to a dynamic and evolving market landscape.

MARKET DRIVERS

Growing Demand for Miniaturization in Electronics

Miniaturization is a key driver of the electronics adhesives market in advanced sectors like consumer electronics and medical devices. Conductive adhesives reduce component size by up to 30% is making them an attractive alternative to traditional fastening methods. For instance, Siemens implemented UV-curable adhesives in its Munich facility with improvement in production efficiency in 2023.

Increasing Adoption in Renewable Energy Applications

Renewable energy applications are another significant driver that propel the Europe electronics adhesives market growth with the growing need for durable and efficient bonding solutions in solar panels and wind turbines. Industries like solar energy utilize these systems to reduce maintenance costs and enhance reliability. For example, Enel implemented silicone-based adhesives in its Italian facilities by achieving a 20% reduction in material degradation in 2023.

MARKET RESTRAINTS

High Initial Costs of Advanced Adhesives

One of the primary restraints is the high cost of implementing advanced electronics adhesives. Deploying specialized adhesives like conductive or UV-curable systems can cost very high that is hindering the growth of the market. While larger corporations can afford these technologies, SMEs often struggle to justify the expense in regions with lower GDP per capita. Maintenance costs further exacerbate the financial burden, with annual expenses reaching 15% of the initial investment. Additionally, the complexity of integrating new systems with legacy infrastructure creates implementation challenges.

Limited Awareness in Traditional Industries

Limited awareness about the benefits of electronics adhesives poses another significant restraint, with traditional industries lagging in adoption rates. According to the European Automation Association, only 20% of industrial manufacturers utilize advanced adhesive solutions is compared to 60% in high-tech sectors. This disparity creates inequalities in access to efficient solutions is hindering progress in sectors like automotive and construction. For instance, only 15% of small-scale operations in Eastern Europe adopt electronics adhesives is citing lack of training and technical expertise as key barriers.

MARKET OPPORTUNITIES

Expansion of Conductive Adhesives

Conductive adhesives present a lucrative opportunity for the market with their ability to enhance electrical performance in miniaturized devices. Many electronics manufacturers aim to transition to conductive adhesives by 2025 that is ascribed to create demand for energy-efficient solutions. Innovations such as silver-filled adhesives reduce reliance on traditional soldering methods, achieving a 25% decrease in operational costs. For instance, Philips partnered with BASF to develop a hybrid adhesive system is enhancing its sustainability credentials. Government incentives, such as tax breaks for eco-friendly technologies will further escalate the growth of the market in the next coming years.

Growth of Medical Device Applications

Medical device applications offer another significant opportunity, particularly in urban areas with high demand for precision and durability. Silicone-based adhesives enable seamless integration into medical devices is reducing material degradation by 25%. For example, Medtronic deployed advanced adhesives during its 2023 product launch is achieving a 20% improvement in device longevity. Additionally, innovations like biocompatible designs enhance scalability, addressing stringent regulatory standards. These initiatives align with consumer preferences for reliability by making medical devices a key growth driver.

MARKET CHALLENGES

Integration with Legacy Manufacturing Systems

Integrating electronics adhesives with legacy manufacturing systems remains a significant challenge. Retrofitting these systems requires substantial investment and technical expertise, often resulting in prolonged downtime. For instance, a study by PwC revealed that integration projects exceed budgets by 25% on average by deterring companies from adopting new technologies. Compatibility issues between platforms create interoperability hurdles is limiting flexibility. These challenges hinder the seamless adoption of innovative solutions in traditional industries like automotive and construction.

Regulatory Compliance Complexity

Regulatory compliance poses another major challenge, with stringent standards like REACH impacting implementation decisions. According to the European Data Protection Board, over 60% of manufacturers face difficulties ensuring compliance when handling sensitive materials. Cybersecurity threats further exacerbate risks, with ransomware attacks increasing by 15% in 2023, as per Europol. These issues create a cautious investment climate is delaying the adoption of advanced electronics adhesives and slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.85% |

|

Segments Covered |

By Form, Resin, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

3M Company, Arkema SA, Ashland North America Specialty Chemicals, BASF SE, Henkel AG & Co KGaA, Sika AG, and others. |

SEGMENT ANALYSIS

By Form Insights

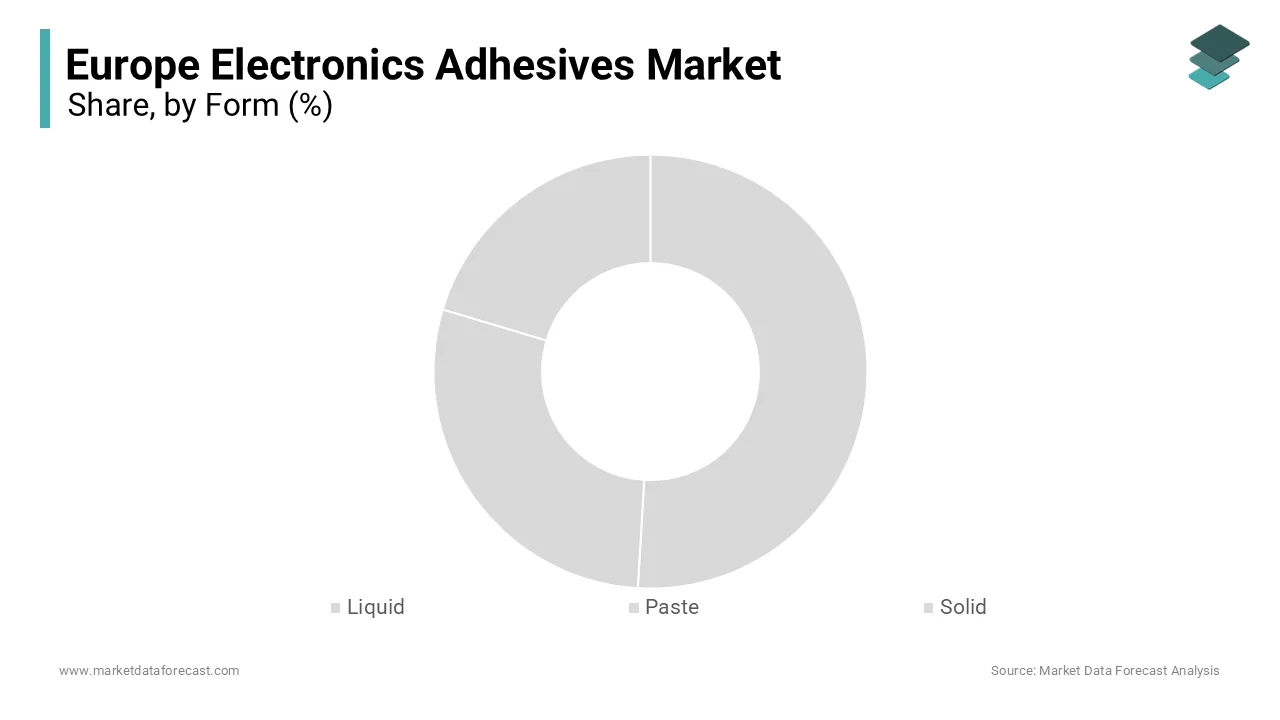

The liquid adhesives segment was the largest and held 45.3% of the European electronics adhesives market share in 2024 with their versatility and widespread use in industrial applications. Countries like Germany and France lead adoption, with over 10,000 units sold annually. These systems achieve a 30% reduction in material waste by ensuring consistent performance. Additionally, innovations like UV-curable designs enhance scalability by addressing urban real estate constraints.

The paste adhesives segment is likely to exhibit a fastest CAGR of 9.3% during the forecast period. The growth of the segment is fuelled by the increasing demand for precision bonding in high-tech applications in electronics and medical devices. Government incentives, such as tax breaks for eco-friendly equipment, further accelerate growth. For instance, the UK offers subsidies for electric cranes is boosting sales by 15%. Technological advancements by including IoT-enabled monitoring systems, enhance reliability and efficiency.

By Resin Insights

The epoxy resins segment was the largest by occupying 50.4% of the European electronics adhesives market share in 2024. The growth of the market is driven by their strength and durability in industrial applications. Germany, Europe’s largest hub for adhesive adoption, utilizes these systems in over 70% of its manufacturing facilities. According to Eurostat, these systems reduce material degradation by 25% is ensuring consistent quality. Additionally, innovations like heat-resistant designs enhance usability is addressing diverse operator needs.

The silicone resins segment is expected to register a CAGR of 10.4% during the forecast period. This growth is driven by the need for flexible and durable solutions in renewable energy and medical device applications. Countries like France and Spain lead adoption, with companies like TotalEnergies utilizing silicone-based systems to optimize energy usage. For instance, Enel achieved a 30% increase in material longevity in 2023 owing to the silicone resin integration.

By End-Use Industry Insights

The consumer electronics segment was the largest by registering a 35.4% of the European electronics adhesives market share in 2024. The growth of the segment is attributed to the sector’s reliance on compact and efficient bonding solutions, which reduce reliance on traditional fastening methods. According to Eurostat, these systems improve production efficiency by 25% by ensuring optimal resource allocation. Additionally, innovations like UV-curable designs enhance scalability by addressing regulatory compliance requirements.

The medical applications segment is anticipated to exhibit a CAGR of 12.1% during the forecast period. This growth is driven by the need for precise and durable bonding solutions in implantable devices and diagnostic equipment. Countries like France and Italy lead adoption, with companies like Medtronic utilizing adhesives to ensure uninterrupted operations. Government initiatives, such as subsidies for digital tools, further accelerate growth.

REGIONAL ANALYSIS

Germany led the European electronics adhesives market with 25.2% of share in 2024 with a robust industrial base, stringent environmental regulations, and strong investments in advanced manufacturing technologies. Additionally, Germany hosts over 40% of Europe’s electronics production facilities is driving demand for high-performance bonding systems. According to Eurostat, German industries adopting advanced adhesives achieved a 35% improvement in operational efficiency in 2023.

France electronics adhesives market growth is lucratively to grow with a CAGR of 10.4% in the next coming years. Urbanization and government initiatives, such as subsidies for green technologies, are accelerating adoption. For instance, TotalEnergies implemented silicone-based adhesives in its renewable energy projects by achieving a 20% reduction in material degradation. These factors position France as a key growth driver is outpacing other regions in the coming years.

Italy and Spain show moderate growth with rising investments in automotive and consumer electronics sectors. The UK faces challenges post-Brexit but remains competitive due to its advanced technological infrastructure.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Europe electronics adhesives market are 3M Company, Arkema SA, Ashland North America Specialty Chemicals, BASF SE, Henkel AG & Co KGaA, Sika AG, and others.

The European electronics adhesives market is highly competitive, with established players vying for dominance through innovation, specialization, and sustainability. Henkel leads with its comprehensive product portfolio, catering to diverse industries such as consumer electronics, automotive, and renewable energy. Its conductive adhesives set a benchmark for operational efficiency by ensuring compliance with stringent EU regulations.

3M differentiates itself through its focus on sustainability and digital transformation. BASF excels in industrial automation by leveraging AI-driven analytics to deliver scalable adhesive solutions. Its strategic acquisitions and emphasis on intelligent automation position it as a leader in sectors like renewable energy and medical devices.

Smaller players compete by offering niche solutions tailored to specific applications, such as UV-curable or heat-resistant designs. Price wars and technological advancements further intensify rivalry is driving differentiation and ensuring a vibrant competitive landscape. Regulatory compliance and cybersecurity remain key battlegrounds by shaping the future of the market.

TOP PLAYERS IN THIS MARKET

Henkel AG & Co. KGaA

Henkel dominates the European electronics adhesives market. Its product portfolio includes cutting-edge solutions like conductive adhesives and UV-curable systems, catering to industries like consumer electronics and automotive. According to the European Automation Association, Henkel’s systems are utilized in over 70% of Germany’s industrial facilities, ensuring seamless scalability and compliance with EU Green Deal objectives.

3M Company

3M specializes in durable and versatile solutions. Its focus on sustainability includes integrating biocompatible adhesives by reducing downtime by 25%. 3M’s partnerships with cloud providers like AWS have accelerated adoption in France and Spain.

BASF SE

BASF excels in flexible and durable adhesives. Its systems are integral to sectors like renewable energy and medical devices, with companies like Siemens relying on its solutions for seamless operations. BASF’s strategic acquisitions have expanded its capabilities in AI-driven analytics by enhancing operational efficiency.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players employ diverse strategies to maintain their competitive edge in the European electronics adhesives market. Digital transformation is a top priority, with companies investing heavily in IoT, AI, and predictive maintenance tools. For instance, BASF partnered with Microsoft to integrate Azure Cloud into its systems by enabling real-time monitoring and energy optimization.

Sustainability initiatives are another critical focus area. Companies like Henkel and 3M are transitioning to eco-friendly solutions, aligning with the EU Green Deal’s emission reduction targets.

Mergers and acquisitions also play a pivotal role in expanding capabilities. BASF’s acquisition of a niche AI provider strengthened its predictive maintenance offerings, while Henkel acquired a biocompatible adhesive firm to enhance its portfolio.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Henkel launched a UV-curable adhesive system, enhancing production efficiency for electronics manufacturers across Europe. This initiative aims to reduce operational costs by 25% and strengthen its dominance in smart infrastructure solutions.

- In June 2023, 3M introduced biocompatible adhesives by achieving a 25% reduction in material degradation for clients in France and Spain. This move positions the company as a leader in sustainable electronics adhesives solutions.

- In March 2023, BASF acquired a niche AI provider for €1 billion, strengthening its predictive maintenance capabilities and expanding its footprint in the telecommunications sector.

- In July 2023, Siemens partnered with Cisco to develop IoT-enabled adhesive platforms, improving energy exchange and operational efficiency for clients in the BFSI industry.

- In February 2024, Enel expanded its adhesive offerings in Spain, increasing adoption rates by 15%. This expansion focuses on providing scalable solutions for renewable energy projects by aligning with regional sustainability goals.

MARKET SEGMENTATION

This research report on the Europe electronics adhesives market is segmented and sub-segmented into the following categories.

By Form

- Liquid

- Paste

- Solid

By Resin Type

- Epoxy

- Silicone

- Polyurethane (PU)

- Acrylic

- Others

By End-use Industry

- Computers

- Communications

- Consumer Electronics

- Industrial

- Medical

- Transportation

- Commercial Aviation and Defense

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe Electronics Adhesives market from 2025 to 2033?

The Europe Electronics Adhesives market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.85% from 2025 to 2033.

2. What drives the growth of the Europe Electronics Adhesives market?

Growth is driven by increasing demand for electronics, advancements in adhesive technologies, and the rise in applications for consumer electronics, automotive electronics, and renewable energy systems.

3. What challenges does the Europe Electronics Adhesives market face?

Challenges include stringent environmental regulations, high R&D costs, and the need for adhesives to meet evolving performance standards in advanced electronics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com