Europe Feed Phytogenics Market Size, Share, Growth, Trends, And Forecast Report, Segmented By Ingredients, Animal Type, Application, And By Region (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

European Feed Phytogenic Market Size

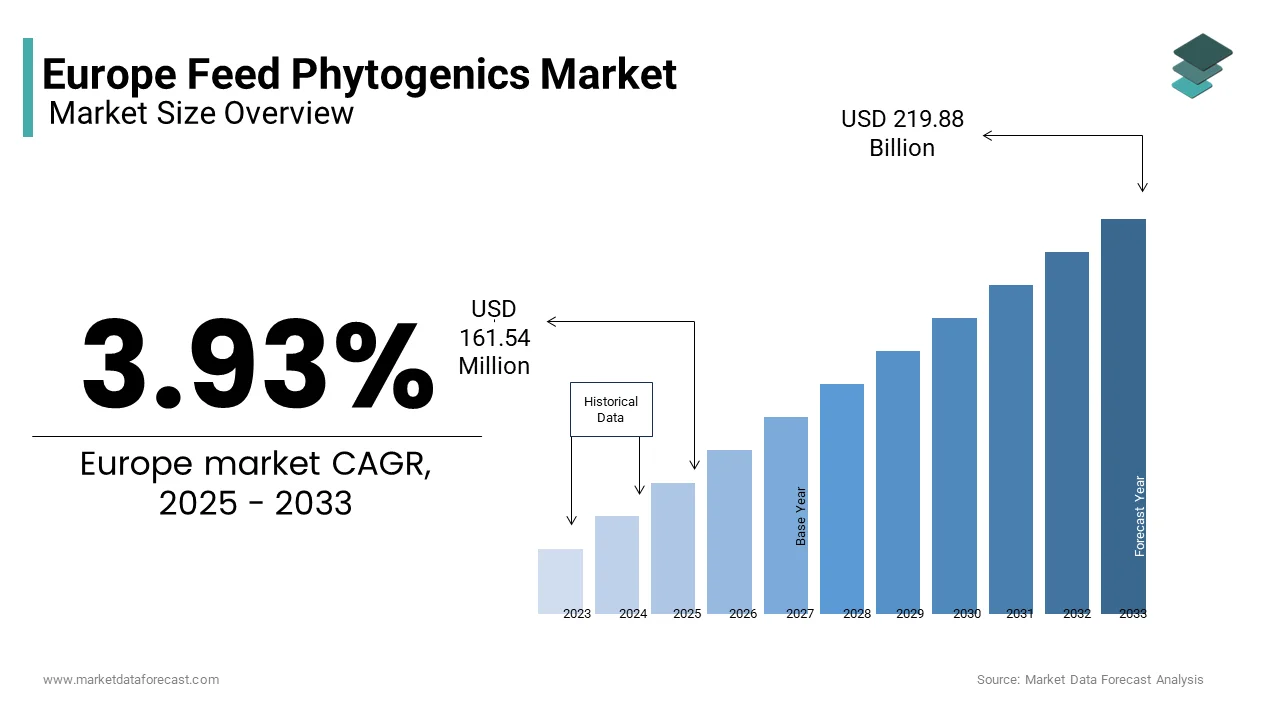

The European feed phytogenic market was valued at USD 155.43 million in 2024 and is anticipated to reach USD 161.54 billion in 2025 from USD 219.88 million by 2033, growing at a CAGR of 3.93% during the forecast period from 2025 to 2033.

The European feed phytogenic market is experiencing robust growth with increasing consumer demand for natural and sustainable animal feed solutions. According to the phytogenics emerging as a key segment due to their ability to enhance animal health and productivity. Phytogenics, derived from herbs, spices, and essential oils, are gaining traction as they align with the EU’s stringent regulations on antibiotic use in livestock farming. Furthermore, as per Eurostat, the organic livestock sector in Europe grew by 18% annually between 2019 and 2022 that is propelling demand for natural feed additives. The market is also supported by advancements in extraction technologies, which have improved the efficacy and cost-effectiveness of phytogenic products.

MARKET DRIVERS

Stringent Regulations on Antibiotic Use

The European Union’s regulatory framework has been a major catalyst for the feed phytogenics market. According to the European Medicines Agency, the ban on antibiotic growth promoters in livestock farming has created a significant demand for natural alternatives like phytogenics. These plant-based additives are proven to enhance digestion, boost immunity, and improve feed efficiency without adverse side effects. A study by the European Food Safety Authority reveals that farms adopting phytogenics reported a 15% reduction in mortality rates among poultry and swine. According to the FEFAC, over 60% of European feed manufacturers have integrated phytogenics into their formulations to comply with EU regulations.

Rising Demand for Organic Livestock Products

The growing consumer preference for organic meat, milk, and eggs has significantly bolstered the feed phytogenics market. According to Eurostat, the organic livestock sector in Europe is expanding by with Germany and France leading the charge. Phytogenics play a critical role in organic farming by enhancing animal health and productivity without synthetic additives. Data from the European Organic Certifiers Council indicates that farms using phytogenic feed additives achieved a 10% improvement in feed conversion ratios is making them more efficient and profitable. According to a report by the European Consumer Organisation, 70% of consumers are willing to pay a premium for organic animal products is creating a strong incentive for farmers to adopt phytogenics.

MARKET RESTRAINTS

High Costs and Economic Constraints

One of the primary challenges facing the feed phytogenics market is the high cost of raw materials and production. According to the European Chemicals Agency, the extraction of active compounds from herbs and spices requires advanced technologies, which increase manufacturing costs by up to 40%. This economic barrier limits the affordability of phytogenic products for small-scale farmers. Additionally, data from the European Agricultural Economics Association reveals that only 30% of livestock farmers in Eastern Europe can afford premium feed additives is hindering market penetration in these regions.

Limited Awareness Among Farmers

Another challenge is the limited awareness and understanding of phytogenics among farmers in rural areas. According to a survey by the European Livestock Farmers’ Association, only 45% of livestock farmers are familiar with the benefits of phytogenic feed additives. This lack of awareness is compounded by insufficient training programs and technical support by leaving many farmers reliant on traditional feed solutions. These knowledge gaps hinder the adoption of phytogenics in regions where education and outreach initiatives are lacking.

MARKET OPPORTUNITIES

Expansion into Aquaculture Applications

Aquaculture presents a significant opportunity for the European feed phytogenics market with the rising demand for sustainable seafood. According to the European Aquaculture Society, aquaculture production in Europe grew by 12% annually between 2019 and 2022, with Norway and Spain leading the way. Phytogenics are increasingly being adopted to improve fish health, enhance growth rates, and reduce mortality. Moreover, the EU’s Blue Growth Strategy emphasizes sustainable aquaculture practices is providing further impetus for phytogenic adoption. This expanding segment offers immense potential for innovation and revenue generation.

Technological Advancements Enhancing Efficacy

Advancements in extraction and formulation technologies present another key opportunity for the market. According to the European Biotechnology Industry Organization, innovations in nanotechnology and encapsulation techniques have improved the stability and bioavailability of phytogenic compounds, making them more effective. Data from the European Research Council reveals that these advancements have increased the efficacy of phytogenics by addressing previous concerns about inconsistent performance. Furthermore, partnerships between research institutions and industry players are accelerating the development of next-generation phytogenic products. For instance, the German Federal Ministry of Education and Research funds projects aimed at optimizing phytogenic formulations is fostering innovation and market expansion.

MARKET CHALLENGES

Regulatory Hurdles Across Member States

Despite the EU’s overarching regulations, inconsistencies in member state policies pose a significant challenge for the feed phytogenics market. According to the European Parliament, each country has its own approval processes and standards for feed additives by creating barriers to cross-border trade. According to a data from FEFAC, obtaining approvals for new phytogenic products can take up to two years by delaying market entry and increasing costs. Additionally, variations in labeling requirements and permissible ingredient lists complicate compliance for smaller companies. These regulatory hurdles hinder the seamless expansion of phytogenics across Europe is limiting their market potential.

Competition from Synthetic Additives

The market faces stiff competition from synthetic feed additives, which are often cheaper and more widely accepted. Data from the European Chemicals Market Observatory reveals that synthetic additives are preferred in large-scale operations due to their consistent performance and lower prices. While phytogenics offer environmental and health benefits, their higher costs and variable efficacy make it challenging to compete in price-sensitive markets. This competitive pressure necessitates continuous innovation to maintain market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.93% |

|

Segments Covered |

By Ingredients, Animal and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

DSM Nutritional Products, Delacon Biotechnik, Phytobiotics, Futterzusatzstoffe, Kemin Industries, Cargill, Pancosma, BIOMIN, Natural Remedies, Dostofarm, DuPont, Nutreco, Silvateam, Nor-Feed, A&A Pharmachem Inc., Phytosynthese, Danisco Animal Nutrition (DuPont), Bluestar Adisseo, Sensient Technologies, Zagro Asia |

SEGMENTAL ANALYSIS

By Ingredients Insights

The essential oils segment dominated the European feed phytogenics market by accounting for 55.5% of the share in 2024 owing to their proven efficacy in enhancing animal health and productivity. According to the European Research Council, essential oils like thyme, oregano, and clove oil exhibit antimicrobial and anti-inflammatory properties by making them highly effective in livestock diets. Additionally, advancements in extraction technologies have reduced production costs, making essential oils more accessible to farmers. Their versatility and compatibility with various animal species further solidify their leadership in the market.

The Herbs and spices segment is likely to grow with a CAGR of 18.5% during the forecast period. This growth is driven by their natural appeal and broad applications in animal nutrition. According to the European Organic Farmers’ Union, herbs like fenugreek and turmeric are increasingly used in poultry and ruminant diets to improve digestion and immunity. Government incentives promoting sustainable farming practices further accelerate this trend. This segment’s rapid expansion underscores its potential to revolutionize feed formulations.

By Animal Insights

The poultry segment was the largest by occupying 40.3% of the European feed phytogenics market share in 2024. This dominance is attributed to the high demand for poultry products and the need for sustainable feed solutions. Additionally, the EU’s focus on reducing antibiotic use in poultry farming has further accelerated the segment’s dominance. These factors collectively reinforce poultry’s dominance in the market.

The aquaculture segment is esteemed to grow with a CAGR of 22.5% in the next coming years. This growth is fueled by the rising demand for sustainable seafood and the adoption of phytogenics to enhance fish health. Government initiatives promoting eco-friendly farming methods further accelerate adoption. This segment’s rapid expansion amplifies its transformative potential in the aquaculture industry.

COUNTRY ANALYSIS

Germany was the largest contributor in the European feed phytogenics market with a 25.4% of share in 2024 due to its robust agricultural sector and stringent regulations on antibiotic use in livestock farming. According to Eurostat, Germany invested €1 billion in sustainable farming technologies in 2022, driven by its commitment to achieving net-zero emissions by 2045. The presence of key manufacturers like BASF and Evonik, along with government incentives such as subsidies for organic farming, further amplifies its dominance. Germany’s emphasis on innovation and sustainability makes it a pivotal player in driving market growth.

Spain is ascribed to hit a fastest CAGR of 20.3% during the forecast period. This growth is fueled by the expansion of aquaculture and organic livestock farming, particularly in regions like Andalusia and Galicia. According to the Spanish Confederation of Farmers, investments in phytogenic feed additives surged by 25% annually since 2020. Government initiatives promoting sustainable practices, including tax rebates for eco-friendly farming, have further accelerated adoption.

KEY MARKET PLAYERS

DSM Nutritional Products, Delacon Biotechnik, Phytobiotics, Futterzusatzstoffe, Kemin Industries, Cargill, Pancosma, BIOMIN, Natural Remedies, Dostofarm, DuPont, Nutreco, Silvateam, Nor-Feed, A&A Pharmachem Inc., Phytosynthese, Danisco Animal Nutrition (DuPont), Bluestar Adisseo, Sensient Technologies, Zagro Asia. are the market players that are dominating the Europe feed phytogenics market.

Top 3 Players In The Market

Delacon Biotechnik GmbH

Delacon is a leading innovator in the European feed phytogenics market. The company’s Phytogenic Feed Additives (PFA) portfolio is renowned for its efficacy in enhancing animal health and productivity. Delacon’s strong R&D capabilities enable it to develop tailored solutions for diverse livestock applications by ensuring compliance with EU regulations. Its global presence and strategic partnerships further reinforce its leadership position.

Biomin Holding GmbH

Biomin contributes significantly to the market. The company’s Digestarom line of phytogenics is widely adopted in poultry and swine farming due to its proven ability to improve digestion and immunity. Biomin’s commitment to sustainability aligns with Europe’s green initiatives, making it a trusted partner for farmers transitioning to natural feed solutions.

Pancosma SA

Pancosma’s Xtract® range of phytogenics is known for its cost-effectiveness and reliability. Pancosma’s focus on expanding its reach in emerging markets is coupled with investments in advanced extraction technologies that escalated its prominence in the marketplace.

Top Strategies Used By Key Players

Key players in the European feed phytogenics market employ diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies like Delacon and Biomin investing heavily in R&D to develop next-generation phytogenics. Strategic partnerships are another focus area; for instance, Pancosma collaborates with local distributors to penetrate underserved markets. Mergers and acquisitions also play a pivotal role, enabling firms to consolidate their positions and access cutting-edge technologies. Additionally, companies emphasize compliance with EU regulations, ensuring their products meet stringent environmental standards.

COMPETITION OVERVIEW

The European feed phytogenics market is highly competitive, characterized by the presence of global giants and regional players striving to capture market share. Smaller players focus on niche segments, offering specialized solutions for specific animal species or applications. The competitive landscape is shaped by stringent environmental regulations, which drive innovation and product differentiation. Companies are increasingly investing in sustainable technologies to align with EU climate goals, fostering a dynamic environment. Price competition remains moderate, as customers prioritize performance and compliance over cost. This evolving ecosystem ensures continuous advancements in phytogenic feed additive technologies.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Delacon launched a new line of phytogenic additives tailored for aquaculture is enhancing its product portfolio and addressing the growing demand for sustainable seafood solutions.

- In June 2023, Biomin partnered with a leading European university to conduct research on phytogenic efficacy by strengthening its R&D capabilities and developing innovative formulations for livestock farming.

- In August 2023, Pancosma unveiled a cost-effective phytogenic formulation designed for small-scale farmers by targeting underserved markets and expanding its customer base in Eastern Europe.

- In October 2023, Evonik acquired a startup specializing in phytogenic extraction technologies by bolstering its innovation pipeline and improving production efficiency.

- In December 2023, BASF invested €50 million in expanding its production facility in Germany to meet rising demand for phytogenic feed additives by reinforcing its commitment to sustainable agriculture.

MARKET SEGMENTATION

This research report on the Europe feed phytogenics market is segmented and sub-segmented into the following categories.

By Ingredients

- Essential oils

- Oleoresins

- Herbs and Species

- others

By Animal Type

- Poultry

- Aquaculture

- Swine

- Ruminant

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Why are European farmers shifting toward phytogenic feed additives?

Due to strict EU regulations on antibiotics and growing consumer demand for natural, residue-free meat, farmers are turning to plant-based additives to boost animal health and productivity.

How do phytogenics benefit livestock in practical terms?

They improve digestion, enhance feed intake, support immunity, and reduce harmful gut bacteria, leading to better weight gain and overall animal performance.

Which phytogenic ingredients are trending in the European market?

Essential oils (like oregano and thyme), garlic, ginger, and turmeric are popular for their antimicrobial and antioxidant properties.

What sets the European market apart from other regions?

Europe has the most stringent regulations on antibiotic use in feed, which accelerates the adoption of natural alternatives like phytogenics compared to other regions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com