Europe Fish Feed Market Size, Share, Trends & Growth Forecast Report, Segmented By Ingredient, Additive, End Users And By Country (The UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Fish Feed Market Size

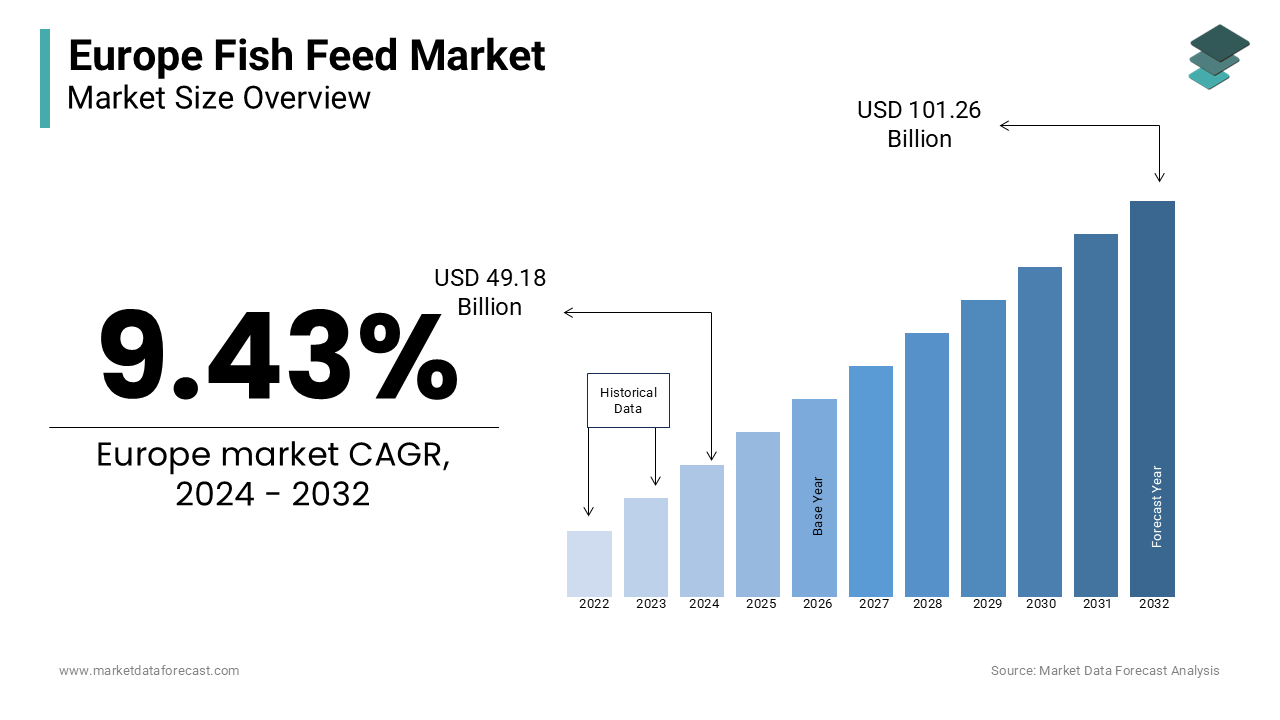

The Europe fish feed market was valued at USD 49.18 billion in 2024 and is anticipated to reach USD 53.82 billion in 2025 from USD 110.67 billion by 2033, growing at a CAGR of 9.43% during the forecast period from 2025 to 2033.

Fish Feed is an important part of modern commercial aquaculture, providing the balanced nutrition needed by farmed fish. The feeds, in the form of pellets or granules, provide nutrition in a concentrated and stable form, enabling the fish to feed efficiently and grow at their full potential.

Traditionally two of the most important ingredients have been fishing oil and fishmeal. The development of dry pelleted fish feeds to date has two main themes. One theme is improving digestibility and refining the balance of nutrients so as to match the needs of the different species of fish more precisely at different periods of development. The other type is to improve the sustainability of the ingredients used. This is being attained mainly by identifying additional sustainable sources of ingredients, in particular, to reduce the need for fish oil and fishmeal. Improving the efficiency of feeding also assists sustainability.

The driving factors of the European fish feed market are population growth, rising income, and rapid urbanization, which are facilitated by the strong expansion of fish production and more efficient distribution channels. The yield which is obtained from the wild catch cannot be increased sustainably, therefore, in the opinion of observers such as the Food and Agriculture Organization of the United Nations, aquaculture must fill the gap.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.43% |

|

Segments Covered |

Basis of ingredient, Additive, Basis of end-user and Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, etc |

|

Market Leaders Profiled |

Ridley Corporation Limited, Archer Daniels Midland Company, Nutreco N.V., Cargill, Avanti Feeds Limited, Purina Animal Nutrition, Biostadt India Limited, Alltech, Nutriad, and Biomar, among others. |

SEGMENT ANALYSIS

By Basic of Ingredients Insights

By End-User Insights

The Europe Fish Feed market is segmented based on the basis of ingredients into corn, soybean, fish oil, fish meal, additives, and others. By additive, the market is divided into vitamins, antibiotics, amino acids, antioxidants, feed acidifiers, feed enzymes, and other additives. On the basis of end-user, the market is divided into fish, mollusks, crustaceans, and others. Fish is further segmented into salmon feed, carp feed, tilapia feed, and catfish feed. By molluscs, the market is further divided into oyster feed and mussel feed. By crustaceans, the market is further divided into crab feed and shrimp feed.

COUNTRY ANALYSIS

Europe has the second-largest market for fish feed in the world by share. Factors such as rising disposable incomes and rapid urbanization are expected to propel market growth during the forecast period.

KEY MARKET PLAYERS

Some of the major players in the market are Ridley Corporation Limited, Archer Daniels Midland Company, Nutreco N.V, Cargill, Avanti Feeds Limited, Purina Animal Nutrition, Biostadt India Limited, Alltech, Nutriad, and Biomar among others.

MARKET SEGMENTATION

This research report on the europe fish feed market is segmented and sub-segmented into the following categories.

By Basic of Ingredients

- Corn

- Soybean

- Fish oil

- Fish Meal

- Additives

- Others

By Additives

- Vitamins

- Antibiotics

- Amino acids

- Antioxidants

- Feed acidifier

- Feed enzymes

- Others

By End-User

- Fish

- Salmon feed

- Carp feed

- Tilapia feed

- Catfish feed

- Molluscs

- Oyster feed

- Mussel feed

- Crustaceans

- Carb feed

- Shirmp feed

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com