Europe FMD Vaccine Market Size, Share, Trends & Growth Forecast Report By Animal (Cattle, Sheep and Goat, Swine, Others), Vaccine (Modified/Attenuated Live, Inactivated (Killed), Other Vaccines), Distribution Channel (Veterinary Hospitals & Clinics, Government Institutions, Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe FMD Vaccine Market Size

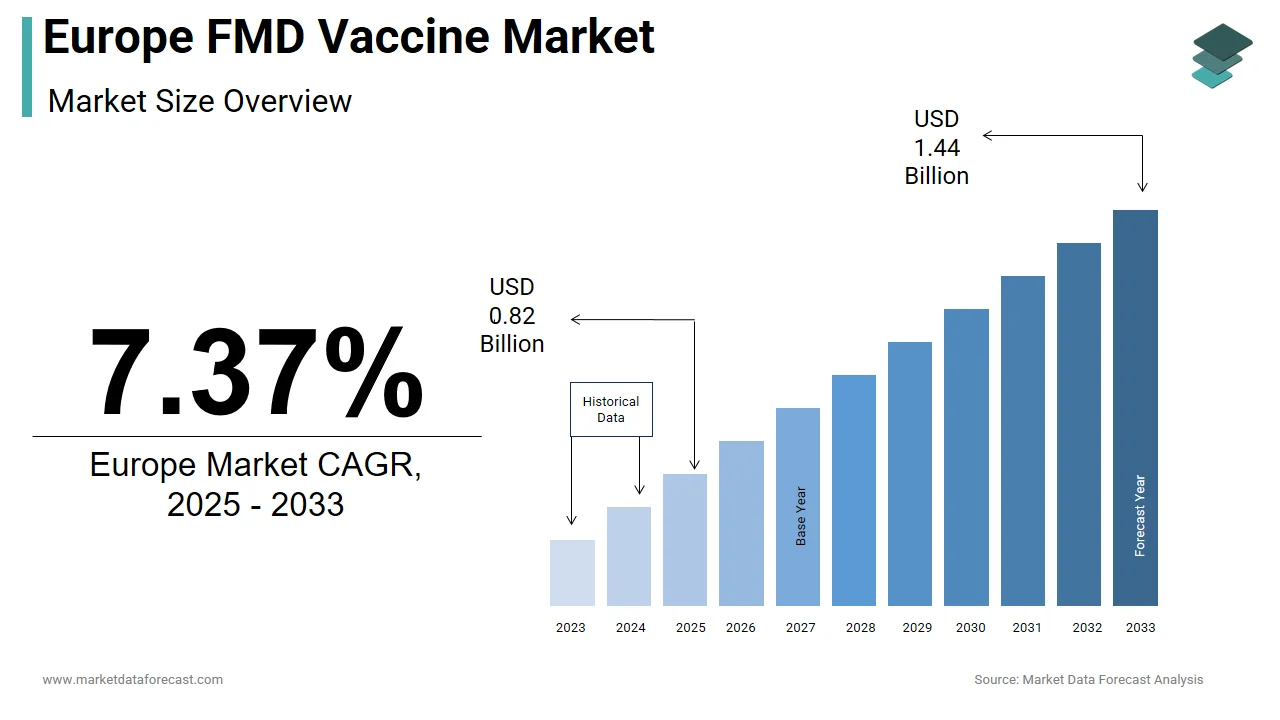

The size of the Europe FMD vaccine market was valued at USD 0.76 billion in 2024. This market is expected to grow at a CAGR of 7.37% from 2025 to 2033 and be worth USD 1.44 billion by 2033 from USD 0.82 billion in 2025.

Foot-and-Mouth Disease (FMD) remains one of the most economically devastating viral infections affecting cloven-hoofed animals, including cattle, pigs, and sheep. Although many European countries have achieved FMD-free status through rigorous vaccination and biosecurity measures, the risk of reintroduction, particularly through trade or migratory animal movements, necessitates continued vigilance. According to the World Organisation for Animal Health (WOAH), several Eastern European nations remain in the process of consolidating their FMD control programs, contributing to ongoing demand for vaccines. Also, the European Commission has maintained strict contingency plans that include emergency vaccination protocols as part of its broader strategy to safeguard regional livestock industries. Moreover, advancements in vaccine technology, such as the development of marker vaccines that allow differentiation between infected and vaccinated animals (DIVA), have significantly improved disease surveillance and trade facilitation. These innovations are increasingly being adopted by national veterinary authorities.

MARKET DRIVERS

Strengthening of Regional Animal Health Surveillance Programs

One of the primary drivers of the Europe FMD vaccine market is the strengthening of regional animal health surveillance and preparedness initiatives. In response to past outbreaks and the persistent threat from neighboring regions where FMD remains endemic, European governments and supranational bodies have intensified efforts to enhance early detection and containment mechanisms. The European Commission, in collaboration with WOAH and FAO, has also emphasized the need for continuous updating of national contingency plans, which often include provisions for pre-outbreak and emergency vaccinations. For instance, in 2023, the EU launched a multi-country exercise simulating an FMD outbreak scenario, during which participating nations tested their vaccine deployment readiness. As per the European Medicines Agency (EMA), this led to a notable increase in vaccine procurement requests from national veterinary agencies aiming to replenish strategic reserves. Furthermore, the adoption of DIVA-compatible vaccines has been encouraged to maintain trade eligibility post-vaccination.

Increased Investment in Veterinary Biologics R&D

Another significant factor propelling the Europe FMD vaccine market is the surge in research and development investments aimed at improving vaccine efficacy, safety, and production efficiency. Several leading biopharmaceutical firms and academic institutions have prioritized innovation in veterinary biologics, supported by both public and private funding sources. This investment has led to the development of temperature-stable formulations, which address logistical challenges in vaccine distribution, particularly in remote or resource-limited areas within Eastern Europe. Companies such as MSD Animal Health and Boehringer Ingelheim have expanded their portfolios to include these next-generation vaccines, enhancing their competitiveness and market reach. Apart from these, partnerships between vaccine manufacturers and regulatory bodies have accelerated approval pathways for new products. Such progress not only fosters innovation but also ensures that the region remains well-equipped to manage any potential resurgence of the disease.

MARKET RESTRAINTS

Regulatory Complexity and Stringent Approval Processes

Despite growing demand, the Europe FMD vaccine market faces significant restraints due to the complex regulatory landscape governing veterinary biologics. The approval process for new vaccines involves extensive testing, compliance with Good Manufacturing Practices (GMP), and adherence to specific guidelines set by the European Medicines Agency (EMA). According to the European Directorate for the Quality of Medicines & HealthCare (EDQM), the average time required for full marketing authorization of a new FMD vaccine exceeds three years, discouraging smaller biotech firms from entering the market. Moreover, variations in national regulations across EU member states create additional hurdles for manufacturers seeking broad market access. While the EMA provides centralized approval for some veterinary medicines, certain countries maintain separate national registration requirements, increasing administrative burden and delaying product launches. Also, the requirement for continuous post-marketing surveillance and periodic revalidation adds operational complexity.

Limited Outbreak Incidents and Perceived Low Risk

A key challenge facing the Europe FMD vaccine market is the relatively low incidence of FMD outbreaks in recent years, particularly in Western Europe. Many countries have successfully maintained FMD-free status through stringent border controls, quarantine measures, and effective vaccination campaigns. This perceived low risk has resulted in reduced urgency for routine vaccination programs, with some countries opting for an "emergency-only" approach rather than proactive immunization. Besides, industry stakeholders have noted that some farmers and cooperatives are reluctant to invest in preventive vaccination without immediate disease threats. This hesitancy hampers market expansion, despite the availability of highly effective vaccines and supportive policy frameworks.

MARKET OPPORTUNITIES

Development of Novel Vaccine Platforms with Enhanced Stability

An emerging opportunity in the Europe FMD vaccine market lies in the development of novel vaccine platforms that offer enhanced stability, ease of storage, and improved immunogenicity. Traditional FMD vaccines require cold-chain logistics, posing challenges in distribution and administration, particularly in remote or resource-constrained settings. However, recent advances in molecular biology and formulation science have enabled the creation of thermostable vaccines that can withstand fluctuating temperatures without compromising potency. These VLP vaccines have demonstrated stability at ambient temperatures for extended periods, reducing dependency on refrigeration and facilitating broader field use. Moreover, companies such as IDT Biologika and Valneva have begun pilot-scale production of thermostable formulations tailored for European markets.

Integration of Digital Technologies in Vaccine Distribution and Monitoring

The integration of digital technologies into vaccine distribution and monitoring systems presents a significant opportunity for the Europe FMD vaccine market. Governments and veterinary authorities are increasingly adopting digital tools such as blockchain, IoT-enabled tracking, and cloud-based data management to enhance transparency, traceability, and responsiveness in vaccine supply chains. These technologies improve inventory management, reduce wastage, and ensure timely delivery of vaccines to high-risk zones. Besides, digital platforms facilitate better coordination between manufacturers, distributors, and end-users, allowing for predictive analytics and demand forecasting.

MARKET CHALLENGES

Balancing Vaccination Policies with Trade Requirements

One of the foremost challenges in the Europe FMD vaccine market is the delicate balance between implementing vaccination policies and complying with international trade regulations. While vaccination is a critical tool for disease prevention, certain export markets impose restrictions on products from vaccinated herds due to the inability to distinguish between vaccinated and naturally infected animals using traditional diagnostic methods. This constraint has prompted European policymakers to prioritize the adoption of Differentiating Infected from Vaccinated Animals (DIVA) compatible vaccines, which allow for accurate serological testing. However, transitioning to DIVA-compliant systems requires extensive infrastructure upgrades, training, and alignment with global standards. Additionally, the cost implications of implementing dual testing and certification processes pose financial burdens on small-scale producers.

Coordination Between National and EU-Level Animal Health Policies

Effective coordination between national and EU-level animal health policies poses a significant challenge for the Europe FMD vaccine market. While the European Union has established overarching directives on animal disease control, individual member states retain considerable autonomy in implementing vaccination strategies and managing outbreaks. For instance, some Eastern European countries continue to rely on routine prophylactic vaccination, whereas Western European nations predominantly follow an emergency vaccination-on-suspected-case basis. Besides, decision-making processes involving vaccine deployment often involve multiple stakeholders, including national veterinary authorities, EU institutions, and international organizations like WOAH and FAO. The resulting bureaucratic delays can hinder swift action during incipient outbreaks. Enhancing policy coherence and fostering closer collaboration among stakeholders remains essential to ensuring a unified and efficient response to FMD threats across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Animal Type, Vaccine Type, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Merck & Co., Inc., Biogenesis Bago, Zoetis Inc., Boehringer Ingelheim International GmbH, Indian Immunologicals Limited, Bayer AG, Hester Biosciences Limited, Inner Mongolia Biwei Antai Biotechnology Co., Ltd., Brilliant Bio Pharma Limited, and Biovet Private Ltd. |

SEGMENTAL ANALYSIS

By Animal Type Insights

The cattle account for the largest segment by capturing 58.5% of the total market share in 2024. This dominance is primarily attributed to the high economic value associated with cattle farming and the critical role bovines play in dairy and meat production across the continent. One key driver behind this segment’s leading position is the high susceptibility of cattle to Foot-and-Mouth Disease, making them a primary target for vaccination campaigns. This biological vulnerability necessitates robust immunization strategies, particularly in countries with large dairy herds such as Germany, France, and the Netherlands. Another major factor fueling demand is the economic impact of an FMD outbreak on national livestock industries. As per the Food and Agriculture Organization (FAO), a single confirmed case in a previously FMD-free country can result in trade bans worth hundreds of millions of euros in lost exports.

The Swine segment is emerging as the fastest-growing category within the Europe FMD vaccine market, registering a CAGR of 11.4%. This progress is largely driven by increasing recognition of pigs as highly efficient transmitters of the FMD virus, prompting intensified focus on porcine vaccination programs. A primary reason for this upward trend is the intensification of pig farming operations, particularly in Eastern and Central Europe, where large-scale industrial farms are more vulnerable to rapid disease spread. The density of swine populations in these regions has heightened biosecurity concerns, leading to increased vaccine procurement. Besides, rising cross-border trade in live animals and pork products has amplified the need for preventive measures. The World Organisation for Animal Health (WOAH) noted that several non-European markets have imposed stricter import conditions on pork from regions with incomplete FMD control strategies.

By Vaccine Type Insights

The Modified/Attenuated Live vaccine segment held the biggest share in the Europe FMD vaccine market by accounting for 63.1% of total consumption in 2024. This is because of the long-standing use of live-attenuated vaccines in emergency outbreak responses due to their ability to induce rapid immunity and provide broad protection against multiple viral strains. One key factor driving this segment’s leadership is the established infrastructure and regulatory acceptance of modified live vaccines across many European countries. These vaccines typically offer a faster onset of protection compared to inactivated or recombinant alternatives, making them crucial in containing outbreaks before diagnostic confirmation. Another major contributor is the cost-effectiveness of modified live vaccines, particularly in large-scale prophylactic or reactive immunization programs. This affordability makes them particularly attractive for countries with constrained veterinary budgets or those maintaining extensive strategic reserves for contingency planning.

The Inactivated vaccine segment is gaining traction at the fastest pace within the Europe FMD vaccine market, exhibiting a CAGR of 12.8%. This development is primarily fueled by the increasing adoption of inactivated vaccines that allow differentiation between infected and vaccinated animals (DIVA), a capability essential for maintaining international trade eligibility. One of the key drivers behind this shift is the need to comply with global trade regulations, particularly for countries seeking unrestricted access to premium export markets. Inactivated vaccines, when paired with appropriate companion tests, enable accurate serological monitoring, facilitating smoother trade negotiations. Additionally, advancements in adjuvant technologies and antigen delivery systems have significantly improved the immunogenicity of inactivated vaccines.

COUNTRY-LEVEL ANALYSIS

Germany maintains a strong presence in the sector due to its substantial livestock population, well-developed veterinary healthcare system, and proactive government support for disease prevention. A primary factor contributing to Germany’s dominant position is its large cattle herd. Given the high economic stakes associated with dairy and beef production, German authorities prioritize emergency preparedness through regular updates to national contingency plans. The Federal Ministry of Food and Agriculture allocates annual funds for strategic vaccine stockpiles, ensuring rapid response capabilities in case of an incursion. Apart from these, Germany benefits from advanced research institutions and biopharmaceutical companies actively involved in vaccine development. Institutions like the Friedrich-Loeffler-Institut collaborate closely with manufacturers such as IDT Biologika to enhance vaccine efficacy and distribution efficiency.

France occupies a significant position in the Europe FMD vaccine market. The country's strategic importance in the sector is underpinned by its vast livestock industry and robust animal health management framework. One of the main drivers of France’s market strength is its well-integrated veterinary surveillance system , which enables early detection and swift containment of potential outbreaks. Moreover, France plays a central role in the European Union’s emergency vaccine reserve program, hosting one of the primary storage facilities under the EU Animal Health Framework. This logistical advantage ensures timely access to vaccines for both domestic use and regional coordination efforts.

Poland holds a prominent position in the Europe FMD vaccine market. As one of the largest livestock producers in the EU, Poland’s significance stems from its sizeable swine and cattle populations, which necessitate comprehensive disease control measures. A key factor driving Poland’s market presence is its strategic location near regions where FMD remains endemic, particularly in parts of Eastern Europe and Asia. This geographical proximity heightens the risk of disease introduction, prompting Polish authorities to implement stringent biosecurity protocols and maintain elevated vaccine stockpiles. Also, the expansion of commercial pig farming has led to increased vaccine procurement by large agribusinesses aiming to safeguard productivity and maintain export eligibility.

Spain contributes significantly to the Europe FMD vaccine market. The country’s livestock industry, particularly its extensive sheep and goat populations, plays a vital role in shaping vaccine demand and policy implementation. One of the primary drivers behind Spain’s market position is its high concentration of small ruminants. These animals, though less frequently implicated in major FMD outbreaks compared to cattle and pigs, remain important vectors in localized transmission, particularly in mountainous and rural areas with free-range grazing practices. Furthermore, Spain benefits from strong collaboration between public veterinary services and private stakeholders, enhancing vaccine accessibility and usage compliance. Additionally, Spain serves as a key logistics hub for vaccine distribution across Southern Europe, reinforcing its relevance in the regional FMD vaccine market.

The United Kingdom holds a notable share of the Europe FMD vaccine market. Despite leaving the European Union, the UK continues to play a crucial role in FMD preparedness due to its history of past outbreaks and ongoing commitment to disease control. A key factor sustaining the UK’s market presence is its robust contingency planning and strategic vaccine reserves, which DEFRA regularly updates to ensure readiness. Additionally, the UK has been actively involved in research and development initiatives aimed at improving vaccine technology. Institutions such as the Pirbright Institute lead global studies on novel FMD vaccine platforms, including synthetic and subunit-based approaches designed to enhance stability and reduce biosafety risks.

KEY MARKET PLAYERS

Companies playing a prominent role in the European FMD vaccine market profiled in this report are Merck & Co., Inc., Biogenesis Bago, Zoetis Inc., Boehringer Ingelheim International GmbH, Indian Immunologicals Limited, Bayer AG, Hester Biosciences Limited, Inner Mongolia Biwei Antai Biotechnology Co., Ltd., Brilliant Bio Pharma Limited, and Biovet Private Ltd.

TOP LEADING PLAYERS IN THE MARKET

MSD Animal Health, a division of Merck & Co., is a global leader in veterinary biologics and holds a strong position in the Europe FMD vaccine market. The company has been instrumental in developing high-quality, efficacious vaccines that align with international standards for disease control. Its contributions extend beyond Europe, as it supports global FMD eradication initiatives through partnerships with organizations such as the FAO and OIE.

Boehringer Ingelheim Animal Health plays a pivotal role in the European FMD vaccine landscape by offering a comprehensive portfolio tailored to both emergency response and preventive strategies. The company’s commitment to innovation and sustainable animal health solutions has made it a trusted partner for governments and livestock producers across the continent.

IDT Biologika, headquartered in Germany, is a key player in the production of Foot-and-Mouth Disease vaccines specifically designed for European regulatory requirements. With its expertise in manufacturing live attenuated and inactivated vaccines, IDT Biologika contributes significantly to regional stockpiling programs and emergency preparedness efforts, ensuring rapid deployment when needed most.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the Europe FMD vaccine market is continuous product innovation and development of next-generation vaccines. Companies are focusing on improving vaccine efficacy, stability, and compatibility with diagnostic tests to meet evolving regulatory and trade requirements.

Another critical approach is strengthening collaborations with government agencies and international animal health organizations. These partnerships enable manufacturers to align their product development pipelines with public health priorities, participate in emergency stockpile programs, and influence policy decisions related to FMD control.

Lastly, companies are increasingly expanding their distribution networks and enhancing local presence through strategic acquisitions or joint ventures. By establishing stronger footholds within key European markets, they ensure better access to procurement tenders and improve responsiveness to outbreak scenarios.

COMPETITION OVERVIEW

The competition in the Europe FMD vaccine market is shaped by a combination of established pharmaceutical firms, specialized biotech companies, and public-private partnerships aimed at strengthening animal health infrastructure. While only a handful of manufacturers hold dominant positions, there is increasing pressure to innovate and adapt to shifting regulatory landscapes and trade-related disease control policies. Market participants differentiate themselves through technological advancements, such as DIVA-compatible formulations and thermostable vaccine platforms, which enhance usability and compliance with international trade protocols. Additionally, agility in responding to potential outbreaks, coupled with strategic engagement in national and EU-level contingency planning, plays a crucial role in maintaining competitive advantage. Smaller firms and research institutions are also entering the space with novel approaches, further intensifying competition and driving progress toward more efficient and accessible FMD prevention tools across the region.

RECENT MARKET DEVELOPMENTS

- In March 2024, MSD Animal Health announced a partnership with a leading European diagnostics firm to develop integrated FMD vaccine and testing kits, enhancing traceability and differentiation between infected and vaccinated animals.

- In August 2023, Boehringer Ingelheim upgraded its vaccine production facility in France to increase capacity and improve cold-chain efficiency, reinforcing its ability to supply large volumes during emergencies.

- In January 2024, IDT Biologika launched a new line of temperature-stable FMD vaccines tailored for use in remote regions, addressing logistical challenges in vaccine storage and administration.

- In October 2023, a major European veterinary health consortium was formed with participation from multiple vaccine manufacturers to coordinate R&D efforts and streamline regulatory submissions for next-generation FMD immunizations.

- In May 2024, a leading biotech firm entered into a licensing agreement with a global pharma giant to co-develop synthetic peptide-based FMD vaccines, aiming to replace traditional virus-cultured formulations with safer alternatives.

MARKET SEGMENTATION

This Europe FMD vaccine market research report is segmented and sub-segmented into the following categories.

By Animal

- Cattle

- Sheep and Goat

- Swine

- Others

By Vaccine

- Modified/ Attenuated Live

- Inactivated (Killed)

- Other Vaccines

By Distribution Channel

- Veterinary Hospitals & Clinics

- Government Institutions

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the main drivers supporting the Europe foot and mouth disease vaccine market?

The Europe foot and mouth disease vaccine market is driven by strengthened animal health surveillance, persistent risk from trade and animal movement, and EU contingency plans mandating emergency vaccination and strategic stockpiling. Growing R&D investments, adoption of DIVA-compatible vaccines, and technological advances in thermostable formulations further support market growth

2. Which challenges currently hinder the Europe foot and mouth disease vaccine market?

Barriers in the Europe foot and mouth disease vaccine market include complex and lengthy regulatory approval processes, variations in national registration requirements, and the operational burden of post-marketing surveillance. Low FMD incidence in Western Europe reduces urgency for routine vaccination, while trade restrictions on vaccinated herds and the need for DIVA-compliant systems add cost and complexity

3. Where do the greatest opportunities for expansion exist in the Europe foot and mouth disease vaccine market?

Opportunities in the Europe foot and mouth disease vaccine market lie in developing thermostable and VLP-based vaccines, integrating digital technologies for supply chain and surveillance, and expanding vaccination in high-risk regions. Collaboration among EU states, adoption of innovative platforms, and improved traceability systems also present major growth prospects

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com