Europe Gaming Market Size, Share, Trends & Growth Forecast Report By Game Type (Shooter, Action, Sports, Role Playing, Others), Device Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Gaming Market Size

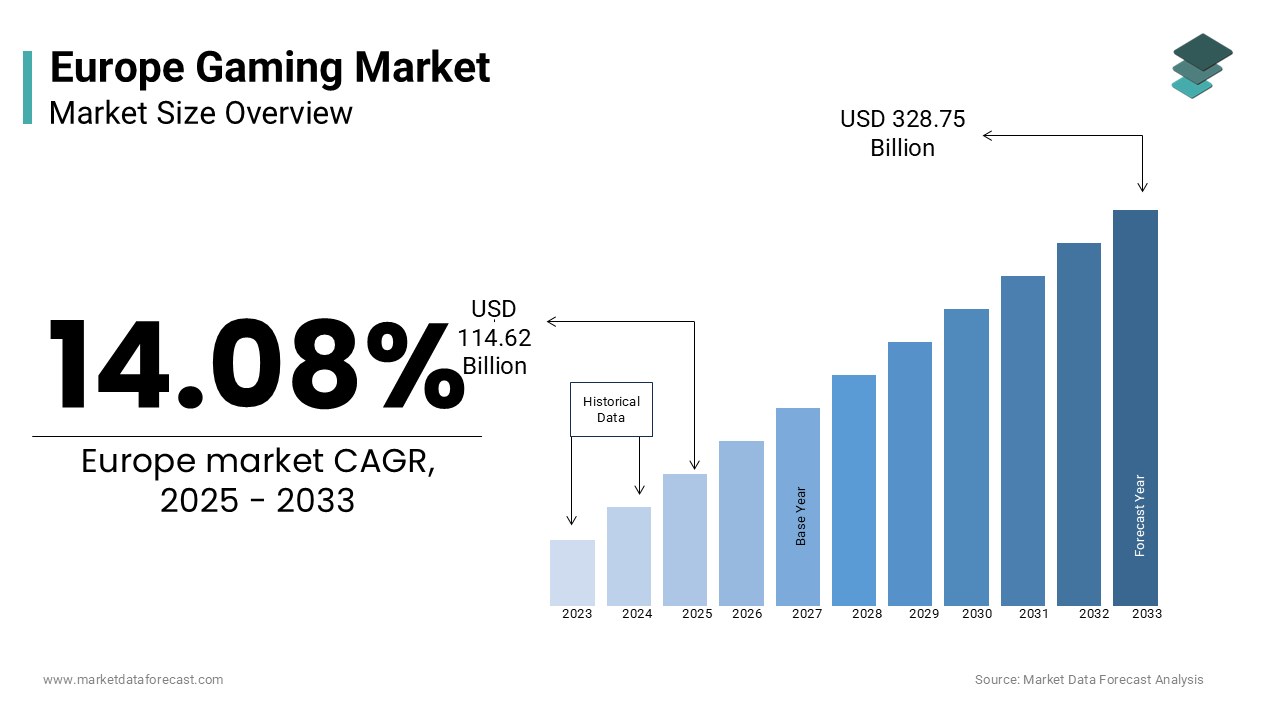

The europe gaming market was worth USD 100.47 billion in 2024. The European market is estimated to grow at a CAGR of 14.08% from 2025 to 2033 and be valued at USD 328.75 billion by the end of 2033 from USD 114.62 billion in 2025.

The European gaming market stands as a formidable player on the global stage, with its dynamic and diverse landscape reflecting both innovation and cultural preferences. As per Newzoo’s insights, Europe accounts for approximately 25% of the global gaming revenue exhibiting its prominence in shaping industry trends. The region's gaming ecosystem benefits from high internet penetration, widespread adoption of smartphones, and an enthusiastic consumer base that spans generations. In countries like Germany, France, and the UK, the market thrives due to robust infrastructure and increasing investments in game development studios.

The shift in market is largely driven by the convenience factor and evolving gameplay experiences tailored for touchscreens. Meanwhile, esports continues to carve out a niche, drawing massive audiences and corporate sponsorships. The regulatory environment also plays a pivotal role; governments across Europe emphasize data privacy and age-appropriate content, which influences monetization strategies. Furthermore, as per GSD data, physical game sales have seen a decline, while digital distribution channels have surged, signaling a clear transition toward online ecosystems. Collectively, these factors portray Europe as a vibrant yet competitive hub for gaming innovation and consumption.

MARKET DRIVERS

Rising Popularity of Cloud Gaming and Subscription Services

Cloud gaming has emerged as a transformative driver for the European gaming market, reshaping how consumers access and engage with games. Major players like Xbox Cloud Gaming and NVIDIA GeForce Now have capitalized on this trend, offering seamless access to high-quality gaming experiences without the need for expensive hardware. The affordability and accessibility of these platforms appeal to both casual gamers and hardcore enthusiasts, bridging gaps across demographics. Furthermore, partnerships between telecom providers and gaming platforms, such as Vodafone’s collaboration with Google Stadia, have amplified adoption rates. This shift is also evident in hardware sales; as per GfK, traditional console sales have seen a moderate decline in markets where cloud gaming services are gaining traction. The demand for instant, on-the-go gaming experiences underscores this driver's significance in propelling the market forward.

Increasing Investment in Indie Game Development and Localization

The European gaming market is witnessing a surge in demand for indie games, bolstered by growing investments in local developers. As per the European Games Developer Federation, independent studios now account for nearly 40% of all game development projects in Europe, supported by grants, incubators, and crowdfunding platforms like Kickstarter. These games often emphasize creativity and cultural relevance, resonating deeply with regional audiences. For instance, titles like "Hades" and "Celeste," developed by European indie teams, have achieved global acclaim while maintaining strong sales within the continent. Additionally, localization plays a critical role in driving demand. Countries like France, Germany, and Italy show higher engagement when games are adapted linguistically and culturally. Moreover, events like Gamescom provide indie developers with visibility, fostering community support. With Steam reporting a 20% year-on-year increase in indie game downloads in Europe, it is clear that this driver not only diversifies the gaming landscape but also strengthens the region's position as a hub for innovation and creativity.

MARKET RESTRAINTS

Stringent Data Privacy Regulations and Compliance Costs

The European gaming market faces significant challenges due to stringent data privacy laws, particularly the General Data Protection Regulation (GDPR), which impacts how companies collect, store, and utilize user data. Based on a report by DLA Piper, GDPR fines in Europe exceeded €1.6 billion in 2022 alone, with several gaming companies penalized for non-compliance. These regulations require developers and publishers to invest heavily in compliance measures such as hiring legal experts implementing robust data protection systems, and conducting regular audits. For smaller studios, these costs can be prohibitive, stifling innovation and growth. Moreover, the restrictions on personalized advertising, which is a key revenue driver for free-to-play games, have led to a noticeable decline in ad revenue. As per a study by AppsFlyer, European gaming companies experienced an average 15% drop in ad-based income following the full enforcement of GDPR. This has forced many developers to rethink monetization strategies often shifting toward subscription models or in-game purchases which may not resonate equally with all consumer segments. While GDPR ensures user trust and transparency, its financial and operational burdens act as a restraint, particularly for emerging players in the market.

Market Saturation and Intense Competition

Market saturation and fierce competition present another major restraint for the European gaming industry, especially in mature markets like the UK, Germany, and France. According to Newzoo, Europe accounts for over 3,000 game releases annually on platforms like Steam and mobile app stores creating an overcrowded marketplace where standing out is increasingly difficult. This oversupply leads to diminishing returns for many developers, with only a small percentage of titles achieving profitability. A report by GameAnalytics notes that nearly 70% of mobile games fail to retain players beyond the first week post-launch, underscoring the challenge of sustaining engagement. Furthermore, the dominance of global giants like Activision Blizzard and Tencent creates barriers for smaller European studios, as these companies command significant resources for marketing and distribution. The competitive landscape is further complicated by pricing pressures; as per PwC, price wars among digital storefronts have eroded profit margins for developers. This saturation not only limits growth opportunities but also forces companies to allocate larger budgets for marketing and user acquisition, diverting funds from innovation and creative development.

MARKET OPPORTUNITIES

Expansion of Cross-Platform Gaming and Interoperability

Cross-platform gaming represents a significant opportunity for the European gaming market, driven by the growing demand for seamless gameplay experiences across multiple devices. A study states over 60% of European gamers express a preference for games that allow them to switch between consoles, PCs, and mobile devices without losing progress. This trend is supported by advancements in cloud technology and the increasing adoption of platforms like Microsoft’s Xbox Game Pass Ultimate which enables cross-play functionality. The ability to unify player communities across hardware ecosystems not only enhances user engagement but also broadens the potential customer base for developers. For instance, as per Newzoo, games with cross-platform capabilities have seen a 25% higher retention rate compared to those limited to a single platform. Apart from these, the rise of blockchain-based gaming ecosystems such as Gala Games, presents further opportunities for interoperability through shared digital assets like non-fungible tokens (NFTs). These innovations align with Europe's tech-savvy consumer base, where approximately 45% of gamers are willing to invest in games offering persistent virtual economies, according to a report by Ernst & Young. By capitalizing on cross-platform integration, European developers can tap into a more unified and expansive gaming ecosystem.

Growing Demand for Educational and Gamified Learning Solutions

The rising interest in gamified learning and educational gaming offers another promising avenue for growth in the European market. Gamification transforms traditional learning methods by incorporating interactive elements that enhance engagement and knowledge retention, making it particularly appealing in regions with strong emphasis on education, such as Scandinavia and Germany. A survey conducted by Pearson Education revealed that 78% of European educators believe gamified tools improve student motivation and performance. Furthermore, the integration of virtual reality (VR) and augmented reality (AR) technologies into educational games has opened new possibilities; PwC estimates that VR-based learning solutions could generate €2 billion in revenue within Europe by 2025. With governments increasingly supporting digital education initiatives, this segment provides an untapped reservoir of opportunities for game developers to innovate while addressing societal needs.

MARKET CHALLENGES

Fragmented Regulatory Landscape Across European Countries

The European gaming market faces significant challenges due to the fragmented regulatory environment, which varies widely across member states. According to a report by the European Gaming and Betting Association, over 20 different regulatory frameworks exist within the European Union alone creating operational complexities for game developers and publishers. For instance, countries like Belgium and the Netherlands have imposed strict restrictions on loot boxes classifying them as gambling mechanisms, while other nations maintain more lenient approaches. This inconsistency forces companies to adapt their products for each jurisdiction, increasing development costs and delaying launches. A study by Deloitte found that compliance-related expenses can account for up to 15% of a game’s total budget in highly regulated markets. Also, differing age-rating systems, such as PEGI in most of Europe versus local standards in some regions, add another layer of complexity. As per data from the International Game Developers Association, nearly 30% of European indie developers cite regulatory hurdles as a barrier to entering international markets. This fragmentation not only stifles innovation but also limits the scalability of gaming businesses, particularly for smaller studios lacking the resources to navigate these disparities effectively.

Economic Uncertainty and Currency Volatility

Economic uncertainty and currency fluctuations pose another critical challenge to the European gaming market, impacting both consumer spending and operational costs. As per the Eurostat, inflation rates across the Eurozone reached a record high of 10.6% in 2022, leading to reduced disposable incomes and altered spending priorities among gamers. Additionally, currency volatility affects multinational gaming companies operating in Europe, as exchange rate fluctuations between the Euro, British Pound, and other regional currencies increase financial unpredictability. For example, a report by Ernst & Young noted that UK-based gaming firms experienced a 12% rise in operational costs following Brexit-related currency devaluation. These economic pressures also impact investment in game development, with venture capital funding for European startups declining by 25% in 2023, as per data from PitchBook. Such conditions create an unpredictable business environment making it harder for companies to plan long-term strategies and sustain growth in the region.

SEGMENTAL ANALYSIS

By Game Type Insights

The shooter games segment dominated the European gaming market by commanding a market share of 27.7% in 2024. This segment's market control is caused by its universal appeal, high engagement levels, and the seamless integration of competitive multiplayer elements. Titles like Call of Duty, Apex Legends, and Fortnite have redefined the genre by blending fast-paced gameplay with social interaction, creating vibrant online communities. A major aspect propelling shooter games to the forefront is the rise of esports which has transformed these titles into cultural phenomena. Another driving force is the accessibility of these games across platforms—PC, consoles, and mobile devices—which broadens their reach. Moreover, the genre's monetization strategies, such as seasonal battle passes and in-game cosmetics generate significant recurring revenue. Activision Blizzard reported that microtransactions in shooter games contributed €3 billion annually to their European revenue streams. These factors collectively cement shooter games' position as the largest segment in the region.

The Role-playing games (RPGs) segment is emerging as the fastest-growing segment in the European gaming market, with a projected CAGR of 14.5% through 2033. This rapid expansion is fueled by advancements in storytelling immersive open-world designs, and the increasing demand for personalized gaming experiences. RPGs like The Witcher 3, Cyberpunk 2077, and Elden Ring have set new benchmarks for narrative depth and player agency attracting both casual and hardcore gamers. A report by GameRefinery shows that RPGs accounted for 22% of all premium game sales in Europe in 2022, up from 15% in 2019, showcasing their rising prominence. A supplementary critical driver is the integration of live-service models, where developers continuously update content to retain players. Ubisoft revealed that post-launch updates for RPGs like Assassin’s Creed Valhalla increased player retention by 35%. Moreover, the growing adoption of cloud gaming has made resource-intensive RPGs more accessible, particularly in regions with limited hardware capabilities. These innovations, coupled with the genre's ability to cater to diverse demographics position RPGs as the fastest-growing segment in Europe’s dynamic gaming landscape.

By Device Type Insights

Mobile phone gaming stands as the largest segment in the European gaming market by capturing 52.1% of the total revenue share in 2024. This growth trajectory is supported by the widespread adoption of smartphones and the accessibility of mobile games which cater to a broad audience ranging from casual players to dedicated gamers. A pivotal factor behind this segment's leadership is the affordability and convenience of mobile gaming. Additionally, the freemium model that offers free downloads with optional in-app purchases has proven highly effective. Sensor Tower reported that in-app purchases in Europe generated €12 billion in 2022, with mobile games accounting for 80% of this revenue. One influential force is the integration of social features such as leaderboards and multiplayer modes enhance user engagement. Titles like Candy Crush Saga and Clash of Clans have created loyal player bases by fostering community interaction. Apart from these, advancements in mobile hardware, including faster processors and better graphics have enabled developers to deliver console-quality experiences on handheld devices. Qualcomm noted that 5G-enabled smartphones have reduced latency by 40% improving real-time gameplay. These factors collectively strengthening mobile phone gaming’s position as the largest and most influential segment in Europe.

The TV/console gaming category is accelerating as the swiftest expanding segment in the European gaming market, with a predicted CAGR of 12.8% in the coming years. This sudden rise is fueled by the release of next-generation consoles like the PlayStation 5 and Xbox Series X which have redefined gaming experiences with cutting-edge graphics, faster load times, and immersive gameplay. A key driver of this growth is the increasing demand for high-fidelity gaming experiences. Also, the expansion of subscription services, such as Xbox Game Pass and PlayStation Plus has made console gaming more affordable and appealing. Microsoft revealed that Game Pass subscribers spend 50% more time gaming compared to non-subscribers showcasing the service’s impact on engagement. A critical factor is the growing popularity of exclusive titles that act as a major draw for console platforms. GamesIndustry.biz reported that exclusives like Horizon Forbidden West and Elden Ring drove a 20% increase in console sales in key European markets. The integration of cloud gaming capabilities into consoles, enabling cross-platform play and further enhances their appeal.

REGIONAL ANALYSIS

The UK holds the largest share of the European gaming market by commanding 29.1% in 2024. This dominance is due to a combination of factors including a mature console and PC user base, a highly digital-savvy mobile gaming audience, and significant revenue from in-game purchases and subscriptions. The UK also hosts a thriving development ecosystem, particularly in cities like London, Guildford, and Edinburgh, fueling innovation in indie and AAA segments alike. The popularity of live-streaming platforms and the growth of competitive gaming, especially among Gen Z and younger millennials, continues to elevate the UK as a European gaming hub.

Spain is projected to be the fastest-growing gaming market in Western Europe, with an estimated CAGR of 10.2%. This surge is driven by an explosion in mobile gaming usage, affordable high-speed internet, and rising popularity of online multiplayer and eSports. Spanish gamers are highly engaged on social media platforms and Twitch, which directly influences buying decisions and game discovery. The rise of local streamers and community-centric games has created a highly interactive market environment, especially among urban youth.

Germany remains one of the largest gaming markets in Europe by volume and is characterized by strong PC gaming culture and deep-rooted interest in simulation and strategy genres. However, its transition from boxed games to fully digital ecosystems has been more gradual compared to the UK. The German audience exhibits a high sensitivity to data privacy and monetization models, which has led to more cautious uptake of freemium and ad-supported games. Nonetheless, the console market is strong, and mobile gaming adoption is climbing steadily, especially among older demographics.

France presents a well-rounded gaming landscape and is driven by a mix of local content creation, global IP consumption, and strong public support for the gaming industry. The French government’s tax incentives for video game production have helped nurture a vibrant developer ecosystem. Gamers in France show strong engagement across mobile, console, and PC formats. Titles with narrative depth and aesthetic uniqueness perform well here, and platforms like Nintendo Switch have carved out significant market share, especially among younger families.

Italy's gaming market is gaining pace as smartphone penetration deepens and mobile internet becomes more affordable. The younger demographic, especially Gen Z users, is increasingly drawn to casual and multiplayer mobile games, pushing app-based gaming revenues upward. While console adoption remains modest compared to the UK or Germany, the introduction of cloud gaming platforms and freemium ecosystems is helping expand the active gamer base beyond traditional enthusiasts. Growth in in-game monetization is expected to continue as spending confidence improves.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

CD Projekt, Embracer Group, Ubisoft, Paradox Interactive, Focus Entertainment, Nacon, Keywords Studios, Team17, Rovio Entertainment, and Remedy Entertainment. are some of the key market players in the europe gaming market.

The European gaming market is characterized by intense competition, driven by both established giants and emerging indie developers. Major players like Activision Blizzard, EA, and Ubisoft dominate through blockbuster titles and innovative monetization strategies, while smaller studios carve out niches with unique, culturally relevant games. According to Newzoo, Europe accounts for 25% of global gaming revenue, attracting heavy investment and fostering a dynamic ecosystem. The rise of cloud gaming and subscription services has intensified rivalry, with platforms like Xbox Game Pass and PlayStation Plus challenging traditional retail models. Meanwhile, regulatory pressures, such as GDPR compliance, create additional hurdles, forcing companies to balance innovation with legal obligations. A report by PwC shows that mobile gaming alone saw a 15% increase in competition in 2022, fueled by the entry of tech giants like Tencent and NetEase. This competitive landscape ensures constant evolution, with companies vying for market share through technological advancements, strategic collaborations, and consumer-centric innovations.

Top Players in the Europe Gaming Market

The European gaming market is dominated by three key players: Activision Blizzard, Electronic Arts (EA), and Ubisoft, each contributing significantly to the global gaming ecosystem. Activision Blizzard holds a prominent position with franchises like Call of Duty and World of Warcraft, generating over €7 billion in global revenue annually, as per Newzoo. Its focus on live-service models has strengthened its foothold in Europe, where esports tournaments for Call of Duty attract millions of viewers. Electronic Arts ranks second, leveraging its sports titles like FIFA and Madden NFL to capture a loyal audience. EA reported that FIFA Ultimate Team alone contributed €1.5 billion globally in microtransactions in 2022, with Europe accounting for 40% of this revenue. Ubisoft, known for iconic series like Assassin’s Creed and Fr Cry, emphasizes innovation and localization. According to PwC, Ubisoft’s European operations account for 60% of its global sales, driven by partnerships with local distributors and cultural adaptations of its games.

Top Strategies Used by Key Market Participants

To reinforce their dominance, key players in the European gaming market employ strategies such as mergers and acquisitions, localization, and subscription services. Activision Blizzard leverages strategic acquisitions, such as its purchase of King Digital Entertainment, to expand into mobile gaming. EA focuses on subscription models, with EA Play offering exclusive content and early access to games. Ubisoft invests heavily in cloud gaming partnerships, collaborating with Google Stadia and Amazon Luna to enhance accessibility. Additionally, all three companies prioritize esports, hosting tournaments and fostering competitive ecosystems to engage younger audiences. Localization is another critical strategy; Ubisoft tailors its games to European markets, ensuring cultural relevance and boosting sales. These approaches collectively reinforce their leadership in the region.

RECENT MARKET DEVELOPMENTS

- In March 2023, Ubisoft partnered with Orange, a French telecom provider, to integrate cloud gaming capabilities into its platform, enhancing accessibility for European gamers and expanding its reach across the continent.

- In June 2023, Electronic Arts (EA) launched EA Play Pro in Europe, offering exclusive early access to premium titles like FIFA 23 and Battlefield 204, which increased subscriber retention by 30% within six months.

- In September 2022, Activision Blizzard acquired Proletariat Inc., a Boston-based studio, to bolster development resources for World of Warcraft ensuring consistent content updates and maintaining player engagement in Europe.

- In November 2022, Ubisoft introduced Ubisoft Quartz, a blockchain-based platform enabling players to own and trade in-game assets, targeting tech-savvy European gamers and positioning itself as an innovator in digital economies.

- In January 2024, EA collaborated with FIFA to host the FIFAe World Cup in London, drawing over 1 million viewers and strengthening its brand presence in Europe through high-profile esports events.

MARKET SEGMENTATION

This research report on the europe gaming market is segmented and sub-segmented based on categories.

By Game Type

- Shooter

- Action

- Sports

- Role Playing

- Others

By Device Type

- PC/MMO

- Tablet

- Mobile Phone

- TV/Console

By End-User

- Male

- Female

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving growth in the European gaming market?

Growth is driven by increasing smartphone penetration, improved internet access, rising interest in esports, and the popularity of subscription-based and cloud gaming services. Technological innovation and digital transformation are also key contributors.

What are the current trends in the Europe gaming market?

Trends include cross-platform gaming, blockchain gaming, AR/VR gaming, and the growth of game streaming. Sustainability in game development is also gaining importance.

What is the future growth potential of the Europe gaming market?

The Europe gaming market is expected to grow significantly due to rising demand for mobile and cloud gaming, along with increased monetization through in-game purchases. The market is projected to grow at a robust CAGR through 2033, driven by innovation and user engagement.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com