Europe Heat Transfer Fluids Market Size, Share, Trends & Growth Forecast Report By Product Type (Mineral Oils, Synthetic Fluids, Biobased HTFs, Glycols), End User Industry (Chemicals and Petrochemicals, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Heat Transfer Fluids Market Size

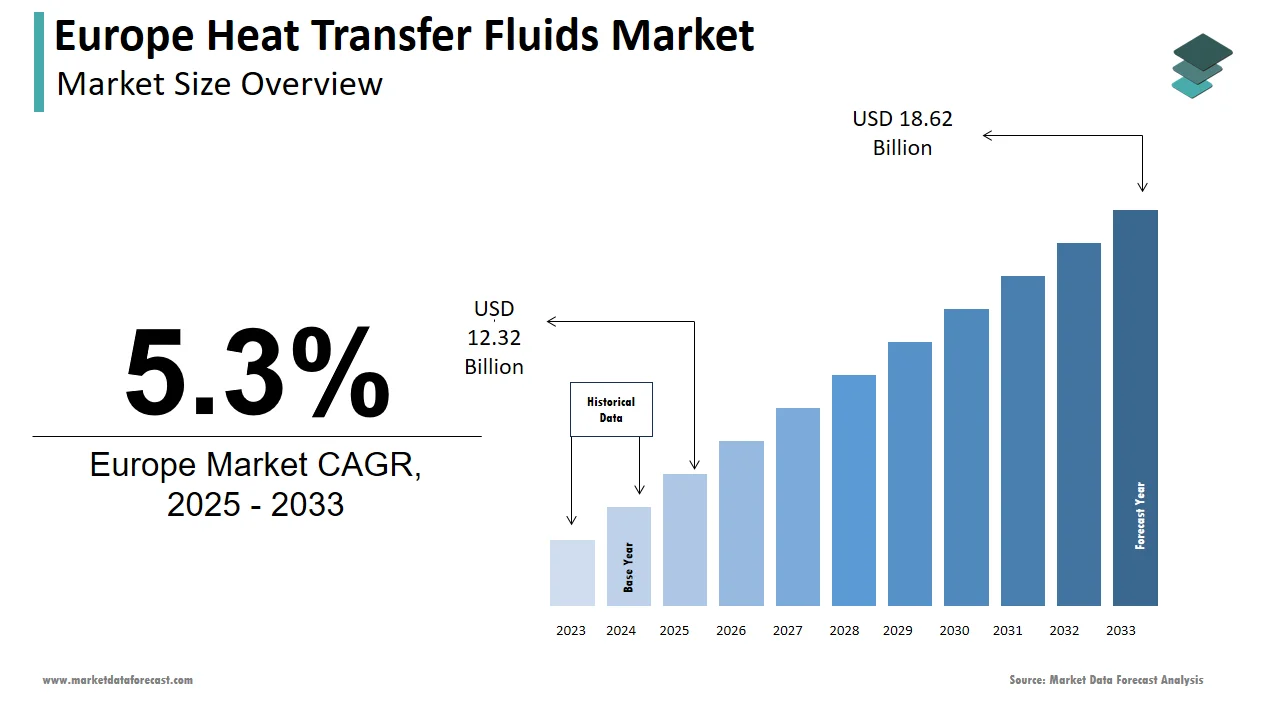

The heat transfer fluids market size in Europe was valued at USD 11.7 billion in 2024. The European market is estimated to be worth USD 18.62 billion by 2033 from USD 12.32 billion in 2025, growing at a CAGR of 5.3% from 2025 to 2033.

Heat transfer fluids are essential components in industrial, commercial, and residential systems where efficient thermal regulation is required. These fluids facilitate the movement of heat within processes such as manufacturing, power generation, district heating, refrigeration, and renewable energy systems. In Europe, the demand for high-performance heat transfer fluids has grown significantly due to increasing industrial automation, expansion of the renewable energy sector, and stringent environmental regulations aimed at reducing carbon emissions. Also, the region's chemical and pharmaceutical sectors, which heavily rely on precise temperature control, are among the largest consumers of these fluids. Besides, the rising deployment of solar thermal energy systems, particularly in Germany, Spain, and Italy, has further boosted the need for thermally stable and long-lasting heat transfer media.

MARKET DRIVERS

Expansion of Renewable Energy Systems Across Europe

One of the key drivers of the Europe heat transfer fluid market is the rapid expansion of renewable energy systems, especially concentrated solar power (CSP) and geothermal plants. These systems require highly efficient and thermally stable fluids capable of operating at elevated temperatures over extended periods. According to the International Renewable Energy Agency (IRENA), installed CSP capacity in Southern Europe grew in recent years, with Spain leading the region in both production and innovation. The use of synthetic heat transfer oils in CSP plants enables efficient energy capture and storage, making them indispensable for maintaining grid stability and maximizing return on investment. Also, the European Geothermal Energy Council (EGEC) reports that geothermal energy utilization increased in Central and Eastern Europe during the same year, driven by new district heating projects in countries like Hungary and Poland. In these applications, heat transfer fluids function as primary media for extracting and distributing geothermal heat efficiently. Moreover, government incentives under the EU’s Renewable Energy Directive II have encouraged investments in clean energy infrastructure, directly boosting demand for specialized heat transfer fluids.

Rising Demand from High-Performance Industrial Applications

Another significant driver of the Europe heat transfer fluid market is the growing reliance on high-performance industrial applications that require precise temperature control and operational consistency. Industries such as chemicals, pharmaceuticals, food processing, and automotive manufacturing depend extensively on heat transfer fluids for reactor heating, drying processes, mold tempering, and other critical operations. According to data published by the European Chemical Industry Council (Cefic), the chemical sector alone accounts a significant share of industrial heat transfer fluid consumption in Europe. This is primarily because many chemical reactions necessitate strict thermal regulation to ensure product quality, safety, and yield optimization. Furthermore, the pharmaceutical industry, which is highly regulated and requires sterile processing conditions, utilizes heat transfer fluids that meet stringent purity and thermal stability standards. The UK Department for Business, Energy & Industrial Strategy (BEIS) notes that modernization efforts in industrial facilities across France, Italy, and the Benelux region have led to increased adoption of premium-grade fluids that offer longer service life and reduced maintenance cycles.

MARKET RESTRAINTS

Regulatory Constraints on Synthetic Oil-Based Fluids

A major restraint affecting the Europe heat transfer fluid market is the increasing regulatory scrutiny on synthetic oil-based fluids due to their potential environmental impact. While these fluids offer excellent thermal performance and longevity, concerns regarding their biodegradability and toxicity have prompted stricter controls under European directives such as REACH and the Industrial Emissions Directive. According to the European Chemicals Agency (ECHA), several mineral oil-derived heat transfer fluids are now subject to registration, evaluation, and authorization requirements, limiting their unrestricted use in certain sectors. The Swedish Chemicals Agency (Kemikalieinspektionen) reports that some widely used aromatic hydrocarbon-based fluids have been flagged for persistent organic pollutant (POP) classification, potentially leading to future restrictions or phase-outs. Also, the European Environment Agency (EEA) emphasizes the need for safer alternatives in industrial settings near water bodies and ecologically sensitive areas. As a result, companies face higher compliance costs and may be required to reformulate products or adopt alternative fluid technologies, which can delay market entry and increase operational complexity. Although synthetic ester and bio-based fluids are gaining traction, they currently represent a smaller share of the market due to higher pricing and limited compatibility with existing equipment.

Supply Chain Disruptions and Raw Material Cost Volatility

Another significant challenge facing the Europe heat transfer fluid market is the ongoing volatility in raw material prices and supply chain disruptions, which have impacted production timelines and cost structures. Key feedstocks such as base oils, additives, and specialty polymers—essential for formulating high-performance heat transfer fluids—have experienced sharp price fluctuations in recent years. Like, global crude oil price swings have directly influenced the cost of mineral and synthetic oil derivatives, creating uncertainty for fluid manufacturers. In addition, geopolitical tensions and logistical bottlenecks following the pandemic have led to delays in sourcing critical components, particularly from Asia and the Middle East. Smaller manufacturers, in particular, struggle to absorb these financial pressures, limiting their ability to invest in R&D or expand product lines. Until supply chain stability improves and raw material markets stabilize, the growth trajectory of the heat transfer fluid industry in Europe will remain partially hindered.

MARKET OPPORTUNITIES

Growth of Biodegradable and Eco-Friendly Heat Transfer Fluids

A major opportunity emerging in the Europe heat transfer fluid market is the increasing demand for biodegradable and eco-friendly alternatives that align with the region’s sustainability goals. As industries and governments prioritize environmental responsibility, there has been a shift toward plant-based esters, synthetic esters, and glycols that offer lower toxicity, enhanced biodegradability, and reduced carbon footprint. According to the European Environment Agency (EEA), the adoption of environmentally acceptable lubricants (EALs) has risen sharply in sectors such as marine, agriculture, and forestry, where spills and leaks pose ecological risks. Also, these eco-friendly fluids are increasingly being used in industrial machinery located near protected natural zones, wastewater treatment plants, and green energy installations. Like, the European Chemical Industry Council (Cefic) notes that research into novel bio-based heat transfer fluids derived from rapeseed, sunflower, and palm oils is accelerating, offering improved thermal stability and oxidative resistance compared to conventional vegetable oils. Several major fluid manufacturers have launched product lines specifically designed for closed-loop systems in renewable energy and district heating networks. As regulatory support and consumer awareness grow, the market for sustainable heat transfer fluids is poised for substantial expansion across Europe.

Integration of Heat Transfer Fluids in Electric Vehicle Manufacturing Processes

The expanding electric vehicle (EV) manufacturing sector presents a significant growth opportunity for the Europe heat transfer fluid market. EV production involves complex thermal management processes, including battery cell formation, electrode drying, and motor assembly, all of which require precise temperature control to ensure product quality and process efficiency. Heat transfer fluids play a crucial role in maintaining uniform temperatures during battery pack curing and testing phases, preventing thermal runaway and enhancing battery longevity. Also, lithium-ion battery production facilities utilize high-performance synthetic fluids for both heating and cooling circuits to optimize electrochemical performance. The growing number of gigafactories across Germany, Hungary, and Sweden has further amplified demand for specialized heat transfer media that can operate reliably under continuous cycling conditions. Companies such as Shell, TotalEnergies, and BP have introduced dedicated EV manufacturing fluid lines tailored for high-purity environments.

MARKET CHALLENGES

Compatibility Issues with New Refrigerants and Heat Pump Technologies

A pressing challenge for the Europe heat transfer fluid market is the growing complexity of compatibility with new refrigerants and next-generation heat pump technologies. As the HVAC industry transitions toward low-global warming potential (GWP) refrigerants such as hydrofluoroolefins (HFOs) and mildly flammable hydrocarbons, existing heat transfer fluids must adapt to maintain system efficiency and longevity. Like, certain synthetic ester and polyalkylene glycol (PAG)-based fluids exhibit degradation when exposed to newer refrigerants, leading to reduced thermal stability and potential system failures. Additionally, the International Institute of Refrigeration (IIR) points out that as heat pump designs evolve to incorporate direct-expansion and ultra-low-temperature operation, traditional glycol-water mixtures may no longer suffice for optimal performance. Manufacturers are investing in reformulation and additive development to address these challenges, but achieving universal compatibility remains difficult due to varying system configurations. Like, misapplication of incompatible fluids can void warranties and compromise system certifications, discouraging end-users from adopting new heat pump models.

Lack of Standardization in Fluid Performance Metrics Across Industries

Another notable challenge confronting the Europe heat transfer fluid market is the absence of standardized performance metrics across different industrial sectors. Unlike lubricants or fuels, which have well-established testing protocols and certification benchmarks, heat transfer fluids are often evaluated using disparate methodologies depending on the application, ranging from chemical processing to renewable energy systems. Also, inconsistencies in viscosity classifications and thermal conductivity measurements make it difficult for users to compare product offerings from different suppliers. The variations in fluid specifications can lead to suboptimal system performance and premature component failure, particularly in high-temperature industrial settings. Moreover, the discrepancies in international standards between ISO, ASTM, and DIN create confusion for procurement teams, delaying purchasing decisions and increasing risk exposure. Without a unified framework for evaluating and certifying heat transfer fluids, end-users face challenges in selecting the most appropriate products for their specific needs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, End-Use Industry, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Arkema S.A., BASF SE, Chevron Corporation, Clariant AG, Dalian Richfortune Chemicals Co. Ltd., Dow Inc., Dynalene Inc., Eastman Chemical Company, Exxon Mobil Corporation, Hindustan Petroleum Corporation Ltd. (Oil and Natural Gas Corporation), Indian Oil Corporation Ltd., Phillips 66 Company, Radco Industries Inc., Shell plc, TotalEnergies SE, and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The mineral oils segment held the bulk share of the Europe heat transfer fluid market by accounting for 38.8% in 2024. This rule is attributed to their widespread use across legacy industrial systems, particularly in the chemicals, food processing, and oil & gas sectors. Like, mineral-based fluids remain the preferred choice for medium-temperature applications due to their cost-effectiveness, compatibility with existing infrastructure, and well-established supply chains. In addition, mineral oils are extensively used in indirect heating processes such as mold tempering in plastics manufacturing and reactor heating in pharmaceutical facilities. Despite growing regulatory scrutiny over sustainability, mineral oils retain a strong foothold, especially in Eastern Europe, where cost sensitivity remains high.

The biobased heat transfer fluids (HTFs) segment is the fastest-growing within the Europe market, projected to expand at a CAGR of 9.5%. This rapid growth is driven by increasing environmental awareness and regulatory emphasis on sustainable industrial practices. According to the European Environment Agency (EEA), the adoption of bio-based fluids has surged in eco-sensitive sectors such as agriculture, marine operations, and green energy installations. These fluids, derived from renewable sources like rapeseed, sunflower, and palm oil, offer superior biodegradability and lower toxicity compared to conventional mineral and synthetic options. Also, biobased HTFs can reduce lifecycle carbon emissions, making them attractive for companies aiming to align with EU Green Deal initiatives. Furthermore, advancements in oxidation stability and additive technologies have extended the service life of these fluids, addressing previous performance limitations. Like, several industrial parks in Scandinavia have mandated the use of environmentally acceptable lubricants (EALs) in new thermal installations, accelerating the shift toward biobased alternatives.

By End User Industry Insights

The chemicals and petrochemicals sector signifies the most important end-user segment in the Europe heat transfer fluid market by capturing an estimated 27.7% market share in 2024. This command is driven by the industry’s intensive reliance on precise temperature control during chemical synthesis, polymerization, distillation, and refining processes. Also, many large-scale chemical plants in Germany, Belgium, and France utilize high-temperature synthetic fluids to manage exothermic reactions and ensure product consistency. Moreover, the sector's transition toward continuous production models and modular plant designs has increased the demand for thermally stable and long-lasting fluids. The UK Royal Society of Chemistry highlights that modern chemical facilities are adopting closed-loop systems that minimize fluid degradation and extend operational intervals. Besides, the European Union’s Industrial Emissions Directive (IED) mandates reduced environmental impact from chemical manufacturing, prompting operators to switch to low-toxicity fluids with improved thermal efficiency.

The renewable energy segment is coming out as the fastest progressing application area in the Europe heat transfer fluid market, expanding at a CAGR of 11.2% through the forecast period. This development is fueled by the rapid deployment of concentrated solar power (CSP), geothermal, and biomass-based plants that require efficient thermal management solutions. In these systems, heat transfer fluids play a critical role in capturing, transporting, and storing thermal energy, often operating at temperatures exceeding 400°C. The European Geothermal Energy Council (EGEC) notes that recent advancements in binary cycle geothermal plants have increased the demand for silicon-based and synthetic ester fluids capable of enduring high-pressure environments without degradation. Apart from these, government incentives under the EU’s Renewable Energy Directive II have accelerated investments in clean energy infrastructure, directly boosting fluid consumption. Also, next-generation thermal storage systems using molten salts and advanced oils are enhancing grid reliability, further reinforcing the need for high-performance heat transfer media.

COUNTRY LEVEL ANALYSIS

Germany grabbed the leading position in the Europe heat transfer fluid market by commanding an estimated 23.1% market share in 2024. As the continent’s largest industrial economy, Germany maintains a robust manufacturing base that spans automotive, chemical, and machinery sectors—all of which heavily depend on reliable thermal management solutions. Moreover, many large-scale chemical and pharmaceutical facilities in Ludwigshafen, BASF’s headquarters, and the Ruhr Valley utilize heat transfer fluids for reactor heating, distillation, and drying applications. Besides, Germany leads in the installation of combined heat and power (CHP) units and biomass-based thermal plants, further expanding the need for high-temperature fluids. The Fraunhofer Institute for Manufacturing Technology and Advanced Materials (IFAM) reports that rising electrification and automation trends in automotive production have necessitated advanced fluid-based cooling systems for battery cell formation and motor assembly.

France is a key player. The country's industrial diversity, particularly in pharmaceuticals, aerospace, and food processing, contributes significantly to its demand for high-performance thermal fluids. Also, many pharmaceutical laboratories in Lyon and Paris rely on synthetic and glycol-based fluids for controlled drying and sterilization processes. In addition, the rise of biorefineries and waste-to-energy projects has led to increased usage of heat transfer fluids in organic Rankine cycle (ORC) systems. Companies have introduced proprietary fluid formulations tailored for high-efficiency thermal cycles.

Italy holds a significant position in the market. The country’s extensive presence of small and mid-sized enterprises across the food processing, textile, and ceramics industries drives consistent demand for heat transfer fluids. Like, mold heating and drying applications in plastics and polymer production are major contributors to fluid consumption. In addition, Italy has emerged as a leader in concentrated solar power (CSP) applications in Southern Europe, with several pilot plants integrating synthetic heat transfer oils for thermal storage. The Italian Energy and Environment Agency (IEFE) reports that recent updates to industrial energy efficiency regulations have prompted companies to upgrade fluid systems to reduce downtime and maintenance costs. Manufacturers such as Eni and Saipem have developed specialized formulations for high-temperature applications in refineries and cogeneration plants.

United Kingdom contributed notably in 2024. The UK’s industrial sector, although smaller in scale compared to continental Europe, plays a crucial role in pharmaceuticals, aerospace, and precision engineering—industries that require tightly controlled thermal environments. Like, the pharmaceutical industry consumes a considerable portion of heat transfer fluids for tablet coating, freeze-drying, and sterilization processes. Moreover, the growth of electric vehicle and battery manufacturing hubs in regions like Coventry and Wolverhampton has also boosted demand for fluids used in electrode drying and battery pack testing. While Brexit-related supply chain disruptions initially affected raw material availability, recent stabilization measures have allowed the UK market to maintain steady growth within the European framework.

Spain’s prowess in concentrated solar power (CSP) and agro-industrial activities makes it a key consumer of thermal fluids. According to the Spanish Association of Concentrated Solar Power (ProtermoSolar), Spain hosts more than 2 GW of CSP capacity, representing nearly half of the EU’s total installed base. These plants operate with synthetic heat transfer oils that circulate through solar fields to capture and store thermal energy efficiently. Additionally, the rise of biogas and biomass plants has increased the need for thermally resistant fluids in anaerobic digestion and waste heat recovery systems. With continued investment in renewable energy and industrial modernization, Spain is reinforcing its position as a strong regional player in the heat transfer fluid market.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe heat transfer fluids market profiled in this report are Arkema S.A., BASF SE, Chevron Corporation, Clariant AG, Dalian Richfortune Chemicals Co. Ltd., Dow Inc., Dynalene Inc., Eastman Chemical Company, Exxon Mobil Corporation, Hindustan Petroleum Corporation Ltd. (Oil and Natural Gas Corporation), Indian Oil Corporation Ltd., Phillips 66 Company, Radco Industries Inc., Shell plc, TotalEnergies SE, and Others.

TOP LEADING PLAYERS IN THE MARKET

One of the leading players in the Europe heat transfer fluid market is Shell plc. The company has a strong presence across multiple industrial sectors, offering a comprehensive portfolio of high-performance synthetic and mineral-based heat transfer fluids tailored for demanding applications. Shell’s focus on innovation and sustainability has led to the development of long-lasting, thermally stable products that cater to industries such as chemicals, food processing, and renewable energy. Its technical expertise and global distribution network make it a preferred supplier across Europe.

Another key player is TotalEnergies SE, which plays a significant role in shaping the European heat transfer fluid landscape. The company emphasizes formulation excellence and environmental responsibility, offering a range of bio-based and synthetic heat transfer fluids designed to meet evolving regulatory standards. TotalEnergies collaborates closely with industrial partners to deliver customized thermal management solutions, particularly in pharmaceuticals and clean energy applications. Their commitment to R&D ensures continuous improvement in product performance and safety.

BP plc is also a major contributor to the Europe heat transfer fluid market. Known for its advanced lubricants and process fluids, BP delivers specialized heat transfer solutions optimized for efficiency and durability. The company supports diverse sectors including manufacturing, power generation, and district heating by providing fluids that enhance system reliability while reducing environmental impact. BP’s strategic partnerships and investment in sustainable technologies position it strongly within the regional market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

A primary strategy employed by key players in the Europe heat transfer fluid market is product innovation and formulation advancement. Companies are continuously developing next-generation fluids that offer enhanced thermal stability, longer service life, and reduced environmental impact. These efforts align with increasing regulatory pressure and customer demand for sustainable, low-toxicity alternatives. By investing in research and development, manufacturers ensure their products remain competitive in performance and compliance.

Another crucial approach is strategic collaborations and partnerships with industrial end-users. Leading companies work closely with chemical, pharmaceutical, and renewable energy firms to tailor fluid formulations to specific operational requirements. These partnerships not only improve integration and efficiency but also foster long-term customer relationships, ensuring consistent demand and feedback-driven product enhancements.

Lastly, expanding sustainable product portfolios and promoting circular economy principles is a growing priority. Market participants are emphasizing eco-friendly offerings such as biodegradable ester-based fluids and synthetic alternatives that reduce carbon footprints. This shift is driven by both regulatory mandates and corporate sustainability goals, positioning environmentally responsible heat transfer fluids as a key growth driver in the European market.

COMPETITION OVERVIEW

The competition in the Europe heat transfer fluid market is marked by a convergence of established multinational corporations and regionally focused specialty suppliers striving to capture market share through differentiation in product performance, sustainability, and technical support. As industries increasingly prioritize energy efficiency and environmental compliance, manufacturers are under pressure to innovate beyond conventional fluid formulations. The market remains highly fragmented, with a mix of large oil and gas majors, specialty chemical firms, and niche players each catering to distinct application areas. Product differentiation is primarily achieved through thermal stability, oxidation resistance, and compatibility with emerging technologies such as electric vehicle manufacturing and renewable energy systems. Additionally, the growing emphasis on biodegradability and low toxicity is reshaping product development strategies, pushing companies to invest in green chemistry and alternative feedstocks. While major players leverage their extensive distribution networks and brand recognition, smaller firms are focusing on agile R&D and localized customer engagement to maintain relevance. Overall, the European heat transfer fluid market is dynamic and evolving, shaped by technological advancements, regulatory shifts, and the broader transition toward sustainable industrial practices.

RECENT MARKET DEVELOPMENTS

- In February 2024, Shell plc launched a new line of fully synthetic heat transfer fluids specifically formulated for high-temperature renewable energy applications. This product introduction was aimed at addressing the rising demand for thermally stable and long-lasting fluids in concentrated solar power and biomass plants across Southern Europe.

- In May 2024, TotalEnergies SE expanded its production capacity at a facility in France dedicated to manufacturing biobased heat transfer fluids. The expansion was designed to meet increasing market demand for sustainable thermal management solutions aligned with EU Green Deal objectives and circular economy initiatives.

- In July 2024, BP plc formed a strategic partnership with a German engineering firm specializing in industrial heat recovery systems. This collaboration was intended to integrate BP’s high-performance heat transfer fluids into next-generation thermal loops, enhancing system efficiency and reducing maintenance cycles for industrial clients.

- In September 2024, Lubrizol Corporation, a key supplier in the heat transfer sector, acquired a specialty additive manufacturer based in Italy. This acquisition was aimed at strengthening Lubrizol’s formulation capabilities to develop advanced heat transfer fluids with superior oxidation resistance and thermal endurance.

- In November 2024, Fuchs Petrolub AG introduced a digital monitoring platform for heat transfer fluids used in industrial settings. The platform enables real-time fluid condition tracking and predictive maintenance, helping customers optimize performance, extend service intervals, and reduce downtime across critical operations.

MARKET SEGMENTATION

This Europe heat transfer fluids market research report is segmented and sub-segmented into the following categories.

By Product Type

- Mineral Oils

- Synthetic Fluids

- Biobased HTFs

- Glycols

- Others

By End User Industry

- Chemicals and Petrochemicals

- Oil and Gas

- Food and Beverages

- Pharmaceutical

- Renewable Energy

- Automotive

- HVAC and Refrigeration

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate of the Europe heat transfer fluids market?

The Europe heat transfer fluids market is expected to grow at a CAGR of 5.3% from 2025 to 2033.

2. Which industries contribute to the demand for the Europe heat transfer fluids market?

The Europe heat transfer fluids market is driven by industries such as chemicals, oil & gas, food processing, and renewable energy.

3. What factors are driving the Europe heat transfer fluids market?

The Europe heat transfer fluids market is growing due to increasing industrial applications, renewable energy expansion, and advancements in biobased fluids.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com