Europe Hyperscale Data Center Market Size, Share, Trends & Growth Forecast Report By Power Capacity (10–50 MW, 50–100 MW, Above 101 MW), IT Infrastructure (Server, Storage, Network), Electrical Infrastructure (PDUs, UPS Systems), Mechanical Infrastructure (Cooling Systems, Rack), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Hyperscale Data Center Market Size

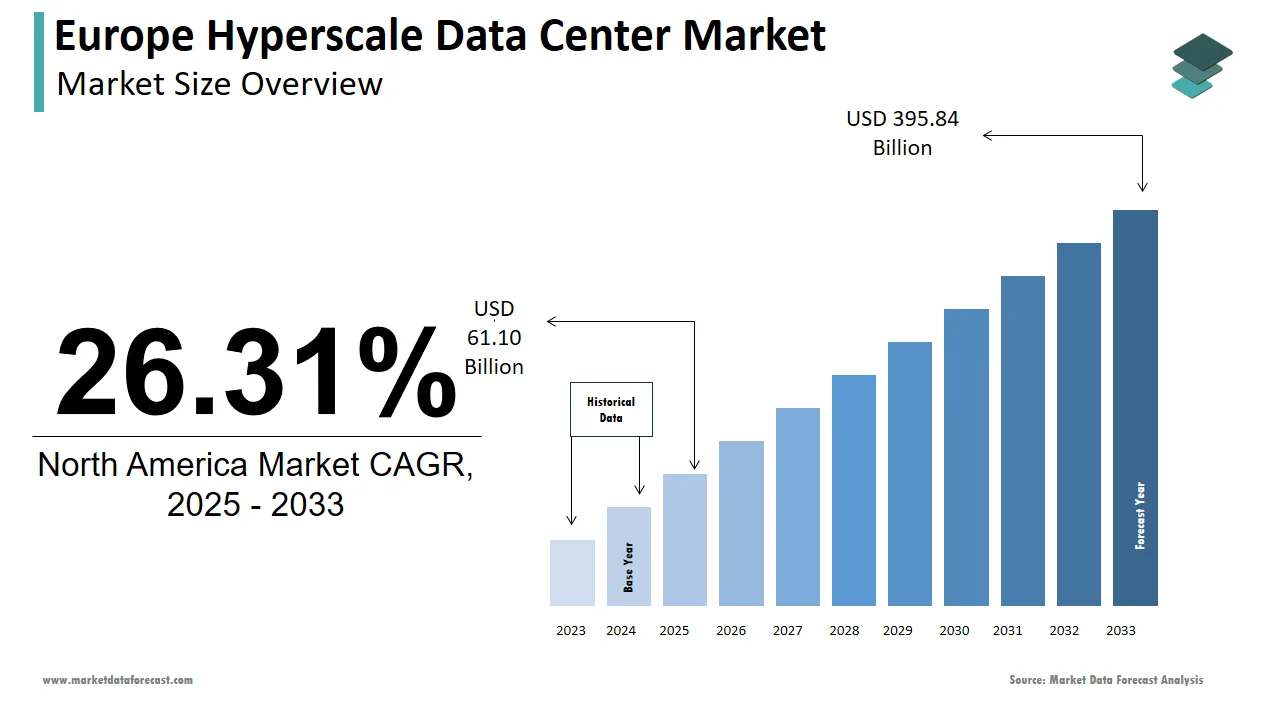

The hyperscale data center market size in Europe was valued at USD 48.37 billion in 2024. The European market is estimated to be worth USD 395.84 billion by 2033 from USD 61.10 billion in 2025, growing at a CAGR of 26.31% from 2025 to 2033.

The Europe hyperscale data center market is witnessing robust expansion, driven by the proliferation of cloud services, IoT, and AI technologies. The market's growth is further fueled by stringent data sovereignty regulations, compelling enterprises to localize their data storage infrastructure. According to Synergy Research Group, investments in hyperscale projects surged by 18% year-on-year in 2022, reflecting heightened demand for scalable computing resources. This has prompted operators to adopt renewable energy solutions, with Nordic countries emerging as preferred locations due to their abundant green energy sources. As per a survey conducted by BroadGroup, over 60% of hyperscale operators are prioritizing sustainability in facility design. Additionally, the rise of edge computing is reshaping the market is creating opportunities for decentralized data architectures to support low-latency applications across urban centers.

MARKET DRIVERS

Surge in Cloud Computing and Digital Transformation Initiatives

The exponential growth of cloud computing stands as a pivotal driver for the Europe hyperscale data center market. Enterprises across industries are transitioning to cloud-based solutions to enhance operational efficiency, scalability, and cost-effectiveness. This surge is further amplified by the adoption of hybrid and multi-cloud strategies, which necessitate robust infrastructure capable of handling massive data volumes. Hyperscale facilities, with their ability to support high-density workloads, have become indispensable for cloud service providers like AWS, Microsoft Azure, and Google Cloud, which collectively command over 60% of the European cloud market share as per Canalys. Additionally, the pandemic-induced acceleration of digital transformation has led to a 30% increase in demand for cloud storage and compute resources since 2020. The need for real-time data processing, coupled with advancements in AI and machine learning, has further intensified reliance on hyperscale facilities.

Stringent Data Privacy Regulations and Localization Mandates

Europe’s stringent data protection laws, particularly the General Data Protection Regulation (GDPR), have significantly influenced the hyperscale data center market. GDPR mandates that personal data of EU citizens must be stored and processed within the region, compelling global enterprises to establish localized data infrastructure. This regulatory push has driven hyperscale operators to expand their footprint, with Germany, Ireland, and the Netherlands witnessing a 40% increase in facility construction between 2020 and 2022, as reported by Datacenter Dynamics. Furthermore, the Schrems II ruling has heightened scrutiny on cross-border data transfers, prompting organizations to adopt data localization strategies. These developments have created a fertile environment for hyperscale data centers, as they offer the scale and security required to meet regulatory demands. With an estimated 80% of European enterprises planning to enhance their data sovereignty measures by 2025, as per PwC, the demand for localized hyperscale facilities is expected to remain strong, reinforcing their role as critical enablers of compliant digital operations.

MARKET RESTRAINTS

Escalating Energy Consumption and Sustainability Challenges

The Europe hyperscale data center market faces significant headwinds due to its rising energy consumption, which has become a contentious issue amid growing environmental concerns. Hyperscale facilities are energy-intensive, with cooling systems and high-performance computing equipment accounting for nearly 40% of operational costs, according to the European Environment Agency. In 2022, data centers across Europe consumed approximately 100 terawatt-hours (TWh) of electricity, equivalent to the annual energy usage of Belgium, as per the International Energy Agency. This heavy reliance on power grids has drawn criticism from environmental groups and policymakers, especially in regions where renewable energy adoption lags behind demand. While operators are increasingly turning to green energy solutions, only 30% of hyperscale facilities currently source their energy entirely from renewables, as per the Climate Neutral Data Centre Pact. The challenge is compounded by regulatory pressures, with countries like France and Spain imposing stricter carbon emission targets on large-scale infrastructure projects.

High Capital Expenditure and Economic Uncertainty

Another major restraint is the substantial capital expenditure required to build and maintain hyperscale data centers, which often exceeds $1 billion per facility, according to Deloitte. This financial burden is exacerbated by economic uncertainties, including inflationary pressures and fluctuating interest rates, which have tightened access to funding for large-scale projects. Additionally, geopolitical tensions and supply chain disruptions have delayed critical imports of IT hardware, further complicating project timelines. According to McKinsey, over 60% of hyperscale operators cite supply chain volatility as a key concern impacting expansion plans. Furthermore, the economic slowdown in Europe has led businesses to reassess their IT budgets, resulting in reduced demand for premium data center services.

MARKET OPPORTUNITES

Expansion of Edge Computing and 5G Networks

The integration of edge computing with hyperscale data centers presents a transformative opportunity for the Europe hyperscale data center market, driven by the rapid rollout of 5G networks. This surge in demand for real-time data processing has created a need for distributed infrastructure, where hyperscale facilities act as central hubs supporting localized edge nodes. A study by IDC projects that edge-related spending in Europe will reach $12 billion by 2024, with hyperscale operators playing a pivotal role in bridging centralized and decentralized architectures. Furthermore, the European Commission’s Digital Decade initiative aims to achieve 100% 5G coverage in urban areas by 2030, further amplifying this opportunity.

Adoption of Renewable Energy and Green Technologies

The push toward sustainability offers another significant growth avenue for the Europe hyperscale data center market, as operators increasingly adopt renewable energy and green technologies to align with regional climate goals. The European Green Deal mandates a 55% reduction in carbon emissions by 2030 is compelling industries to prioritize eco-friendly practices. According to BloombergNEF, renewable energy adoption in European data centers has grown by 45% since 2020, with companies like Google and Amazon leading the charge through power purchase agreements (PPAs). Hyperscale facilities are uniquely positioned to capitalize on this trend, as their scale allows for cost-effective implementation of innovations like liquid cooling, AI-driven energy management systems, and modular designs.

MARKET CHALLENGES

Regulatory Fragmentation and Compliance Complexity

The Europe hyperscale data center market faces significant challenges due to the fragmented regulatory landscape across the continent, which complicates compliance efforts for operators. Each European Union member state interprets and enforces regulations such as GDPR differently, creating inconsistencies in data governance requirements. Additionally, emerging regulations like the EU’s Digital Services Act (DSA) and the proposed AI Act impose stricter oversight on data processing activities, requiring hyperscale facilities to invest heavily in advanced security and monitoring systems. The complexity is further amplified by cross-border data transfer restrictions following the Schrems II ruling, which has led to an estimated 25% increase in operational costs for multinational operators, as per PwC. These regulatory hurdles not only slow down project timelines but also deter smaller players from entering the market.

Land Scarcity and Urbanization Pressures in Key Markets

Land scarcity in densely populated urban areas poses another critical challenge for the Europe hyperscale data center market in key markets like London, Frankfurt, and Paris. According to Knight Frank, land prices in these cities have surged by an average of 30% over the past five years, making it prohibitively expensive to acquire space for large-scale facilities. This issue is compounded by competing demands for real estate from housing and commercial sectors, driven by rapid urbanization. The European Environment Agency estimates that urban areas in Europe will expand by 7% by 2030, further reducing available land for industrial use. Moreover, zoning laws and community opposition to data center construction, often citing environmental concerns, add layers of difficulty to site selection. This scarcity forces operators to explore remote locations, which, while potentially more affordable that may lack the necessary infrastructure or connectivity to support hyperscale operations effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

26.31% |

|

Segments Covered |

By Power Capacity, IT Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

AWS (US), Google (US), Microsoft (US), Oracle (US), IBM (US), HPE (US), Arista Network (US), Dell (US), Tencent (China), Alibaba (China), Cisco (US), NVIDIA (US), Vertiv (US), Nlyte Software (US), ABB (US), Quanta Cloud Technology (US), AdaniConnex (India), Eaton (Ireland), Colt Data Center Services (UK), Rittal (Germany), Penguine Solution (US), Infinidat (Israel), Energy Vault (Switzerland), and Others. |

SEGMENT ANALYSIS

By Power Capacity Insights

The 50-100 MW segment dominated the Europe hyperscale data center market with an expected share of 45.3% during the forecast period. The growth of the segment is driven by the segment's ability to strike an optimal balance between scalability and operational efficiency, catering to the growing demand for cloud services and enterprise-grade applications. Hyperscale facilities in this range are particularly favored by large tech companies like Google, Microsoft, and Amazon Web Services, which collectively account for over 60% of the region’s hyperscale capacity, according to Synergy Research Group. These operators require robust infrastructure capable of supporting high-density workloads while maintaining cost-effectiveness. Facilities within the 50-100 MW range are often designed with modular architectures that allow for incremental expansion that is reducing upfront capital expenditure. According to BloombergNEF, such designs have led to a 25% reduction in energy consumption compared to smaller facilities.

The above 101 MW segment is likely to grow with an anticipated CAGR of 18.5% during the forecast period. This rapid growth is fueled by the increasing adoption of AI, machine learning, and big data analytics, which demand massive computational power and storage capabilities. For instance, the International Data Corporation (IDC) estimates that global data creation will grow to 175 zettabytes by 2025, with Europe accounting for a significant share of this volume. Such exponential data growth necessitates facilities with higher power capacities to handle intensive workloads efficiently. Hyperscale operators are consolidating their operations into fewer but larger facilities to achieve economies of scale. According to Eurostat, centralized facilities reduce operational costs by up to 40% by making them highly attractive for enterprises seeking cost optimization. Furthermore, the push toward sustainability has incentivized operators to build larger facilities in regions with abundant renewable energy sources. For example, Nordic countries like Sweden and Norway have seen a 50% increase in hyperscale projects exceeding 101 MW since 2020, as reported by the Climate Neutral Data Centre Pact.

By IT Infrastructure Insights

The servers segment dominated the Europe hyperscale data center market with an estimated share of 55.4% in 2024. The servers play in supporting the computational needs of cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale facilities rely heavily on high-performance servers to handle workloads generated by enterprise applications, streaming services, and IoT devices. Another key factor propelling the dominance of servers is the increasing adoption of AI-driven technologies. According to McKinsey, AI-related workloads are expected to grow by 30% annually across Europe by necessitating advanced server architectures equipped with GPUs and TPUs. Additionally, the rise of edge computing has further fueled server demand, as hyperscale operators deploy edge nodes to process real-time data closer to end-users.

The storage segment is the fastest-growing category within the Europe hyperscale data center market, with a projected CAGR of 21.3% during the forecast period, as per Mordor Intelligence. This rapid expansion is driven by the exponential growth of unstructured data, including video content, social media interactions, and IoT-generated information. According to the International Data Corporation (IDC), Europe’s data storage requirements are expected to increase by 45% annually through 2025, outpacing other regions globally. Hyperscale facilities are increasingly investing in scalable storage solutions to accommodate this surge, particularly in sectors like healthcare, finance, and e-commerce.

Another significant driver is the adoption of all-flash storage systems, which offer superior performance and energy efficiency compared to traditional hard disk drives (HDDs). BroadGroup reports that flash storage adoption in Europe has grown by 60% since 2020, driven by its ability to reduce latency and enhance data retrieval speeds. Additionally, regulatory mandates such as GDPR have amplified the need for secure and compliant data storage, prompting hyperscale operators to deploy advanced encryption and backup solutions. As per Eurostat, compliance-driven storage investments account for nearly 35% of total IT infrastructure spending in Europe.

By Electrical Infrastructure Insights

The UPS (Uninterruptible Power Supply) systems segment was the largest and held a prominent share of the Europe hyperscale data center market in 2024. The growth of the segment is driven by the critical need for power reliability in hyperscale facilities, where even a few seconds of downtime can result in significant financial losses and reputational damage. Another factor contributing to the dominance of UPS systems is the increasing adoption of modular and scalable designs. These systems allow operators to efficiently manage power distribution while accommodating future capacity expansions. Additionally, stringent energy efficiency regulations, such as the EU’s Energy Efficiency Directive, have incentivized operators to invest in advanced UPS technologies like lithium-ion battery systems, which offer longer lifespans and faster charging capabilities.

The PDU (Power Distribution Unit) segment is ascribed to grow with a fastest CAGR of 22.8% during the forecast period. This rapid growth is fueled by the increasing complexity of power management in hyperscale facilities, which require precise monitoring and distribution of electricity to thousands of IT devices. As per a report by Synergy Research Group, the average power density of racks in European hyperscale data centers has increased by 25% since 2020.

Another key driver is the integration of smart PDUs with IoT-enabled sensors and analytics platforms. These intelligent systems provide real-time insights into power consumption, enabling operators to optimize energy efficiency and reduce operational costs. According to Statista, smart PDU adoption in Europe has surged by 50% over the past three years, driven by their ability to achieve energy savings of up to 20%. Furthermore, the rise of edge computing has amplified demand for compact and modular PDUs, which can be deployed in smaller, decentralized facilities

By Mechanical Infrastructure Insights

The cooling systems segment was accounted in holding a dominant share of the Europe hyperscale data center market in 2024. The growth of the market can be attributed to the escalating energy demands of hyperscale facilities, where cooling accounts for nearly 40% of total power consumption. According to the European Environment Agency, data centers across Europe consumed over 100 terawatt-hours (TWh) of electricity in 2022, with cooling systems being a significant contributor.

A key factor propelling the growth of cooling systems is the adoption of innovative technologies like liquid cooling and free-air cooling. Liquid cooling, in particular, has gained traction due to its ability to reduce energy usage by up to 30%, as per Gartner. Additionally, the push for sustainability has led operators to invest in renewable-powered cooling systems, particularly in Nordic countries, where natural cold air is leveraged to minimize energy costs. According to the Climate Neutral Data Centre Pact, over 70% of new hyperscale projects in Northern Europe now incorporate eco-friendly cooling solutions.

The fire suppression systems segment is likely to gain huge traction with a CAGR of 19.5% during the forecast period. This rapid expansion is fueled by the increasing complexity and scale of hyperscale data centers, which require robust safety measures to mitigate risks associated with high-density computing environments. As per the International Fire Protection Association, fire-related incidents in European data centers have risen by 15% over the past five years. Another significant driver is the adoption of clean agent fire suppression systems, which are non-toxic and do not damage sensitive IT equipment. According to Eurostat, investments in sustainable fire suppression technologies have grown by 30% annually since 2021.

COUNTRY LEVEL ANALYSIS

Germany was the top performer in the Europe hyperscale data center market with a share of 30.2% in 2024. The country’s strategic position in Central Europe, coupled with its robust digital infrastructure that makes it a preferred destination for hyperscale investments. Frankfurt, one of the world’s leading data center hubs, hosts over 40% of Germany’s hyperscale facilities, as per BroadGroup. This dominance is driven by the city’s proximity to key fiber-optic networks and its role as a gateway to Eastern Europe. Another critical factor is Germany’s strong industrial base, which increasingly relies on cloud computing and IoT technologies. Additionally, the government’s push for Industry 4.0 has accelerated the adoption of AI and big data analytics is fueling hyperscale growth. According to a report by Eurostat, renewable energy adoption in German data centers has grown by 30% since 2020, aligning with national sustainability goals.

The UK hyperscale data center market is likely to experience a CAGR of 13.5% during the forecast period. London’s status as a global financial hub and its advanced telecommunications infrastructure have cemented its position as a hotspot for hyperscale development. According to Knight Frank, the UK accounts for over 50% of all colocation data center investments in Western Europe, driven by the presence of major cloud providers like AWS, Microsoft Azure, and Google Cloud. Additionally, Brexit-related regulatory changes have incentivized operators to localize their infrastructure, spurring new hyperscale projects. According to the Climate Neutral Data Centre Pact, over 60% of UK-based facilities now use renewable energy is reflecting a commitment to sustainability.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe hyperscale data center market profiled in this report are AWS (US), Google (US), Microsoft (US), Oracle (US), IBM (US), HPE (US), Arista Network (US), Dell (US), Tencent (China), Alibaba (China), Cisco (US), NVIDIA (US), Vertiv (US), Nlyte Software (US), ABB (US), Quanta Cloud Technology (US), AdaniConnex (India), Eaton (Ireland), Colt Data Center Services (UK), Rittal (Germany), Penguine Solution (US), Infinidat (Israel), Energy Vault (Switzerland), and Others.

TOP LEADING PLAYERS IN THE MARKET

Equinix

Equinix stands as a global leader in the Europe hyperscale data center market, renowned for its extensive network of interconnected facilities. The company operates over 40 data centers across key European cities like Frankfurt, London, and Amsterdam, providing a robust platform for cloud, IT, and financial services. Equinix’s emphasis on interconnection has made it a preferred partner for enterprises seeking seamless integration with global ecosystems. According to Synergy Research Group, Equinix’s European operations contribute significantly to its global revenue, accounting for nearly 35% of its total income. By leveraging renewable energy and sustainable designs, Equinix has positioned itself as a pioneer in eco-friendly infrastructure by aligning with Europe’s stringent environmental regulations.

Digital Realty Trust

Digital Realty Trust is another dominant player in the Europe hyperscale data center market, with a strong focus on scalable and flexible solutions. The company has expanded its footprint through strategic acquisitions, such as the purchase of Interxion, which bolstered its presence in key markets like Germany and the Netherlands. Digital Realty’s PlatformDIGITAL® solution enables enterprises to deploy distributed IT architectures while ensuring low-latency connectivity. Its commitment to sustainability is evident in its adoption of renewable energy, with over 70% of its facilities powered by green sources.

NTT Ltd.

NTT Ltd. has emerged as a formidable player in the Europe hyperscale data center market by offering cutting-edge infrastructure tailored to enterprise needs. With facilities in major hubs like London, Madrid, and Frankfurt, NTT provides secure and high-performance environments for hyperscale workloads. The company’s Global Data Centers division focuses on innovation, particularly in AI-driven energy management systems, which reduce operational costs by up to 20%, according to BroadGroup. NTT’s contributions extend globally, with its European operations serving as a launchpad for emerging technologies like edge computing and IoT. Its ability to deliver scalable solutions while adhering to regional compliance standards has solidified its reputation as a trusted hyperscale provider.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Acquisitions and Partnerships

Key players in the Europe hyperscale data center market are increasingly leveraging acquisitions and partnerships to expand their footprint and enhance service offerings. For instance, Digital Realty Trust’s acquisition of Interxion significantly bolstered its presence in Europe, granting access to high-demand markets like Frankfurt and Amsterdam. According to Datacenter Dynamics, such mergers have enabled companies to consolidate resources, reduce competition, and tap into new customer bases. Additionally, partnerships with cloud service providers like AWS and Microsoft Azure have allowed operators to offer integrated solutions that cater to enterprise demands for hybrid cloud environments. These collaborations not only strengthen market positioning but also drive innovation by combining expertise in IT infrastructure and connectivity.

Investment in Sustainable and Energy-Efficient Solutions

Sustainability has become a cornerstone strategy for hyperscale operators in Europe, driven by stringent environmental regulations and growing corporate responsibility goals. Equinix, for example, has committed to achieving 100% renewable energy usage across its European facilities, as reported by the Climate Neutral Data Centre Pact. This focus on green energy adoption includes deploying advanced cooling systems, such as liquid cooling and free-air cooling, which reduce power consumption by up to 30%. Similarly, NTT Ltd. has invested in AI-driven energy management platforms to optimize resource utilization.

Expansion into Emerging Markets and Edge Computing

To meet the rising demand for low-latency applications and decentralized infrastructure, key players are expanding into emerging markets and investing in edge computing capabilities. According to BroadGroup, hyperscale operators like Equinix and Digital Realty are establishing facilities in underserved regions such as Eastern Europe and Turkey, where digital transformation is accelerating. Simultaneously, they are deploying edge data centers closer to urban centers to support real-time processing for IoT, AI, and 5G applications. This dual strategy allows companies to address diverse client needs while future-proofing their operations.

COMPETITION OVERVIEW

The Europe hyperscale data center market is characterized by intense competition, with key players striving to expand their footprint, enhance sustainability, and cater to rising enterprise demands for scalable infrastructure. Major operators like Equinix, Digital Realty Trust, and NTT Ltd. dominate the landscape, leveraging strategic acquisitions, partnerships, and investments in green technologies to solidify their positions. The market is also witnessing increased activity from regional players and new entrants, intensifying rivalry. Additionally, stringent regulatory frameworks, such as GDPR and the EU’s climate goals, have pushed companies to prioritize renewable energy and compliance-driven solutions. The competitive dynamics are further shaped by the race to establish facilities in emerging markets like Eastern Europe and Nordic countries, which offer cost advantages and access to renewable resources.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In March 2023, Equinix announced the expansion of its Frankfurt campus with a new hyperscale facility powered entirely by renewable energy. This move strengthened its dominance in sustainable data center operations.

- In June 2023, Digital Realty Trust partnered with AWS to offer direct cloud connectivity in its Amsterdam data centers. This collaboration enhanced its appeal to enterprises seeking hybrid cloud solutions.

- In September 2023, NTT Ltd. launched a state-of-the-art edge data center in London to support 5G and IoT applications. This initiative positioned NTT as a key player in low-latency infrastructure.

- In November 2023, Interxion (a subsidiary of Digital Realty) acquired a site in Warsaw, Poland, to develop a new hyperscale facility. This acquisition expanded its presence in Central and Eastern Europe.

- In January 2024, Equinix completed the acquisition of Maincubes, a Dutch data center provider. This deal bolstered its network of interconnected facilities across Europe, enhancing its global reach.

MARKET SEGMENTATION

This Europe hyperscale data center market research report is segmented and sub-segmented into the following categories.

By Power Capacity

- 10–50 MW

- 50–100 MW

- Above 101 MW

By IT Infrastructure

- Server

- Storage

- Network

By Electrical Infrastructure

- PDUs

- UPS Systems

By Mechanical Infrastructure

- Cooling Systems

- Rack

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the Europe hyperscale data center market growth?

Growing cloud adoption and digital transformation are driving the Europe hyperscale data center market.

2. Which industry is a major user of hyperscale data centers in Europe?

The IT and telecom sector is a major user in the Europe hyperscale data center market.

3. What is a key trend in the Europe hyperscale data center market?

Increasing investments in green data centers is a key trend in the Europe hyperscale data center market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com