Europe Intraocular Lens Market Size, Share, Trends & Growth Forecast Report By Material (Polymethylmethacrylate (PMMA), Silicone, Hydrophobic Acrylic), Type, End User & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Intraocular Lens Market Size

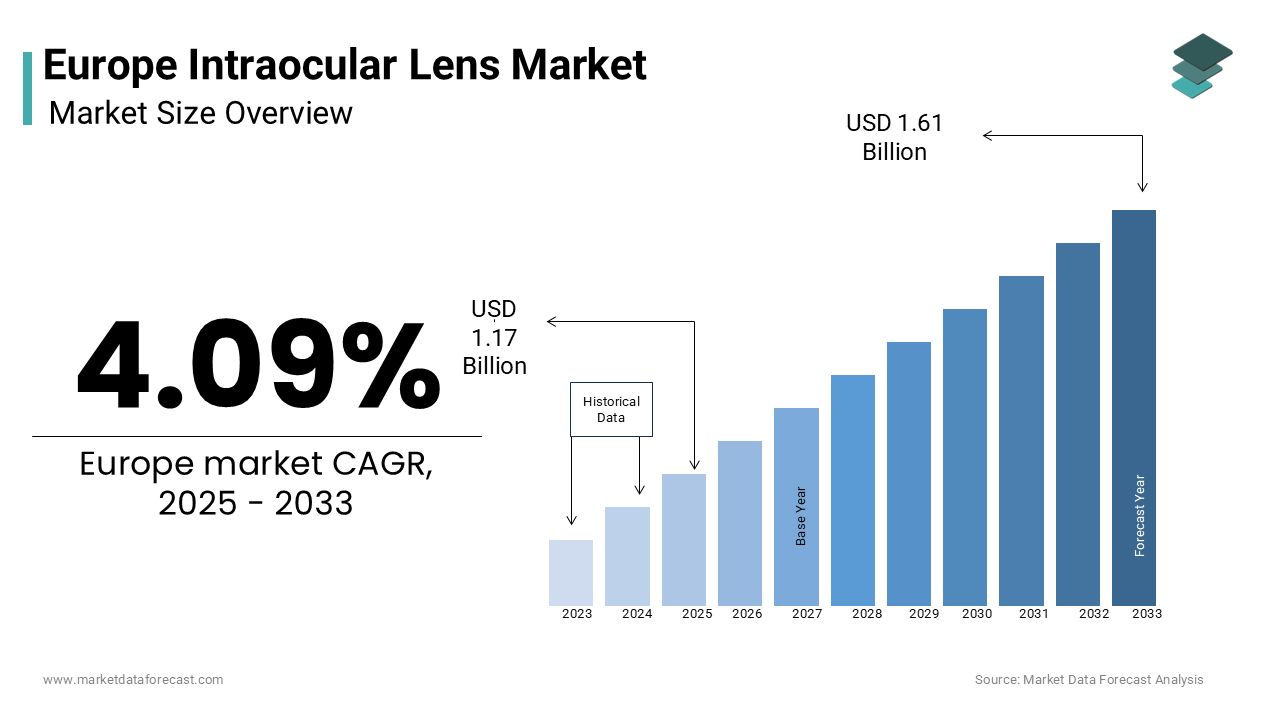

The intraocular lens market size in Europe was valued at USD 1.12 billion in 2024. The European market is estimated to be valued at USD 1.17 billion in 2025 and USD 1.61 billion by 2033, forecasted to grow at a steady CAGR of 4.09% between 2025 to 2033.

MARKET DRIVERS

Y-O-Y growth in the incidence of cataracts, particularly in diabetic people, is predicted to increase the enhanced superior intraocular lens, which is estimated to drive market growth for the European IOL market. An estimated 34 million people in the European Union (EU) are strained by age-related macular degeneration, as reported by EURETINA in 2017. Another source stated that according to the European Society of Retinal Specialists, the occurrence rate of age-related macular degeneration accounted for nearly 32.8% in Germany in 2017. The number of eye clinics and hospitals in European countries is significantly increasing, along with the patient population getting affected by eye-related disorders such as cataracts, blindness, or diabetic retinopathy. Therefore, the factor mentioned above is expected to return massive fuel to the intraocular lens market in the European region.

MARKET RESTRAINTS

The costs associated with the intraocular lens are expensive and not affordable to everyone in the European population, which is expected to hamper the market growth slightly. Also, the poor reimbursement policies present in this region and the deficit of proper coverage for premium IOLs are likely to disturb the growth rate of the European IOL market.

REGIONAL ANALYSIS

Europe is assumed to be a developed market and is anticipated to witness significant growth in the forecast period. The European market is driven by factors such as the growing number of ophthalmic disorders and an increase in the aging population in European countries. Germany is one of the leading regions in the European IOL market. The appearance of improved healthcare amenities and increasing new product launches propel the market growth. The government's growing number of steps in eradicating blindness and regular increase of cataracts, particularly in aged people, is likely to boost the region's IOL market growth over the assessment period. In addition, the companies are introducing novel and enhanced premium IOLs for treating patients suffering from eye disorders. For example, in May 2020, Bausch +Lomb invented its first extended depth of IOL, LuxSmart, in Europe. Moreover, advanced technologies for treating people with eye ailments are influencing the IOL market growth.

KEY MARKET PLAYERS

Some of the notable companies operating in the Europe intraocular lens market profiled in the report are Johnson & Johnson, Valeant, Carl Zeiss Meditec AG, Rayner, Alcon, Inc. (a division of Novartis AG), EyeKon Medical, Inc., Lenstec, Inc., HumanOptics AG, STAAR Surgical, PhysIOL s.a., Calhoun Vision Center, and Oculentis GmBH.

MARKET SEGMENTATION

This research report on the Europe intraocular lens market is segmented and sub-segmented into the following categories.

By Material

- Polymethylmethacrylate (PMMA)

- Silicone

- Hydrophobic Acrylic

By Type

- Monofocal Intraocular Lens

- Premium Intraocular Lens

- Toric Intraocular Lens

- Multifocal Intraocular Lens

- Accommodating Intraocular Lens

By End User

- Hospitals

- Ophthalmology Clinics

- Eye Research Institutes

- Ambulatory Surgical Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the size of the Europe intraocular lens market?

The European intraocular lens market was worth USD 1.12 billion in 2024.

What are the factors driving the growth of the Europe intraocular lens market?

The growing aging population, increasing prevalence of cataracts, advancements in surgical techniques, and increasing demand for premium intraocular lenses are some of the major factors driving the intraocular lens market in Europe.

Who are the key players in the Europe intraocular lens market?

Alcon Inc., Carl Zeiss Meditec AG, Bausch & Lomb Inc., and Johnson & Johnson Vision are some of the notable companies in the European intraocular lens market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]