Europe Pasta Market Size, Share, Trends & Growth Forecast Report By Product Type (Dried, Chilled and Canned), Raw Material (Wheat and Gluten Free), Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis (2025 to 2033)

Europe Pasta Market Size

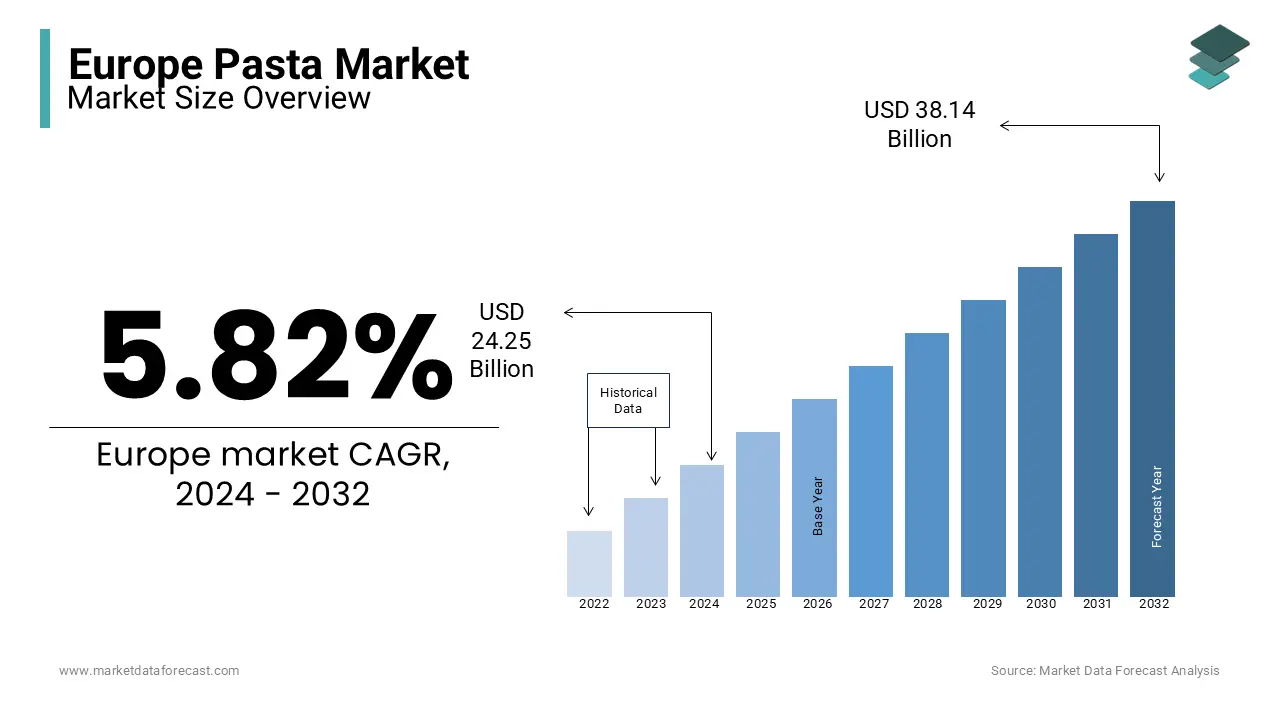

The pasta market size in Europe was estimated at USD 24.25 billion in 2024. The European market is expected to exhibit a CAGR of 5.82% from 2025 to 2033 and grow from USD 25.66 billion in 2025 to USD 40.35 billion by 2033.

Pasta holds a significant place in European cuisine, serving as both a cultural staple and a dietary mainstay. Its versatility and ease of preparation have cemented its status across the continent. Italy stands at the forefront of pasta consumption, with an average per capita intake of 23 kilograms annually. This figure underscores the deep-rooted tradition of pasta in Italian culture. Following Italy, Tunisia records a per capita consumption of 17 kilograms, while Germany's per capita consumption is 7.9 kilograms, highlighting regional variations in dietary preferences. In terms of production, Italy leads the European Union, producing 4.2 million tonnes of pasta in 2023, accounting for 68% of the EU's total pasta production. This dominance in production aligns with Italy's high domestic consumption and its role as a major exporter within Europe.

MARKET DRIVERS

Cultural Significance and Tradition

The historical roots of pasta in Europe, especially Italy, make it a culinary cornerstone. Italy leads global pasta consumption with an average per capita intake of 23 kilograms annually, while other countries like Germany and France have steadily increasing demand. The Mediterranean diet, celebrated for its health benefits, prominently features pasta, enhancing its cultural and nutritional appeal. Moreover, Italy produces 4.2 million tonnes of pasta annually, accounting for 68% of the EU's total production, solidifying its dominance. This deep cultural connection ensures that pasta remains a staple in European households, fueling consistent demand across all demographics.

Health and Wellness Trends

Growing awareness about health has driven demand for whole-grain, gluten-free, and protein-rich pasta varieties. Gluten-free pasta, supported by EU labeling laws, caters to nearly 5% of Europeans with gluten intolerance or celiac disease. Meanwhile, whole-grain pasta sales have surged by 7% year-on-year as consumers prioritize high-fiber, low-GI foods for better health. Innovations like lentil or chickpea-based pasta cater to vegans and fitness-conscious consumers. The trend reflects the European preference for healthier diets, making nutritional innovation a strong growth driver.

Convenience and Product Versatility

In fast-paced modern lifestyles, pasta's quick preparation appeals to European consumers. The rise of ready-to-cook pasta kits reflects the demand for hassle-free yet flavorful meals. As a versatile base, pasta adapts to various sauces and cuisines, ensuring widespread use. Retail expansions and online sales channels further boost accessibility, ensuring pasta remains a go-to choice for time-conscious and culinary-diverse households.

MARKET RESTRAINTS

Health Concerns Linked to Carbohydrate Consumption

The rising scrutiny of carbohydrate-heavy diets poses a restraint for the European pasta market. With growing awareness around conditions like obesity and diabetes, consumers are reducing their intake of refined carbs, including traditional pasta. According to Eurostat, over 53% of adults in Europe were classified as overweight in 2022, driving a shift toward low-carb or ketogenic diets. Although healthier pasta alternatives (e.g., whole-grain or protein-enriched) are gaining traction, the perception of pasta as calorie-dense has caused stagnation in demand for traditional variants. This evolving dietary preference challenges manufacturers to innovate while balancing consumer skepticism about pasta's nutritional value.

Rising Costs of Raw Materials

The volatility of wheat prices directly impacts pasta production costs, making affordability a concern. Europe imports significant quantities of durum wheat, and adverse weather patterns or geopolitical issues, such as the Russia-Ukraine conflict, have disrupted supplies, causing wheat prices to rise by 30–40% in recent years. This escalation strains manufacturers and retailers, potentially leading to higher product prices. Consequently, cost-sensitive consumers may switch to alternative staples or reduce discretionary spending on premium pasta varieties. This economic pressure underscores the industry's reliance on stable agricultural outputs and global trade dynamics to maintain market stability and growth.

SEGMENTAL ANALYSIS

By Product Type Insights

The dried segment led the market, accounting for 74.8% of the European market share in 2023 due to its practicality, affordability, and long shelf life. The versatility of dried pasta makes it an essential pantry staple, accommodating a variety of sauces, cooking methods, and cultural recipes. Furthermore, its wide availability across retail channels and cost-effectiveness compared to chilled or canned alternatives drive its demand. Countries like Italy, where per capita pasta consumption is among the highest globally, heavily rely on dried pasta, reinforcing its market leadership.

The chilled pasta is predicted to grow at the fastest CAGR of 6.14% over the forecast period. This growth is propelled by the increasing consumer preference for fresh and premium-quality food products. Chilled pasta offers superior taste and texture, aligning with the demand for fresh, minimally processed, and ready-to-cook meal solutions. The rise of refrigerated retail sections and the availability of gourmet options, such as stuffed ravioli and tagliatelle, further boosted its popularity. Additionally, its appeal among health-conscious and younger consumers seeking convenient yet fresh alternatives is driving its rapid expansion across European markets.

By Raw Material Insights

The wheat-based pasta segment dominated the market by capturing 85.6% of the European market share in 2023. The dominance of the wheat-based pasta segment is attributed to its traditional and widespread consumption, cost-effectiveness, and compatibility with diverse culinary applications. Durum wheat, prized for its high gluten content and elasticity, is the primary raw material for pasta production. Italy, the largest pasta producer in Europe, uses over 70% durum wheat in its manufacturing processes. Additionally, wheat-based pasta benefits from an established supply chain, affordability, and universal appeal, making it a staple in European diets and ensuring its leading position.

However, the gluten-free pasta segment is anticipated to be the fastest-growing segment and register a CAGR of 9.94% in the European market over the forecast period. This growth is driven by increasing awareness of gluten intolerance and celiac disease, which affects approximately 1% of the European population. Moreover, the rising adoption of gluten-free diets for perceived health benefits has broadened the consumer base. Gluten-free pasta, made from alternative ingredients like rice, corn, quinoa, and legumes, aligns with health and wellness trends. The European Union’s strict gluten-free labeling standards and a growing range of high-quality, flavorful gluten-free pasta options have further accelerated its demand, making it a key growth driver.

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the European pasta market in 2023 by capturing 61.7% of the regional market share in 2023. These outlets lead due to their widespread presence, comprehensive product range, and ability to offer competitive pricing. They provide consumers with a one-stop solution for grocery shopping, featuring both branded and private-label pasta options. Promotional activities, bulk discounts, and the inclusion of specialty products like organic and gluten-free pasta contribute to their appeal. Countries like Italy, Germany, and France heavily rely on supermarkets as their primary food shopping destination. Their ability to cater to diverse consumer preferences and ensure product visibility cements their leadership.

However, the online stores segment is growing rapidly and is predicted to witness the fastest CAGR of 10.8% over the forecast period. This rapid growth is fueled by the increasing adoption of e-commerce platforms and the convenience of home delivery. Online channels allow consumers access to a wider variety of pasta, including niche products like artisanal and specialty gluten-free options, which may not be readily available in physical stores. Additionally, the COVID-19 pandemic accelerated the shift to online shopping for groceries, including pasta. Subscription models and direct-to-consumer initiatives by manufacturers have further boosted this segment, highlighting its growing importance in catering to tech-savvy and convenience-focused consumers.

REGIONAL ANALYSIS

Italy dominated the pasta market in Europe and held 25.8% of the European pasta market share in 2023. Italy remains the epicenter of the pasta market in Europe due to its deep-rooted cultural and culinary heritage. Italians consume the highest per capita pasta globally, averaging 23 kilograms annually. The country also produces 68% of the EU’s pasta, with exports growing steadily. Key drivers include strong domestic demand, increasing global interest in authentic Italian pasta, and a flourishing artisanal pasta industry. Recent innovations include the rising availability of organic and gluten-free pasta to meet modern health trends. Events like World Pasta Day, held annually in Italy, continue to emphasize the cultural and economic significance of pasta production.

The UK is anticipated to register the fastest CAGR of 6.12% in the European market over the forecast period. The growth of the pasta market in the UK is driven by convenience, affordability, and the rise of Italian cuisine’s popularity. Post-pandemic, there has been a notable increase in home cooking, boosting pasta consumption. Gluten-free and plant-based pasta varieties are growing rapidly, catering to the health-conscious and vegan populations. Retailers like Tesco and Sainsbury’s dominate distribution, with online channels gaining prominence. A key recent trend includes expanding premium and ready-to-eat pasta lines. Additionally, initiatives to reduce packaging waste and introduce eco-friendly products align with the UK's increasing focus on sustainability.

Germany accounts for a notable share of the European pasta market and is estimated to register a CAGR of 4.54% over the forecast period. The pasta market in Germany thrives on its diverse, multicultural population and growing preference for convenience foods. Germans consume 7.9 kilograms of pasta per capita annually, reflecting steady demand. The market is driven by a shift toward healthier options, such as whole-grain and gluten-free pasta, as well as the popularity of private-label products in retail chains. E-commerce is expanding rapidly in Germany, with consumers increasingly buying specialty pasta online. Recent trends include collaborations between German and Italian manufacturers to deliver authentic products, along with promotional activities in supermarkets to boost pasta’s appeal across varied demographics.

France is predicted to showcase a CAGR of 4.2% over the forecast period. The French pasta market benefits from a preference for premium, gourmet, and organic products. French consumers value culinary sophistication, leading to growing demand for fresh and chilled pasta. Health-conscious choices, such as whole-grain and legume-based pasta, have also gained traction. France imports a significant volume of Italian pasta, reflecting its affinity for authentic products. Recent developments include the rise of artisanal pasta brands, increasing the variety available in supermarkets and specialty stores. France’s strong organic food sector further boosts demand for sustainably produced pasta, aligning with consumer preferences.

KEY MARKET PARTICIPANTS

Barilla G. e R. F.lli S.p.A. (Italy), Ebro Foods, S.A. (Spain), Unilever (U.K.), BORGES INTERNATIONAL GROUP (Spain), Nestlé (Switzerland) and F.lli De Cecco di Filippo S.p.A (Italy) is playing a major role in the European pasta market.

MARKET SEGMENTATION

This research report on the European pasta market is segmented and sub-segmented based on product type, raw material, distribution channel, and country.

By Product Type

- Dried

- Chilled

- Canned

By Raw Material

- Wheat

- Gluten-free

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com