Europe Power Market Size, Share, Trends & Growth Forecast Report By Power Generation (Thermal, Hydroelectric, Renewables, Other Types), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Power Market Size

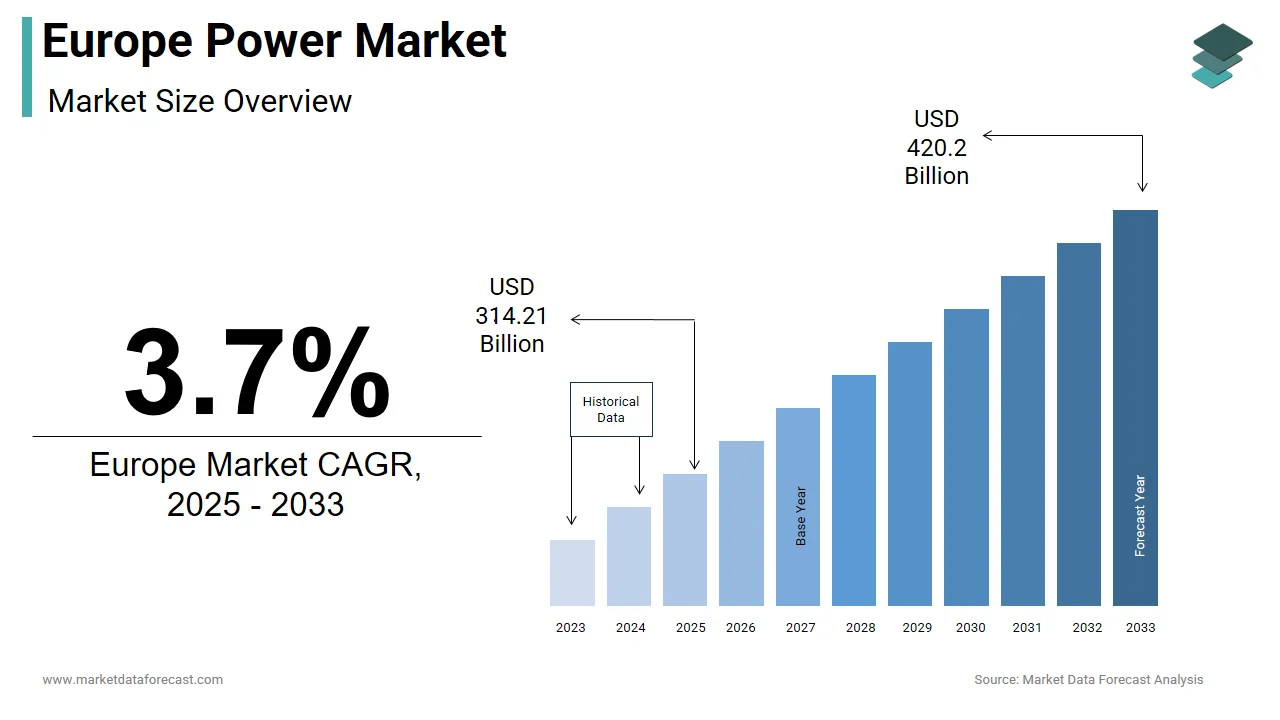

The size of the Europe power market was valued at USD 303 billion in 2024. This market is expected to grow at a CAGR of 3.7% from 2025 to 2033 and be worth USD 420.2 billion by 2033 from USD 314.21 billion in 2025.

The power represents one of the most advanced and regulated energy landscapes globally, which is driven by a strong policy focus on decarbonization, energy security, and technological innovation. The region has been at the forefront of transitioning from fossil fuel-based generation to cleaner, renewable sources such as wind, solar, and hydroelectric power. A defining feature of the European power sector is its integration under the framework of the European Union’s internal energy market, which promotes cross-border trade, grid interconnectivity, and harmonized regulatory standards. According to Eurostat, in 2023, renewables accounted for over 40% of total electricity generation in the EU, reflecting sustained investments in clean energy infrastructure. Additionally, the continent has seen a significant decline in coal-fired generation, with several nations committing to full phase-outs by 2030.

The market also benefits from robust research and development initiatives in smart grid technologies, battery storage, and digital energy management systems. As per the International Energy Agency, Europe contributed nearly 30% of global investments in new energy technologies in 2023. Moreover, consumer behavior is shifting toward decentralized energy models, with growing adoption of rooftop solar and prosumer participation.

MARKET DRIVERS

Policy Support and Regulatory Frameworks Promoting Renewable Energy

One of the primary drivers of growth in the Europe power market is the robust policy support and regulatory frameworks aimed at accelerating the transition to renewable energy. The European Green Deal, launched in 2019, set an ambitious target of achieving climate neutrality by 2050, directly influencing national policies across member states. According to the European Commission, this initiative spurred over €500 billion in public and private investments in clean energy projects between 2020 and 2023. Countries such as Denmark, Sweden, and Austria have already surpassed 70% renewable electricity generation, largely due to favorable feed-in tariffs, auctions, and subsidies.

Furthermore, the Renewable Energy Directive (RED III) mandates that at least 42.5% of electricity consumed in the EU must come from renewable sources by 2030. Member states are aligning their national energy plans accordingly, offering long-term visibility for investors. In Germany, for example, the Renewable Energy Act (EEG) continues to facilitate large-scale solar and wind deployment through guaranteed pricing mechanisms. Additionally, carbon pricing through the EU Emissions Trading System (EU ETS) has made fossil fuel-based power less economically viable, further incentivizing clean energy investments.

Rising Electricity Demand Due to Electrification of Transport and Industry

Another key driver shaping the Europe power market is the increasing electrification of transport and industrial sectors, which is significantly boosting electricity demand. In the transportation sector, the uptake of electric vehicles (EVs) has surged in recent years. This shift translates into greater demand for charging infrastructure and additional electricity supply. Simultaneously, industrial processes are undergoing electrification to meet sustainability goals. Steel manufacturing, chemical production, and food processing sectors are increasingly adopting electric boilers, heat pumps, and automated electric machinery to reduce emissions. As reported by the International Energy Agency, industrial electrification accounted for a 7% rise in overall electricity consumption across the EU between 2021 and 2023.

MARKET RESTRAINTS

Supply Chain Disruptions Affecting Renewable Energy Infrastructure Development

A significant restraint affecting the Europe power market is the persistent disruption in supply chains, particularly impacting the deployment of renewable energy infrastructure. The ongoing geopolitical tensions, raw material shortages, and logistical bottlenecks have delayed project timelines and increased costs for wind, solar, and battery storage installations. According to the European Wind Energy Association, in 2023, nearly 30% of planned onshore and offshore wind projects faced delays due to the unavailability of critical components such as turbines, gearboxes, and rare earth magnets used in permanent magnet generators. These components often rely on imports from Asia, where production slowdowns and export restrictions have created bottlenecks. As per SolarPower Europe, module delivery lead times extended from 8 weeks in 2021 to 16 weeks in 2023, contributing to higher installation costs.

High Upfront Investment Costs and Financing Challenges

Despite strong policy backing, high upfront capital requirements and financing challenges remain a critical barrier to expanding the Europe power market for small-scale developers and emerging technologies. While the long-term economic benefits of renewable energy are well established, the initial investment needed for wind farms, solar parks, and grid modernization remains substantial. These figures do not include grid connection, permitting, or balancing costs, which can add another 10–20% to total project expenses. For smaller independent producers, securing funding under such conditions proves challenging, especially in Southern and Eastern Europe, where access to affordable credit is limited. Moreover, rising interest rates across the eurozone have further strained project viability. Banks and institutional investors, although supportive of clean energy transitions, remain cautious due to policy uncertainties and market volatility.

MARKET OPPORTUNITIES

Expansion of Offshore Wind Energy Capacity

A transformative opportunity for the Europe power market lies in the rapid expansion of offshore wind energy, positioning the region as a global leader in marine-based renewable generation. With abundant wind resources along the North Sea, Baltic Sea, and Atlantic coastlines, Europe is uniquely positioned to harness large-scale offshore wind potential. Several governments have set aggressive offshore wind targets to bolster energy independence and meet net-zero commitments. The EU’s Offshore Renewable Energy Strategy aims to increase installed offshore wind capacity from 17 gigawatts (GW) in 2023 to 300 GW by 2050. Technological advancements are also driving cost reductions and performance improvements. Larger turbine sizes, floating wind platforms, and improved foundation designs are enhancing efficiency and reducing levelized costs.

Growth of Distributed Energy Resources and Smart Grid Technologies

The proliferation of distributed energy resources (DERs) and smart grid technologies is opening new avenues for growth in the Europe power market, enabling a more flexible, efficient, and decentralized electricity system. DERs, including rooftop solar, small-scale wind, battery storage, and microgrid, are empowering consumers to become active participants in the energy ecosystem, commonly referred to as "prosumers." According to the European Distribution System Operators’ Association (EUDSO), over 12 million households in the EU had installed rooftop solar photovoltaic (PV) systems by the end of 2023, which is a 25% increase compared to two years prior. This surge is driven by falling technology costs, government incentives, and rising consumer awareness about energy independence. Countries like the Netherlands, Spain, and Poland have witnessed particularly strong growth in residential solar adoption.

Simultaneously, smart grid technologies are gaining traction as a means to manage the complexity introduced by variable renewable generation and bidirectional power flows. Advanced metering infrastructure, real-time monitoring systems, and AI-driven grid analytics are enhancing grid stability and optimizing energy distribution. Moreover, peer-to-peer energy trading platforms and virtual power plants are emerging as innovative business models by allowing consumers to trade excess electricity locally. These developments signal a paradigm shift in how electricity is produced, managed, and consumed across Europe, which is unlocking significant opportunities for market players willing to embrace digitalization and decentralization.

MARKET CHALLENGES

Intermittency and Grid Integration of Renewable Energy Sources

Managing the intermittency and variability of renewable energy sources such as wind and solar, within the existing grid infrastructure, is prompting the growth of the market. Unlike conventional fossil fuel-based power plants that offer dispatchable generation, renewables depend on weather conditions, which leads to fluctuations in supply that can strain grid stability. Energy storage is viewed as a critical solution, but current deployment levels remain insufficient to fully address intermittency. Additionally, cross-border interconnection capacity remains unevenly developed, limiting the ability to balance supply and demand across regions. Addressing these technical challenges requires coordinated investments in grid modernization, demand-side response programs, and enhanced forecasting tools.

Geopolitical Risks and Energy Security Concerns

The Europe power market faces heightened risks related to geopolitical instability and energy security, particularly in the wake of Russia’s invasion of Ukraine and the subsequent disruption of natural gas supplies. Historically reliant on Russian gas for both direct heating and electricity generation, several European nations were forced to rapidly diversify their energy sources, which is leading to short-term volatility and long-term strategic recalibrations.

According to the European Commission, before 2022, the EU sourced nearly 40% of its natural gas from Russia. The abrupt reduction in pipeline deliveries following sanctions and political tensions prompted urgent investments in liquefied natural gas (LNG) import terminals, coal stockpiling, and emergency demand reduction measures. Moreover, the conflict has accelerated discussions around strategic autonomy in critical energy technologies. Dependence on imported components for renewable infrastructure, such as solar panels from China and batteries from South Korea and Japan, raises concerns about supply chain resilience. This evolving geopolitical landscape necessitates a balanced approach to energy security, combining domestic manufacturing investments, diversified supply chains, and strengthened regional cooperation to mitigate future disruptions in the Europe power market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Power Generation and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Statkraft AS, Enel Green Power S.p.A, National Grid plc, Agder Energi SA, and Électricité de France SA. |

SEGMENTAL ANALYSIS

By Power Generation Insights

The renewables segment was the largest and held 43.2% of the Europe power market in 2024. A key driver behind this growth is the European Union’s binding renewable energy targets under the Renewable Energy Directive III (RED III), which mandates that at least 42.5% of final energy consumption must come from renewable sources by 2030. Additionally, public sentiment favoring clean energy has strengthened investment flows and regulatory backing. A 2023 Eurobarometer survey found that 86% of EU citizens supported increased use of renewables, which is making it politically viable for governments to phase out coal and nuclear plants in favor of cleaner alternatives. Moreover, corporate power purchase agreements (PPAs) have surged in popularity, enabling large industrial consumers to directly source renewable energy. According to Pexapark AG, the volume of corporate PPAs signed in Europe reached an all-time high of 18 terawatt-hours (TWh) in 2023, up from just 2 TWh in 2020.

COUNTRY-LEVEL ANALYSIS

Germany was the top performer in the Europe power market by accounting for 19.3% of the share in 2024. A key driver of Germany’s dominant position is its Energiewende policy, which aims to phase out nuclear power and significantly expand renewable energy capacity. Furthermore, Germany has been proactive in modernizing its grid infrastructure to accommodate higher shares of variable renewables. Additionally, corporate demand for green power is rising, with major automotive and manufacturing firms entering into long-term power purchase agreements (PPAs) to secure a sustainable electricity supply.

France was positioned second by holding 14.3% of the share in the Europe power market. Traditionally reliant on nuclear energy, France continues to maintain one of the lowest carbon intensities in its electricity mix due to its extensive fleet of nuclear reactors. According to the International Atomic Energy Agency, nuclear power contributed approximately 66% of France’s electricity in 2023, with Électricité de France (EDF) operating 56 reactors nationwide. The country is also investing heavily in hydrogen and battery storage technologies to complement its low-carbon generation model.

Italy is anticipated to fuel the Europe power market growth due to its growing renewable energy capacity and strategic geographic location for regional electricity trade. A primary driver of Italy’s power market evolution is its commitment to phasing out coal-fired generation. In 2023, only two coal plants remained operational, down from ten in 2020, as reported by Terna, the Italian transmission system operator. This transition has been supported by robust solar PV deployment, with rooftop installations surging amid government incentives such as the Superbonus tax credit program.

Spain's power market is likely to showcase huge growth opportunities in the coming years with the presence of the key player in renewable energy, particularly wind and solar. A major growth driver is Spain’s National Integrated Energy and Climate Plan (PNIEC), which sets a target of achieving 74% renewable electricity by 2030. In addition to domestic generation, Spain is playing a crucial role in European electricity connectivity. REE reported that cross-border exchanges increased by 18% in 2023 by enhancing regional power flow stability.

The Netherlands' power market is growing with its advanced grid infrastructure, strong offshore wind ambitions, and active participation in regional electricity trade. A major driver of growth is the Dutch government’s commitment to reducing greenhouse gas emissions by 55% compared to 1990 levels by 2030. The country is also advancing its hydrogen economy, which is aiming to produce green hydrogen from offshore wind to support industrial decarbonization. The Port of Rotterdam, Europe’s largest seaport, is spearheading hydrogen import and distribution infrastructure, as highlighted by the European Commission in its Hydrogen Strategy update.

KEY MARKET PLAYERS

Companies playing a prominent role in the European power market profiled in this report are Statkraft AS, Enel Green Power S.p.A, National Grid plc, Agder Energi SA, and Électricité de France SA.

TOP LEADING PLAYERS IN THE MARKET

Orsted A/S – Global Leader in Offshore Wind Development

Orsted is headquartered in Denmark, which is a leading force in the Europe power market and a global pioneer in offshore wind energy. Once a fossil fuel-based utility, the company has successfully transformed into a renewable energy champion, focusing on large-scale offshore wind farms across Northern and Western Europe. Orsted plays a crucial role in advancing Europe’s clean energy transition by developing next-generation wind projects that support national decarbonization targets. Its strategic emphasis on innovation, sustainability, and grid integration has positioned it as a model for green energy companies worldwide.

Iberdrola S.A. – Spanish Multinational Championing Renewable Integration

Iberdrola, based in Spain, is one of the largest electricity utilities in Europe and a major investor in renewable energy infrastructure. The company has been instrumental in expanding wind, solar, and hydroelectric capacity across multiple European markets. With a strong commitment to sustainability and long-term energy security, Iberdrola leads in integrating renewables into national grids while also investing in smart grids, storage, and hydrogen technologies. Its forward-looking strategy supports Europe’s ambitions for a resilient, low-carbon power system.

E.ON SE – German Energy Major Focused on Customer-Centric Solutions

E.ON, headquartered in Germany, is a key player in the Europe power market, specializing in customer-focused energy solutions, including smart grids, decentralized generation, and digital energy services. Following its strategic shift away from conventional power generation, E.ON now focuses on distribution, energy efficiency, and customer engagement. The company plays a pivotal role in enabling prosumer participation and enhancing grid flexibility, which aligns with Europe’s evolving energy landscape and sustainability goals.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Expansion into Offshore Wind and Green Hydrogen Projects

Major players in the Europe power market are aggressively investing in offshore wind farms and green hydrogen production to capitalize on Europe’s decarbonization agenda. These initiatives align with national and EU-level climate goals, which offer long-term revenue opportunities through large-scale infrastructure development and cross-border partnerships.

Digitalization and Smart Grid Investments

Energy companies are increasingly adopting digital technologies to enhance grid efficiency, integrate variable renewables, and improve demand-side management. Smart metering, AI-driven analytics, and real-time monitoring systems are being deployed to optimize asset performance and deliver more responsive, consumer-centric services.

Strategic Mergers, Acquisitions, and Partnerships

To strengthen their competitive edge, leading firms are pursuing mergers, acquisitions, and joint ventures focused on emerging technologies and regional expansion. These moves allow companies to diversify portfolios, access new markets, and accelerate their transition toward sustainable energy models in alignment with evolving regulatory frameworks.

COMPETITION OVERVIEW

The competition in the Europe power market is marked by a complex interplay between traditional utility giants, agile renewable developers, and innovative technology providers. As the region accelerates its transition toward a low-carbon energy future, companies are redefining their business models to adapt to changing regulatory landscapes, consumer preferences, and technological advancements. Established energy firms such as Iberdrola, Orsted, and E.ON are leveraging their financial strength and operational expertise to lead in renewable deployment and grid modernization, while newer entrants are challenging the status quo with decentralized solutions and digital innovations.

A defining feature of this competitive environment is the increasing convergence of power generation, digital infrastructure, and energy services. Utilities are no longer confined to producing and distributing electricity but are now offering integrated solutions such as home energy management, battery storage, and electric vehicle charging networks. Additionally, the rise of corporate power purchase agreements and direct energy trading platforms has empowered consumers to play a more active role in shaping the market. Governments and regulators are further influencing competition through policy incentives, carbon pricing mechanisms, and cross-border market integration efforts by ensuring a dynamic and evolving power sector landscape.

RECENT MARKET DEVELOPMENTS

- In March 2024, Orsted signed a strategic partnership agreement with a major German industrial conglomerate to co-develop green hydrogen facilities powered by offshore wind.

- In July 2024, Iberdrola launched a new digital energy platform in France, designed to provide households and businesses with real-time energy usage insights, dynamic pricing models, and seamless integration with rooftop solar and storage systems. This move enhances customer engagement and strengthens its presence in the French retail electricity market.

- In October 2024, E.ON announced a collaboration with a leading battery technology firm to deploy distributed energy storage units across urban centers in the Netherlands. The initiative is intended to support grid stability, reduce peak load pressures, and offer consumers greater control over their energy consumption patterns.

- In January 2025, RWE Renewables secured exclusive rights to develop a hybrid offshore wind and tidal energy project in the North Sea, combining two renewable sources to ensure more consistent power output. This innovation reflects the growing trend of multi-technology integration in the European power sector.

- In March 2025, Engie agreed to acquire a Finnish startup specializing in AI-powered grid optimization software. This acquisition is expected to enhance Engie’s capabilities in predictive maintenance, demand forecasting, and renewable balancing, positioning the company at the forefront of digital energy solutions in Europe.

MARKET SEGMENTATION

This Europe power market research report is segmented and sub-segmented into the following categories.

By Power Generation

- Thermal

- Hydroelectric

- Renewables

- Other Types

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the main drivers of the Europe power market?

The Europe power market is driven by strong policy support for decarbonization, ambitious EU renewable energy targets, rapid electrification of transport and industry, and major investments in smart grids, offshore wind, and battery storage

2. What challenges does the Europe power market face?

The Europe power market faces challenges such as supply chain disruptions for renewables, high upfront capital costs, grid integration issues due to intermittent renewables, and heightened risks from geopolitical instability and energy security concerns

3. What opportunities exist in the Europe power market?

Opportunities in the Europe power market include the expansion of offshore wind, growth in distributed energy resources and smart grid technologies, increased prosumer participation, and digitalization of energy management and trading

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com