Europe Precision Agriculture Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report Segmented By Technology, Offering, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Precision Agriculture Market Size

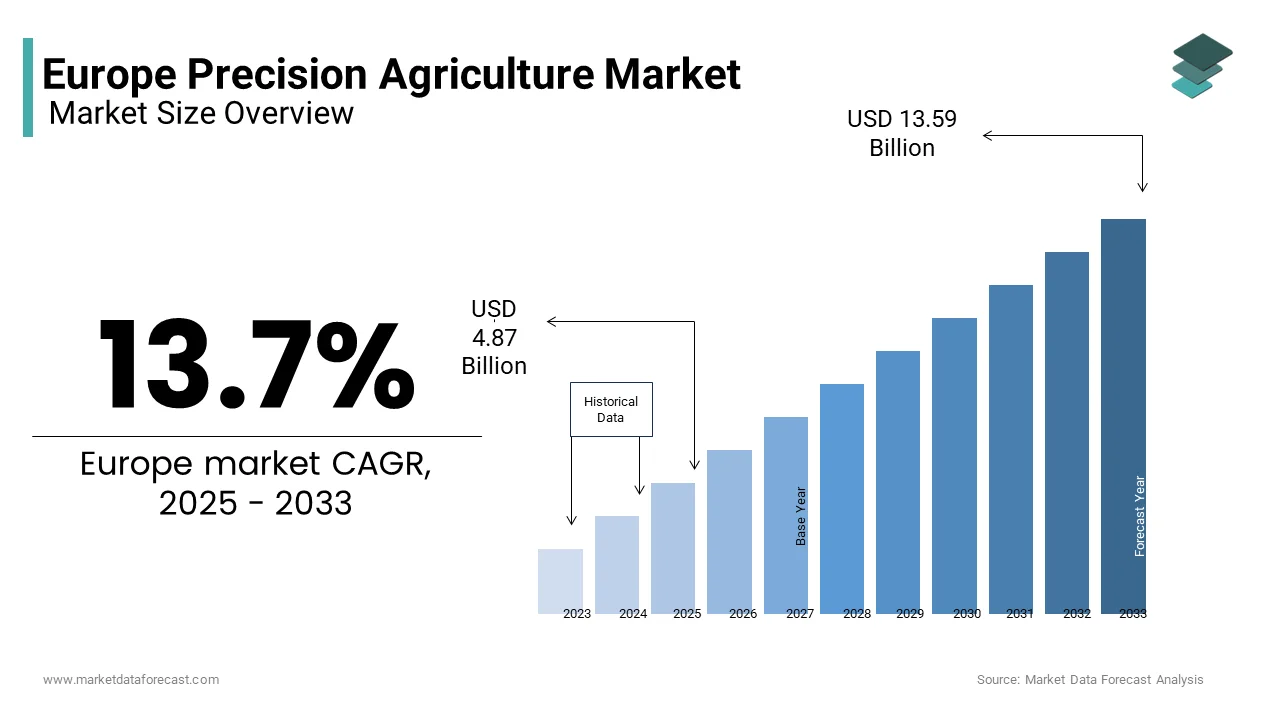

The European precision agriculture market was valued at USD 4.28 billion in 2024 and is anticipated to reach USD 4.87 billion in 2025 from USD 13.59 billion by 2033, growing at a CAGR of 13.7% during the forecast period from 2025 to 2033.

The rising trend of IOT usage in Europe's agriculture is driving the growth of the European precision agriculture market. The fruit and vegetable farming sector depends entirely on automatic machines with minimal manual labor. Precision technology is integrated with farming machinery for better results, accelerating Europe's market expansion of precision agriculture. Precision agriculture technologies include sensors, GPS, and data analytics, which farmers can incorporate into harvesters, tractors, and drones. This integration with the help of IOT helps in data collection by enhancing efficiency and enabling efficient decision-making. Automation helps in increasing efficiency by reducing labor costs. By introducing data analytics and farm management software, farmers can easily make decisions about irrigation, fertilization, and pest control, resulting in significant productivity and sustainability. Introducing drones in farm machinery enhances the precision agriculture benefits due to the results of aerial surveys and early detection of disease outbreaks.

Cost-effectiveness and decreased energy consumption are accelerating the growth rate of the European market. Due to the introduction of innovative farm management, the overall energy consumption and cost have been reduced due to minimal labor costs. There is increasing demand for convenient, innovative farming solutions that produce better results than traditional methods. The incorporation of precision agriculture techniques is projected to have a significant growth rate in the upcoming years. With the reduced input energy and cost, farmers are getting the same output in a better way, which is accelerating the expansion of the European precision agriculture market.

Digital agriculture platforms and farm management software are in demand for sustainable agriculture. The output of smart agriculture is attracting farmers for installation. The rising usage of smart agriculture in start-ups is expected to create lucrative opportunities for market expansion. Agritech start-ups are using AI and data analytics to provide farmers with better solutions to problems.

The primary factor hampering market growth is the need for more technical knowledge. Many studies show that many farmers are stepping back without investing in new agricultural techniques due to a lack of understanding of technology. For successful smart agriculture implementation, farmers must be trained in using apps and technologies to expand the regional market growth. Another restraining factor for the market expansion is the high cost of installation. The initial cost of installing smart agriculture is expensive, and farmers are thinking about future expenses in farming, such as supply chain, harvesting, and others. There needs to be more financial resources and certainty in supply chain issues.

The primary challenge is greater data privacy and security in the precision farming market. Precision farming uses sensors, drones, and satellites for data collection, so the data collected needs to be protected and secured. The technology providers should assure the farmers that the data collected will be secured and stored to avoid data breaches and unauthorized access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.7% |

|

Segments Covered |

By offering Technology, Application, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Deere & Company, Trimble, Inc., Leica Geosystems, AJ Junction, Inc., Monsanto Company, AgSmarts Inc., CropMetrics LLC, and Dickey-John Corporation |

SEGMENT ANALYSIS

By Offering Insights

The hardware segment held a significant share of the European precision agriculture market in 2024 and is expected to dominate in the forecast period. The automation and control systems sub-segment dominated the precision agriculture market due to its services, such as GPS receivers, guidance in steering mechanisms, and variable-rate technology devices. Automation helps reduce manual labor, which is increasing the adoption of the technology.

Cloud-based software is projected to be the fastest-growing software segment in the forecast period.

By Technology Insights

The variable rate technology segment dominated the precision agriculture market in the European region in 2022 due to its high adaptability. It is expected to have the highest CAGR in the forecast period compared to other technologies. The integration of GPS-based auto technology, which is highly adopted by farmers, is driving the market in this technology. It empowered agricultural professionals to optimize the equipment and tractor utilization, reducing fuel and labor expenses with high efficiency.

By Application Insights

Irrigation management had the highest market value in 2022 due to water scarcity problems, and farmers are increasingly adopting micro-irrigation control systems. Yield monitoring is projected to dominate the European precision agriculture market revenue over the forecast period. This domination is due to services like climate service initiatives, which enhance food security with a quality decision-making process in agriculture.

COUNTRY ANALYSIS

Europe is expected to be the second-largest region adopting smart agriculture after North America. Germany dominated the European precision agriculture market due to significant agricultural revenue output. The rapid adoption of new technologies in Germany and the UK is accelerating the market expansion in Europe.

As a developed country, the UK consists of the market key players investing in the R&D sector for innovative technological developments with better adoption among the farmers. France and Spain are expected to have a decent growth rate in the upcoming years due to the increasing adoption of farm management software. The increasing demand for crop protection in many countries with fresh crop production and animal feed drives smart agriculture techniques. The increasing government investments are allowing smart agriculture technologies to expand and reach the farmers.

KEY MARKET PLAYERS

Deere & Company, Trimble, Inc., Leica Geosystems, AJ Junction, Inc., Monsanto Company, AgSmarts Inc., CropMetrics LLC, and Dickey-John Corporation are some of the major companies in the European precision agriculture market.

By Offering

- Hardware

- Automation and Control Systems

- Sensing and Monitoring devices

- Software

- Web-based

- Cloud-based

- Services

By Technology

- Guidance Systems

- Variable Rate Technology

- Remote Sensing

By Application

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Weather Tracking and Forecasting

- Irrigation Management

- Inventory Management

- Farm Labor Management

- Financial Management

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries contribute significantly to the precision agriculture market in Europe?

Germany, France, the United Kingdom, and the Netherlands are the major contributors to the European market.

What are the key driving factors behind the growth of precision agriculture in Europe?

Factors such as increased adoption of advanced farming technologies, government initiatives, and the need for sustainable farming practices are primarily driving the growth of the European precision agriculture market.

What are the major trends shaping the precision agriculture market in Europe?

The rise of drone technology, farm management software, and the integration of big data analytics for decision-making are some of the notable trends in the Europe precision agriculture market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]