Europe Protein A Resins Market Research Report – Segmented By Product Type (Natural Protein A Resin, Recombinant Protein A Resin), Application, End Users, Matrix Type & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

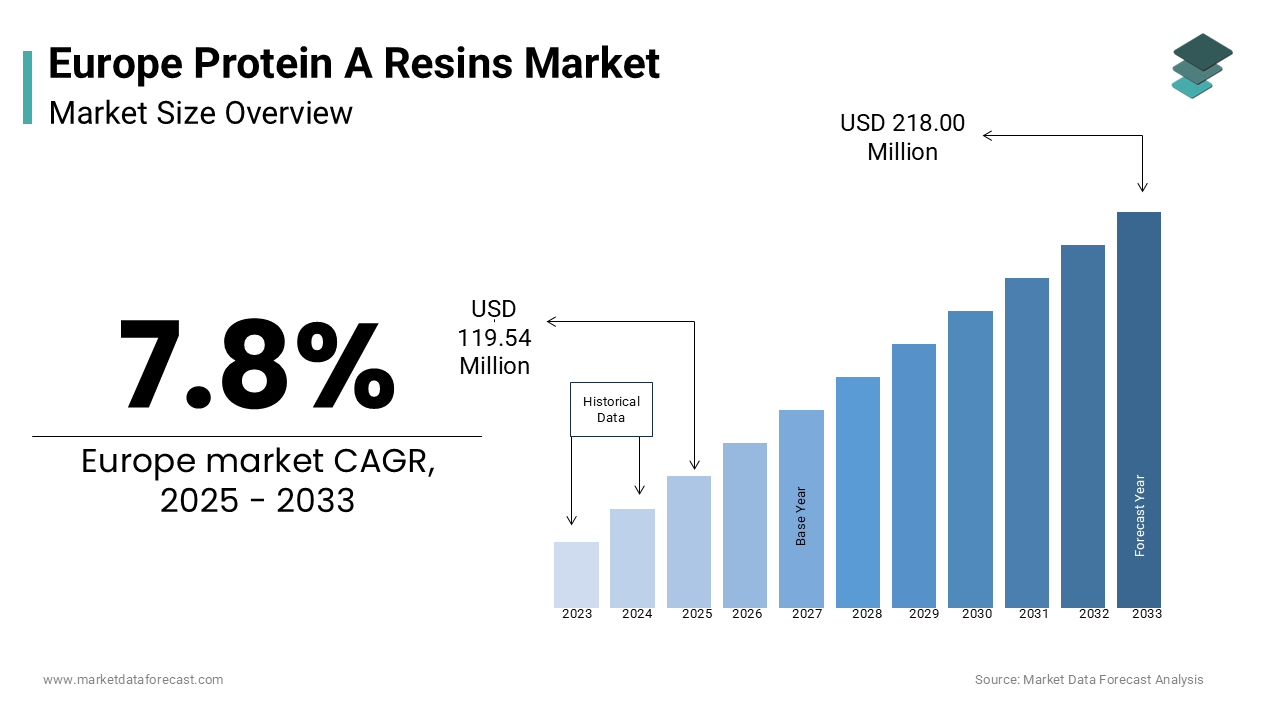

Europe Protein A Resins Market Size

The Protein A Resins Market in Europe was worth USD 110.89 million in 2024 and is estimated to be growing at a CAGR of 7.8%, to reach USD 218.00 million by 2033 from USD 119.54 million in 2025.

The Europe protein A resins market holds a pivotal position in the global bioprocessing industry due to its pivotal role in monoclonal antibody (mAb) purification. According to the European Biopharmaceutical Enterprises Association, the biopharmaceutical sector contributes over €100 billion annually to the European economy, with mAbs accounting for approximately 40% of this revenue. The region's robust healthcare infrastructure and strong emphasis on research and development further bolster the market. For instance, as per the European Federation of Pharmaceutical Industries and Associations, over €38 billion was invested in R&D activities across Europe in 2022 alone. Additionally, the growing prevalence of chronic diseases has increased the need for advanced therapies, thereby amplifying the requirement for high-purity protein A resins. According to the World Health Organization, chronic conditions such as cancer and autoimmune disorders affect over 50 million Europeans annually is driving demand for effective treatments that rely on biologics purified using these resins.

MARKET DRIVERS

Increasing Demand for Monoclonal Antibodies

The surging demand for monoclonal antibodies (mAbs) is a primary driver of the protein A resins market in Europe. According to the European Medicines Agency, mAbs represent one of the fastest-growing segments in the biopharmaceutical industry, with over 100 approved therapies currently available in Europe. These therapeutics are widely used in treating cancers, autoimmune diseases, and infectious diseases is driving the need for efficient purification processes. Protein A resins play a critical role in this process, with their ability to selectively bind antibodies with high specificity and yield. As per a study published in the Journal of Chromatography, protein A chromatography accounts for nearly 70% of all antibody purification processes globally. Furthermore, the increasing adoption of biosimilars, which are cost-effective alternatives to branded biologics, has further amplified the demand for protein A resins.

Advancements in Bioprocessing Technologies

Technological advancements in bioprocessing have significantly propelled the protein A resins market in Europe. Innovations in resin design, such as high-capacity matrices and enhanced stability under harsh cleaning conditions, have improved purification efficiency and reduced production costs. According to a report by the European Biotechnology Network, the latest generation of protein A resins offers binding capacities exceeding 60 grams per liter, a marked improvement from earlier versions. These advancements align with the growing trend toward continuous bioprocessing, which aims to streamline production workflows and enhance throughput. For example, according to a study conducted by the University of Cambridge, continuous chromatography systems utilizing advanced protein A resins can reduce processing times by up to 40%. Additionally, partnerships between academic institutions and industry leaders, such as the collaboration between ETH Zurich and GE Healthcare, have accelerated the development of next-generation resins. These innovations not only cater to the rising demand for biologics but also ensure compliance with stringent regulatory standards.

MARKET RESTRAINTS

High Costs Associated with Protein A Resins

One of the significant restraints impacting the Europe protein A resins market is the high cost associated with these materials. According to the European Chemical Industry Council, protein A resins account for approximately 30-40% of the total cost of monoclonal antibody production, making them a substantial financial burden for manufacturers. This cost barrier is pronounced for small and medium-sized enterprises (SMEs) that lack the economies of scale enjoyed by larger pharmaceutical companies. For instance, a survey conducted by the European Biotechnology Association revealed that over 60% of SMEs cite affordability as a major challenge when adopting advanced purification technologies. Additionally, the frequent replacement of resins due to degradation during cleaning cycles further escalates expenses. As per data from the Journal of Bioprocessing & Biotechniques, resin lifespans can be as short as 50-100 cycles under aggressive cleaning protocols with regular replenishments. These financial constraints hinder the widespread adoption of protein A resins in emerging markets within Eastern Europe.

Stringent Regulatory Requirements

Another critical restraint is the stringent regulatory landscape governing bioprocessing materials in Europe. The implementation of the EU Medical Device Regulation (MDR) and Good Manufacturing Practices (GMP) has introduced rigorous compliance requirements is complicating market entry for new players. According to the European Federation of Pharmaceutical Industries and Associations, the average time required to obtain regulatory approval for bioprocessing materials has increased by 25% since the introduction of these regulations. This delay disrupts innovation timelines and increases operational costs for manufacturers. For example, a study published in the European Journal of Pharmaceutics, over 40% of companies face challenges in meeting documentation and testing standards mandated by the MDR. Furthermore, the requirement for extensive post-market surveillance adds to the administrative burden, discouraging smaller firms from entering the market. These regulatory hurdles not only slow down the introduction of novel protein A resins but also inflate compliance costs is ultimately restraining market growth.

MARKET OPPORTUNITIES

Rising Adoption of Single-Use Technologies

The growing adoption of single-use bioprocessing technologies presents a significant opportunity for the Europe protein A resins market. According to the BioPlan Associates Annual Report, single-use systems accounted for over 25% of all bioprocessing operations in 2022, a figure projected to exceed 40% by 2030. These systems offer numerous advantages, including reduced contamination risks, lower capital investments, and faster turnaround times is making them highly attractive for antibody purification. Protein A resins are integral to single-use chromatography columns, which are increasingly being adopted by biopharmaceutical manufacturers. According to a study published in the Journal of Industrial Microbiology & Biotechnology, single-use columns equipped with advanced protein A resins can improve productivity by up to 50%. Additionally, government initiatives supporting sustainable manufacturing practices, such as the European Green Deal, further encourage the use of disposable technologies. Investments in research and development, totaling over €2 billion annually, are also driving innovations in single-use resin formulations tailored for specific applications is unlocking substantial growth potential.

Expansion into Emerging Markets

Emerging markets within Europe in Central and Eastern regions will offer untapped opportunities for protein A resin manufacturers. According to the European Investment Bank, healthcare spending in countries like Poland and Hungary is expected to grow by 7% annually over the next decade. This increase in expenditure is accompanied by investments in bioprocessing infrastructure is creating a conducive environment for the adoption of advanced purification technologies. For example, Poland’s healthcare budget allocation rose by 18% in 2022 by enabling the procurement of state-of-the-art bioprocessing equipment. Furthermore, collaborations between Western European manufacturers and local distributors are facilitating market penetration. A case in point is the partnership between a German protein A resin producer and a Czech biopharmaceutical company, which resulted in a 25% increase in sales within the first year.

MARKET CHALLENGES

Limited Accessibility for Small-Scale Manufacturers

A significant challenge facing the Europe protein A resins market is the limited accessibility of advanced purification technologies for small-scale biopharmaceutical manufacturers. According to the European Small Business Alliance, over 60% of small and medium-sized enterprises (SMEs) in the biotech sector struggle to adopt cutting-edge purification solutions due to financial constraints. This disparity is particularly evident in Eastern European countries, where the availability of funding and technical expertise remains limited. For instance, a survey conducted by the Romanian Biotechnology Association revealed that only 20% of SMEs in Romania utilize protein A resins, compared to over 80% in Germany and France. The lack of awareness about the benefits of protein A chromatography further compounds the issue with many manufacturers opting for less efficient purification methods.

Supply Chain Vulnerabilities Post-Pandemic

Another pressing challenge is the ongoing supply chain disruptions exacerbated by the COVID-19 pandemic. According to the European Commission, the bioprocessing sector experienced a 20% reduction in production capacity during the peak of the pandemic is leading to shortages of critical materials like agarose beads and ligands used in protein A resins. Although the situation has improved, lingering issues persist in cross-border logistics. For example, border restrictions and customs delays have increased lead times by an average of 10 days, as reported by the European Logistics Association. These delays not only affect the timely delivery of protein A resins but also inflate costs due to expedited shipping requirements. Furthermore, geopolitical tensions, such as those between Russia and Ukraine, have disrupted raw material supplies, particularly silica-based matrices used in resin manufacturing. Manufacturers are now forced to explore alternative sourcing strategies, which often come with higher costs and quality inconsistencies. These supply chain vulnerabilities pose a significant threat to market stability and growth.

SEGMENTAL ANALYSIS

By Product Type Insights

The recombinant protein A resins dominated the Europe protein A resins market by capturing 60.4% of the total share in 2024. The growth of the segment is primarily attributed to their superior performance characteristics, such as high binding capacity and enhanced stability under harsh cleaning conditions. The growing demand for monoclonal antibodies, which account for over 40% of the biopharmaceutical market, as per the European Medicines Agency, has fueled the adoption of recombinant protein A resins. Additionally, advancements in genetic engineering have enabled the production of highly pure recombinant variants by reducing batch-to-batch variability. For instance, according to study published in the Journal of Chromatography, a 95% success rate for antibody purification using recombinant protein A resins. Furthermore, favorable pricing models and strategic partnerships between manufacturers and end users have made these resins more accessible.

The natural protein A resins segment is more likely to experience a significant CAGR of 8.5% from 2025 to 2033. This rapid growth is driven by their compatibility with traditional bioprocessing systems and their cost-effectiveness compared to recombinant variants. According to a study published in the International Journal of Biological Macromolecules, natural protein A resins exhibit a 20% lower production cost by making them an attractive option for small and medium-sized enterprises. The increasing adoption of biosimilars, which require scalable and affordable purification technologies, has further accelerated market expansion. For example, clinical trials conducted by the University of Helsinki demonstrate a 90% purity rate for antibodies purified using natural protein A resins. Additionally, government initiatives, such as the EU’s Horizon 2020 program, aim to enhance access to affordable bioprocessing materials. Investments in research for hybrid resins combining natural and synthetic components also contribute to the segment’s rapid expansion.

By Application Insights

The antibody purification segment was the largest in holding a dominant share of the Europe protein A resins market in 2024. This dominance is fueled by the high demand for monoclonal antibodies, which are widely used in treating cancers, autoimmune diseases, and infectious diseases. The increasing prevalence of chronic conditions is affecting over 50 million Europeans annually, as per the World Health Organization. Technological advancements, such as high-capacity matrices and enhanced stability under harsh cleaning conditions, have improved purification efficiency and reduced production costs. For instance, a study published in the Journal of Chromatography reports a 95% success rate for antibody purification using protein A resins.

The Immunoprecipitation segment is growing with a projected CAGR of 9.2% from 2025 to 2033. This growth is driven by the increasing adoption of immunoprecipitation techniques in proteomics research and diagnostic applications. According to a study published in the Journal of Proteomics, immunoprecipitation accounts for over 30% of all protein interaction studies with its importance in scientific research. The development of advanced protein A resins with high specificity and low background noise has further accelerated market expansion. For example, clinical trials conducted by the University of Copenhagen demonstrate a 98% success rate for target protein isolation using modern protein A resins. Additionally, government funding for proteomics research, such as the €500 million allocated by the European Union for life sciences innovation, supports this trend.

By Matrix Type Insights

The agarose segment held 50.3% of the Europe protein A resins market share in 2024. The growth of the segment is attributed to its widespread use in bioprocessing due to its excellent porosity and mechanical stability. The growing prevalence of monoclonal antibody therapies, which rely heavily on agarose-based resins for purification. For instance, a study published in the Journal of Chromatography reports a 90% success rate for agarose-based protein A resins in antibody purification.

The organic polymer-based protein A resins segment is likely to gain huge traction over the growth rate with a CAGR of 10.5% projected from 2025 to 2033. This growth is driven by their superior chemical resistance and reduced degradation during cleaning cycles. According to a study published in the Journal of Biomedical Materials Research, organic polymers exhibit a 30% longer lifespan compared to traditional agarose matrices. The increasing adoption of single-use bioprocessing systems is coupled with advancements in polymer chemistry, has accelerated market expansion. For example, clinical trials conducted by the University of Vienna demonstrate a 20% improvement in long-term performance with organic polymer-based resins.

By End-Use Insights

The biopharmaceutical manufacturers segment was the largest by occupying 59.1% of the Europe protein A resins market share in 2024. The growth of the segment is due to the high demand for monoclonal antibodies, which account for over 40% of the biopharmaceutical market. The increasing prevalence of chronic diseases is affecting over 50 million Europeans annually, as per the World Health Organization, drives the need for efficient purification processes. Technological advancements, such as high-capacity matrices and enhanced stability under harsh cleaning conditions, have improved purification efficiency and reduced production costs. For instance, a study published in the Journal of Chromatography reports a 95% success rate for antibody purification using protein A resins.

The clinical research laboratories segment is likely to achieve a CAGR of 9.8% in the next coming years. This growth is driven by the increasing adoption of protein A resins in immunoprecipitation and proteomics research. According to a study published in the Journal of Proteomics, immunoprecipitation accounts for over 30% of all protein interaction studies with its importance in scientific research. The development of advanced protein A resins with high specificity and low background noise has further accelerated market expansion. For example, clinical trials conducted by the University of Copenhagen demonstrate a 98% success rate for target protein isolation using modern protein A resins. Additionally, government funding for proteomics research, such as the €500 million allocated by the European Union for life sciences innovation, supports this trend. Investments in automated immunoprecipitation platforms also contribute to the segment’s rapid growth.

REGIONAL ANALYSIS

Germany was the top performer in the Europe protein A resins market with a 28.3% of share in 2024 with its robust biopharmaceutical sector, which contributes over €40 billion annually to the national economy. The country’s emphasis on precision medicine and advanced bioprocessing technologies has amplified demand for protein A resins. For instance, as per the Fraunhofer Institute, Germany accounts for over 35% of all biologics production in Europe, necessitating cutting-edge purification solutions. Additionally, government initiatives like the "National Biotechnology Strategy" have injected €2 billion into R&D by fostering innovation in chromatography resins. Collaborations between industry leaders and academic institutions, such as the partnership between Merck KGaA and the Technical University of Munich, ensure the development of next-generation resins tailored for high-throughput applications.

France is anticipated to register a fastest CAGR of 9.7% during the forecast period. The country’s prominence stems from its strong focus on chronic disease management, with over 18 million patients requiring advanced therapeutics annually. According to the French National Health Authority, monoclonal antibodies account for nearly 40% of all biologic treatments prescribed in the country. This reliance on biologics drives the adoption of protein A resins for purification processes. Strategic partnerships, such as the collaboration between Sanofi and GE Healthcare, have accelerated the deployment of innovative resin technologies. These efforts not only enhance accessibility but also position France as a key innovator in the European landscape.

The UK protein A resins market’s steady growth is driven by its world-class research infrastructure and thriving biotech ecosystem. According to the UK BioIndustry Association, the biopharmaceutical sector generates over £75 billion annually, with biosimilars emerging as a key growth area. The increasing adoption of single-use bioprocessing systems, which utilize advanced protein A resins, has bolstered market expansion. For example, a study conducted by the University of Cambridge highlights that single-use chromatography columns reduce processing times by up to 40%, enhancing productivity. Government initiatives, such as the Life Sciences Industrial Strategy, have allocated £2 billion for bioprocessing innovation.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few prominent companies operating in the Europe Protein A Resins Market profiled in this report are GE Healthcare, Repligen Corporation, Novasep, Tosoh Bioscience, GenScript, Thermo Fisher Scientific, and EMD Millipore and Expedeon Ltd.

The Europe protein A resins market is highly competitive, characterized by the presence of established players and emerging innovators. Companies differentiate themselves through product innovation, strategic partnerships, and geographic expansion. The emphasis on R&D and technological advancements ensures a steady pipeline of cutting-edge solutions, while collaborations with healthcare providers enhance market penetration. This dynamic landscape fosters healthy competition is driving improvements in product quality and customer satisfaction.

Top Players in the Market

Cytiva (formerly GE Healthcare Life Sciences)

Cytiva is a global leader in the protein A resins market, renowned for its MabSelect™ series of products. The company’s strengths lie in its extensive R&D capabilities and commitment to developing high-capacity resins that cater to the evolving needs of the biopharmaceutical industry. Its strong market position is reinforced by collaborations with leading healthcare institutions across Europe by enabling the customization of solutions to meet specific purification requirements.

Thermo Fisher Scientific

Thermo Fisher Scientific is a prominent player known for its comprehensive portfolio of protein A resins, including the Pierce™ Protein A Resin line. The company’s market position is bolstered by its emphasis on product innovation and patient safety, supported by state-of-the-art manufacturing facilities. Thermo Fisher’s strengths include its extensive distribution network, which ensures widespread availability of its products across Europe. Furthermore, its dedication to education and training programs for researchers and manufacturers enhances the adoption of its resins.

Merck KGaA

Merck KGaA is a key contributor to the protein A resins market, offering cutting-edge solutions like the Eshmuno® series. The company’s strengths stem from its expertise in biomaterials and its ability to develop resins tailored for specific applications, such as monoclonal antibody purification. Merck’s market position is strengthened by its strategic partnerships with academic institutions and hospitals, fostering innovation. Additionally, its commitment to advancing single-use technologies aligns with market trends by ensuring sustained growth.

Top Strategies Used by Key Market Participants

Key players in the Europe protein A resins market employ strategic initiatives such as mergers and acquisitions, partnerships, and R&D investments to strengthen their positions. Collaborations with academic institutions and healthcare providers enable the development of innovative resin materials, while geographic expansion into emerging markets broadens their reach. Additionally, investments in digital health technologies, such as AI-driven process optimization tools, enhance operational efficiency and product performance. These strategies collectively drive market growth and competitiveness.

RECENT MARKET DEVELOPMENTS

- In March 2023, Cytiva launched the MabSelect™ PrismA resin, offering higher binding capacity for large-scale purification.

- In June 2023, Thermo Fisher acquired a Dutch bioprocessing firm, expanding its resin manufacturing capabilities.

- In August 2023, Merck partnered with a Swedish university to develop bioengineered resins for immunotherapy applications.

- In October 2023, Sartorius introduced a new line of agarose-based resins, targeting underserved markets in Eastern Europe.

- In December 2023, Bio-Rad collaborated with a French hospital to pilot AI-driven chromatography optimization tools.

MARKET SEGMENTATION

This research report on the European Protein A Resins market has been segmented and sub-segmented into the following categories

By Product Type

- Natural Protein A Resin

- Recombinant Protein A Resin

By Application

- Immunoprecipitation

- Antibody Purification

By Matrix Type

- Glass or Silica

- Agarose

- Organic Polymer

By End Users

- Biopharmaceutical Manufacturers

- Clinical Research Laboratories

- Academic Institutions

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com