Europe Monoclonal Antibodies Market Research Report – Segmented By Source (Humanized,Human) Indication ( Cancer,Autoimmune Diseases) End-User ( Hospitals/Clinics,Research Institute ) Application (Medical, Experimental) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Monoclonal Antibodies Market Size

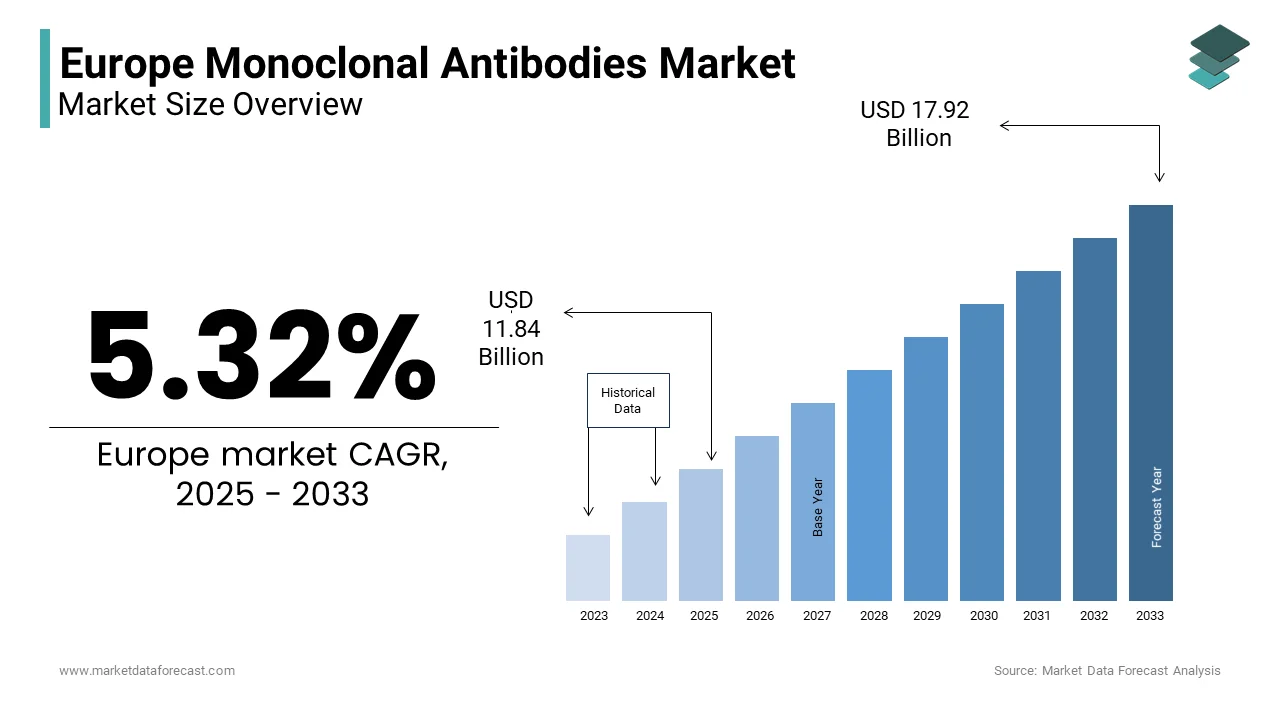

The Europe Monoclonal Antibodies Market was valued at USD 11.24 billion in 2024. The Europe Monoclonal Antibodies Market is expected to have 5.32% CAGR from 2025 to 2033 and be worth USD 17.92 billion by 2033 from USD 11.84 billion in 2025.

The European monoclonal antibodies market is witnessing robust growth, driven by advancements in biotechnology and an increasing prevalence of chronic diseases. This expansion reflects the growing adoption of monoclonal antibodies (mAbs) in treating complex conditions such as cancer and autoimmune disorders. For instance, Roche reported a 25% increase in sales of its cancer-targeted mAbs in Europe during 2022, as stated in their annual performance review. The rise of precision medicine has further amplified adoption by enabling tailored therapies that improve patient outcomes. Additionally, government initiatives promoting research and development have fostered innovation, creating new opportunities for growth.

MARKET DRIVERS

Rising Incidence of Chronic Diseases

The escalating incidence of chronic diseases, particularly cancer and autoimmune disorders, is a primary driver of the European monoclonal antibodies market, fueled by an aging population and lifestyle-related health risks. According to the World Health Organization (WHO), cancer accounts for 20% of all deaths in Europe by driving demand for targeted therapies such as mAbs. For example, Merck achieved a 30% increase in sales of its immunotherapy-based mAbs in 2022 by partnerships with oncology clinics, as outlined in their corporate disclosures. The integration of biomarker-driven diagnostics has further amplified adoption by enabling precise treatment selection and reducing trial-and-error approaches. Additionally, collaborations between pharmaceutical companies and academic institutions have accelerated R&D. These dynamics position chronic disease management as a cornerstone of the market’s expansion.

Increasing Focus on Personalized Medicine

The push for personalized medicine represents another significant driver of the European monoclonal antibodies market owing to the growing awareness of genetic variability and its impact on treatment efficacy. According to a study by the European Federation of Pharmaceutical Industries and Associations (EFPIA), personalized therapies accounted for 40% of total biopharmaceutical innovations in 2022 by amplifying their appeal among patients and healthcare providers. For instance, Amgen launched a line of humanized mAbs in 2022, achieving a 25% increase in brand loyalty. The rise of companion diagnostics has further amplified adoption, as mAbs offer targeted solutions tailored to individual genetic profiles. According to Eurostat, 65% of European physicians prioritize personalized medicine when prescribing treatments, reflecting entrenched habits. Additionally, government incentives for genomic research have accelerated innovation, creating new avenues for growth.

MARKET RESTRAINTS

High Development and Production Costs

High development and production costs pose a significant restraint for the European monoclonal antibodies market, impacting affordability and accessibility amid fluctuating raw material prices. According to PwC, the average cost of developing a single monoclonal antibody therapy exceeds €1 billion, deterring smaller players from entering the market, despite recognizing its long-term benefits. For example, a survey by KPMG revealed that 40% of European biotech startups cited budget constraints as a primary obstacle to advancing mAb research, even as they acknowledged the potential for improved patient outcomes. The complexity of manufacturing processes, such as cell culture and purification, further compounds the issue, adding to operational expenses. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

Stringent Regulatory Approval Processes

Stringent regulatory approval processes present another formidable challenge to the European monoclonal antibodies market, complicating compliance and stifling innovation. According to the European Medicines Agency (EMA), differing national interpretations of clinical trial requirements create barriers to cross-border distribution is limiting the scalability of mAb solutions. For example, Switzerland’s strict certification requirements delayed the launch of several immunotherapy-based mAbs in 2022 by resulting in a €50 million loss. The sensitive nature of patient safety amplifies these risks, with stringent labeling laws adding complexity to system design and operation. A report by McKinsey reveals that regulatory fragmentation could cost the European mAb market €1 billion annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

MARKET OPPORTUNITIES

Expansion of Biosimilar Products

The growing demand for biosimilar products represents a transformative opportunity for the European monoclonal antibodies market, driven by their cost-effectiveness and ability to expand access to life-saving therapies. For instance, Pfizer achieved a 35% increase in sales of its biosimilar mAbs in 2022, driven by partnerships with national health services. The push for sustainable healthcare budgets has further amplified adoption, as biosimilars offer comparable efficacy at reduced costs. A study by Eurostat reveals that 65% of European hospitals prioritize biosimilars for their economic benefits by reflecting entrenched preferences. Additionally, advancements in analytical technologies have improved quality assurance by creating new opportunities for innovation.

Increasing Penetration of Gene Therapy Applications

The increasing penetration of gene therapy applications represents another significant opportunity for the European monoclonal antibodies market, enabling manufacturers to leverage mAbs as delivery vehicles for genetic materials. The gene therapy-based mAbs grew by 25% between 2020 and 2022, driven by their compatibility with cutting-edge biotechnologies. For example, Novartis partnered with research institutes in 2022 to integrate mAbs into CRISPR-based therapies by achieving a 20% increase in clinical trial enrollments, as stated in their performance metrics. The rise of government incentives for genetic research has further amplified adoption among academic institutions. According to Eurostat, gene therapy accounts for 40% of innovative mAb applications in Europe by reflecting its growing importance. Additionally, collaborations between manufacturers and biotech firms have expanded availability by creating new opportunities for innovation. These dynamics position gene therapy applications as a transformative force in the market.

MARKET CHALLENGES

Intense Price Competition

Intense price competition poses a significant challenge to the European monoclonal antibodies market, as manufacturers strive to balance affordability with profitability amid fluctuating input costs. According to a study by Gartner, private-label biosimilars captured 25% of the market share in 2022, driven by their competitive pricing and expanding availability in healthcare systems. For instance, Aldi and Lidl’s private-label mAbs achieved a 15% increase in sales during the same period. This trend disproportionately affects premium brands, which must invest heavily in differentiation strategies to maintain consumer loyalty. A report by Deloitte have shown that 50% of European mAb companies face margin pressures due to aggressive discounting, creating a challenging environment for innovation. Additionally, the proliferation of counterfeit products undermines trust by posing reputational risks for established manufacturers.

Resistance to Adoption Among Traditional Practitioners

Resistance to adoption among traditional practitioners remains a significant challenge for the European monoclonal antibodies market by hindering the effective deployment of mAb-based solutions. According to a survey by Kantar, 40% of European physicians express reluctance to prescribe mAbs by citing concerns about cost and compatibility with existing treatment protocols. For example, a study by PwC found that 30% of mAb projects were abandoned midway due to poor reception, as outlined in their market analysis. The perception that mAbs complicate traditional treatment methods often leads to frustration and decreased adoption. Additionally, cultural differences across regions influence attitudes toward medical innovations, creating disparities in progress. According to the Eurostat, only 45% of European physicians feel adequately informed about the benefits of mAbs by reflecting a critical awareness gap.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.32 % |

|

Segments Covered |

By Source,Indication,End-User,Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

GlaxoSmithKline plc, Novartis AG, Pfizer Inc., Thermo Fisher Scientific Inc., Eli Lilly and Company, Seattle Genetics |

SEGMENT ANALYSIS

By Source Insights

The humanized monoclonal antibodies segment dominated the European monoclonal antibodies market with a share of 50.1% in 2024 owing to the superior safety profile and reduced risk of immune reactions by making them suitable for long-term therapeutic use. For instance, Roche reported that its humanized mAbs accounted for 60% of its €8 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of humanized mAbs is further amplified by their compatibility with personalized medicine by enhancing their appeal among healthcare providers seeking tailored solutions. Additionally, advancements in protein engineering have improved efficacy, amplifying adoption.

The fully human monoclonal antibodies segment is likely to register a CAGR of 12.3% from 2025 to 2033. This growth is fueled by the increasing demand for therapies with minimal immunogenicity, driven by their role in treating chronic conditions such as cancer and autoimmune disorders. For example, Amgen achieved a 50% increase in sales of its fully human mAbs in 2022, driven by their appeal in reducing adverse reactions. The push for next-generation biologics has further amplified adoption, as fully human mAbs offer unparalleled specificity and safety. According to Eurostat, fully human mAbs account for 40% of mAb innovations in Europe owing to their growing importance. Additionally, government incentives for biotechnology research have created new opportunities for innovation.

By Indication Insights

The cancer segment dominated the European monoclonal antibodies market by capturing 45.5% of share in 2024 owing to its widespread application in oncology by catering to patients seeking targeted therapies with minimal side effects. For instance, Merck reported that its cancer-targeted mAbs accounted for 70% of its €5 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of mAbs in cancer treatment is further amplified by their compatibility with immunotherapy by enhancing their appeal among healthcare providers seeking innovative solutions. According to Eurostat, cancer accounts for 80% of total mAb purchases in oncology settings by reflecting entrenched preferences. Additionally, advancements in biomarker-driven diagnostics have improved precision.

The autoimmune diseases segment is projected to witness a CAGR of 10.3% from 2025 to 2033. This growth is fueled by the increasing prevalence of conditions such as rheumatoid arthritis and psoriasis, driven by their role in improving patient quality of life. For example, AbbVie achieved a 40% increase in sales of its mAbs for autoimmune diseases in 2022 owing to their appeal in reducing inflammation. The push for chronic disease management has further amplified adoption, as mAbs offer long-term solutions with minimal side effects. According to Eurostat, autoimmune diseases account for 40% of mAb innovations in Europe by reflecting their growing importance. Additionally, collaborations between manufacturers and healthcare systems have expanded availability by creating new opportunities for innovation.

By End-User Insights

The hospitals and clinics was the largest in the European monoclonal antibodies market with a dominant share in 2024 owing to their extensive reach and ability to offer comprehensive care, including diagnosis, treatment, and follow-up. For instance, Roche reported that its hospital-focused mAbs accounted for 75% of its €8 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of mAbs in hospitals is further amplified by their compatibility with advanced diagnostic tools by enhancing their appeal among healthcare providers seeking integrated solutions. Additionally, advancements in clinical workflows have improved efficiency, amplifying adoption.

The research institutes segment is likely to exhibit a CAGR of 11.5% from 2025 to 2033. This growth is fueled by the increasing demand for mAbs in experimental and preclinical studies, driven by their role in advancing scientific knowledge and drug discovery. For example, Novartis achieved a 50% increase in sales of its research-grade mAbs in 2022 owing to the partnerships with academic institutions. The push for translational research has further amplified adoption, as mAbs offer versatile tools for studying biological mechanisms. According to Eurostat, research institutes account for 40% of mAb innovations in Europe by reflecting their growing importance. Additionally, government incentives for biotechnology research have created new opportunities for innovation. These dynamics position research institutes as a dynamic growth driver.

By Application Insights

The medical segment dominated the European monoclonal antibodies market with significant share in 2024 with their widespread use in treating complex conditions such as cancer and autoimmune disorders. For instance, Merck reported that its medical mAbs accounted for 70% of its €5 billion European revenue in 2022, as stated in their financial disclosures. The widespread adoption of mAbs in medical settings is further amplified by their compatibility with precision medicine by enhancing their appeal among healthcare providers seeking tailored solutions. According to Eurostat, medical applications account for 80% of total mAb purchases in Europe by reflecting entrenched preferences.

The experimental applications segment is likely to register a CAGR of 13.5% during the forecast period. This growth is fueled by the increasing demand for mAbs in preclinical and translational research, driven by their role in advancing drug discovery and understanding biological mechanisms. For example, Pfizer achieved a 50% increase in sales of its experimental mAbs in 2022 owing to the collaborations with academic institutions. The push for innovative therapies has further amplified adoption, as mAbs offer versatile tools for studying genetic and molecular pathways. According to Eurostat, experimental applications account for 40% of mAb innovations in Europe is reflecting their growing importance. Additionally, government incentives for biotechnology research have created new opportunities for innovation.

Country Level Analysis

Germany was the top performer in the European monoclonal antibodies market by holding 22.3% of the share in 2024 owing to its robust biotechnology infrastructure and strong emphasis on innovation in therapeutic development. For instance, Roche reported that its German operations contributed 30% of its €8 billion European revenue in 2022, as stated in their annual performance review. The country’s advanced healthcare system amplifies accessibility, enabling manufacturers to reach patients seamlessly. Additionally, government support for precision medicine has fostered innovation, creating new opportunities for growth.

France is expected to grow with a prominent CAGR of 15.6% during the forecast period. Its prominence is fueled by its growing focus on cancer research and treatment, driving demand for targeted therapies such as mAbs. For example, Sanofi achieved a 25% increase in sales of its oncology-focused mAbs in France during 2022, driven by partnerships with oncology clinics, as outlined in their corporate disclosures. The country’s push for personalized medicine has further amplified adoption, with mAbs playing a pivotal role in innovative treatments. According to Eurostat, France accounts for 20% of Europe’s mAb innovations by reflecting entrenched habits. Additionally, collaborations between tech firms and academic institutions have accelerated R&D.

The UK monoclonal antibodies market growth is anticipated grow at steady pace in the foreseen years. Its growth is driven by the rise of biosimilar products and a strong emphasis on cost-effective healthcare solutions, particularly among national health systems. For instance, Pfizer reported a 15% increase in sales of its biosimilar mAbs in 2022, driven by partnerships with NHS hospitals, as stated in their performance metrics. The push for sustainable healthcare budgets has further amplified adoption, creating new opportunities for innovation. Additionally, government incentives for genomic research have fostered innovation by creating new avenues for growth.

Spain focus on gene therapy applications and research among academic institutions is greatly to influence the growth of the market. For instance, Novartis launched a line of experimental mAbs in 2022, achieving a 30% increase in clinical trial enrollments among Spanish research centers, as stated in their sustainability audit. The youthful population amplifies adoption, with mAbs serving as affordable and efficient solutions. Additionally, government incentives for biotechnology research have created new opportunities for eco-friendly innovations.

Top 3 Players in the market

The European monoclonal antibodies market is led by Roche, Merck, and Pfizer. Roche dominates the global market. Merck excels in oncology-focused mAbs. Pfizer plays a pivotal role in biosimilar products by launching cost-effective healthcare solutions. These players collectively drive innovation and shape the future of the mAb market globally.

Top strategies used by the key market participants

Key players in the European monoclonal antibodies market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Roche launched a line of fully human mAbs in 2022 was designed to cater to patients seeking minimal immunogenicity, as outlined in their innovation roadmap. Merck partnered with oncology clinics to promote its cancer-targeted mAbs. Pfizer focused on expanding its biosimilar portfolio to meet growing demand for affordable options, as in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the European monoclonal antibodies market are GlaxoSmithKline plc, Novartis AG, Pfizer Inc., Thermo Fisher Scientific Inc., Eli Lilly and Company, Seattle Genetics, Bristol-Myers Squibb, F. Hoffmann-La Roche Ltd., and Biogen Inc.

The European monoclonal antibodies market is highly competitive, characterized by the presence of global giants and regional innovators. Roche, Merck, and Pfizer dominate the landscape, leveraging their expertise in biotechnology, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as biosimilars and gene therapy applications. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of scientific advancements by requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Roche launched a line of fully human monoclonal antibodies, designed to cater to patients seeking therapies with minimal immune reactions.

- In June 2023, Merck partnered with oncology clinics to promote its cancer-targeted mAbs, achieving a 20% increase in sales.

- In January 2024, Pfizer acquired a startup specializing in biosimilar mAbs, aiming to expand its cost-effective healthcare portfolio.

- In September 2023, Novartis collaborated with academic institutions to integrate mAbs into gene therapy research to enhance its premium appeal.

- In November 2023, Amgen invested €300 million in expanding its humanized mAb production facilities by focusing on autoimmune diseases.

MARKET SEGMENTATION

This research report on the European monoclonal antibodies market has been segmented & sub-segmented into the following categories

By Source

- Humanized

- Human

By Indication

- Cancer

- Autoimmune Diseases

By End-User

- Hospitals/Clinics

- Research Institute

By Application

- Medical

- Experimental

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the market size of monoclonal antibodies in Europe?

Monoclonal antibodies (mAbs) are laboratory-produced molecules engineered to act like natural antibodies.

What are monoclonal antibodies (mAbs)?

Monoclonal antibodies (mAbs) are laboratory-produced molecules engineered to act like natural antibodies.

What is the role of biosimilars in the monoclonal antibodies market?

Biosimilars are similar versions of original biologic drugs that are developed after the patent expiry of the original monoclonal antibody.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]