Europe qPCR Reagents Market Size, Share, Trends & Growth Forecast Report By Detection Method, Packaging Type, End-User, Application & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe qPCR Reagents Market Size

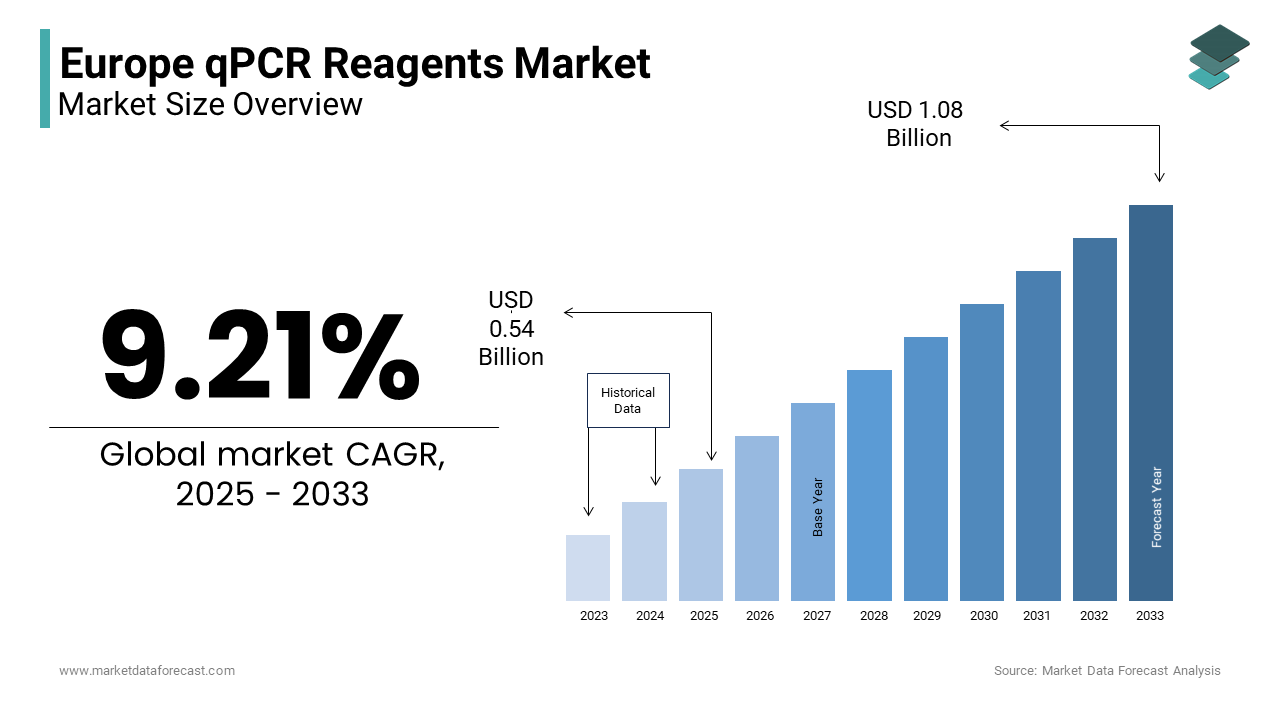

The qPCR reagents market size in Europe was valued at USD 0.49 billion in 2024. The European market size is estimated to grow at a CAGR of 9.21% from 2025 to 2033 and be worth USD 1.08 billion by 2033 from USD 0.54 billion in 2025.

Quantitative Polymerase Chain Reaction (qPCR) has emerged as a crucial technology to detect and quantify nucleic acids that enable applications ranging from infectious disease diagnosis to genetic research. According to the European Molecular Biology Organization, qPCR is now considered the gold standard for molecular diagnostics due to its unparalleled sensitivity, specificity, and ability to provide real-time data. The robust healthcare infrastructure, stringent regulatory frameworks, and a strong focus on innovation plays a pivotal role in shaping global trends in qPCR reagent adoption. For instance, as per the reports of the European Commission, over 20% of Europe’s population will be aged 65 or older by 2030, driving demand for advanced diagnostic tools like qPCR. Additionally, government initiatives such as Horizon Europe and national health strategies have prioritized funding for research and development in molecular diagnostics, fostering a conducive environment for the European market.

MARKET DRIVERS

Increasing Prevalence of Infectious Diseases and Genetic Disorders in Europe

The rising incidence of infectious diseases and genetic disorders in Europe is propelling the European qPCR reagents market growth. According to the European Centre for Disease Prevention and Control, over 33,000 deaths annually in the European Union are attributed to antibiotic-resistant bacterial infections alone. This alarming statistic underscores the critical need for advanced diagnostic tools such as qPCR, which enable rapid and accurate detection of pathogens. Furthermore, genetic disorders like cystic fibrosis and sickle cell anemia remain prevalent, with approximately 1 in 2,500 newborns in Europe diagnosed with cystic fibrosis, as per Eurostat. These conditions necessitate precise molecular diagnostics, thereby driving demand for qPCR reagents. The ability of qPCR to provide quantitative data with high sensitivity and specificity makes it indispensable in both clinical diagnostics and research settings. Additionally, government initiatives aimed at enhancing healthcare infrastructure have further bolstered the adoption of qPCR technologies. For instance, Germany’s Federal Ministry of Health has allocated substantial funding for molecular diagnostics research, reinforcing the prominence of qPCR reagents in disease management across Europe.

Advancements in Molecular Diagnostics Technologies

Technological advancements in molecular diagnostics are boosting the qPCR reagents market growth in Europe. According to the World Health Organization, the integration of automation and artificial intelligence in diagnostic platforms has enhanced the efficiency and accuracy of qPCR assays. For example, automated qPCR systems can process up to 96 samples simultaneously, reducing turnaround times and operational costs. Moreover, innovations such as multiplex qPCR, which allows the simultaneous detection of multiple targets in a single reaction, have revolutionized disease monitoring and research applications. A report by the European Molecular Biology Laboratory highlights that over 70% of research laboratories in Europe have adopted advanced qPCR technologies due to their versatility and reliability. These advancements not only improve diagnostic capabilities but also expand the scope of qPCR applications, ranging from cancer biomarker detection to environmental monitoring. As a result, the demand for high-quality qPCR reagents continues to surge, driven by the increasing sophistication of molecular diagnostics tools and their widespread adoption across various sectors.

MARKET RESTRAINTS

High Costs Associated with qPCR Reagents and Equipment

The elevated costs of qPCR reagents and associated equipment is a significant restraint to the growth of the European qPCR reagents market. According to the European Federation of Pharmaceutical Industries and Associations, the average cost of a single qPCR assay kit ranges between €200 and €500, depending on the complexity and application. This financial burden is particularly pronounced for smaller research institutions and diagnostic centers operating with limited budgets. Additionally, the initial investment required for qPCR instruments, which often exceeds €20,000, further exacerbates the financial strain. Such high costs hinder the widespread adoption of qPCR technologies, especially in economically challenged regions within Europe. For instance, countries like Romania and Bulgaria face significant disparities in healthcare spending, as highlighted by the European Commission, limiting their capacity to invest in advanced diagnostic tools. While larger pharmaceutical companies and academic institutions may absorb these costs, smaller entities often struggle to justify the expenditure. Consequently, the affordability barrier restricts market penetration, particularly in underfunded sectors, thereby impeding the qPCR reagents market growth in Europe.

Stringent Regulatory Frameworks Governing Diagnostic Tools

Stringent regulatory frameworks governing the approval and use of diagnostic tools is a notable restraint for the qPCR reagents market in Europe. According to the European Medicines Agency, diagnostic reagents must comply with rigorous standards outlined in the In Vitro Diagnostic Medical Devices Regulation (IVDR), which came into effect in May 2022. These regulations mandate extensive clinical validation and documentation, significantly increasing the time and resources required for product approval. For instance, the IVDR requires manufacturers to demonstrate the analytical and clinical performance of qPCR reagents through large-scale studies, a process that can take up to three years. Additionally, non-compliance with these regulations can result in severe penalties, including product recalls and market withdrawal. A study by the European Association of Science Editors reveals that nearly 40% of diagnostic tool manufacturers face delays in product launches due to regulatory hurdles. Such stringent requirements not only increase operational costs but also discourage innovation, as smaller companies may lack the resources to navigate the complex regulatory landscape. As a result, the pace of technological advancement and market expansion in the qPCR reagents sector is considerably slowed.

MARKET OPPORTUNITIES

Growing Adoption of Personalized Medicine

The burgeoning field of personalized medicine is a lucrative opportunity for the qPCR reagents market in Europe. According to the European Alliance for Personalised Medicine, personalized medicine is projected to account for over 20% of all medical treatments by 2030 due to the advancements in genomics and molecular diagnostics. qPCR technology plays a pivotal role in this domain by enabling precise quantification of gene expression levels and identification of genetic mutations, which are critical for tailoring therapeutic interventions. For instance, in oncology, qPCR-based assays are widely used to detect mutations in genes such as EGFR and KRAS, guiding targeted therapies for cancer patients. As per the estimations of the European Society for Medical Oncology, personalized medicine could reduce healthcare costs by up to €10 billion annually in Europe by minimizing ineffective treatments. Furthermore, government initiatives, such as the UK’s National Health Service Genomic Medicine Service, have prioritized the integration of genomic technologies into routine clinical practice, further propelling the demand for qPCR reagents. As personalized medicine gains traction, the qPCR reagents market stands to benefit significantly from the growing emphasis on precision diagnostics and tailored treatment strategies.

Expansion of Point-of-Care Testing Solutions

The increasing demand for point-of-care testing (POCT) solutions is a promising opportunity for the qPCR reagents market in Europe. According to the European Point-of-Care Testing Network, the demand for POCT is expected to grow at an exponential CAGR over the next decade owing to the need for rapid and decentralized diagnostic services. qPCR-based POCT devices, which deliver results within 30 minutes, are particularly advantageous in emergency care and remote settings where timely diagnosis is critical. For example, during the COVID-19 pandemic, portable qPCR systems were instrumental in enabling rapid screening at airports and community health centers. According to the European Centre for Disease Prevention and Control, the POCT adoption increased by 35% in rural areas of Europe during the pandemic, showcasing its potential to bridge healthcare accessibility gaps. Additionally, advancements in miniaturization and microfluidics have made qPCR-based POCT devices more affordable and user-friendly, expanding their applicability across diverse end-user segments. As healthcare providers increasingly prioritize convenience and speed, the demand for qPCR reagents tailored to POCT applications is poised to rise substantially.

MARKET CHALLENGES

Limited Awareness and Expertise Among End Users

A significant challenge facing the Europe qPCR reagents market is the limited awareness and expertise among end users, particularly in smaller diagnostic centers and emerging economies. According to the European Biotechnology Industry Organization, over 60% of healthcare professionals in Eastern Europe lack formal training in advanced molecular diagnostics techniques, including qPCR. This knowledge gap hinders the effective utilization of qPCR reagents, leading to suboptimal outcomes and reduced adoption rates. For instance, improper handling of reagents or incorrect interpretation of results can compromise diagnostic accuracy, undermining confidence in qPCR technologies. Furthermore, a survey conducted by the European Society for Clinical Chemistry and Laboratory Medicine reveals that only 45% of laboratories in Southern Europe adhere to standardized protocols for qPCR assays, indicating a pressing need for education and training initiatives. The absence of skilled personnel not only limits market growth but also increases the risk of errors, which can have serious implications for patient care. Addressing this challenge requires concerted efforts from manufacturers, regulatory bodies, and educational institutions to enhance awareness and proficiency in qPCR methodologies.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages present another formidable challenge for the qPCR reagents market in Europe. According to the European Chemical Industry Council, the global shortage of key raw materials, such as enzymes and nucleotides, has led to production delays and increased costs for qPCR reagent manufacturers. The ongoing geopolitical tensions and trade restrictions have further exacerbated these issues, with countries like Russia imposing export bans on critical biochemicals. As per a report by the European Commission, over 30% of European biotech companies experienced supply chain disruptions in 2022, which is impacting their ability to meet market demands. Additionally, the reliance on a limited number of suppliers for high-quality reagents creates vulnerabilities, as any disruption in the supply chain can have cascading effects. For instance, during the height of the COVID-19 pandemic, the unprecedented demand for qPCR reagents resulted in a global backlog, leaving many laboratories without essential supplies. To mitigate these challenges, manufacturers must explore alternative sourcing strategies and invest in local production capabilities to ensure a stable and resilient supply chain.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.21% |

|

Segments Covered |

By Detection Method, Packaging Type ,End User, Application, and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Thermo Fisher Scientific, Bio-Rad Laboratories, Qiagen N.V., F. Hoffmann-La Roche, Agilent Technologies Inc., Takara Bio, Affymetrix Inc., |

SEGMENTAL ANALYSIS

By Detection Method Insights

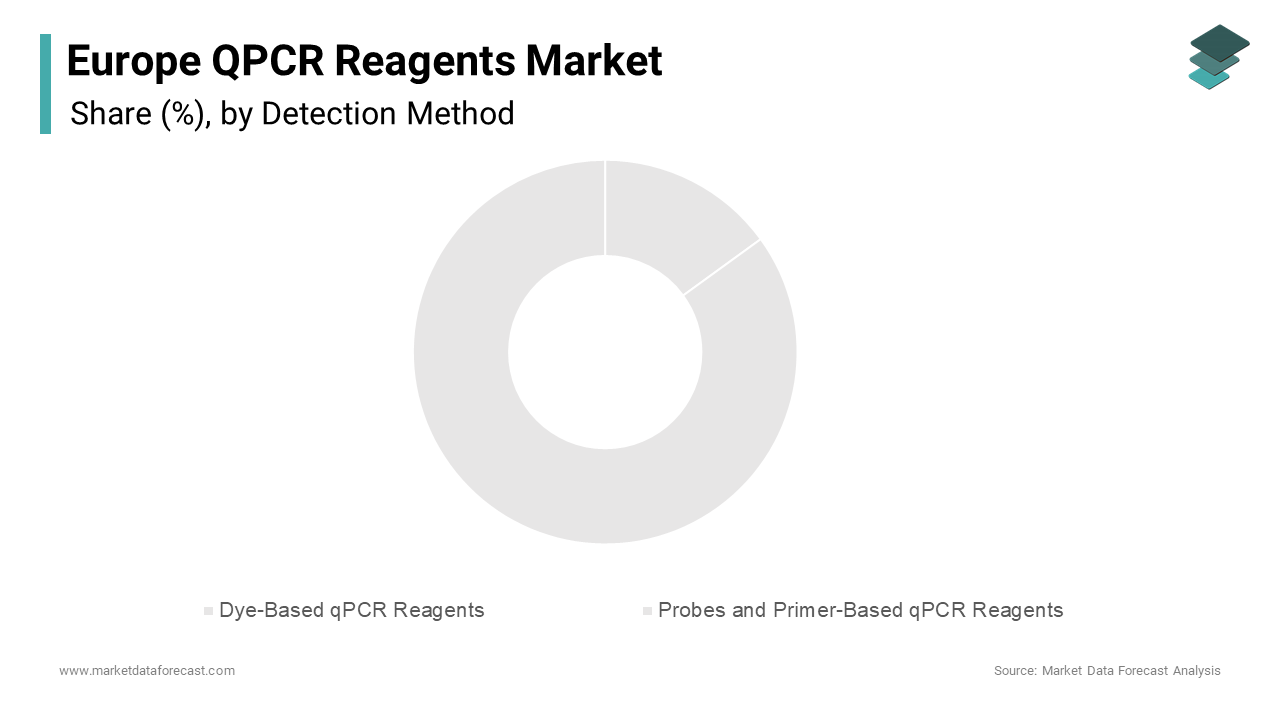

The probes and primer-based qPCR reagents segment dominated the Europe qPCR reagents market by holding the leading share of 65.1% of the European market in 2024. The growth of the probes and primer-based qPCR reagents segment is attributed to its superior specificity and sensitivity, making it the preferred choice for applications requiring precise quantification, such as viral load monitoring and cancer biomarker detection. For instance, hydrolysis probes, commonly used in this method, offer real-time fluorescence detection with minimal background noise, ensuring highly reliable results. The European Society for Clinical Microbiology notes that probe-based assays are employed in over 80% of diagnostic laboratories for detecting infectious diseases like HIV and hepatitis. Furthermore, the versatility of probes and primers allows customization for multiplex assays, enabling simultaneous detection of multiple targets in a single reaction. This adaptability not only enhances efficiency but also reduces operational costs, making it an attractive option for both research and clinical applications.

The dye-based qPCR reagents segment is predicted to witness the fastest CAGR of 14.5% over the forecast period owing to cost-effectiveness and simplicity, which is making them ideal for high-throughput screening and routine diagnostic applications. Unlike probe-based methods, dye-based assays utilize intercalating dyes like SYBR Green, which bind to double-stranded DNA, offering a more affordable alternative without compromising sensitivity. According to the European Association for Predictive, Preventive, and Personalized Medicine, dye-based qPCR is extensively used in academic research, where budget constraints often dictate method selection. Additionally, advancements in dye chemistry have improved the specificity and stability of these reagents, broadening their applicability. For example, newer dyes exhibit reduced photobleaching and enhanced binding affinity, addressing previous limitations. As demand for accessible and scalable diagnostic solutions rises, the demand for dye-based qPCR reagents are expected to gain further traction in this regional market

By Packaging Type Insights

The qPCR core kits segment captured the major share of 60.8% of the European market share in 2024. These kits include essential components such as enzymes, buffers, and dNTPs, providing a comprehensive solution for conducting qPCR assays. Their popularity stems from their convenience and reliability, as they eliminate the need for researchers to source individual reagents, thereby reducing variability and ensuring consistent results. The European Society for Translational Medicine highlights that qPCR core kits are widely adopted in academic and industrial research, where reproducibility is paramount. For instance, over 70% of research laboratories in Western Europe rely on core kits for gene expression studies and pathogen detection. Furthermore, the availability of pre-optimized formulations simplifies assay setup, saving time and labor costs. This ease of use, combined with the kits' compatibility with a wide range of qPCR platforms, underscores their dominance in the market. As research activities continue to expand, the demand for qPCR core kits is expected to remain robust in the European market.

The qPCR mastermixes segment is expected to expand at a CAGR of 15.2% over the forecast period due to their ability to streamline workflows and enhance assay performance. Mastermixes are pre-formulated solutions containing all necessary components, including polymerases, buffers, and stabilizers, enabling researchers to perform qPCR assays with minimal preparation. According to the European Biotechnology Industry Organization, the adoption of mastermixes has surged by 40% in pharmaceutical and biotechnology companies over the past five years, owing to their compatibility with high-throughput screening. Additionally, advancements in formulation technologies have improved the stability and shelf life of mastermixes, addressing previous concerns about degradation. For example, lyophilized mastermixes offer extended storage durations without refrigeration, making them ideal for field applications. As the demand for efficient and scalable diagnostic solutions rises, qPCR mastermixes are poised to witness accelerated growth in the European market

By End User Insights

The hospitals and diagnostic centers segment accounted for the major share of the European market in 2024. The prominence of the hospitals and diagnostic centers segment in the European market is attributed to the critical role of qPCR in diagnosing infectious diseases, genetic disorders, and cancer. For instance, the European Centre for Disease Prevention and Control notes that over 70% of diagnostic tests for respiratory infections in hospitals rely on qPCR technology due to its rapid turnaround time and high accuracy. Additionally, the increasing prevalence of chronic diseases, coupled with aging populations in countries like Germany and Italy, has amplified the demand for advanced diagnostic tools. Hospitals and diagnostic centers are also at the forefront of adopting innovative technologies, such as automated qPCR systems, to enhance throughput and efficiency. The according to the European Society for Clinical Chemistry and Laboratory Medicine, hospitals account for over 60% of qPCR reagent consumption in clinical settings.

The research laboratories and academic institutes segment is anticipated to progress at a CAGR of 16.8% over the forecast period owing to the increasing focus on genomic research and the development of novel therapeutics. For example, the European Molecular Biology Laboratory reports that over 50% of academic research projects involving gene expression analysis utilize qPCR technology. Additionally, government funding for scientific research has surged, with the European Union allocating €100 billion to Horizon Europe, a program supporting cutting-edge research initiatives. This financial backing has enabled academic institutions to invest in advanced qPCR reagents and equipment, driving demand. Furthermore, the versatility of qPCR in applications such as CRISPR validation and epigenetic studies has expanded its utility in academic settings. As research activities intensify, particularly in fields like oncology and microbiology, the demand for qPCR reagents in research laboratories and academic institutes is expected to grow exponentially in the European market.

By Application Insights

The diagnostic applications segment dominated the Europe qPCR reagents market by accounting for 50.8% of the European market share in 2024. The domination of diagnostics segment is driven by the critical role of qPCR in detecting infectious diseases, genetic disorders, and cancer. For instance, the European Centre for Disease Prevention and Control highlights that qPCR-based assays are the gold standard for diagnosing viral infections like influenza and HIV, with over 80% of clinical laboratories relying on this technology. The increasing prevalence of chronic diseases, coupled with the growing emphasis on early diagnosis, has further amplified demand. Additionally, the COVID-19 pandemic underscored the importance of qPCR in public health, with millions of tests conducted daily across Europe. The European Society for Clinical Microbiology notes that qPCR's ability to provide quantitative data with high sensitivity and specificity makes it indispensable in diagnostic settings. As healthcare systems prioritize precision medicine and preventive care, the dominance of diagnostic applications in the qPCR reagents market is expected to persist.

The research segment is anticipated to progress at a promising CAGR of 17.3% over the forecast period owing to the expanding scope of genomic research and the development of innovative therapies. For example, the European Molecular Biology Organization reports that over 60% of gene expression studies utilize qPCR technology due to its versatility and reliability. Additionally, advancements in fields like CRISPR gene editing and single-cell analysis have increased the demand for high-quality qPCR reagents. Government initiatives, such as the European Union's Horizon Europe program, have allocated substantial funding for research projects, further propelling adoption. According to the European Biotechnology Industry Association, research applications account for over 40% of qPCR reagent consumption in academic settings. As research activities intensify, particularly in oncology, immunology, and microbiology, the demand for qPCR reagents in research applications is expected to grow rapidly in the European market.

Country Level Analysis

Germany stood as the leading position in the Europe qPCR reagents market by holding 25.9% of the European market share in 2024. The dominance of Germany in the European market is attributed to the country's robust healthcare infrastructure and strong emphasis on research and development. For instance, Germany is home to over 300 biotechnology companies, many of which specialize in molecular diagnostics, driving demand for qPCR reagents. The European Federation of Pharmaceutical Industries and Associations highlights that Germany accounts for over 30% of Europe's total pharmaceutical R&D expenditure, underscoring its pivotal role in advancing qPCR technologies. Additionally, government initiatives, such as the "High-Tech Strategy 2025," have prioritized investments in precision medicine and digital health, further boosting adoption. The presence of renowned research institutions like the Max Planck Society and Helmholtz Association also contributes to Germany's leadership. As the country continues to invest in healthcare innovation, the prominence of Germany in the European qPCR reagents market is expected to strengthen.

The UK market did well in the European market and is expected to showcase a prominent CAGR over the forecast period. The growth of the UK market in the European market is driven by the country's advanced healthcare system and strong focus on genomic research. For example, the UK's National Health Service Genomic Medicine Service has integrated qPCR technologies into routine clinical practice, enhancing diagnostic capabilities. The European Alliance for Personalised Medicine notes that the UK is a global leader in cancer research, with over 50% of oncology studies utilizing qPCR for biomarker detection. Additionally, the UK government's Life Sciences Industrial Strategy has allocated £4.7 billion for R&D, fostering innovation in molecular diagnostics. The presence of leading universities and research institutions, such as the University of Cambridge and Imperial College London, further reinforces the UK's position.

France is a notable regional market for qPCR reagents in Europe and is estimated to account for a prominent share of the European market over the forecast period. The well-established pharmaceutical industry of France and commitment to healthcare innovation are boosting the French market growth. For instance, France is home to over 200 biotech companies, many of which focus on developing advanced diagnostic tools, including qPCR technologies. As per the European Biotechnology Industry Association, France accounts for over 20% of Europe's biotech funding, underscoring its role in driving market growth. Additionally, government initiatives like the "France 2030" plan aim to bolster investments in precision medicine and digital health, further enhancing adoption. The presence of renowned research institutions, such as the Institut Pasteur and INSERM, also contributes to France's leadership. As the country continues to prioritize healthcare innovation, the position of France in the qPCR reagents market is expected to grow.

Italy holds a market share of approximately 12% in the Europe qPCR reagents market, as per the Italian Ministry of Health. This leadership is driven by the country's aging population and increasing prevalence of chronic diseases, which necessitate advanced diagnostic tools. For example, the Italian Society of Clinical Pathology notes that over 60% of diagnostic laboratories in Italy utilize qPCR for detecting infectious diseases and genetic disorders. Additionally, government funding for healthcare innovation has surged, with initiatives like the "National Recovery and Resilience Plan" allocating €19 billion for digital transformation and research. The presence of leading universities and research institutions, such as the University of Milan and CNR, further reinforces Italy's position. As the demand for precision diagnostics rises, the role of Italy in the qPCR reagents market is expected to expand.

Spain is predicted to hold a notable share of the European market over the forecast period. The prominence of Spain is supported by the country's growing biotechnology sector and increasing focus on healthcare innovation. For instance, Spain is home to over 150 biotech companies, many of which specialize in molecular diagnostics, driving demand for qPCR reagents. The European Federation of Biotechnology highlights that Spain accounts for over 15% of Europe's biotech workforce, underscoring its role in advancing qPCR technologies. Additionally, government initiatives like the "Spanish Strategy for Science, Technology, and Innovation" aim to boost investments in precision medicine and digital health, further enhancing adoption. The presence of renowned research institutions, such as the Spanish National Research Council and Barcelona Institute for Global Health, also contributes to Spain's leadership.

KEY MARKET PLAYERS

Companies playing a leading role in the European qPCR Reagents market include Thermo Fisher Scientific, Bio-Rad Laboratories, Qiagen N.V., F. Hoffmann-La Roche, Agilent Technologies Inc., Takara Bio, Affymetrix Inc., Promega Corporation, Sigma-Aldrich Corporation, and Quanta Biosciences.

MARKET SEGMENTATION

This research report on the Europe qPCR reagents market is segmented and sub-segmented into the following categories.

By Detection Method

- Dye-Based qPCR Reagents

- Probes and Primer-Based qPCR Reagents

By Packaging Type

- qPCR Core Kits

- qPCR Mastermixes

By End User

- Hospitals & Diagnostic Centre

- Research Laboratories & Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Clinical Research Organizations

- Forensic Laboratories

By Application

- Diagnostic

- Research

- Forensic

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]