Europe Rechargeable Battery Market Size, Share, Trends, & Growth Forecast Report By Technology (Lead Acid, Lithium-Ion, and Others (NiMh, NiCd, etc.)), Application (Automobiles, Industrial Batteries, Portable Batteries, and Other Applications), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Rechargeable Battery Market Size

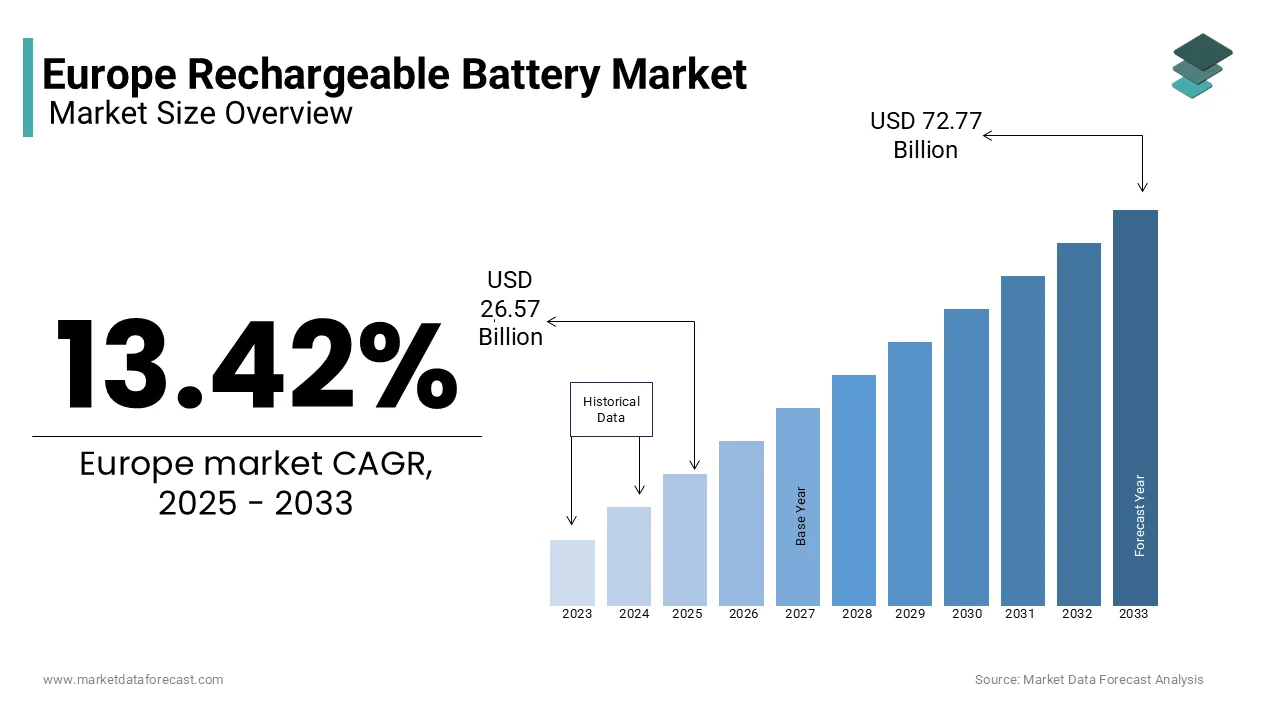

The Europe rechargeable battery market was worth USD 23.43 billion in 2024. The European market is projected to reach USD 72.77 billion by 2033 from USD 26.57 billion in 2025, rising at a CAGR of 13.42% from 2025 to 2033.

Rechargeable batteries are integral to powering electric vehicles (EVs), renewable energy storage systems, and portable electronic devices to align with the EU’s ambitious Green Deal objectives. The European rechargeable batteries market includes various technologies, including lithium-ion, lead-acid, nickel-metal hydride (NiMH), and nickel-cadmium (NiCd) batteries, each catering to specific applications across industries. The demand for rechargeable batteries in Europe surged by 25% in 2022 owing to the rapid adoption of EVs and renewable energy integration. Germany, France, and Sweden emerged as key contributors to the European market. The International Energy Agency (IEA) estimates that Europe will require approximately 150 gigawatt-hours (GWh) of battery production capacity by 2030 to meet growing demand, particularly for automotive applications. With significant investments in battery manufacturing facilities and stringent regulations promoting sustainability, the Europe rechargeable battery market is poised for exponential growth. This expansion is further supported by innovations in energy density, charging efficiency, and recyclability, ensuring alignment with Europe’s carbon neutrality goals by 2050.

MARKET DRIVERS

Increasing Adoption of Electric Vehicles (EVs) in Europe

The accelerating adoption of electric vehicles, spurred by stringent emission regulations and government incentives is one of the major factors driving the growth of the Europe rechargeable battery market. According to the European Automobile Manufacturers’ Association (ACEA), EV sales in Europe grew by 45% in 2022, reaching over 2 million units. This surge has created unprecedented demand for high-capacity lithium-ion batteries, which power the majority of EVs on the market. According to the German Federal Ministry for Economic Affairs and Energy, Germany alone accounted for 30% of Europe’s EV registrations in 2022, driven by subsidies of up to €9,000 per vehicle. Similarly, France’s National Low-Carbon Strategy allocated €8 billion to support EV infrastructure, further boosting battery demand. These initiatives have not only stimulated market growth but also positioned Europe as a global leader in sustainable mobility. With projections indicating that EVs will represent 70% of new car sales by 2030, the rechargeable battery market is set to expand significantly to ensure long-term economic and environmental benefits.

Renewable Energy Integration and Storage Solutions

The integration of renewable energy systems with advanced battery storage solutions to enable efficient energy management and grid stability is further propelling the European market expansion. According to the European Photovoltaic Industry Association, solar and wind energy accounted for 38% of the EU’s electricity generation in 2022, necessitating robust energy storage systems to address intermittency challenges. As per the Swedish Energy Agency, lithium-ion batteries are increasingly being deployed in residential and commercial settings, achieving an average efficiency of 95%. Additionally, according to the UK Department for Business, Energy & Industrial Strategy, investments in utility-scale battery storage projects exceeded €5 billion in 2022, underscoring the growing importance of rechargeable batteries. These systems not only enhance the viability of renewable energy but also contribute to energy independence, positioning the Europe rechargeable battery market as a key enabler of the clean energy transition.

MARKET RESTRAINTS

Supply Chain Vulnerabilities and Material Scarcity

A significant restraint hindering the Europe rechargeable battery market is the vulnerability of its supply chain, particularly concerning critical materials such as lithium, cobalt, and nickel. According to the European Raw Materials Alliance, Europe relies heavily on imports for over 90% of its lithium requirements, exposing the market to geopolitical risks and price volatility. According to the Czech Ministry of Industry and Trade, disruptions in the global supply chain during the COVID-19 pandemic caused a 30% increase in material costs, significantly impacting battery production timelines. Moreover, the scarcity of cobalt, a key component in lithium-ion batteries, poses additional challenges. Efforts to develop alternative materials and recycling technologies are underway, but progress remains slow. Addressing these supply chain vulnerabilities is imperative to ensure the resilience and competitiveness of the Europe rechargeable battery market.

Environmental Concerns and Recycling Challenges

The environmental impact of rechargeable batteries, particularly concerning electronic waste (e-waste) and recycling inefficiencies is another notable restraint to the Europe rechargeable battery market. According to the European Environmental Bureau, e-waste from batteries is projected to exceed 50 million metric tons globally by 2030, with Europe contributing significantly to this figure. According to the Italian Ministry of Environment, less than 30% of lithium-ion batteries are currently recycled in Europe, posing significant environmental risks due to hazardous materials like cobalt and cadmium. Furthermore, the absence of standardized recycling processes exacerbates the problem, leaving manufacturers unaccountable for end-of-life disposal. Bridging these gaps through innovative recycling technologies and stringent regulatory measures is crucial to ensuring the sustainability of the Europe rechargeable battery market.

MARKET OPPORTUNITIES

Advancements in Solid-State Battery Technology

The development and commercialization of solid-state battery technology that offer superior energy density and safety compared to traditional lithium-ion batteries is one of the notable opportunities for the European rechargeable battery market. According to the Fraunhofer Institute for Silicon Technology, solid-state batteries could achieve energy densities exceeding 500 watt-hours per kilogram (Wh/kg), significantly outperforming current technologies. As per the French Alternative Energies and Atomic Energy Commission, pilot projects in France and Germany have demonstrated a 20% improvement in charging efficiency, attracting substantial private sector investment. Additionally, the European Investment Bank has allocated €2 billion to support research and development in next-generation battery technologies. By capitalizing on this opportunity, Europe can position itself as a global leader in cutting-edge battery innovation while addressing existing limitations in energy storage.

Expansion into Emerging Applications

The expansion of rechargeable batteries into emerging applications, such as aerospace, marine transport, and smart grids is another promising opportunity in the European market. According to the European Space Agency, the aerospace industry is increasingly adopting lightweight lithium-ion batteries for satellite and spacecraft operations, creating a lucrative growth avenue. As per the Dutch Ministry of Infrastructure and Water Management, hybrid marine vessels equipped with rechargeable batteries are expected to grow at a significant CAGR in the coming years. Similarly, the integration of batteries with smart grids is projected to enhance energy distribution efficiency by 30%. By diversifying into these untapped sectors, the Europe rechargeable battery market can address evolving consumer demands while reinforcing its leadership in clean energy innovation.

MARKET CHALLENGES

Regulatory Uncertainty and Policy Fragmentation

The regulatory uncertainty and policy fragmentation across member states is one of the major challenges to the growth of the Europe rechargeable battery market. According to the European Policy Centre, inconsistent national policies regarding battery recycling standards and import tariffs create barriers to cross-border collaboration and market integration. According to the Danish Energy Agency, this lack of alignment has resulted in fragmented battery infrastructure, with only 50% of planned projects reaching completion. Additionally, frequent changes in subsidy schemes and tax regulations complicate compliance for manufacturers and installers, undermining investor confidence. Overcoming these challenges requires greater coordination among EU member states and the establishment of unified frameworks to facilitate seamless market growth and innovation.

High Initial Costs and Financial Barriers

The high initial cost associated with rechargeable batteries poses a financial barrier for end-users, particularly in emerging markets is one of the significant challenges to the European market. According to the UK Department for Business, Energy & Industrial Strategy, the upfront cost of installing a residential energy storage system, including batteries, ranges between €8,000 and €15,000, deterring potential adopters despite long-term savings. According to the Spanish Institute for Energy Diversification and Saving, limited access to affordable financing options remains a key obstacle, particularly in rural areas where awareness of energy storage benefits is low. Moreover, the absence of standardized subsidy programs across Europe has created disparities in adoption rates, with Eastern European countries lagging behind their Western counterparts. Bridging these financial gaps through innovative financing models and targeted government support is crucial to overcoming cost-related barriers and fostering widespread adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.42% |

|

Segments Covered |

By Technology, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation. |

SEGMENTAL ANALYSIS

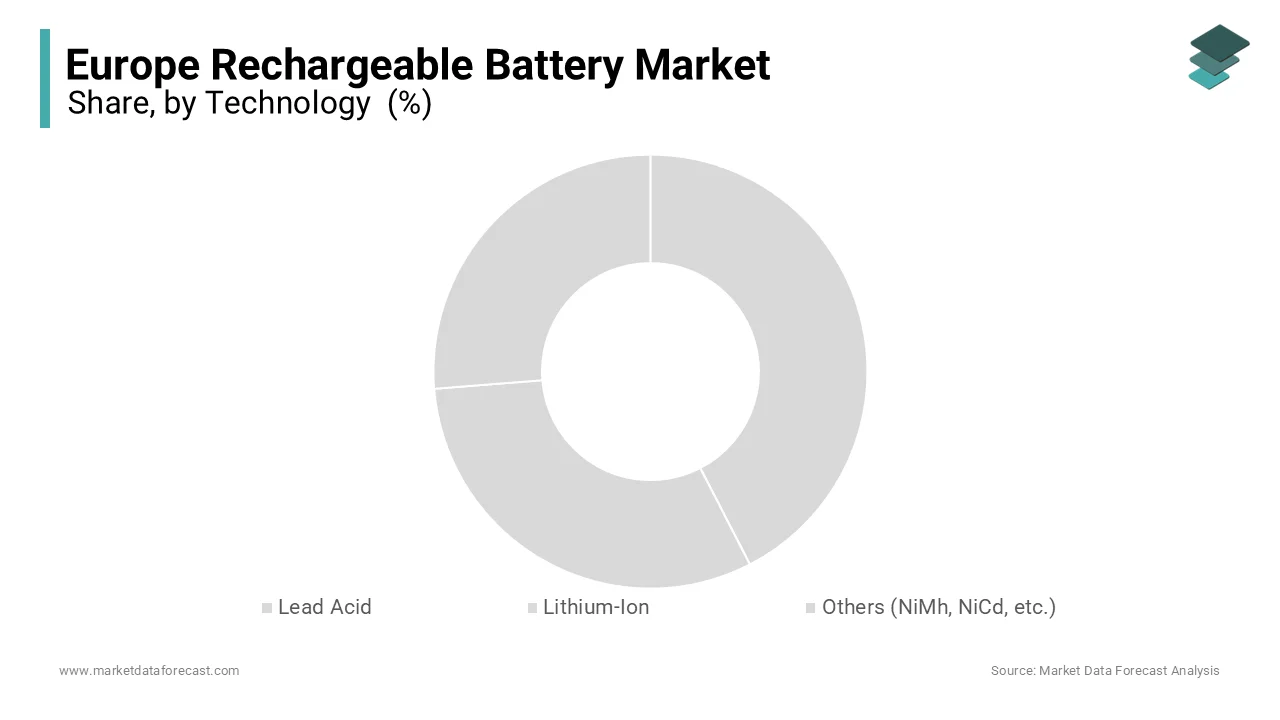

By Technology Insights

The lithium-ion batteries segment captured 66.3% of the European market share in 2024. The prominent position of the lithium-ion batteries segment in the European market is driven by their high energy density, long lifespan, and versatility across applications, including electric vehicles, renewable energy storage, and portable electronics. According to the German Federal Ministry for Economic Affairs and Energy, lithium-ion batteries achieved an average efficiency of 95%, making them ideal for demanding applications. Additionally, advancements in cathode and anode materials have reduced production costs by 20% over the past five years, further boosting adoption rates. With over 50 GWh of lithium-ion battery capacity installed in Europe in 2022, this segment continues to lead the market due to its proven performance and scalability.

The solid-state batteries segment is expected to witness the fastest CAGR of 35.5% over the forecast period owing to their superior safety features and higher energy density compared to traditional lithium-ion batteries. As per the Italian Ministry of Ecological Transition, solid-state batteries are increasingly adopted in aerospace and defense applications, where reliability and performance are paramount. Their compatibility with renewable energy systems further amplifies their appeal, positioning them as a key driver of innovation in the Europe rechargeable battery market.

By Application Insights

The automobiles segment dominated the Europe rechargeable battery market by capturing 50.9% of the European market share in 2024. The rapid adoption of electric vehicles due to the stringent emission regulations and government incentives is majorly driving the growth of the automobiles segment by application over the forecast period. According to the French Ministry of Ecological Transition, automobile batteries achieved an average lifespan of 8 years, making them a reliable choice for consumers. Additionally, investments in EV infrastructure have expanded their applicability, with over 2 million EVs registered in Europe in 2022. Their dominance underscores their critical role in advancing sustainable mobility.

The industrial segment is anticipated to register the highest CAGR of 30.5% over the forecast period owing to the increasing demand for energy storage solutions in manufacturing and logistics sectors, particularly in regions with unstable grids. As per the Dutch Ministry of Infrastructure and Water Management, industrial batteries are essential for optimizing energy yield in large-scale installations, underscoring their importance in achieving Europe’s renewable energy targets.

REGIONAL ANALYSIS

Germany played the dominating role in the Europe rechargeable battery market by accounting for 25.7% of the European market share in 2024. The dominance of Germany in the European market is driven by robust government policies and a thriving manufacturing base. According to the German Battery Alliance, Germany invested over €10 billion in battery production facilities in 2022, reinforcing its leadership in renewable energy innovation.

France is another major regional market for rechargeable batteries in Europe and accounted for the second largest share of the European market in 2024. The emphasis of France on renewable energy integration and industrial decarbonization has spurred battery adoption. As per the French Alternative Energies and Atomic Energy Commission, France aims to deploy 5 GWh of battery storage capacity by 2025, underscoring its commitment to advancing the market.

Italy is anticipated to register a healthy CAGR in the European market over the forecast period owing to the favorable incentives and a strong focus on residential energy storage installations. As per the Italian National Agency for New Technologies, Italy installed over 1 GWh of battery storage capacity in 2022, highlighting its growing influence in the regional market.

KEY MARKET PLAYERS

The major players in the Europe rechargeable battery market include BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

MARKET SEGMENTATION

This research report on the Europe rechargeable battery market is segmented and sub-segmented into the following categories.

By Technology

- Lead Acid

- Lithium-Ion

- Others (NiMh, NiCd, etc.)

By Application

- Automobiles

- Industrial Batteries

- Portable Batteries

- Other Applications

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe rechargeable battery market?

The growth is driven by the increasing demand for electric vehicles (EVs), renewable energy storage, and consumer electronics, along with government incentives for battery production and sustainability initiatives.

How is the electric vehicle industry impacting the rechargeable battery market in Europe?

The rapid adoption of electric vehicles is significantly increasing the demand for lithium-ion batteries, leading to new battery manufacturing plants and research into more efficient battery technologies.

What industries besides EVs are driving demand for rechargeable batteries in Europe?

Besides EVs, industries such as renewable energy storage, consumer electronics, industrial machinery, and medical devices are contributing to the growing demand for rechargeable batteries.

What future trends are expected in the Europe rechargeable battery market?

The market is expected to see advancements in solid-state battery technology, increased investment in local gigafactories, improved recycling processes, and further policy support for sustainable battery development.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]