Europe Retail Market Size, Share, Trends & Growth Forecast Report By Product Type (Food, Beverage, and Grocery; Personal and Household Care; Apparel, Footwear, and Accessories; Furniture and Home Decor; Industrial and Automotive; Electronic and Household Appliances; Pharmaceuticals; Luxury Goods; Others), Distribution Channels (Hypermarket and Supermarket, Convenience Stores, Speciality Stores, Online, Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Retail Market Size

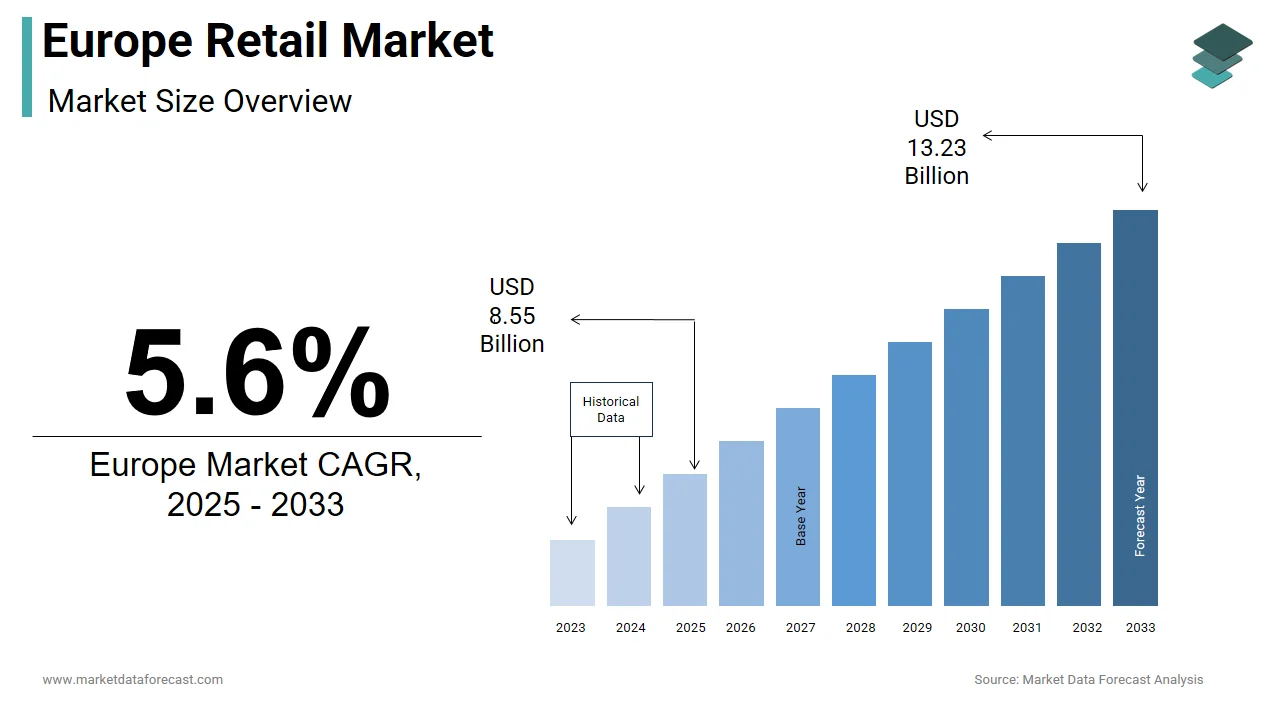

The size of the Europe retail market was valued at USD 8.1 billion in 2024. This market is expected to grow at a CAGR of 5.6% from 2025 to 2033 and be worth USD 13.23 billion by 2033 from USD 8.55 billion in 2025.

The retail sector is a highly diversified sector that includes food and beverage, apparel, electronics, home furnishings, and luxury goods. The region's mature economies, high disposable incomes, and strong consumer confidence have historically supported a robust retail ecosystem. According to Eurostat, retail trade turnover in the EU increased by 5.6% year-on-year in late 2023, driven largely by growth in non-food sectors such as electronics and furniture. Consumer behavior has also evolved significantly, with sustainability and ethical sourcing becoming key purchasing determinants. As per a survey conducted by Deloitte, over 62% of European consumers prefer brands that demonstrate environmental responsibility.

MARKET DRIVERS

Rising Adoption of E-Commerce Platforms

E-commerce has emerged as a pivotal growth driver in the Europe retail market, fueled by increasing internet penetration, smartphone usage, and favorable logistics infrastructure. Consumers are increasingly gravitating toward convenience, competitive pricing, and wider product variety offered by online platforms. For instance, Amazon maintains a dominant position in several European markets, but local players such as Zalando in Germany and Fnac Darty in France have successfully captured niche segments. This rise reflects improved trust in international transactions, streamlined payment gateways, and efficient delivery systems. Governments and private stakeholders have invested heavily in digital infrastructure, which has further accelerated this growth trajectory.

Growth of Sustainable and Ethical Consumption Trends

Sustainability has become a central theme shaping consumer choices in the Europe retail market. A growing number of shoppers are prioritizing products that align with their values, particularly those related to environmental impact, fair labor practices, and animal welfare. This shift is being driven by younger demographics, especially Gen Z and Millennials, who are more informed about climate change and corporate accountability. Retailers such as H&M, Decathlon, and Carrefour have responded by launching eco-friendly product lines, reducing plastic packaging, and incorporating circular economy principles into their operations. Regulatory pressures are also reinforcing these trends. The European Commission's Green Deal aims to make the EU climate-neutral by 2050, prompting stricter regulations on carbon emissions and waste management. Additionally, transparency in sourcing and production processes is gaining importance. Brands that disclose their supply chain information publicly, such as Patagonia and Everlane, have seen higher customer loyalty.

MARKET RESTRAINTS

Economic Volatility and Inflationary Pressures

Economic instability continues to pose a significant challenge to the Europe retail market, particularly due to persistent inflation and rising living costs. However, even at this reduced level, it remains above pre-pandemic averages, which is squeezing household budgets and reducing discretionary spending. Inflation has disproportionately affected lower-income households, leading to a decline in overall consumer confidence. Retailers have faced dual pressure by absorbing cost increases or passing them onto consumers. Many have opted for selective price hikes, often leading to margin compression. Moreover, wage growth has not kept pace with inflation in many regions. Data from the International Labour Organization shows that average real wages in the EU declined by 1.2% in 2023, marking the first drop since records began in 2008. This stagnation has further dampened retail demand in mid-tier and premium segments.

Regulatory Complexity and Compliance Burdens

The Europe retail market operates within one of the world’s most stringent regulatory environments, posing a significant restraint on business agility and profitability. The General Data Protection Regulation (GDPR), introduced in 2018, has set a high bar for consumer privacy compliance, which is requiring retailers to invest heavily in cybersecurity, data governance, and customer consent mechanisms.

Beyond data protection, the European Union enforces rigorous standards regarding product safety, labeling, and environmental impact. For instance, the EU’s Circular Economy Action Plan mandates that all packaging be reusable or recyclable by 2030. Labor laws also vary widely across member states, complicating pan-European expansion strategies. Countries like France and Germany enforce strict working hour limits, mandatory union consultations, and generous employee benefits, increasing payroll expenditures.

MARKET OPPORTUNITIES

Expansion of AI-Powered Personalization and Customer Analytics

Artificial intelligence is unlocking transformative opportunities in the Europe retail market by enabling hyper-personalized shopping experiences and advanced customer insights. Retailers are increasingly deploying AI technologies to analyze vast datasets from online interactions, social media behavior, and purchase histories to tailor recommendations and promotions. Companies like Zalando and ASOS use machine learning algorithms to adjust prices in real-time based on demand elasticity, competitor activity, and inventory levels. Personalized marketing is another area where AI is making strides. Additionally, AI is being used to optimize supply chain logistics. Tesco, for instance, leverages predictive analytics to forecast demand more accurately, which is reducing stockouts and overstock situations by 12%, according to internal performance reports published in 2023.

Growth of Secondhand and Circular Retail Models

The rise of secondhand and circular retail models presents a substantial opportunity in the Europe retail market, driven by shifting consumer attitudes and supportive policy frameworks. Platforms such as Vinted, Vestiaire Collective, and Depop have capitalized on this momentum, attracting millions of users across Europe. Beyond peer-to-peer marketplaces, traditional retailers are also embracing circularity. Governments are incentivizing these shifts. The Netherlands, for instance, launched the “Second-hand Strategy 2030,” which is aiming for 50% of all textile sales to be circular by that year.

MARKET CHALLENGES

Supply Chain Disruptions Due to Geopolitical Instability

Supply chain fragility remains a pressing challenge for the Europe retail market, exacerbated by ongoing geopolitical tensions and regional conflicts. The war in Ukraine, sanctions on Russia, and trade disputes involving China have disrupted established import-export routes, causing delays and cost escalations. The reliance on global sourcing has made European retailers vulnerable to external shocks. For instance, approximately 30% of Europe’s textile imports originate from Asia, primarily China and Bangladesh. Furthermore, energy shortages and inflation have compounded transportation costs. Diesel prices in the EU rose by 28% in 2022, which is directly impacting last-mile delivery expenses. Diversifying sourcing strategies has proven difficult due to limited domestic manufacturing capacity. Only 12% of clothing sold in Europe is produced locally, according to Eurostat, leaving little room for quick substitution.

Intensifying Competition from Direct-to-Consumer (DTC) Brands

The proliferation of direct-to-consumer (DTC) brands is disrupting the traditional retail landscape in Europe, presenting a formidable challenge for established multibrand retailers and department stores. DTC brands bypass intermediaries, selling directly to consumers through owned e-commerce platforms, thereby offering competitive pricing, personalized experiences, and greater brand control.

Startups in categories such as beauty, wellness, and home goods have gained traction by leveraging digital marketing and social media to build loyal communities. Brands like BYBORRE (fashion), Rothy’s (footwear), and Marley Spoon (meal kits) have successfully captured niche markets by focusing on storytelling, sustainability, and customer-centric innovation. Traditional retailers are struggling to match the agility and branding prowess of these newcomers. Department stores and big-box retailers often suffer from legacy systems, slower decision-making cycles, and higher overhead costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Schwarz Unternehmenskommunikation GmbH & Co. KG, Zalando SE, Tesco plc, Coop, Carrefour Group, Esselunga SpA, and Auchan Retail International, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The food, beverage, and grocery segment dominated the Europe retail market by accounting for 37.3% of the share in 2024. One of the key drivers behind this segment’s dominance is the continued preference for in-store shopping among older demographics. Additionally, inflation has played a significant role in maintaining high spending levels in this category. Furthermore, convenience-driven formats such as discount supermarkets and express stores have gained traction.

The pharmaceuticals segment is lucratively growing with a CAGR of 8.6% in the coming years. This rapid expansion is being fueled by aging demographics, rising prevalence of chronic diseases, and increased healthcare awareness among consumers. Moreover, the shift toward digital health platforms and online pharmacies has significantly improved access to medicines. Amazon Pharmacy expanded into several European markets during 2023, which is contributing to this growth trajectory.

By Distribution Channel Insights

The hypermarkets and supermarkets segment accounted in holding 43.2% of the Europe retail market share in 2024. These formats continue to dominate due to their ability to offer one-stop shopping experiences, competitive pricing, and extensive product assortments under a single roof. A key driver of this segment's dominance is the consumer preference for bulk purchasing and weekly shopping trips. As per Euromonitor International, 72% of European households visit hypermarkets or supermarkets at least once a week in urban centers where time constraints favor consolidated shopping. Additionally, these stores have adapted well to omnichannel strategies, incorporating click-and-collect services and home delivery options without compromising their core business.

The online retail segment is lucratively growing with a CAGR of 11.2% from 2025 to 2033, with the technological advancements, changing consumer behavior, and the increasing penetration of mobile commerce across both urban and rural regions. The expansion of cross-border e-commerce is another factor that is prompting the growth of the segment. Improved logistics networks, including same-day delivery services offered by Amazon and Zalando, have enhanced the appeal of online shopping.

COUNTRY-LEVEL ANALYSIS

Germany was the largest contributor in the Europe retail market by holding 22.3% of the share in 2024. The market status in Germany is characterized by a balanced mix of discounters, full-line supermarkets, and specialty retailers. Consumer behavior in Germany is marked by a preference for value-for-money offerings and sustainability. Government policies supporting green logistics and renewable energy have further shaped retail strategies.

France ranks second in the Europe retail market with a 14% share, driven by a combination of large domestic retailers, evolving consumer trends, and strong regulatory oversight. Carrefour, Auchan, and Leclerc maintain dominant positions in the grocery sector, with private label products constituting nearly 31% of total sales, as per IRI. In fashion, Galeries Lafayette and Printemps continue to attract both domestic and international shoppers in Paris, which remains a global luxury hub. Additionally, the government’s “Anti-Waste Law” has prompted widespread changes in packaging and surplus management, with supermarkets required to donate unsold food instead of discarding it.

The United Kingdom is likely to grow with a dominant CAGR in the coming years. Tesco, Sainsbury’s, and Asda dominate the grocery landscape, collectively controlling over 60% of the market, as per Kantar Worldpanel. Consumer confidence has fluctuated due to cost-of-living challenges, but demand for premium and sustainable products remains resilient. A 2023 survey by Mintel indicated that 61% of British shoppers are willing to pay more for ethically sourced products, particularly in the beauty and fashion sectors.

KEY MARKET PLAYERS

Companies playing a prominent role in the Europe retail market profiled in this report are Schwarz Unternehmenskommunikation GmbH & Co. KG, Zalando SE, Tesco plc, Coop, Carrefour Group, Esselunga SpA, Auchan Retail International, and others.

TOP LEADING PLAYERS IN THE MARKET

Carrefour (France)

Carrefour is a dominant force in the Europe retail market, operating a vast network of hypermarkets, supermarkets, and convenience stores across multiple European countries. The company has continuously adapted to evolving consumer preferences by expanding its private label portfolio, integrating digital shopping experiences, and emphasizing sustainability. Carrefour’s omnichannel strategy, which includes click-and-collect services and home delivery, has strengthened its relevance in competitive markets like France, Spain, and Poland. Its commitment to responsible sourcing and carbon neutrality further positions it as a leader shaping the future of retail in Europe.

Schwarz Group (Germany)

Operating under well-known banners such as Lidl and Kaufland, Schwarz Group holds a significant share in the European retail sector. Lidl and Kaufland have expanded aggressively across Central and Eastern Europe, adapting store formats to local consumer behavior while maintaining operational efficiency. Schwarz Group’s investments in logistics, supply chain innovation, and selective private branding have reinforced its dominance and set benchmarks for discount retailing across the continent.

Tesco (United Kingdom)

Tesco remains one of the most influential retailers in Europe, with a strong presence not only in the UK but also in Hungary, the Czech Republic, and Slovakia. The company has successfully maintained its prominence through strategic brand positioning, customer-centric loyalty programs, and robust online infrastructure. Tesco’s focus on enhancing food waste reduction initiatives and strengthening community engagement has elevated its brand image. Its integration of technology into supply chain management and store operations has allowed it to remain agile in a rapidly transforming retail environment.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by leading players in the Europe retail market is the expansion of omnichannel capabilities to meet changing consumer expectations. Retailers are investing heavily in digital platforms, mobile applications, and seamless integration between online and offline shopping experiences. This approach ensures that consumers can access products and services through multiple touchpoints without disruption. Another crucial strategy involves enhancing private label offerings to improve margins and strengthen brand differentiation. The major players are focusing on sustainability and ethical sourcing to align with regulatory requirements and consumer demand. Companies are redesigning packaging, reducing carbon footprints, and promoting circular economy principles. These initiatives not only enhance brand reputation but also foster long-term customer loyalty in an increasingly conscious marketplace.

COMPETITION OVERVIEW

The competition in the Europe retail market is intense and highly fragmented, shaped by a mix of large multinational chains, regional supermarket operators, discounters, and emerging e-commerce players. Traditional retailers face mounting pressure from digital-first brands that leverage data analytics, personalization, and rapid delivery networks to capture consumer attention. Established players are responding by accelerating their digital transformation efforts, investing in automation, and redefining store formats to align with modern shopping behaviors. The market is also witnessing increased collaboration between retailers and tech firms to enhance supply chain visibility and optimize inventory management. As sustainability becomes a key differentiator, companies are competing not only on price and convenience but also on ethical sourcing and environmental impact. The rise of direct-to-consumer models further complicates the landscape, forcing traditional multibrand retailers to reassess their value propositions.

RECENT MARKET DEVELOPMENTS

- In February 2024, H&M announced the launch of a new rental fashion service across select European markets, which is aiming to tap into the growing demand for sustainable consumption and circular retail models.

- In May 2024, Carrefour partnered with a leading logistics technology firm to implement AI-driven warehouse automation solutions by enhancing efficiency in fulfillment processes across its distribution centers in France and Spain.

- In July 2024, Zalando expanded its same-day delivery footprint by acquiring a minority stake in a last-mile delivery startup based in Germany, which is reinforcing its position as a top-tier e-commerce player in the region.

- In September 2024, Schwarz Group introduced a new line of plant-based private label products under both Lidl and Kaufland banners by reflecting its commitment to meeting rising consumer demand for sustainable and alternative food options.

- In November 2024, Tesco launched an integrated health and wellness platform within its digital app, offering personalized nutrition advice and pharmacy services to customers in the UK and Ireland, which is extending its reach beyond traditional retail boundaries.

MARKET SEGMENTATION

This Europe retail market research report is segmented and sub-segmented into the following categories.

By Product Type

- Food, Beverage, and Grocery

- Personal and Household Care

- Apparel, Footwear, and Accessories

- Furniture and Home Decor

- Industrial and Automotive

- Electronic and Household Appliances

- Pharmaceuticals

- Luxury Goods

- Others

By Distribution Channels

- Hypermarket and Supermarket

- Convenience Stores

- Speciality Stores

- Online

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key growth drivers for the Europe retail market?

The Europe retail market is fueled by expanding e-commerce, digitalization, urbanization, rising disposable incomes, and strong consumer demand for convenience, sustainability, and omnichannel shopping experiences

2. What challenges does the Europe retail market face?

The Europe retail market faces challenges from economic instability, persistent inflation, supply chain disruptions, stringent regulations, labor shortages, and intense competition from direct-to-consumer and online-first brands

3. What opportunities exist in the Europe retail market?

Opportunities in the Europe retail market include leveraging AI and big data for personalization, expanding circular and secondhand retail, investing in sustainable products, and integrating digital and physical retail channels

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com