Europe Soups Market Size, Share, Trends & Growth Research Report By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Other) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Soups Market Size

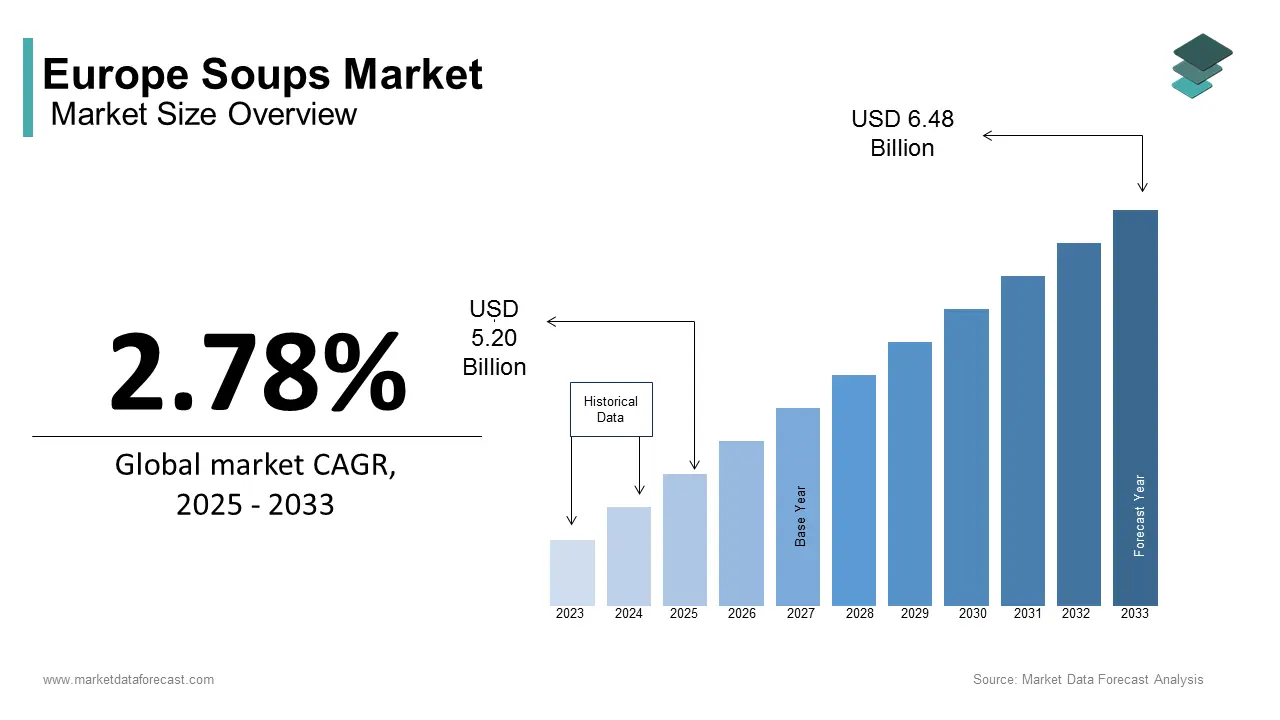

The soups market size in Europe was valued at USD 5.06 billion in 2024. The European soups market is estimated to be worth USD 6.48 billion by 2033 from USD 5.20 billion in 2025, growing at a CAGR of 2.78% from 2025 to 2033.

The Europe soup market has been experiencing steady growth from the last few years and is estimated to grow promisingly during the forecast period owing to the shifting consumer preferences toward convenient and healthy meal options, increasing demand for ready-to-eat meals, particularly among urban populations with busy lifestyles. As per the European Food Information Council, over 60% of European consumers now prioritize health-conscious food choices, driving the popularity of organic and plant-based soups. Additionally, the growing trend of home-cooked meals during the post-pandemic era has further propelled demand. These trends collectively position the Europe soup market as a dynamic and evolving sector within the broader food industry.

MARKET DRIVERS

Rising Demand for Convenience Foods in Europe

The increasing demand for convenience foods is one of the most significant drivers propelling the Europe soup market growth. According to Nielsen, over 70% of European consumers prefer ready-to-eat meals due to their time-saving nature, particularly in urban areas where work-life balance is a priority. For instance, in the UK, canned and UTH (Ultra High Temperature) soups have gained immense popularity, with sales increasing by 15% in 2022, as per the British Retail Consortium. The growing urbanization rate across Europe is also favouring the regional market growth. According to Eurostat, over 75% of the European population resides in urban areas, creating a robust market for quick and nutritious meal solutions. Additionally, the integration of innovative packaging technologies, such as resealable pouches and microwave-safe containers, has enhanced the appeal of soups. These advancements ensure that convenience remains a cornerstone of the Europe soup market’s growth trajectory.

Growing Health Consciousness

The rising health consciousness among European consumers that has amplified the demand for nutritious and low-calorie soups, which is another factor boosting the European soup market. According to the European Society for Clinical Nutrition and Metabolism, over 50% of Europeans are actively seeking healthier dietary options, with soups emerging as a preferred choice due to their high fiber and low-fat content. For example, in France, the sales of organic soups surged by 25% in 2022, as per the French Organic Food Association. Government initiatives promoting healthy eating habits have further bolstered this trend. As per the World Health Organization, countries like Sweden and Denmark have introduced campaigns encouraging the consumption of plant-based diets, driving demand for vegetable-based soups. Additionally, the availability of gluten-free and allergen-free variants has expanded the market’s reach to health-conscious and dietary-restricted consumers. These factors underscore the pivotal role of health trends in shaping the Europe soup market.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints hindering the Europe soup market is the high production costs associated with sourcing premium ingredients and maintaining quality standards. According to the European Food Safety Authority, the cost of raw materials, such as organic vegetables and exotic spices, has increased by 20% over the past two years, impacting profit margins for manufacturers. For instance, in Italy, small-scale soup producers face challenges in competing with larger brands due to the rising expenses of sustainable sourcing. Additionally, as per the European Commission, stringent food safety regulations require companies to invest heavily in compliance measures, further straining budgets. While larger players can absorb these costs, smaller enterprises often struggle to maintain affordability, limiting their ability to innovate and expand. This financial barrier poses a significant challenge for the overall growth of the Europe soup market.

Short Shelf Life of Fresh Soups

The limited shelf life of fresh soups that restricts their distribution and market reach is further inhibiting the expansion of the European soup market. According to the European Federation of Food Science and Technology, fresh soups typically have a shelf life of 5-7 days, making them less viable for long-distance transportation and storage. For example, in Spain, retailers reported a 10% loss in fresh soup inventory due to spoilage, as per the Spanish Retailers Association. This limitation is exacerbated by consumer skepticism regarding preservatives, which discourages manufacturers from extending shelf life artificially. As per a survey by the European Consumer Organization, over 60% of consumers prefer natural and additive-free products, creating a trade-off between shelf life and product appeal. These challenges not only increase operational costs but also limit the accessibility of fresh soups, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Expansion of Plant-Based and Vegan Soups

The growing popularity of plant-based diets is a significant opportunity for the Europe soup market. According to a study by ProVeg International, the plant-based food market in Europe is projected to grow at a CAGR of 12% through 2030, with soups playing a pivotal role in this expansion. For instance, in Germany, vegan soups accounted for 30% of total soup sales in 2022, as per the German Vegetarian Society. As per the European Environment Agency, plant-based diets reduce carbon emissions by 50% compared to traditional diets, encouraging consumers to adopt eco-friendly food choices. Additionally, innovations in flavor profiles and ingredient combinations have broadened the appeal of plant-based soups. For example, companies like Knorr have introduced exotic blends featuring lentils, quinoa, and turmeric, gaining traction among health-conscious millennials. These developments highlight the immense potential of plant-based soups to reshape the market landscape.

Growth of E-Commerce Channels

The rapid expansion of e-commerce channels for soup distribution is another notable opportunity for the European soup market. According to Statista, online grocery sales in Europe grew by 40% in 2022, with soups emerging as a popular category due to their lightweight and easy-to-ship nature. For example, in the Netherlands, online platforms like Picnic reported a 25% increase in soup orders, as per the Dutch Grocery Retail Association. The convenience of doorstep delivery and subscription-based models has further amplified demand. As per McKinsey & Company, over 50% of European consumers prefer online shopping for recurring purchases, creating a lucrative avenue for soup manufacturers. Additionally, the integration of AI-driven personalization tools has enhanced customer engagement, allowing brands to recommend tailored soup options based on dietary preferences. These innovations underscore the transformative potential of e-commerce in boosting the Europe soup market.

MARKET CHALLENGES

Intense Competition and Brand Loyalty

One of the most major challenges facing the Europe soup market is the intense competition among established brands and private labels, which complicates efforts to build brand loyalty. According to Kantar Worldpanel, private label soups account for over 40% of total sales in Europe, with major supermarket chains like Tesco and Carrefour offering affordable alternatives to branded products. For instance, in France, private labels captured 45% of the soup market share in 2022, as per the French Retail Federation. This competition is further intensified by the low differentiation among products, making it difficult for brands to stand out. As per Nielsen, over 60% of consumers switch between brands based on price promotions, underscoring the challenge of retaining customer loyalty. Additionally, the lack of innovation in traditional soup categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to differentiate themselves.

Fluctuating Raw Material Prices

The volatility of raw material prices that impacts production costs and pricing strategies is further challenging the expansion of the European soup market. According to the European Food and Drink Federation, the cost of key ingredients like tomatoes and vegetables has fluctuated by up to 30% over the past year due to climate change and supply chain disruptions. For example, in Italy, tomato shortages caused by adverse weather conditions led to a 15% increase in soup production costs, as per the Italian Farmers’ Association. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. These challenges not only strain profitability but also hinder long-term planning and investment in the Europe soup market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.78% |

|

Segments Covered |

By Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Unilever, W.A. Baxter & Sons Holdings Ltd., Campbell Soup Company, The Kraft Heinz Company, The Hain Celestial Group Inc., Conagra Brands Inc., General Mills Inc., Premier Foods PLC, Nestlé S.A., Princes Group. |

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the market by holding 60.7% of the European soup market in 2024. The leading position of supermarkets and hypermarkets segment in the European soup market is driven by their extensive reach and ability to offer a wide variety of soup options under one roof. For instance, in France, chains like Carrefour and Auchan account for over 70% of all soup sales, as per the French Retail Federation. The growing trend of one-stop shopping, particularly among families and bulk buyers is also aiding the expansion of the supermarkets and hypermarkets segment in the European market. According to Eurostat, over 75% of European households prefer purchasing groceries from supermarkets due to their convenience and competitive pricing. Additionally, promotional activities, such as discounts and loyalty programs, have further strengthened their position. These attributes ensure that supermarkets and hypermarkets remain the primary distribution channel for soups across Europe.

The online distribution segment is predicted to register a promising CAGR of 15.7% over the forecast period owing to the increasing adoption of e-commerce platforms and the convenience of doorstep delivery. For example, in the Netherlands, online grocery platforms like Picnic reported a 40% increase in soup orders in 2022, as per the Dutch Grocery Retail Association. The integration of AI-driven personalization tools that enhance customer engagement is fuelling the growth rate of the online distribution segment in the European market. According to McKinsey & Company, over 50% of European consumers prefer tailored recommendations, creating a lucrative avenue for online retailers. Furthermore, subscription-based models have gained traction, ensuring recurring revenue streams. These innovations underscore the immense potential of online channels to transform the Europe soup market.

REGIONAL ANALYSIS

Germany dominated the European soup market by accounting Known for its emphasis on quality and convenience, Germany’s soup industry is valued at €1.5 billion in 2023, according to the German Food Industry Association. Urban centers like Berlin and Munich are key drivers of demand, with consumers increasingly favoring organic and ready-to-eat soups due to busy lifestyles. Over 60% of German households purchase packaged soups weekly, reflecting their integration into daily meals. The rise of health-conscious eating has spurred demand for low-sodium and plant-based options, which now account for 25% of total sales. Retailers like Aldi and Lidl have capitalized on this trend by offering affordable yet high-quality products. Additionally, Germany’s strong regulatory framework ensures transparency in labeling and ingredient sourcing, fostering consumer trust. Seasonal variations also play a role; winter months see a 40% spike in sales, particularly for hearty varieties like lentil and potato soups. By blending tradition with modern preferences, Germany continues to shape Europe’s soup market.

France is another promising regional segment for soups in Europe. Renowned for its culinary heritage, France views soup not just as sustenance but as an art form. According to NielsenIQ, in the French soup market, premium and gourmet products are accounting for 35% of total sales. Paris, Lyon, and Bordeaux are hubs for innovation, where brands emphasize locally sourced ingredients and traditional recipes. Organic soups have gained significant traction, growing by 15% annually since 2021, driven by rising environmental awareness. French consumers prioritize authenticity, with homemade-style soups representing 50% of purchases. The rise of meal kits and subscription services, such as HelloFresh, has further boosted demand, particularly among younger demographics. Moreover, government initiatives promoting sustainable agriculture align with consumer preferences for eco-friendly packaging. By harmonizing tradition with modern trends, France remains a pivotal player in Europe’s soup landscape.

The UK is predicted to register a healthy CAGR in the European soup market over the forecast period. London, Manchester, and Birmingham lead the charge, where urbanization and hectic lifestyles drive demand for convenient meal solutions. Ready-to-eat and microwaveable soups dominate sales, accounting for 60% of the market. Health-conscious trends have also fueled growth, with low-calorie and vegan options seeing a 20% annual increase since 2020. Retail giants like Tesco and Sainsbury’s have expanded their private-label offerings, capturing 40% of total sales. Seasonality plays a crucial role; winter months witness a 30% surge in demand, particularly for classic varieties like tomato and chicken noodle. Additionally, the rise of online grocery platforms has transformed distribution, with e-commerce representing 25% of sales. By balancing convenience with nutritional value, the UK continues to influence Europe’s soup market.

Italy ranks as a notable regional market for soups in Europe. Known for its rich culinary traditions, Italy’s soup consumption reflects regional diversity, with northern regions favoring creamy minestrone and southern areas preferring lighter, vegetable-based broths. According to Coldiretti, the Italian soup market reached €900 million in 2023, driven by a resurgence of interest in home-cooked meals. Milan, Rome, and Naples are key markets, where consumers increasingly seek premium and organic products, which now represent 20% of total sales. Rising health awareness has spurred demand for gluten-free and low-fat options, particularly among urban professionals. Local brands like Barilla have capitalized on this trend by launching innovative lines that cater to modern tastes while preserving traditional flavors. Moreover, Italy’s focus on sustainability has encouraged the use of recyclable packaging and locally sourced ingredients. By celebrating its culinary heritage while embracing innovation, Italy continues to carve out a unique niche in Europe’s soup market.

Spain is projected to hold a prominent share of the European soup market over the forecast period. Spain’s soup industry benefits from its Mediterranean diet culture, which emphasizes fresh ingredients and simple preparation. Madrid, Barcelona, and Valencia are pivotal markets, where demand for affordable yet flavorful soups is highest. Packaged soups account for 70% of total sales, with consumers favoring varieties like gazpacho and vegetable-based broths. The rise of single-person households and delayed parenthood has increased reliance on convenient meal options, driving growth in ready-to-heat products. Additionally, Spain’s warm climate boosts year-round consumption, particularly for chilled soups like salmorejo, which represent 25% of sales. Retailers like Mercadona have played a key role by offering budget-friendly yet high-quality options. Government campaigns promoting healthy eating habits further amplify demand. By combining accessibility with regional flavors, Spain continues to emerge as a dynamic player in Europe’s soup market.

LEADING PLAYERS IN THE EUROPE SOUP MARKET

Unilever, headquartered in the Netherlands, holds a substantial presence in Europe, offering iconic brands like Knorr, which accounts for over 30% of the region’s soup sales, as per Euromonitor International.

Nestlé, based in Switzerland, specializes in premium and gourmet soups, with a growing footprint in markets like Germany and France. As per Statista, Nestlé’s Maggi brand dominates the instant soup segment, reflecting its global influence. Meanwhile, Campbell Soup Company, a U.S.-based firm, is renowned for its classic canned soups, widely adopted by European households. According to Nielsen, Campbell’s products account for 15% of the canned soup market share in Europe. These players collectively drive innovation and set benchmarks for the Europe soup market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe soup market employ diverse strategies to strengthen their positions. One prominent strategy is product innovation. For instance, in March 2023, Unilever launched a line of plant-based soups under the Knorr brand, aiming to capitalize on the growing demand for vegan options.

Another strategy is strategic partnerships. In June 2023, Nestlé collaborated with a Swiss startup specializing in sustainable packaging to develop eco-friendly soup containers. This move aligns with the company’s goal of reducing its carbon footprint. Additionally, as per the European Investment Bank, Campbell Soup Company has invested heavily in digital marketing campaigns to enhance brand visibility and engage younger consumers. These strategies reflect a commitment to innovation and market leadership.

KEY MARKET PLAYERS COMPETITION OVERVIEW

Major Players of the Europe Soups Market include Unilever, W.A. Baxter & Sons Holdings Ltd., Campbell Soup Company, The Kraft Heinz Company, The Hain Celestial Group Inc., Conagra Brands Inc., General Mills Inc., Premier Foods PLC, Nestlé S.A., Princes Group.

The Europe soup market is characterized by intense competition, with established players and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like Unilever and Nestlé dominate the premium segment, while private labels compete aggressively on price.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like The New Soup Company are pioneering artisanal and organic soups, challenging incumbents in the health-conscious segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Unilever acquired a UK-based startup specializing in plant-based soups. This acquisition aimed to expand its portfolio of vegan offerings and cater to health-conscious consumers.

- In May 2024, Nestlé partnered with a German retailer to launch a line of eco-friendly soups. This initiative aimed to strengthen its position as a leader in sustainable food solutions.

- In July 2024, Campbell Soup Company introduced a subscription-based model for its online store, allowing customers to receive monthly deliveries of canned soups. This move aimed to enhance customer retention and boost recurring revenue.

- In September 2024, The New Soup Company secured USD 5 million in funding from European investors. This investment aimed to scale its operations and expand into new markets across Europe.

- In November 2024, Knorr launched a campaign promoting its zero-waste packaging initiative. This effort aimed to align with consumer values and enhance brand loyalty.

MARKET SEGMENTATION

This research report on the europe soups market has been segmented and sub-segmented based on distribution channel & region.

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Grocery Stores

- Other Distribution Channels

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which factors are driving the growth of the soup market in Europe?

The growing demand for convenience foods, health-conscious consumers, and the increasing popularity of plant-based and organic options are key drivers.

2. Who are the target consumers of soups in Europe?

The primary consumers are busy professionals, health-conscious individuals, and families looking for convenient meal options.

3. What challenges does the soup market in Europe face?

Challenges include competition from homemade alternatives, the rising cost of raw materials, and adapting to changing consumer preferences.

4. How has consumer behaviour impacted the soup market in Europe?

Consumers' demand for healthier, organic, and allergen-free options has pushed manufacturers to innovate and reformulate their products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]