Europe Water Filters Market Size, Share, Trends & Growth Forecast Report By Technology, Distribution Channel, Portability, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Water Filters Market Size

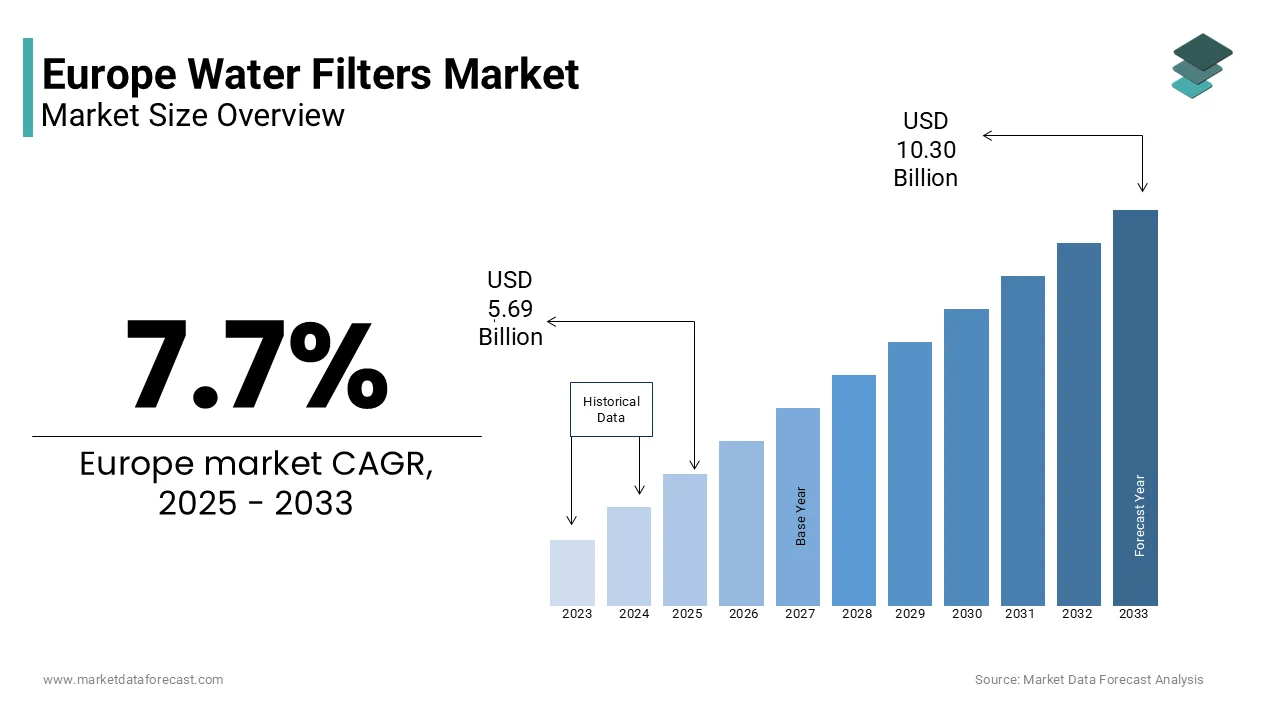

The water filters market size in Europe was valued at USD 5.28 billion in 2024. The European market is further estimated to progress at a CAGR of 7.7% from 2025 to 2033 and be worth USD 10.30 billion by 2033 from USD 5.69 billion in 2025.

Water filters are devices employed to decontaminate water from harmful substances, chemicals, pathogens, microorganisms, and other dissolved solids and to make it portable. Nan Yang Technology University in Singapore recently developed a multi-functional water filtration membrane. This new water filter technology replaced the usual polymer-based water filtration membranes with titanium dioxide nanotechnology. According to the UN and the WHO, every 21 seconds, a child and close to 3.5 million individuals die in a year in developing countries owing to waterborne diseases caused by drinking contaminated water. The situation in the growing economies of Europe is worse owing to the scarcity of freshwater, an increase in pollution, and a fast increase in population. Hence, development in the incidence of waterborne disease mainly boosts the call for water filter market trends. Diminishing the quality of water is resulting in major health problems. The declining water quality is a result of dumping untreated sewage, chemicals, pesticides, nutrients, and garbage from factories, agriculture, and municipal corporations into water bodies.

MARKET DRIVERS

The increasing prevalence of healthcare services, changes in economic & social systems, and improved diagnostics have developed the health of customers across different regions. Therefore, a rise in health consciousness and an upsurge in the incidence of waterborne diseases boost the demand for water purification systems. Furthermore, an increase in disposable income in growing nations fuels the expansion of the water filter market. The rise in income level expands consumers' purchasing ability, which could result in a higher standard of living. Besides, the demand for water purification systems in developing countries of Europe is boosted by the increasing availability of safe water by municipalities and the rise in the number of water recycling treatments. As the disposable income of the customer is rising, individuals are more interested in having a better lifestyle and purified water. For this purpose, a rise in the expansion of the water purification market can be seen. Escalated incidence of waterborne diseases has resulted in the water filtration market expansion. The dominance of significant users of water purifiers, like industrial establishments and municipalities, will be advantageous for market expansion during the foreseen period. The nitrate concentration in Germany in water reservoirs is leading to rising health concerns with regard to babies and pregnant women.

MARKET RESTRAINTS

As there is the availability of several alternatives in this business, the manufacturer is facing issues in the European water filters market. The rise in the number of unorganized players becomes a critical restraint for this market.

SEGMENTAL ANALYSIS

By Technology Insights

In 2024, the RO water filter sector occupied the biggest share of the water purifier market in Europe, followed by the UV sector, and is estimated to rise at the highest CAGR during the forecast period. RO water purification systems are broadly adopted across the region, owing to their performance efficiency, low electricity consumption, and regular technological innovation.

By Distribution Channel Insights

The retail store sector held a large share of the Europe water filter market in 2024 compared to others. This was credited to the higher affinity of customers toward physical stores, as they are perceived to be safe and allow customers to try the product before buying.

By Portability Insights

In 2024, the non-portable segment was the dominating segment due to a rise in adoption among households and corporate offices, hospitals, and others.

By End-User Insights

The residential user sector occupied a major market share in Europe in 2024 and is estimated to rise at a notable CAGR during the forecast period.

REGIONAL ANALYSIS

Europe is anticipated to account for a substantial share of the worldwide market during the forecast period. Health-conscious individuals have given rise to the latest trends globally. Germany is the biggest market for water purifiers in Europe. The critical factors that have driven the German market are the rising economy, growing domestic players, and increasing export and import business in Germany. Among other regions, in 2019, Germany accounted for the most significant share, followed by the UK and France. In France, the growing construction segment is estimated to lead to rising demands for clean water, propelling the market's expansion. The water treatment strategies of different water resources in Italy are set to boost its market expansion. The rising demand for water purifiers from commercial and industrial segments is estimated to fuel the market expansion in Spain. The increasing concerns regarding the environment and the resultant corrective measures with regard to consumable water are the most significant factors in escalating market expansion in Russia.

KEY MARKET PLAYERS

Companies such as Eaton Corporation, Suez Water Technologies & Solutions (France), Veolia (France), Dow Water & Process Solutions, EvoQua Water Technologies, Mann-Hummel (Germany), Pall Corporation, and Pentair PLC are playing a leading role in the Europe water filters market.

MARKET SEGMENTATION

This research report on the Europe water filters market has been segmented and sub-segmented based on the following categories.

By Technology

- UV

- RO

- Gravity-based

By Distribution Channel

- Retail Sales

- Direct Sales

- Online

By Portability

- Portable

- Non-portable

By End User

- Commercial

- Residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the major opportunities driving growth in the Europe water filters market?

Opportunities include rising concerns over drinking water quality, increasing adoption of point-of-use filtration systems, and stringent EU regulations promoting clean water access.

2. What challenges are affecting the expansion of the water filters market in Europe?

Challenges involve high initial installation and maintenance costs, lack of awareness in some rural regions, and competition from alternative water purification technologies.

3. Who are the key players in the Europe water filters market?

Key players include Brita GmbH, 3M, Pentair PLC, A.O. Smith Corporation, and Culligan International, all contributing to innovation and expansion across the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com