Global Facility Management Market Size, Share, Trends, Growth Forecast Report by Component (Solution and Services), Deployment Mode (On-Premise and Cloud-based), Organization Size (Large and Small & Midsize), and Industry Vertical (BFSI, IT & Telecom, Public Sector, Healthcare, Manufacturing, Retail, Real Estate, and Others) & Region - Industry Forecast From 2025 to 2033

Global Facility Management Market Size

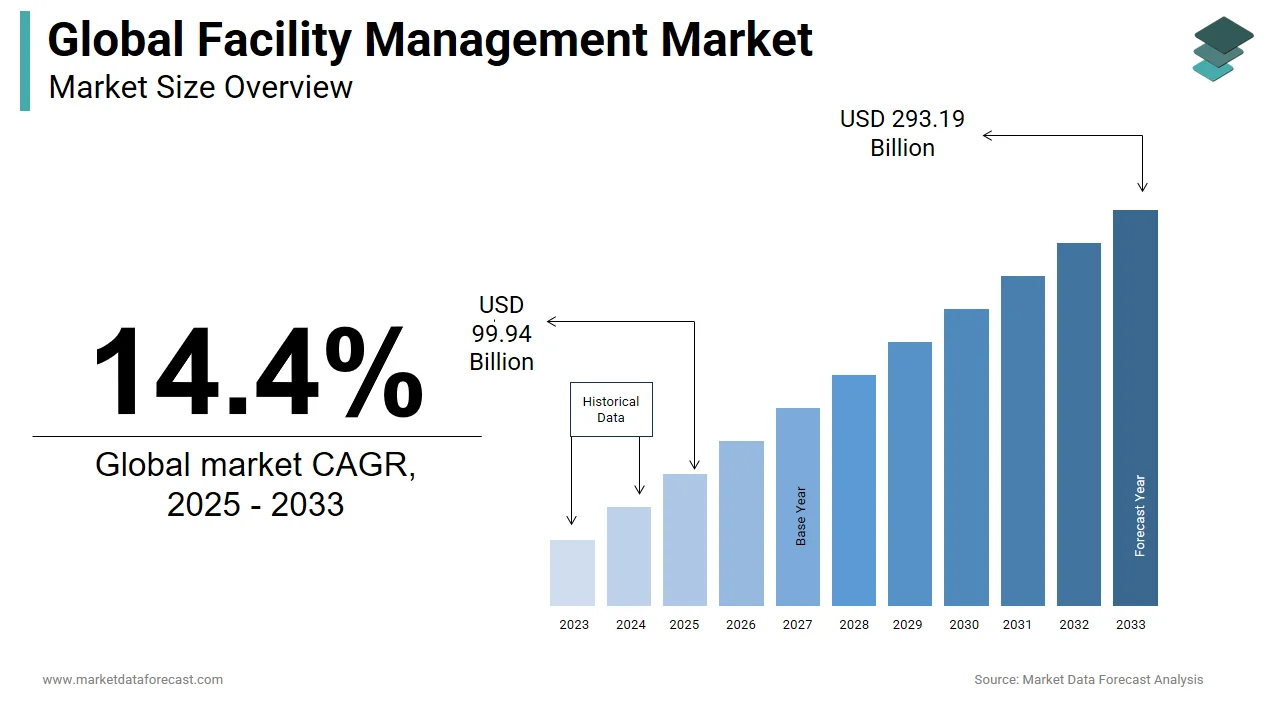

The global facilities management market was worth USD 87.36 billion in 2024. The global market is expected to reach USD 99.94 billion in 2025 and is determined to reach USD 293.19 billion by 2033, expanding at a compound annual growth rate of 14.4% during the forecast period.

The International Association for Facilities Management (IFMA) has defined facilities management as the practice of coordinating the physical workplace with people, and the work of the firm includes several activities like device maintenance, space planning, and portfolio predicting. Facility management, in general, contains different skills, such as readiness for any emergencies and continuity of business, sustainability towards the environment, human elements, communication, project management, quality, property management, leadership and strategy, etc. However, the report focuses mainly on the technological aspect of facilities management, which includes software and services used to increase the efficiency and effectiveness of facilities management services.

MARKET TRENDS

The demand for facilities management services has increased in recent years and is expected to increase significantly over the forecast period. This growth is attributable to the increase in public investments in sectors such as transport, energy, construction, and others. These services can be provided by two methods: internal services and outsourced services.

MARKET DRIVERS

The global market for facility management is majorly supported by the need to maintain environmental and regulatory compliance, increased demand for integrated facility management to achieve economies of scale, shifting focus to the virtual workplace and mobility, the rise in the development of sustainable infrastructure, the emergence of the SaaS implementation model, growing adoption of IoT and connected smart devices for building automation, and so on.

The other prominent factors driving growth in this business are the increased adoption of cloud-based solutions, the change in organizational structure and work management, and the introduction of new solutions by key market players. Other factors hampering market growth include a lack of knowledge of facility management solutions and their benefits, as well as increased demand for external services.

MARKET RESTRAINTS

However, the lack of knowledge of management and dependence on the internal facilities management team may limit the expansion of this market to some extent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.4% |

|

Segments Covered |

By Component, Implementation, Organization Size, Vertical Sector, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM Corporation, Oracle Corporation, SAP SE, Loffice Corporation, Inc., Archibus, Inc., FM System, Inc., CA Technologies, Inc., Accruent, LLC, Planon Corporation, Trimble, Inc., and Others. |

SEGMENTAL ANALYSIS

By Components Insights

The market is divided into solutions and services. The solutions segment includes relocation and workplace management, strategic facility planning, asset management, real estate and lease management, maintenance management, and more (sustainability management, project management, program management, and technology management).

By Implementation Insights

The market is classified in cloud and on-site. Web solutions have been included in the cloud-based segment, while mobile software, including iOS and Android, is included in the local segment. The cloud-based deployment is anticipated to develop with a remarkable growth rate in the coming years owing to the high accessibility and affordability offered by these solutions compared to their counterparts.

By Organization Size Insights

The market is studied in large organizations and SMEs. The large enterprises are the major contributors to the global facility management market, which, however, is determined to alter in the foreseen years with the increasing investments in SMEs.

By Vertical Sector Insights

The global facility management market is classified in banking, financial and insurance services (BFSI), IT and telecommunications, the public sector, health, manufacturing, retail, real estate and others (energy and public services and travel and hospitality).

REGIONAL ANALYSIS

The North American facility management market generated the most substantial revenues in 2018 due to increased ICT spending, the presence of large numbers of companies, and increased IoT adoption. The Asia Pacific facility management market is deemed to grow with the notable CAGR due to increasing Internet penetration, development of the construction industry, and growing demand for better management of data.

In Latin America, the facility management business is foreseen to advance with a considerable portion because of its robust GDP and considerable investment in infrastructure. Among competitors, mergers and acquisitions should be the key growth strategy to increase service offerings and vertical reach. In the Middle East and Africa, the facility management market is likely to progress at the fastest rate because of the surge in construction activities, changing work cultures within organizations and ease of contract management.

KEY MARKET PLAYERS

Major players in the global facility management market are IBM Corporation, Oracle Corporation, SAP SE, Loffice Corporation, Inc., Archibus, Inc., FM System, Inc., CA Technologies, Inc., Accruent, LLC, Planon Corporation, and Trimble, Inc. These players have expanded their market presence by adopting various business strategies such as acquisition, geographic expansion, product development, strategic alliance, and collaboration.

RECENT MARKET HAPPENINGS

-

In January 2018, Accruent acquired Kykloud, a UK-based asset management and topography software provider. This acquisition is expected to strengthen Accruent's current strength in capital planning and asset management.

-

In February 2018, SAP launched the SAP Asset Strategy and Performance Management solution to improve the intelligence of assets across the digital supply chain. This new solution should help SAP customers define, plan and monitor performance data on a network of connected assets in real time.

-

In May 2017, Trimble declared the completion of its purchase of Network Mapping Group Limited (NM Group). The deal is anticipated to improve Trimble's solutions to offer immense value-added data modeling and 3D asset visualization for the utility sector.

MARKET SEGMENTATION

The global facility management market is segmented by component, implementation, organization size, vertical sector, and Region.

By Components

- Solution

- Services

By Implementation

- On-Premise

- Cloud

By Organization Size

- large

- Small & Midsize

By Vertical Sector

- BFSI

- IT & Telecom

- Public Sector

- Healthcare

- Manufacturing

- Retail

- Real Estate

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which factors are driving the growth of the facility management market on a global scale?

The market growth is primarily driven by the increasing adoption of technology-enabled solutions, rising demand for outsourcing facility services, stringent regulatory compliances, and the need for cost-effective and sustainable facility management practices across various industries worldwide.

How are technological advancements impacting the global facility management market?

Technological advancements such as IoT, AI, cloud computing, and predictive analytics are revolutionizing the facility management industry by enabling real-time monitoring, predictive maintenance, energy optimization, and enhanced operational efficiency, thus driving market growth globally.

What are the emerging trends shaping the future of the global facility management market?

Emerging trends such as smart buildings, integrated workplace management systems (IWMS), mobile workforce management, remote monitoring, and sustainability certifications are expected to reshape the facility management landscape globally, driving innovation and transforming service delivery models.

What are the competitive dynamics within the global facility management market?

The global facility management market is highly competitive, with key players competing based on factors such as service offerings, technological innovation, geographic presence, and pricing strategies. Mergers and acquisitions, strategic partnerships, and investments in research and development are common strategies adopted by companies to gain a competitive edge in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]