Global Agricultural Microbials Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Type (Fungi, Bacteria, Viruses, and Others), Crop Type (Oil Seeds & Pulses, Cereals & Grains, Fruits & Vegetables, and Others), Formulation (Liquid, Dry), Function (Soil Amendment, Crop Protection), Mode of Application (Soil Treatment, Seed Treatment, Foliar Spray, and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis From 2025 to 2033

Global Agricultural Microbials Market Size

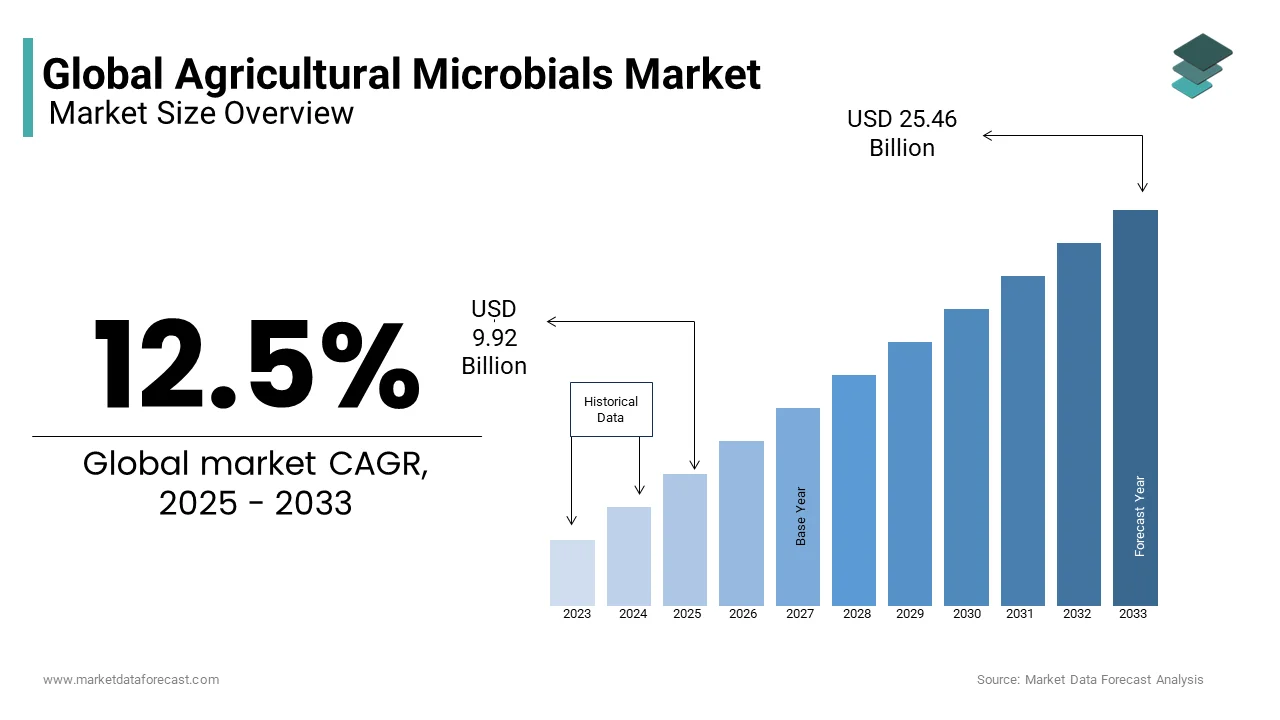

The global agricultural microbials market was valued at USD 8.82 billion in 2024 and is anticipated to reach USD 9.92 billion in 2025 from USD 25.46 billion by 2033, growing at a CAGR of 12.5% during the forecast period from 2025 to 2033.

Agricultural Microbials are made from naturally existing microorganisms like bacteria, fungi, viruses, and protozoa. The management of soil and plant health relies heavily on microbial communities and their variety of functions, which also aids in controlling agroecology, the environment, and agriculture.

MARKET DRIVERS

The increasing demand for maintaining soil health and enhancing crop yield is the main factor contributing to the growth of the global agricultural microbial market during the forecast period. In addition, microorganisms are essential for N-fixation, nutrient uptake, carbon sequestration, plant growth promotion, pathogen suppression, induced systemic resistance, and stress tolerance, all of which are utilized as indications of increased crop yield and long-term soil health. Hence, microbial's various benefits in agriculture boost the growth of the global agricultural microbial market. Additionally, the increasing government efforts to promote the use of microbes in the fields are accelerating the growth of the global agricultural microbial market. Furthermore, increasing awareness among farmers regarding the benefits of microbes in the agricultural field and the various market players coming up with innovations in their products are further contributing to the growth of the global agricultural microbial market during the forecast period.

MARKET RESTRAINTS

There are certain disadvantages concerning using microbes in agricultural fields, such as the microbial culture applied in the seed treatment results in the destruction of the accessibility of sowing seeds. Additionally, because microbes have a poor on-seed survival rate, their storage stability hinders their efficient usage. Furthermore, a lack of awareness among the farmers regarding the efficient use of agricultural microbials may prevent them from adopting them in their fields. Hence, the above-mentioned factors result in the low adoption of microbes in agricultural fields, hampering the growth of the global agricultural microbial market.

Impact of COVID-19 on the Global Agricultural Microbials Market

The COVID-19 pandemic positively impacted the global agricultural microbial market due to the growing demand for organic fertilizers to develop healthier and sustainable agricultural products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.5% |

|

Segments Covered |

By Type, Crop Type, Formulation, Function, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Corteva Agriscience, BASF SE, FMC Corporation, Syngenta Crop Protection AG, Novozymes, Bayer CropScience, Fytofend S.A., IPL Biologicals, AgriLife Biosolutions, Koppert Biological Systems |

SEGMENT ANALYSIS

By Type Insights

Based on type, the bacteria segment is expected to dominate the global agricultural microbial market with the largest shares during the forecast period. There are around 1,408,525 recognized bacteria strains. Bacteria are well known for their ability to control root fungus illness. Furthermore, they are widely used to enhance the growth of plants.

By Crop Type Insights

Based on crop type, the fruits & vegetables segment is expected to grow the fastest during the forecast period. The increasing demand for organic fruits & vegetables around the globe results in the increasing adoption of agricultural microbials in the fruits & vegetable industry.

By Formulation Insights

Based on formulation, the liquid segment is expected to dominate the global agricultural microbials market with the largest market share during the forecast period as they are convenient to use compared to dry agricultural microbials.

By Function Insights

Based on function, the soil amendment segment is expected to dominate the global agricultural microbial market, with the largest market share during the forecast period. As agricultural microbials enhance soil fertility by providing essential nutrients, they are widely used for amendment purposes. Hence this factor is driving the growth of the soil amendment segment during the forecast period.

By Mode of Application Insights

Based on the mode of application, the foliar spray segment is expected to dominate the global agricultural microbials market with the largest shares during the forecast period. With the help of foliar sprays, the crops can easily absorb the nutrients produced by the liquid microbial. Hence, most farmers adopt foliar sprays to spray the liquid microbial on their crops.

REGIONAL ANALYSIS

North America is expected to dominate the global agricultural microbials market with the largest market share during the forecast period. The increasing adoption of agricultural microbials in the region is driving the growth of the agricultural microbials market in North America. Moreover, government agencies such as the U.S. Department of Agriculture (USDA) and the National Science Foundation (NSF) are promoting agricultural microbials and propelling the growth of the agricultural microbials market. Also, the presence of the major market players in North America is further boosting the growth of agricultural microbials in the region.

Europe is expected to hold the largest market share after North America during the forecast period. The presence of huge agricultural lands in Europe is the major factor contributing to the growth of the agricultural microbials in the region. Furthermore, the rising awareness regarding agricultural microbials and the increasing adoption of organic fertilizers to enhance soil fertility and boost plant growth drives agricultural microbial growth in Europe.

KEY MARKET PLAYERS

Corteva Agriscience, BASF SE, FMC Corporation, Syngenta Crop Protection AG, Novozymes, Bayer CropScience, Fytofend S.A., IPL Biologicals, AgriLife Biosolutions, Koppert Biological Systems. These are some of the major market players that dominate the global agriculture microbial market.

RECENT HAPPENINGS IN THE MARKET

- In September 2022, FMC Corporation (India), an agricultural sciences company, expanded its portfolio with the introduction of three novel products for the management of pests and enhancing soil fertility. These new products are Talstar Plus insecticide, Petra Bio solution, and Cazbo crop nutrition.

- In January 2022, Syngenta Crop Protection AG acquired two next-generation bioinsecticides, NemaTrident and UniSpore, from Bionema Limited, a leading UK-based biocontrol technology developer. This acquisition provided clients with even more options while combating rising resistance and various insects and pests in horticulture and ornamentals, turf amenities, and forestry.

MARKET SEGMENTATION

This research report on the global agricultural microbial market is segmented and sub-segmented into the following categories.

By Type

- Fungi

- Bacteria

- Viruses

- Others

By Crop Type

- Oil Seeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

- Others

By Formulation

- Liquid

- Dry

By Function

- Soil Amendment

- Crop Protection

By Mode of Application

- Soil Treatment

- Seed Treatment

- Foliar Spray

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global agriculture microbials market?

The global agriculture microbials market is expected to be valued at USD 9.92 billion in 2025.

Which regions are leading in terms of market share for agriculture microbials?

North America and Europe currently hold the largest market share for agriculture microbials, driven by advanced agricultural practices and high adoption rates of microbial products.

How is the adoption of precision agriculture influencing the agriculture microbials market in Europe?

In Europe, the adoption of precision agriculture techniques such as soil mapping, variable rate application, and remote sensing is driving the demand for microbial products tailored for specific crop and soil conditions.

What are the key trends driving growth in the agriculture microbials market in Asia Pacific?

In Asia Pacific, the increasing demand for organic farming practices, sustainable agriculture, and the need to reduce chemical inputs are driving the growth of the agriculture microbials market.

How is the agriculture microbials market in Canada responding to changing regulations for pesticide usage?

In Canada, the agriculture microbials market is witnessing increased demand for microbial biopesticides as alternatives to conventional chemical pesticides, driven by regulatory restrictions and consumer demand for safer agricultural practices.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com