Global Agricultural Testing Market Size, Share, Trends & Growth Forecast Report - Segmented By Contaminants (Toxins, Chemical Residues, Pathogens, And Others), Sample Type (Soil, Water, Seed, Bio-Solids, Manures And Others), And Region (North America, Europe, Asia-Pacific, Middle East & Africa, Latin America) - Industry Analysis From 2025 To 2033

Global Agricultural Testing Market Size

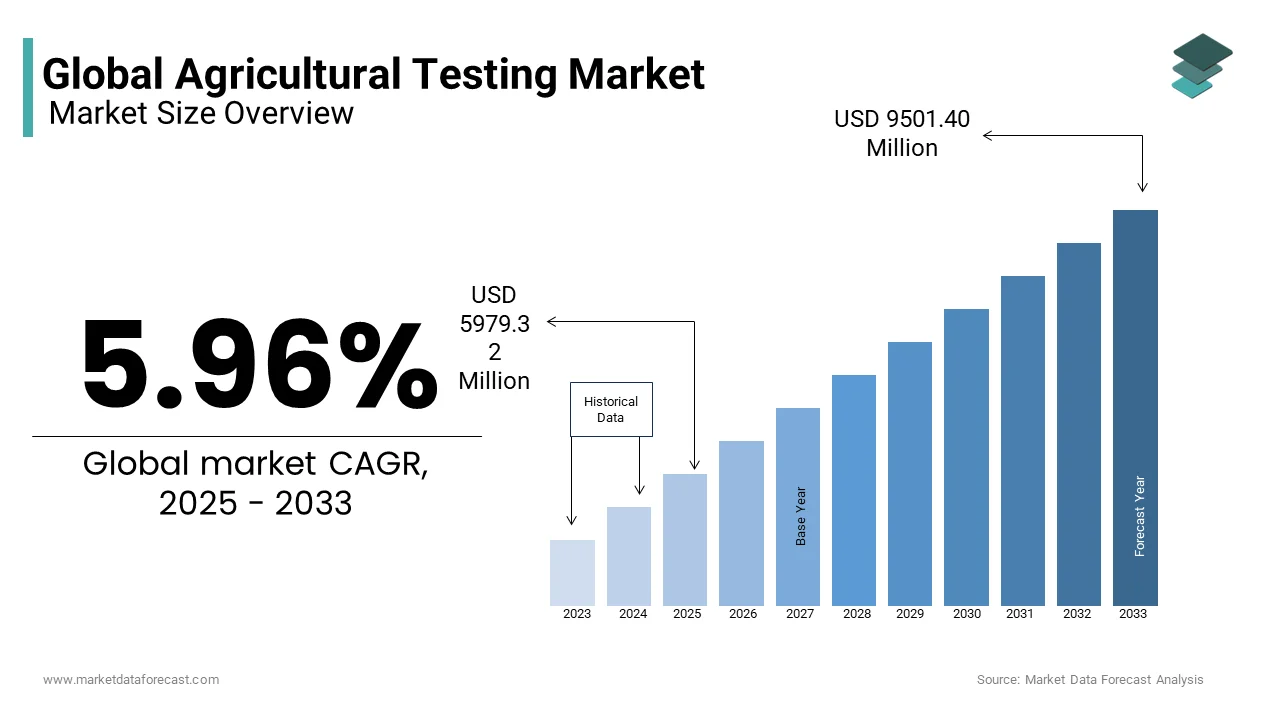

The global agricultural testing market was valued at USD 5643 million in 2024 and is anticipated to reach USD 5979.32 million in 2025 from USD 9501.40 million by 2033, growing at a CAGR of 5.96% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Consumer awareness plays a pivotal role in propelling the agricultural testing market. Consumers now seek assurance that the agricultural products they buy meet stringent safety and quality standards. This demand, in turn, exerts pressure on agricultural producers and suppliers to subject their products to rigorous testing processes to gain consumer trust. As a result, the agricultural testing market experiences growth, with an expanding clientele of producers striving to meet these evolving consumer expectations. This trend reinforces the significance of agricultural testing in ensuring the safety and quality of food products while fostering transparency and consumer confidence in the agricultural supply chain.

The globalization of food supply chains has become a pivotal driver behind the agricultural testing market's expansion. In today's interconnected world, agricultural products frequently traverse international borders. To access global markets, agricultural producers must meet stringent quality and safety standards demanded by various countries. This necessity has created a surge in the demand for agricultural testing services. International trade regulations and consumer preferences necessitate thorough testing to ensure that agricultural products meet the diverse and often rigorous standards set by importing nations. Agricultural testing ensures that these products are safe, compliant, and of high quality, thus facilitating their smooth entry into global markets. As a result, the agricultural testing industry has experienced substantial growth, aiding in the harmonization of standards across borders, enabling smoother trade, and providing a vital link in the global food supply chain. This trend underscores the importance of agricultural testing in supporting international trade, bolstering the competitiveness of agricultural businesses, and meeting the demands of a globalized world.

MARKET RESTRAINTS

The sophisticated technologies and equipment required for comprehensive agricultural testing often come with a significant price tag, making them a financial challenge for many smaller and resource-constrained agricultural businesses.

The agricultural testing market faces a substantial restraint in the form of high costs associated with advanced testing methods, equipment, and services. These high costs encompass not only the initial investment in cutting-edge testing equipment but also the ongoing expenses related to maintenance, calibration, and skilled labor. For small-scale and family-owned farms, these financial burdens can limit their access to crucial testing services, potentially compromising the quality and safety of their agricultural products. Addressing this restraint necessitates innovative solutions, such as shared access to testing facilities, government subsidies, or the development of cost-effective testing alternatives. Ensuring affordability and accessibility to agricultural testing is crucial for fostering a level playing field in the industry, supporting food safety, and promoting sustainable agricultural practices for businesses of all sizes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.96% |

|

Segments Covered |

By Type of Sample, Contaminants, and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SGS SA, Eurofins Scientific, Intertek Group plc, Bureau Veritas, ALS Limited, Agilent Technologies, Thermo Fisher Scientific, Mérieux NutriSciences, TUV Nord Group, AsureQuality Limited, RJ Hill Laboratories Ltd., SCIO Analytical, Cropnuts, Eurofins BioDiagnostics, A&L Canada Laboratories Inc., Waters Corporation, R J Hill Laboratories Ltd., SCS Global Services, Invivo Labs. |

SEGMENTAL ANALYSIS

Global Agricultural Testing Market By Contaminants

Chemical residues hold the largest share in the agricultural testing market due to the widespread use of agrochemicals in modern farming, and chemical residues are driven by the need to ensure that agricultural products meet regulatory limits and consumer safety expectations.

Pathogens are second dominating in the market as they can contaminate agricultural products, particularly fresh produce, meat, and dairy. Ensuring that agricultural products are pathogen-free is a key priority for food safety and public health.

Toxins hold the third largest share as they include natural toxins produced by plants as well as environmental contaminants. The dominance of toxins in agricultural testing is due to health risks associated with their consumption. Mycotoxins, for instance, are a common concern in crops like maize and peanuts, and their testing is essential to prevent health issues.

Global Agricultural Testing Market By Type Of Sample

Soil testing is one of the most dominating in the agricultural testing market as it is essential for assessing soil fertility, nutrient content, pH levels, and the presence of contaminants. Soil testing provides valuable insights for optimizing crop production, managing fertilizer use, and addressing soil health concerns.

The seed testing segment is expected to hit the highest CAGR by the end of 2028. Seed testing is crucial for ensuring the quality and purity of seeds used for planting.

It involves assessing factors like germination rates, genetic traits, and the absence of pathogens or contaminants. The dominance of seed testing is driven by the fundamental role of high-quality seeds in crop production.

Water testing is important for assessing water quality in agriculture, as it impacts irrigation, livestock, and the safety of produce. It involves checking for contaminants, pathogens, and chemical residues. The dominance of water testing is related to its significance in ensuring safe and sustainable agricultural practices.

Manure testing is particularly relevant in livestock farming. It helps in managing nutrient content and pathogen levels in manure, which is essential for both crop fertilization and environmental stewardship. The dominance of manure testing aligns with the importance of sustainable nutrient management in agriculture.

Biosolids are organic materials derived from wastewater treatment processes and can be used as soil conditioners or fertilizers. Testing bio-solids ensures their safety and compliance with environmental regulations.

REGIONAL ANALYSIS

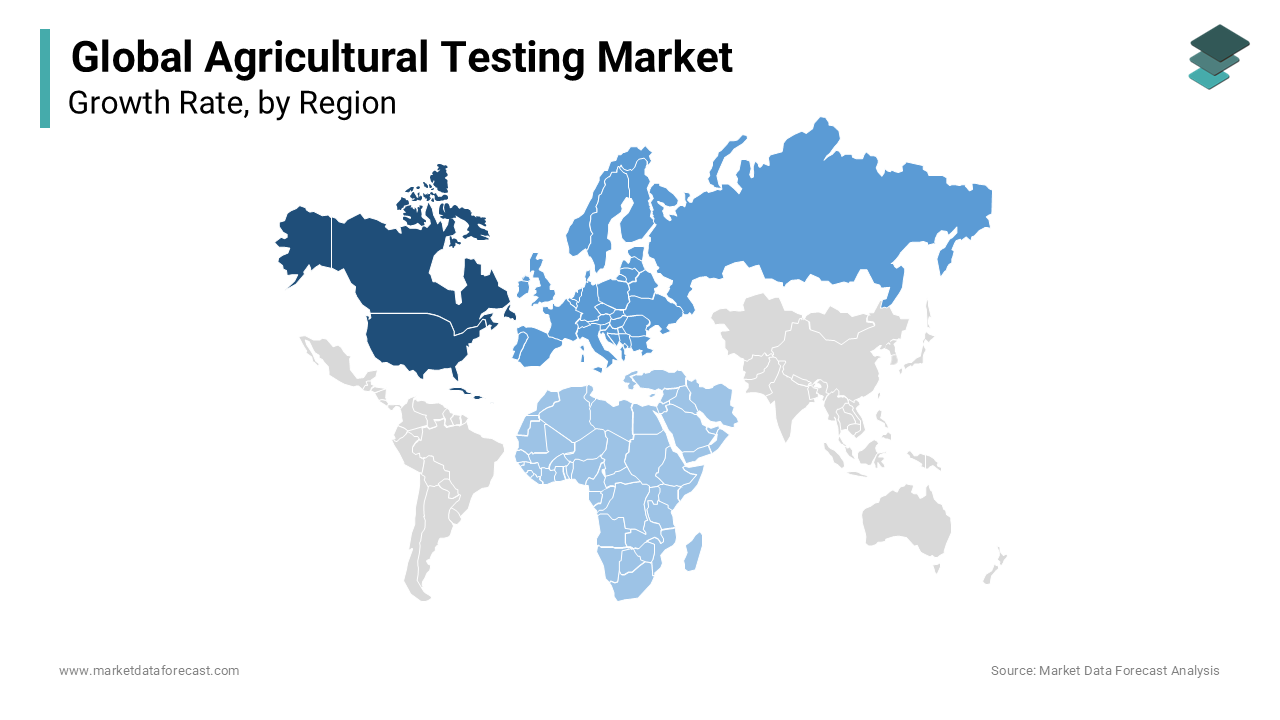

North America is a dominant region in the agricultural testing market. The United States and Canada have well-established agricultural sectors with high levels of technology adoption. They have stringent regulatory requirements for food safety and product quality, which drive the demand for extensive testing. North America's dominance in agricultural testing is a result of its focus on innovation, precision agriculture, and a strong emphasis on export quality.

Europe is another significant player in the agricultural testing market. The European Union has stringent regulations related to food safety and environmental standards. European agriculture often integrates sustainable and organic practices, leading to a focus on testing for pesticide residues, heavy metals, and soil health. This region is also an important market for GMO testing due to regulatory requirements.

Asia Pacific is a rapidly growing market for agricultural testing. The demand for agricultural testing is increasing in response to concerns about food safety, the need to meet export requirements, and the adoption of modern farming practices.

Latin America's agricultural testing is driven by the production of key agricultural commodities like soybeans and corn, which require extensive testing for pesticide residues, GMO content, and pathogen presence. Export-oriented agriculture is a significant driver of testing demand.

The Middle East and Africa region has a growing agriculture sector, and the focus on agricultural testing is increasing due to food security concerns and the need to improve crop yields.

KEY MARKET PLAYERS

SGS SA, Eurofins Scientific, Intertek Group plc, Bureau Veritas, ALS Limited, Agilent Technologies, Thermo Fisher Scientific, Mérieux NutriSciences, TUV Nord Group, AsureQuality Limited, RJ Hill Laboratories Ltd., SCIO Analytical, Cropnuts, Eurofins BioDiagnostics, A&L Canada Laboratories Inc., Waters Corporation, R J Hill Laboratories Ltd., SCS Global Services, Invivo Labs. Are playing a dominant role in the agricultural market.

RECENT HAPPENINGS IN THIS MARKET

- In 2023, SGS expanded its agricultural testing services to address the growing demand for soil health testing, providing farmers with comprehensive insights into soil quality and nutrient levels.

- In 2023, Intertek Group introduced advanced testing technologies for pesticide residue detection, ensuring the safety and compliance of agricultural products with regulatory standards.

- In 2023, Bureau Veritas enhanced its digital agriculture testing platforms, offering farmers real-time analytics and data-driven insights to optimize crop management practices.

MARKET SEGMENTATION

This research report on the global agricultural testing market is segmented and sub-segmented based on by type of sample, contaminants, and region.

By Type Of Sample

- Water

- Seed

- Bio-solids

- Manures

- Soil

- Others

By Contaminants

- Toxins

- Chemical residues

- Pathogens

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which countries in Europe are driving growth in the agriculture testing market?

Countries such as Germany, France, and the UK are the major contributors to the growth of the agriculture testing market in Europe.

What are the key factors influencing the growth of the agriculture testing market in Asia Pacific?

In Asia Pacific, factors such as increasing awareness about food safety, growing demand for organic products, and stringent government regulations are driving the growth of the agriculture testing market.

How is the agriculture testing market segmented in Latin America?

The agriculture testing market in Latin America is segmented based on testing type, including soil testing, water testing, and crop testing.

What are the major challenges faced by the agriculture testing market in Africa?

Challenges such as lack of infrastructure, limited access to advanced testing technologies, and inadequate regulatory frameworks hinder the growth of the agriculture testing market in Africa.

How does the agriculture testing market differ between developed and developing regions?

In developed regions, such as North America and Europe, the agriculture testing market is characterized by advanced technologies and strict regulatory standards, while in developing regions, there may be challenges related to infrastructure and access to testing facilities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]