Global Atherectomy Devices Market Size, Share, Trends & Growth Forecast Report By Type (Directional, Rotational, Orbital and Latera), Application (Peripheral, Cardiovascular and Neurovascular), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Atherectomy Devices Market Size

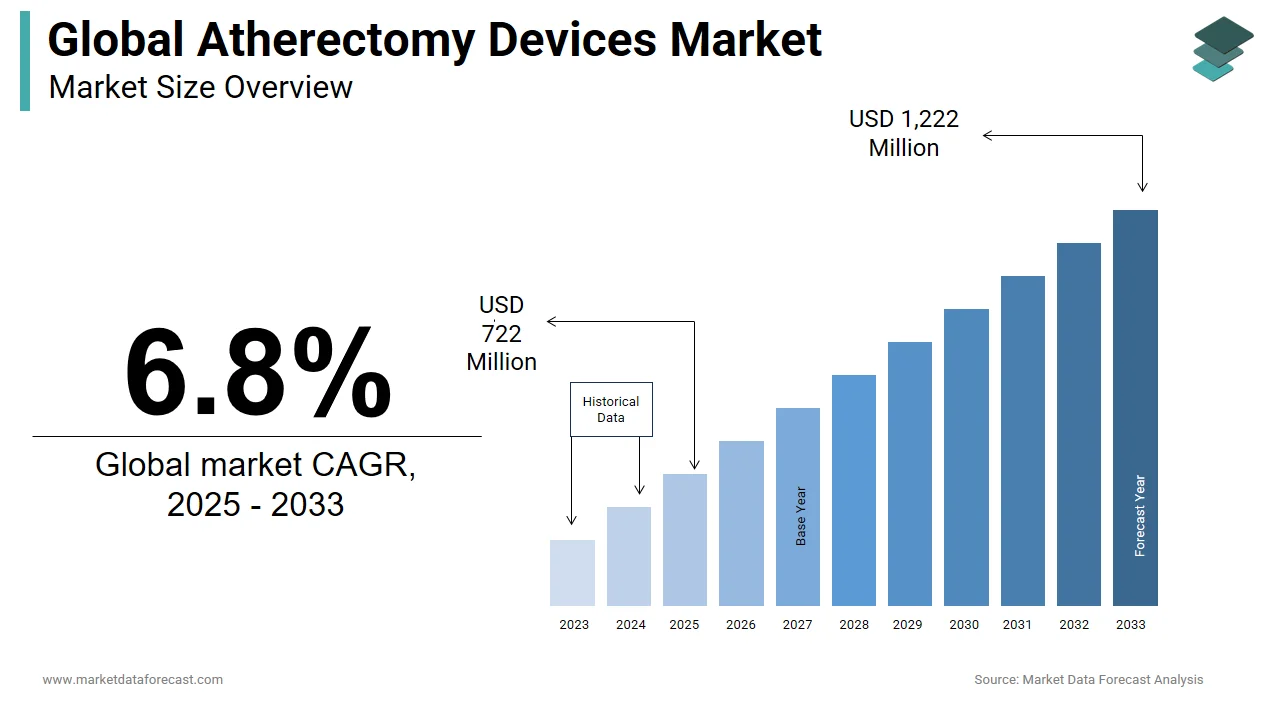

The size of the global atherectomy devices market was worth USD 676 million in 2024. The global market is anticipated to grow at a CAGR of 6.8% from 2025 to 2033 and be worth USD 1,222 million by 2033 from USD 722 million in 2025.

The market is showcasing evident potential in the forecast period. The market continues to gain momentum with rapid development in the medical industry. Peripheral artery disease occurs when a block of fat deposits in the arteries due to high cholesterol levels in the blood. Atherectomy is a surgical process for plaque that blocks the arteries or veins related to the heart; it is a peripheral artery disease where the blood flow is restricted, causing problems. Atherectomy devices are equipment used to either shave, cut, vaporize, or sand these plaques, which block the way of the blood in either coronary or peripheral atrial diseases.

MARKET DRIVERS

The growing patient population suffering from chronic diseases and technological advancements are majorly driving the global atherectomy devices market growth.

The growing geriatric population, vulnerable to several chronic conditions will foster market growth over the forecast period. YOY growth in the number of patients suffering from the target diseases is the primary factor driving the market growth over the period. In addition, growing efforts on R&D activities by the key players tend to the introduction of new products. Furthermore, the YOY rise in the incidence of target diseases and awareness regarding limb ischemia fuels the global market growth. Nearly 17.9 million died of cardiovascular diseases, which accounts for 31% of deaths worldwide. Around 4,300,000 people had critical limb ischemia; half of the population was diagnosed with peripheral artery disease in 2016.

Increasing cases of diseases and disorders such as peripheral arterial disease, cerebrovascular disease, cardiovascular disease, and rheumatic heart disease in people due to unhealthy lifestyles are offering opportunities for the growth of the atherectomy devices market. Furthermore, the research activities have escalated in the atherectomy in recent times due to technological advancements leading to the development of innovative products anticipated to provide numerous opportunities across the world over the forecast period.

Furthermore, increasing demand for minimally invasive surgical devices and procedures due to benefits associated with them, such as reducing the recovery span and procedure time and eliminating, or limiting the risk of complications and infections, is expected to offer lucrative growth opportunities atherectomy market across the world over the forecast period.

MARKET RESTRAINTS

The unavailability of experienced professionals to operate atherectomy devices is the major challenge expected to retardate the growth of the atherectomy devices market. Also, stringent policymaking is slowing down the growth of the global atherectomy devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bayer HealthCare, C. R. Bard, Inc., Cardinal Health (Cordis), Avinger, Inc., Boston Scientific Corporation, Straub Medical AG, St. Jude Medical, Cardiovascular Systems, Inc., and Spectranetics. |

SEGMENTAL ANALYSIS

By Type Insights

Within these, the directional atherectomy segment is predicted to lead the global atherectomy devices market and is continually expanding as it enhances efficiency and a cost reduction of treatment. Products such as Turbohawk and Silverhawk, developed by Medtronic, have been highly successful. They have contributed a vital share of the market, and the emergence of such products in the directional atherectomy segment is likely to stay dominant in the forecast period.

However, the rotational atherectomy segment is also expected to have significant growth during the forecast period due to the low time of recovery for the procedure and the fact that the patient does not have to visit the doctor for up to nine months after the procedure for check-ups promoting segmental growth.

By Application Insights

Based on the application, the peripheral segment is projected to have profitable growth throughout the forecast period. Factors like lifestyle changes, standard increase of peripheral vascular diseases, and demand for minimally invasive procedures, particularly in hospitals with advanced medical devices, fuel the segment's growth over the forecast period.

However, the cardiovascular atherectomy devices segment is also expected to have significant revenue owing to rising cardiovascular problems and the need for better treatment procedures. According to the WHO stats, the most significant cause of death worldwide is cardiovascular disease (CVD), which claims 17.9 million lives annually.

By End-User Insights

The hospital segment is accounted for to contribute a significant share of the market based on the end-user. It is estimated to have the highest CAGR due to the growing acceptance of atherectomy for heart-related and peripheral vascular diseases.

The surgical centers segment is expected to contribute considerably to the growth of the overall atherectomy devices market, with the highest CAGR of 6.6%. In addition, the Research laboratories and academic research segments are also expected to grow due to the rising quality of infrastructure for laboratories and increasing funding toward research initiatives in the current markets.

REGIONAL ANALYSIS

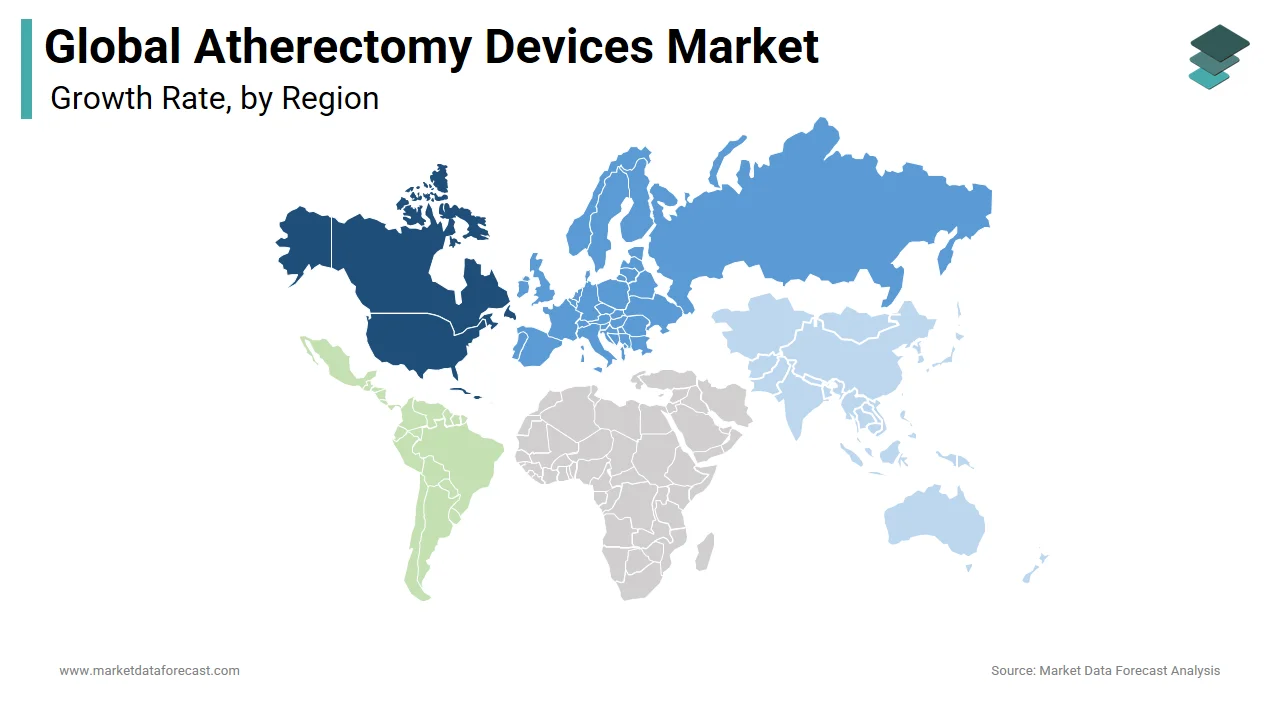

Regionally, the atherectomy devices market in North America is expected to have the largest share in the global market during the forecast period. Factors such as increasing reimbursements for atherectomy systems, adopting atherectomy systems among medical professionals, and the large patient population of peripheral & coronary artery diseases fueling the North American market. In addition, an increasing number of clinical trials (that aim to evaluate the therapeutic efficacy of atherectomy systems in specific disease treatment) drive the growth of the North American atherectomy devices market. As a result, North America is expected to dominate the atherectomy market during the period with the launch of reimbursement policies and approving innovative products. The U.S. is a leading country in this region, followed by Canada, with over 50%.

On the other hand, the European atherectomy devices market is expected to hold the second-largest share in the global atherectomy devices market over the forecast period owing to increasing healthcare infrastructure and different steps taken by the government and non-government organizations.

The atherectomy devices market in Asia-Pacific is expected to have the fastest growth in atherectomy devices over the forecast period. Unhealthy lifestyle changes, socioeconomic changes, smoking, and alcohol intake boost market growth over the foreseen period. Moreover, the increasing acquisition of atherectomy devices in the medical field and the rising accessibility of damages for these devices fuel the market in this region. China is the leading and dominating country in this region, followed by Japan and India.

The atherectomy devices market in Latin America is expected to showcase substantial growth in the analysis period, which owes to developing economies like Brazil and Mexico. This region's growth is due to the sudden increase in high-risk old age population and common lifestyle-related illnesses, which help grow the market.

The atherectomy devices market in Middle East & Africa is expected to hold a minor share in the global atherectomy devices market over the review period. The growth of this region owes to the appearance of economically diverse countries and increasing knowledge about atherectomy devices in the medical profession.

KEY MARKET PARTICIPANTS

A few of the notable companies leading the global atherectomy devices market profiled in this report are Bayer HealthCare, C. R. Bard, Inc., Cardinal Health (Cordis), Avinger, Inc., Boston Scientific Corporation, Straub Medical AG, St. Jude Medical, Cardiovascular Systems, Inc., and Spectranetics.

RECENT MARKET DEVELOPMENTS

- In September 2022, allegations in a federal lawsuit against the vascular clinics claimed that Boston Scientific Corp. disregarded staff objections that a sizeable medical chain was using its gadgets in pointless treatments. The lawsuit, brought by a whistleblower against Modern Vascular in January 2020 and maintained under wraps until the US Department of Justice decided to get involved late last week, does not mention Boston Scientific as a defendant.

- In July 2022, the FDA approved the reprocessing of the Philips Spectranetics 0.9mm OTW Turbo-Elite laser atherectomy catheter, according to Northeast Scientific Inc., pioneers in the reprocessing of single-use peripheral vascular catheters. The Connecticut-based company had achieved yet another first-of-its-kind feat in that the FDA has never before approved a 510(k) clearance for reprocessing this particular kind of atherectomy catheter.

- In June 2022, the first and only intravascular image-guided catheter-based system for the diagnosis and treatment of peripheral artery disease (PAD) is offered by Avinger, Inc., a commercial-stage medical device company. Today, the company announced two podium presentations showcasing its Lumivascular technology at the New Cardiovascular Horizons (NCVH) annual conference held in New Orleans from May 31 to June 3.

- In August 2019, Cardiovascular Systems expanded its product portfolio by acquiring WIRION Embolic Protection System and other assets from Gardia Medical Ltd. the company has co-developed a laser atherectomy device which is used for treating various types of peripheral arterial diseases by collaborating with Aerolase Corp., and FDA approved the device in July 2018.

- Boston Company completed the acquisition of BTG in August 2019 to expand its product line regarding vascular devices.

- In January 2019, Terumo Company expanded its distribution network in Canada by opening a new region. In addition, for the expansion of the product portfolio, the Terumo Company has completed acquiring a large-bore vascular device from Medion Biodesign inc. in March 2018.

- Avinger inc. Developed pantheris small vessel image-guided atherectomy system for which it had received clearance from FDA in March 2019. With the extension of its product line in atherectomy devices, the market will likely witness significant growth during the forecast period.

MARKET SEGMENTATION

This market research report on the global atherectomy devices market has been segmented and sub-segmented into the following categories.

By Type

- Directional

- Rotational

- Orbital

- Latera

By Application

- Peripheral

- Cardiovascular

- Neurovascular

By End-User

- Hospitals

- Surgical Centers

- Research Laboratories

- Academic Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the atherectomy devices market worldwide in 2024?

The global atherectomy devices market size was worth USD 676 million in 2024.

What is the growth rate of the global atherectomy devices market?

The global atherectomy devices market is anticipated to be growing at a CAGR of 6.8% from 2025 to 2033.

Does this report include the impact of COVID-19 on the atherectomy devices market?

Yes, we have studied and included the COVID-19 impact on the global atherectomy devices market in this report.

Who are the leading players in the atherectomy devices market?

Bayer HealthCare, C. R. Bard, Inc., Cardinal Health (Cordis), Avinger, Inc., Boston Scientific Corporation, Straub Medical AG, St. Jude Medical, Cardiovascular Systems, Inc., and Spectranetics are a few of the noteworthy companies in the atherectomy devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com