Global Contrast Injector Market Size, Share, Trends & Growth Analysis Report – Segmented By Product (Injector Systems, Consumables and Accessories), Application (Radiology, Interventional Cardiology and Interventional Radiology) & Region - Industry Forecast from 2025 to 2033

Global Contrast Injector Market Size

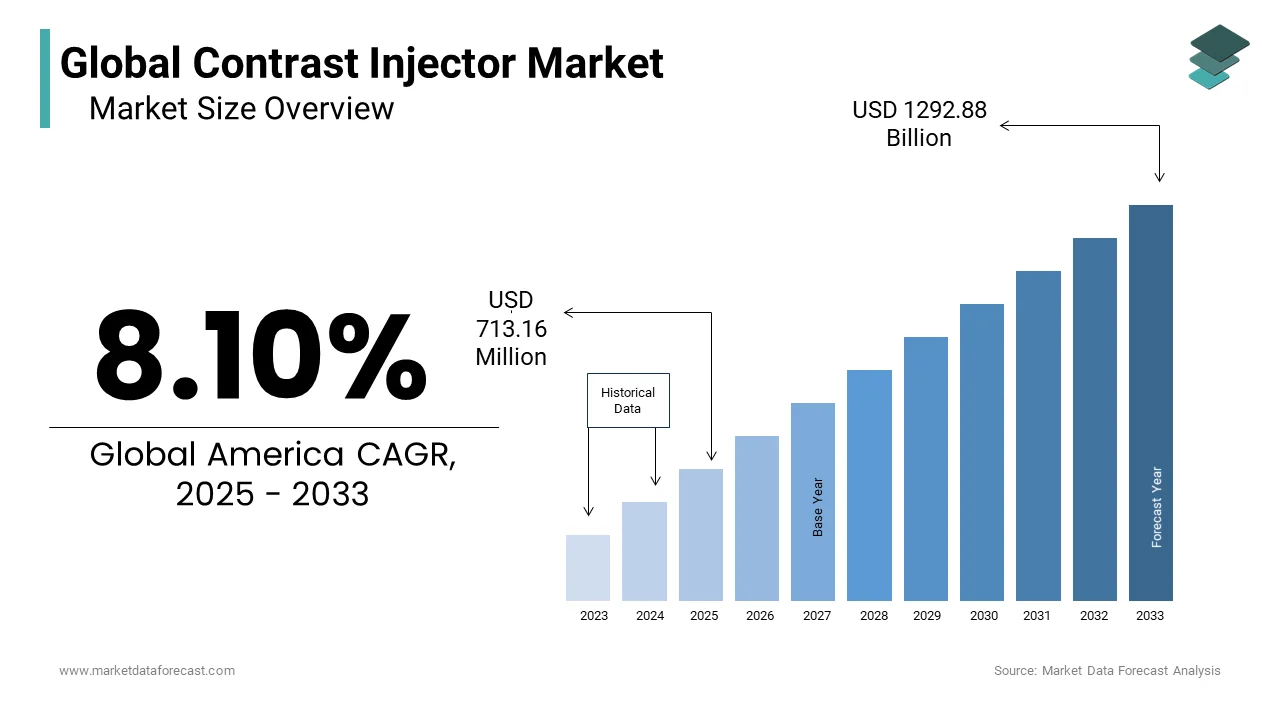

In 2024, the global contrast injector market was valued at USD 662.05 million and it is expected to reach USD 1292.88 million by 2033 from USD 713.16 million in 2025, growing at a CAGR of 8.10% during the forecast period.

The contrast injector is used to inject contrast media or agents into the blood to increase the contrast of the structure of fluids within the body in medical imaging. The contrast media absorb or alter the external electromagnetism or the ultrasound and give an accurate image in medical imaging. Contrast media are commonly used to improve the visibility of blood vessels and the gastrointestinal tract. Different contrast media are used in medical imaging, depending on the type of medical imaging. An automation injection system helps to deliver a precise amount of contrast.

The injection of contrast media enables visualization of various ailments through X-ray, CT, MRI, or other medical-imaging modalities into the bloodstream. The delivery of contrast media is considered most effective by implementing a medical device for this purpose, known as a contrast injector or power injector. Plungers, in contrast, injectors, push the contrast media into the tubing connected to a patient's vascular system. Contrast injectors are controlled by a computer-controlled unit in the room, where volumes and flow rates of the media are programs, and the start & stop mechanisms are controlled. The device can be programmed to deliver specific amounts of contrast agents at accurate flow rates.

MARKET DRIVERS

The growing number of contrast agent approvals and developments in the technology increasing funding by the governments primarily propel the global contrast injector market.

The use of medical imaging in the healthcare sector is increasing the demand for more accurate imaging, which is estimated to support the growth of the global contrast injector market. Growing awareness of the benefits of utilizing these injectors is enhancing market growth. In addition, increasing investments in innovative products in healthcare is likely to bolster the market's growth rate. The key players in the market are using different software and IT to improve technological solutions, promoting contrast media market growth.Growing prevalence of chronic diseases and advanced diagnostic procedures to drive market growth.

The rising prevalence of chronic diseases such as CVDs, diabetes, cancer, neurological disorders, and others, which lead to more surgeries and more diagnostic procedures, are driving the demand for contrast media procedures. According to WHO statistics, non-communicable diseases (NCDs) account for 41 million annual fatalities, or 74% of all fatalities worldwide. In addition, 17 million people worldwide pass away from an NCD before they turn 70 each year; 86% of these untimely deaths occur in low- and middle-income nations. Most NCD deaths, or 17.9 million people each year, are caused by cardiovascular diseases, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes causes over 2 million deaths. Additionally, the growing advances in diagnostic procedures that make disease diagnosis more efficient, like CT scans, X-rays, MRI, ultrasound, and others, also support the market's growth. A growing number of technological advancements further drive the contrast media market growth.

Contrast injectors assist clinicians better than angiography techniques and help the workflow of healthcare systems. The procedure helps eradicate any mistakes in the treatment, properly collects and manages data, and helps to avoid repeated scans, thus making the task easier for the staff. Moreover, contrast injectors are more efficient and easier to control than other procedures. In addition, the contrast injectors, in terms of technological advancements, provide a better user interface with LCD and touch-enabled display screens for monitoring the patient's vitals and the internal connectivity of the procedure with the hospital's I.T. systems like electronic health records (EHR) to maintain records without the chances of any human error.

MARKET RESTRAINTS

The shortage of trained and skilled professionals to operate also impedes the growth of the contrast injector market. In addition, some people experience rash, skin redness, vomiting, or dizziness which could last for one hour or longer with the regular use of a contrast injector, which is projected to hamper the growth rate of the contrast injector market to some extent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.10% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Bracco Imaging S.p.A. (Italy), Bayer HealthCare (Germany), Guerbet Group (France) |

SEGMENTAL ANALYSIS

By Product Insights

Based on product, the injector system segment was the largest in the global contrast media market in 2022. The injector systems segment is anticipated to grow, showcasing healthy growth during the forecast period. The injectors system is further sub-segmented into C.T. injectors, MRI injectors, and Angiography injectors. The CT injectors segment is estimated to display a lucrative growth rate during the forecast period.

The consumables segment is expected to have the highest CAGR during the forecast period based on the product. Growing necessities of consumables to conserve welfare and sterilized conditions during the diagnostic processes are majorly attributing to the market growth.

By Application Insights

Based on the application, the radiology segment is anticipated to hold the largest share of the global contrast injector market during the forecast period. The growth is accredited due to the increasing number of radiology procedures that use contrast media. In addition, this segment is estimated to produce lucrative growth due to the demand for non-invasive medical imaging techniques.

The interventional cardiology segment is projected to have the quickest growth rate during the forecast period owing to the considerable increase in patients suffering from cardiac diseases such as stroke, heart attack, and heart valve problems.

REGIONAL ANALYSIS

As of 2021, the North American contrast media market leads the global market, accounting for a significant global market share, with the U.S. accounting for a considerable share. Additionally, the presence of well-established healthcare facilities, a preference for minimally invasive surgery, easy access to radiologists and surgeons, the easy availability of advanced technologies, the prevalence of chronic diseases, the high demand for diagnostic procedures, changing lifestyles, along with the prevalence of cardiac conditions, diabetes, cancer, obesity, etc. in nations like the U.S. and Canada, all contribute to the market's expansion in the region.

The contrast media market in Europe accounted for the second largest global market share in 2021. Countries like the U.K., France, Germany, Italy, and others are continuously showing growth in the market due to efforts to better the healthcare systems and spread awareness among the populations.

However, the contrast media market in Asia-Pacific is expected to expand at the highest CAGR during the forecast period, majorly because of the increasing feasibility of approvals for the use of contrast media and the market potential offered by the region to companies producing contrast injectors. In addition, the growth of the region driven by increasing R&D investments, rapidly developing economies, aging populations, demand for quality healthcare facilities, rising prevalence of chronic diseases, increased government support & market players' focus, growing neurological disorders, and increased awareness in nations like China, India, Japan, and others.

The Latin American contrast media market and MEA contrast media market are also expected to show lucrative growth during the forecast period. However, the growth can be relatively slower due to a lack of awareness and regional economic barriers.

KEY MARKET PLAYERS

Some of the noteworthy companies operating in the global contrast injector market profiled in the report are Bracco Imaging S.p.A. (Italy), Bayer HealthCare (Germany), Guerbet Group (France), Medtronic AG (Germany), Ulrich GmbH & Co. K.G. (Germany), G.E. Healthcare (U.S.), AngioDynamics (U.S.), Nemoto Kyorindo Co., Ltd. (Japan), Sino Medical- Device Technology Co., Ltd. (China), VIVID IMAGING (China), and Apollo R.T. Co., Ltd. (China).

RECENT HAPPENINGS IN THIS MARKET

-

In April 2020, the FDA gave Guerbet (GBT), a world authority in medical imaging, permission to produce Dotarem® (gadoterate meglumine injectable) at its plant in Raleigh, North Carolina. Dotarem® was only produced outside of the United States up until late 2019. As part of Guerbet's overall goal to provide US-made goods to U.S. consumers, the company plans to manufacture Dotarem® in the U.S. for US-based clients. Guerbet's power injectors and urology systems are assembled in Cincinnati, Ohio.

-

In November 2022, a deal between G.E. Healthcare and Ulrich Medical for a GE Healthcare-branded contrast media injector in the United States was announced today. By removing time-consuming preparation steps, the C.T. motion multi-dose syringeless injector, which delivers iodinated contrast media for Computed Tomography (C.T.) imaging procedures, decreases procedure setup time and increases patient throughput. It also helps to optimize patient dosing and decrease wasted contrast media.

- In November 2022, at the 2022 Radiological Society of North America (RSNA) Scientific Assembly and Annual Meeting, Guerbet LLC, the U.S. affiliate of Guerbet, a global leader in medical imaging offering a comprehensive range of pharmaceutical products, medical devices, and digital and artificial intelligence (A.I.) solutions for diagnostic and interventional imaging, will present data on Elucirem (gadopiclenol) injection, Dotarem (gadoterate meglumine) injection, and A.I. solutions.

- In November 2022, Bayer Radiology, a pioneer in diagnostic imaging, will present its portfolio of products and solutions intended to address the most pressing issues confronting the field of radiology today at the 2022 Radiological Society of North America (RSNA) Annual Meeting, which will bring together international leaders in the field of imaging. In addition, Bayer will present new research findings regarding a potential contrast agent. Chicago will play host to the RSNA in 2022 from November 27 to December 1.

MARKET SEGMENTATION

This research report on the global contrast injector market has been segmented and sub-segmented based on the product, application, and region.

By Product

- Injector Systems

- Consumables

- Accessories

By Application

- Radiology

- Interventional Cardiology

- Interventional Radiology

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region is growing the fastest in the global contrast injector market?

The Asia-Pacific region is anticipated to be the fastest-growing region in the global market during the forecast period.

What was the size of the contrast media market worldwide in 2024?

The global contrast media market size was worth USD 662.05 million in 2024.

Which region had the leading share in the global contrast injector market in 2025?

North America dominated the contrast injector market in 2025.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com