Global Crude Sulfate Turpentine Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Alpha Pinene, Beta Pinene, Delta 3 Carene, Camphene, Limonene), Application (Aromatic Chemicals, Adhesives, Paints And Printing Inks, Camphor), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Crude Sulfate Turpentine Market Size

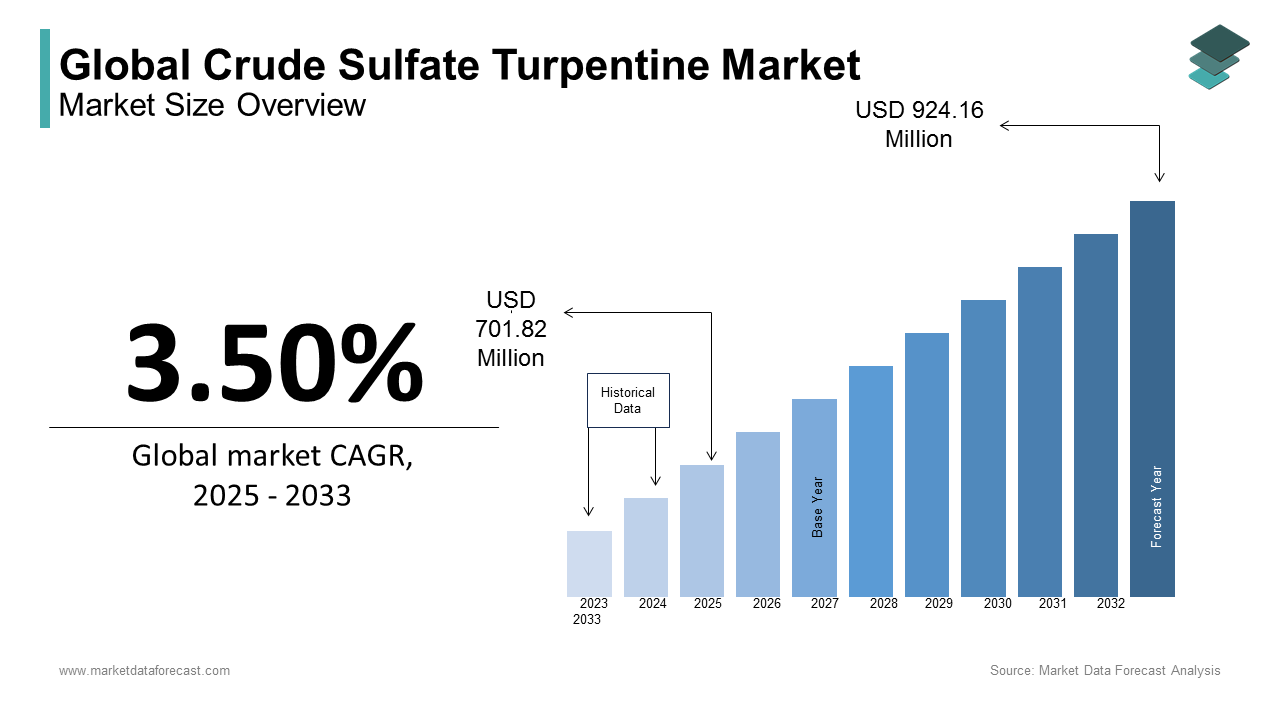

The global crude sulfate turpentine market size was calculated to be USD 678.09 million in 2024 and is anticipated to be worth USD 924.16 million by 2033 from USD 701.82 million In 2025, growing at a CAGR of 3.50% during the forecast period. Increased penetration of aromatic chemicals is expected to help grow your business.

Crude sulfate turpentine is a derivative of oil obtained by the distillation of resins that are produced in living trees, especially pine trees. It is a flammable fluid that is insoluble in water but soluble in certain solvents. Turpentine is also known as Wood Turpentine, Turpentine Oil, Turpentine Spirit. Crude turpentine sulfate is obtained as a by-product of the crafting process with the help of substrates and catalysts. Crude sulfate terpene contains terpene hydrocarbons and other sulfur compounds. Terpenes are a broad and diverse class of organic compounds obtained from a wide range of plants, especially those that belong to the Pinopsida group.

Crude turpentine oil is mainly used for the production of fragrances and flavors. The primary end-use industries of crude turpentine oil include cosmetics and food and beverages. It is also used as a solvent to dilute oil paints and produce varnish. It is used as a raw material in the organic synthesis process in the chemical industry, especially in aromatic (aromatic) compounds. Crude turpentine sulfate acts as a raw material for the manufacture of products that participate in the production of polymeric additives, turpentine oils, pines, spices, fragrances and pine oils. Turpentine oil is extracted from oleoresin and collected from trees. Demand for products in a variety of applications, including aroma chemistry, personal care, and home care products, is anticipated to drive the market boom.

MARKET DRIVERS

The crude sulfate turpentine market is witnessing a maximum boom due to the surge in demand for natural products and high consumption rates in various personal and household care products.

In addition, increased chemical production from turpentine used as a solvent, fragrance and fragrance are other factors that are supposed to stimulate the growth of the global market for crude turpentine and sulfate oil. Due to its superior advantages over synthetically derived products, the higher the preference for products of biological origin, the more demand will increase during the foreseen period. Key industry participants focus on sustainable food and effective production processes. They are turning to high bio-reproducible content products to ensure superior performance in end-use applications. Solvent manufacturers implementing Carene with ingredients are capturing more opportunities by replacing chemicals such as hydrocarbons, cement, and mineral spirits for the chemical process, paint, and adhesive industries. This growth is due to the wide range of applications for aroma chemistry and personal and home care products.

Furthermore, an increase in demand for products in the Asia-Pacific region is assumed to stimulate market development. The industry is expected to further develop as the preference for green CST derivatives instead of petrochemical derivatives changes. Due to the high consumption of household and personal care products, the world market for crude turpentine sulfate is presumed to increase in the future. Growth of crude turpentine oil occurs in many industries as demand for green products increases. The list of chemicals made from euro oil is extended. However, it is widely used as a solvent and fragrance; These are some essential factors that are suspected to accelerate the growth of the global market.

Furthermore, the development of strong ties with various flavors and consumer goods companies to ensure the flow of capital has been an essential factor in the growth of the turpentine market. The market is now witnessing a severe shortage of chemicals derived from pine. These vital supply and demand gaps are affecting the end-use industry's choice of synthetic alternatives to meet its needs and disrupt market growth.

MARKET RESTRAINTS

The reduced consumption of crude sulfate turpentine products, the availability of low-cost petroleum-based products, the reduced recovery of black liquor in the craft wood pulp process and the reduced production of paper mills are some of the limiting factors that to a certain extent hinder the global market for crude sulfate turpentine.

The primary inhibitor on the market of crude turpentine sulfate is that it requires a high investment in distillation, which limits manufacturers to use raw materials efficiently. Also, the low recovery rate of black liquor through the crafting process is expected to hamper the growth of the turpentine crude oil market worldwide during the outlook period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.50% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Renessenz LLC, Dujodwala Paper Chemicals Ltd, Arizona Chemical Company LLC, International Flavors & Fragrances Inc, Pine Chemical Group, Lawter Inc, Privi Organics Limited, HARTING Technology Group, Derives Resiniques et Terpeniqes, Privi Organics Limited and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The Alpha-pinene segment had the leading share of the global crude sulfate turpentine market in 2024. Alpha-pinene is one of the primary components extracted from turpentine and is widely used in a variety of industries, including fragrances, chemicals, and solvents. Its widespread application in the production of resins, flavorings, and the fragrance industry contributes to its dominance in the market. The versatility and high demand for alpha-pinene in both industrial and consumer products make it the largest segment in the crude sulfate turpentine market.

The limonene segment is predicted to be the most lucrative segment in the global market during the forecast period. Limonene, known for its citrus fragrance and solvent properties, is in increasing demand in the food, beverage, and cosmetics industries, as well as in cleaning products. With rising consumer interest in natural and eco-friendly products, limonene's growth is fueled by its use in green solvents and its popularity in natural flavoring and scent applications. This demand, driven by environmental and health-conscious trends, is making limonene the fastest-growing segment in the crude sulfate turpentine market.

By Application Insights

The aromatic chemicals segment held the dominating position in the global crude sulfate turpentine market in 2024. Crude sulfate turpentine is rich in terpenes, which are essential for producing aromatic chemicals used in fragrances, flavors, and perfumes. The high demand for essential oils, particularly in the fragrance and cosmetics industries, drives this segment’s dominance. Aromatic chemicals derived from turpentine are also used in various industrial applications, contributing to the sector's large market share in crude sulfate turpentine usage.

The camphor segment is estimated to grow at a prominent CAGR over the forecast period. Camphor is a white crystalline substance derived from turpentine, is increasingly used in pharmaceuticals, personal care products, and as a plasticizer in certain plastics. The growing demand for camphor in medicinal products, as well as its use in the wellness and cosmetic industries for its soothing and cooling properties, is driving the rapid growth of this segment in the crude sulfate turpentine market. This growth is also fueled by the increasing trend towards natural and plant-based ingredients.

REGIONAL ANALYSIS

North America has become the most significant local market in the past due to the presence of major exporters. The region is anticipated to continue its dominion during the forecast period.o North America dominates the entire crude sulfate turpentine market because its fields, including paints and aromatic chemicals, are widespread in the region, which is the leading consumer of crude sulfate turpentine. The United States and Canada are known manufacturers and consumers of raw turpentine. Europe also has a large share of the industry and will expand in the future due to the high demand for natural ingredients in cosmetics and personal care products. The presence of strong personal care manufacturing bases in countries such as the UK, France and Germany are also expected to benefit the market.

The Asia Pacific is envisioned to be the fastest-growing regional market for years as demand for products in the cosmetics and personal care industries increases in developing countries such as China and Japan. China is the world's largest producer of turpentine, so local production units mostly meet the United States' requirements for oil. Japan has become another area that expands growth due to the presence of large manufacturers of aromatic chemicals and the availability of paint products that consume sulfate-terpene materials. The Asia Pacific shows a significant increase in the near future.

KEY PLAYERS IN THE GLOBAL CRUDE SULFATE TURPENTINE MARKET

Major Key Players in the global Crude Sulfate Turpentine Market are Renessenz LLC, Dujodwala Paper Chemicals Ltd, Arizona Chemical Company LLC, International Flavors & Fragrances Inc, Pine Chemical Group, Lawter Inc, Privi Organics Limited, HARTING Technology Group, Derives Resiniques et Terpeniqes, Privi Organics Limited and Others.

RECENT HAPPENINGS IN THE MARKET

- In 2019, DRT, a French manufacturer of turpentine derivatives, signed an agreement to expand the marketing and distribution of four alpha-fine chemicals in Europe and Africa with Quimidroga.

- ORGKHIM Biochemical Holding and Ilim Group collaborate to develop a novel biochemical production project with an equal partnership.

- The University of Florida has developed new methods to increase the flow of pine oleoresin within trees through advanced genetics associated with high resin production.

DETAILED SEGMENTATION OF THE GLOBAL CRUDE SULFATE TURPENTINE MARKET INCLUDED IN THIS REPORT

This research report on the global crude sulfate turpentine market has been segmented and sub-segmented based on type, application, and region.

By Type

- Alpha-pinene

- Beta-pinene

- Delta-3-Carene

- Camphene

- Limonene

- Others

By Application

- Aromatic Chemicals

- Adhesives

- Paints and printing inks

- Camphor

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the major challenges faced by the Crude Sulfate Turpentine Market?

Challenges include fluctuations in raw material supply, the complexity of CST extraction and purification, competition from synthetic alternatives, and regulatory compliance related to environmental and safety standards.

2. What is the future outlook for the Crude Sulfate Turpentine Market?

The future outlook is positive, with anticipated growth driven by the rising demand for natural and sustainable products, innovations in CST applications, and expanding industrial uses in emerging markets.

3. What factors are driving the growth of the Crude Sulfate Turpentine Market?

Growth factors include the increasing demand for natural fragrances and flavors, the rising use of bio-based adhesives and resins, the expanding pulp and paper industry, and technological advancements in CST extraction and processing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com