Global Food Preservatives Market Size, Share, Trends & Growth Forecast Report By Type (Natural and Synthetic), Function (Antimicrobials, Antioxidants, Chelating And Enzyme Inhibitors), Application (Beverages, Oils & Fats, Bakery, Dairy & Frozen Products, Snacks, Meat, Poultry, & Seafood Products, Confectionery, Other Applications), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Food Preservatives Market Size

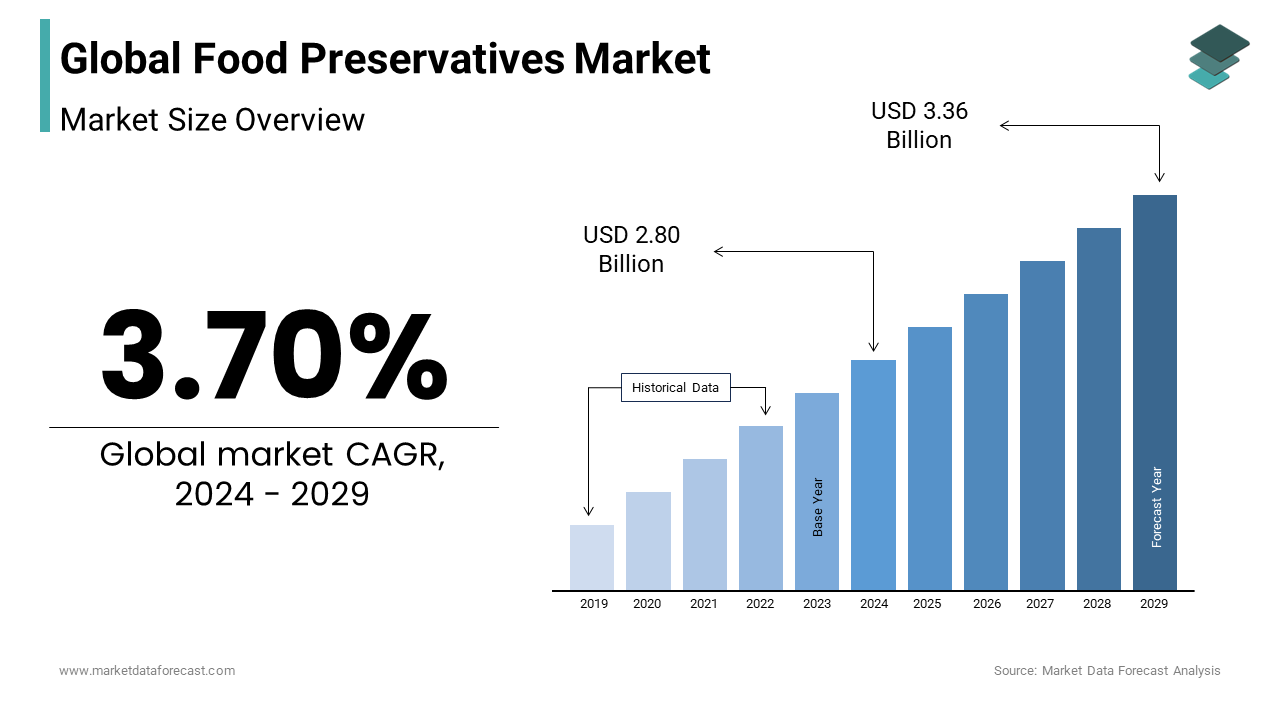

The global food preservatives market size was estimated at USD 2.80 bn in 2024 and is expected to be worth USD 2.90 billion in 2025 and grow at a CAGR of 3.70% from 2025 to 2033 to achieve USD 3.88 billion by 2033.

Food preservatives are chemical compounds that are added to various types of food in small amounts to inhibit or delay shelf life. Salt, sugar, and spices have traditionally been used to preserve meat and other kinds of food. Food preservatives are commonly used to extend the shelf life of perishable foods and reduce food spoilage to maintain the nutritional quality of the product. Antibacterial chemicals inhibit microbial growth, while antioxidant preservatives reduce the oxidation rate of the lipid and vitamin content in food. Antienzyme preservatives control enzyme processes and prevent the harmful effects of chemical enzymes. For example, anti-enzyme preservatives prevent fruit from ripening before harvest. Chelating agents combine with trace metal ions to increase the effectiveness of antioxidant preservatives.

The need for preservatives is driving the need for food additives and ingredients that limit the growth of mold, bacteria, and other microorganisms. This is the primary growth engine for the global food preservatives market.

MARKET DRIVERS

Food preservatives are integrated products to increase product stability and prevent spoilage during food processing. They are added in small amounts to various types of food as needed. Traditionally, salt, sugar, and spices have been used to preserve meat and other kinds of food. Food preservatives prevent or delay food spoilage by stopping the growth of microorganisms. Non-toxic chemicals can be used for processing, and moderate toxicity is regulated by relevant regulatory agencies such as the United States Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). It is identified by an appropriate index number (INS or E). The food and beverage industry consists of two key sectors that are supposed to create an invaluable growth atmosphere in the global food preservative market as demand increases. The demand for organic food is actively increasing in recent years. They have been studied to require different preservative groups.

Meanwhile, the change in lifestyle is said to be an increase in demand for prepared food, the other vital sector of the food and beverage industry. The desperate need to stop the development of the disease may be another essential factor in defending the use of food preservatives. Foods that are prone to spoiling with a long shelf life can be included on a large scale in food preservatives. The food preservative market has grown significantly in recent years. The growth of the world market for food preservatives is mostly due to increased demand for food with a long shelf life.

Furthermore, the expansion of distribution channels and the increased demand for natural and organic foods are some of the other factors that contribute to the growth of the market. The global market for food preservatives is currently growing as a result of increased demand for processed foods and increased awareness of food security. Synthetic foods are the fastest-growing segment of the global food preservative market. Current healthy eating trends and preferences for quality foods are driving demand for food preservatives worldwide.

MARKET RESTRAINTS

The growing demand for organic foods and consumer preferences for natural foods is limited worldwide, and the use of preservation technologies is restraining the growth of the global market for food preservatives. The main challenge in slowing the growth of the worldwide food preservative market is strict government regulations on the use of some dangerous chemicals as food preservatives. Furthermore, the cost of natural preservatives and the health problems associated with the use of synthetic food preservatives are other factors that hinder the growth of the target market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.7% |

|

Segments Covered |

By Type, Function, Application, & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE, Cargill Incorporated, Celanese Corporation, Chr. Hansen A/S, Kerry Group, Koninklijke DSM N.V, The Archer Daniels Midland Company, Corbion N.V, DuPont, JEY’S F.I. Inc |

SEGMENTAL ANALYSIS

By Type Insights

The natural segment is currently dominating the food preservatives market. Natural preservatives are considered to be healthy and do not cause any harm when they are consumed on a regular basis. The rising prominence of making a variety of food at home using only natural products is solely to elevate the growth rate of the market. In urban cities, there are a high number of working women who opt for healthy food products that can be prepared in a minimal time. This attribute is also ascribed to propel the market’s growth rate.

The synthetic segment is predicted to register the highest CAGR in the global market over the forecast period. Processed foods are mostly prepared using synthetic preservatives to make the products stay longer. With a busy lifestyle schedule, people are highly dependent on processed food products, majorly in both developed and developing countries, which will certainly set up new opportunities for this segment in the coming years.

By Function Insights

The antimicrobial segment accounted for a significant share of the food preservatives market in 2023. These preservatives have a pivotal role in maintaining the food without spoilage for longer days. The antimicrobial function of preservatives is used to protect food from the growth of bacteria that spoil in very little time. There are many compounds that are used according to the food style to protect the food from bacteria.

The antioxidants segment is anticipated to showcase the fastest CAGR in the global market over the forecast period. The increasing demand for the launch of innovative and flavored food products like salads and fruits & vegetables. People are more likely to eat salads, freshly cut fruits, or juices, which are readily available in the stores. The antioxidants are used to maintain the freshness for a longer time. Freshly cut fruits taste high, but they change their color if the preservatives are not used. Therefore, there is huge scope for the antioxidant food preservatives market in the coming years.

By Application Insights

The beverage segment is majorly holding the largest share of the food preservatives market. There are many companies manufacturing innovative flavored beverages in accordance with the customer’s preferences. The major plan is to maintain the quality and freshness by using natural preservatives, which are gaining huge customer attention across the world.

The dairy and frozen products segment is positioned next in holding the market share. Dairy products are mostly preferred in many households in day-to-day life. The growing awareness of maintaining healthy diet options by eating high-protein foods like paneer and other dairy products is attributed to leveraging the growth rate of the market.

REGIONAL ANALYSIS

North America dominates the world market for food preservatives and is supposed to maintain market dominance during the forecast period. This advantage is due to the presence of the leading manufacturers of food preservatives and the increased demand for processed foods in the region. North America is also a major exporter of fruit, and the need for preservatives is expanding. Some risk-related insights associated with chemical preservatives have fueled the market for natural preservatives. North America strictly regulates policies regarding the marketing of food and ingredients. These regulations provided a profitable growth opportunity for manufacturers to introduce new preservatives that minimize or have no side effects on human health. As the demand for convenience and processed foods increases, manufacturers are using food preservatives to improve the shelf life of food. As part of the strategy, the companies are spending a significant amount of money developing technology to produce chemicals using more natural ingredients than synthetic inputs.

The European market occupies a significant share of revenue in the target market and is presumed to witness substantial growth during the outlook period. The Asia Pacific market is assumed to show the most robust growth in terms of revenue and expand to TCAC during the forecast period. This may be due to the rapid growth of the food and beverage sector in the region, along with an increase in disposable income and an increased demand for ready-to-eat food in developing countries such as India, China, etc.

KEY MARKET PLAYERS

BASF SE, Cargill Incorporated, Celanese Corporation, and Chr. Hansen A/S, Kerry Group, Koninklijke DSM N.V, The Archer Daniels Midland Company, Corbion N.V, DuPont and JEY’S F.I. Inc. are some of the notable companies in the global food preservatives market.

RECENT HAPPENINGS IN THE MARKET

- BASF SE cooperated with China's state-owned SINOPEC to expand its production capacity and meet China's strict safety standards.

- On January 29, the Kerry Group launched GMO-free yeast as a natural solution for acrylamide reduction. Kerry Group's latest solution, Acryleast™, was launched in partnership with Renaissance BioScience.

- Arjuna Natural Extracts recently launched specific organic formulated preservatives to increase the shelf life of refrigerated meat.

- Scientists at the Nanyang University of Technology have identified plant food preservatives that are more effective than artificial preservatives. Newly discovered organic chemicals consist of a natural substance called 'flavonoid,' a group of various plant nutrients that can be used in almost all vegetables and fruits.

- In May 2016, Kemin opened a new quality control laboratory, warehouse, and logistics office in Belgium. This enabled the company to better serve its customers by adding value to its products.

MARKET SEGMENTATION

This research report on the global food preservatives market has been segmented and sub-segmented based on type, function, application, & region.

By Type

- Natural

- Synthetic

By Function

- Antimicrobials

- Antioxidants

- Chelating

- Enzyme inhibitors

By Application

- Beverages

- Oils & fats

- Bakery

- Dairy & frozen products

- Snacks

- Meat

- poultry & seafood products

- Confectionery

- Other applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the challenges faced by the food preservatives market?

Some challenges faced by the food preservatives market include consumer concerns regarding the safety of synthetic preservatives, the growing demand for preservative-free products, and the need for continuous innovation to develop effective natural preservatives with broad-spectrum activity.

2. What are some emerging trends in the food preservatives market?

Some emerging trends in the food preservatives market include the growing preference for natural and clean-label preservatives, innovative preservation technologies such as nanotechnology and edible coatings, and the rising demand for preservatives with multifunctional properties.

3. What factors are driving the growth of the food preservatives market?

The growth of the food preservatives market can be attributed to several factors, including the increasing demand for convenience foods, rising awareness regarding food safety and shelf-life extension, the expanding food and beverage industry, and the growing trend of clean-label products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com