Global Turf And Ornamental Grass Protection Market Size, Share, Trends and Growth Forecasts Report – Segmented By Type (Turf, Ornamental), Product (Synthetic Pesticides, Synthetic Herbicides, Synthetic Insecticides, Synthetic Fungicides, Other Synthetic Pesticides, Bio-pesticides, Bio-herbicides, Bio-insecticides, Bio-fungicides, Other Bio-pesticides, Other Protection Products), and Region(North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Turf and Ornamental Grass Protection Market Size

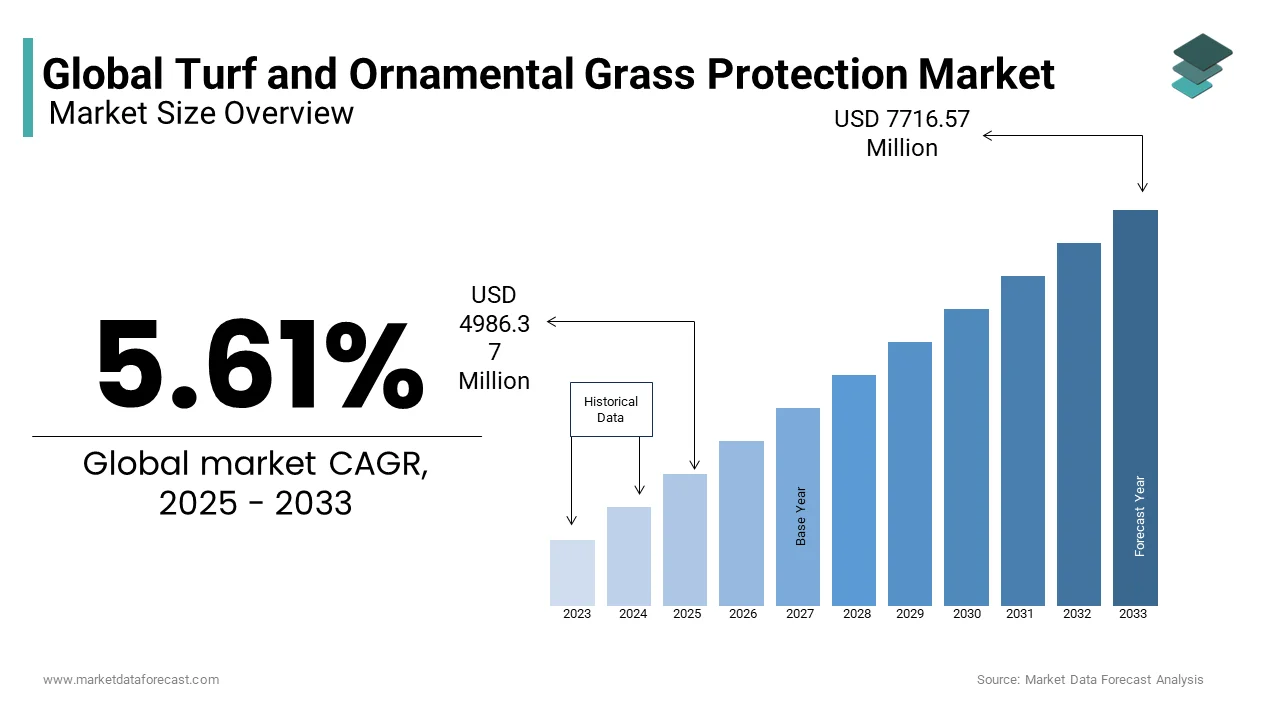

The global turf and ornamental grass protection market was valued at USD 4721.49 million in 2024 and is anticipated to reach USD 4986.37 million in 2025 from USD 7716.57 million by 2033, growing at a CAGR of 5.61% from 2025 to 2033.

The turf and ornamental grass protection market is growing steadily due to rising interest in maintaining attractive and healthy lawns, gardens, and sports fields. Over the forecast period, the global market is expected to continue to expand as more residential, commercial, and public spaces invest in landscaping. The main products in this market include herbicides (to control weeds), fungicides (to prevent diseases), and insecticides (to protect against pests). Biostimulants that boost plant health are also gaining popularity. North America and Europe are currently the largest markets due to high standards in landscaping and sports grounds, but demand is also increasing rapidly in Asia-Pacific as urban green spaces grow in cities like Beijing and Tokyo. A key trend in the market is the shift towards eco-friendly solutions, as stricter environmental regulations limit the use of certain chemicals. Companies are responding by developing bio-based products and using advanced application technologies that are safer and more precise. This focus on sustainable products is expected to shape the future of the turf and ornamental grass protection market, helping it meet both consumer demand and environmental standards.

MARKET TRENDS

Shift Toward Bio-Based and Eco-Friendly Products

An increasing environmental awareness worldwide is making bio-based solutions in turf protection are becoming essential. For instance, approximately 70% of consumers now prefer eco-friendly lawn care products, according to industry surveys. Biopesticides and organic fertilizers are gaining ground as safer alternatives to reduce chemical runoff by 30-40% and improve soil biodiversity. In the U.S., regulatory changes are influencing this trend, with over 20 states imposing restrictions on synthetic pesticides in public spaces. This eco-conscious shift is leading companies to invest in green solutions, offering products that protect turf health without compromising environmental standards.

Increasing Demand in the Sports Turf Sector

The sports turf sector, covering stadiums, golf courses, and athletic fields, is witnessing growing investment in advanced turf care. For instance, according to reports, golf courses and stadiums experience up to a 50% higher need for turf treatments due to heavy foot traffic and play frequency. To maintain high standards, nearly 80% of major sports facilities use specialized fungicides and pest management solutions. Furthermore, advancements in turf technologies, such as precision spraying, are being widely adopted to optimize application, save costs, and reduce environmental impact, enhancing turf resilience and playability across these facilities.

MARKET DRIVERS

Urbanization and Landscaping Demand

Rapid urbanization is fueling demand for green spaces, parks, and landscaped areas in cities globally. For instance, as per the reports of The World Bank, nearly 56% of the global population now lives in urban areas, which is driving investment in beautifying urban landscapes. Many city planners and property developers prioritize attractive lawns and gardens to improve aesthetics and air quality. This has increased demand for turf protection products, such as herbicides and fungicides, to maintain high-quality lawns. In the U.S., professional landscaping services have grown annually by about 4%, underscoring the ongoing need for turf management products.

Growth of the Sports Industry

The rise in sports facility development, especially for soccer, golf, and tennis, has boosted demand for turf protection. These venues require durable and well-maintained grass that can endure high traffic and frequent use. Golf courses, for example, cover nearly 2 million acres in the U.S. alone, demanding significant investment in turf care. Increasing attendance at sporting events (up by 15% globally over the last five years) has led facilities to adopt advanced protection products, such as pest and disease control, to ensure fields stay resilient and safe for players.

Environmental Awareness and Sustainability Trends

As environmental concerns rise, there is increasing pressure to adopt sustainable turf care practices. Research shows that nearly 65% of consumers prefer eco-friendly lawn products, with institutions and local governments following suit to minimize chemical use. Many regulatory bodies have placed restrictions on synthetic pesticides, with over 30 U.S. states implementing policies to reduce chemical exposure in public spaces. This shift is driving growth in bio-based turf protection solutions, which are seen as safer and more sustainable. For instance, biopesticides reduce harmful runoff by 30%, which aligns with the market’s push toward environmentally friendly products.

MARKET RESTRAINTS

Stringent Regulatory Restrictions

Regulatory bodies worldwide are tightening controls on chemical pesticides and synthetic fertilizers due to their environmental impact. The European Union, for example, has banned over 100 pesticides to reduce soil and water contamination, impacting product availability in the turf protection market. In the U.S., the Environmental Protection Agency (EPA) has implemented stricter regulations, limiting synthetic pesticide applications in public spaces. These regulations can significantly increase compliance costs for companies while also limiting the types of products available to turf managers, restraining market growth.

High Cost of Bio-Based Products

Eco-friendly alternatives, such as biopesticides and organic fertilizers, often come with a premium price tag, making them less accessible to budget-sensitive segments. Bio-based turf protection products can cost up to 30-40% more than synthetic options, creating a barrier to widespread adoption, especially among smaller landscaping businesses and residential consumers. Although the demand for sustainable solutions is growing, the higher cost limits immediate market expansion as users seek cost-effective options for large-scale applications like sports facilities and public parks.

Climate Variability and Seasonal Dependency

Turf and ornamental grass protection is highly dependent on seasonal cycles, with demand peaking in warmer months. Climate variability, such as unpredictable weather and extended droughts, affects turf growth and reduces the need for protective treatments. For instance, prolonged drought conditions in regions like California have led to reduced water use and curbing turf maintenance activities. Additionally, extreme temperatures can hinder the efficacy of certain pesticides and fertilizers, forcing market players to adapt products to fluctuating climates, which poses operational challenges and may restrain growth in some regions.

MARKET OPPORTUNITIES

Expansion of Eco-Friendly and Organic Products

Growing environmental awareness is creating opportunities for bio-based, organic turf protection products. According to studies, 65% of consumers are willing to pay more for sustainable options, driving demand for eco-friendly pesticides and fertilizers. In response, companies are investing in research to develop high-performance bio-pesticides and plant-based fertilizers. These products are especially attractive in regions with strict pesticide regulations, like Europe and parts of North America. This trend allows companies to capture an emerging market segment and meet sustainability goals, positioning themselves as leaders in environmentally conscious turf protection solutions.

Adoption of Precision Turf Management Technology

Advances in technology, such as GPS-guided sprayers and soil sensors, are creating new opportunities in precision turf management. These tools allow groundskeepers to apply fertilizers and pesticides with greater accuracy, reducing waste by up to 20% and lowering costs. According to industry data, precision technology adoption in turf management has grown by 12% annually. This approach not only appeals to budget-conscious facilities but also aligns with environmental goals by minimizing chemical runoff. Companies offering compatible products or integrated solutions can capitalize on this tech-driven demand for efficient, sustainable turf care.

Growing Demand in Emerging Markets

Rapid urbanization and economic growth in emerging markets, especially in Asia and Latin America, are boosting demand for landscaping and green space maintenance. Cities in China, India, and Brazil are increasingly investing in parks, golf courses, and sports fields to enhance urban living. For example, China has initiated programs to expand urban green spaces, with new parks growing by over 5% annually in major cities. These developments create opportunities for companies to introduce turf protection products tailored to regional needs, including cost-effective, eco-friendly options that suit these markets’ growing landscaping sectors.

MARKET CHALLENGES

Compliance with Regulatory Standards

Navigating diverse and increasingly strict regulatory standards worldwide poses a major challenge. In Europe, for example, regulations like the EU’s Sustainable Use Directive limit pesticide types and application frequency, affecting product availability. Similarly, the U.S. EPA has placed strict guidelines on synthetic pesticides for public spaces, impacting both product design and market entry. Regulatory variations across countries increase compliance costs and complicate product formulations for companies looking to operate globally. For turf protection manufacturers, consistently meeting these standards requires significant investment in research and development, testing, and frequent product reformulation.

Rising Raw Material Costs

The turf and ornamental grass protection market relies on various raw materials, including chemicals and organic compounds, which have seen price volatility in recent years. For example, fertilizer prices rose by nearly 30% in 2021 due to supply chain disruptions and increased demand. Such price hikes elevate production costs for manufacturers and can lead to higher product prices for consumers, limiting the purchasing power of cost-sensitive buyers, especially small landscaping firms. This challenge affects profit margins and can reduce the appeal of advanced or sustainable products, impacting overall market growth.

Limited Awareness and Adoption of Sustainable Products

While sustainable products are gaining traction, there remains limited awareness and slower adoption rates in certain regions and market segments. A 2022 survey found that only 40% of small to medium landscaping firms had switched to eco-friendly products, citing lack of knowledge, cost concerns, and skepticism about efficacy. For example, emerging markets and budget-conscious sectors may prioritize low-cost, traditional products over sustainable alternatives. To overcome this, companies need to invest in educational campaigns and demonstrate the long-term value of eco-friendly solutions, which requires resources and time to change purchasing behavior at a large scale.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.61% |

|

Segments Covered |

By Type, Product and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Adama Agricultural Solutions LTD, American Vanguard Corporation, AMVAC Chemical Corporation, Arysta Lifescience, Bayer CropScience AG, Bio-works Inc, Cheminova A/S, Chemtura agro solutions, DuPont, FMC Corporation, Syngenta International AG, and Valent Biosciences Corp. |

SEGMENTAL ANALYSIS

By Type Insights

The turf segment had 60.4% of the global market share in 2023. This dominance is due to high demand from sports facilities, public parks, and commercial landscaping, where turf must be resilient, aesthetically pleasing, and safe for heavy use. Golf courses alone cover over 16,000 square miles globally and require extensive turf care, making them significant consumers of herbicides, fungicides, and other protection products. High maintenance requirements, frequent treatment schedules, and investments in turf durability drive this segment’s leading role, as well-maintained turf directly enhances user experience and environmental aesthetics.

However, the ornamental grass segment is anticipated to grow at the fastest CAGR of 8.5% over the forecast period. This rapid growth is driven by rising landscaping demand in urban developments, private gardens, and corporate environments, where ornamental grasses are valued for their aesthetic appeal and low-maintenance requirements. As green space expansion increases worldwide, ornamental grasses are popular due to their drought tolerance and environmental benefits, including erosion control. Rising interest in eco-friendly landscaping has boosted demand for sustainable biopesticides and fertilizers in this segment, further accelerating its growth.

By Product Insights

The synthetic pesticides segment was the largest segment in the turf and ornamental grass protection market and accounted for 65.6% of the global market share in 2023. This dominance is attributed to their effectiveness in providing quick, broad-spectrum control over pests and diseases, which is crucial for high-traffic applications like sports fields and public parks. Despite rising regulatory constraints, synthetic pesticides remain popular due to their reliability and cost-effectiveness in large-scale applications. For example, conventional herbicides have been shown to reduce weed presence by over 80%, which is vital for maintaining the health and appearance of turf in high-visibility areas.

On the other hand, the bio-pesticides segment is predicted to be the fastest-growing segment and register a CAGR of 9.12% over the forecast period. This rapid growth is driven by increasing environmental awareness and stricter regulations on synthetic chemicals, which push consumers and businesses toward sustainable alternatives. Bio-pesticides are attractive due to their reduced environmental impact and compatibility with integrated pest management (IPM) practices, as they minimize chemical residues and improve soil health. Rising adoption in North America and Europe, where demand for organic landscaping solutions is strong, underscores the significance of bio-pesticides in driving sustainable practices within the turf and ornamental grass protection market.

REGIONAL ANALYSIS

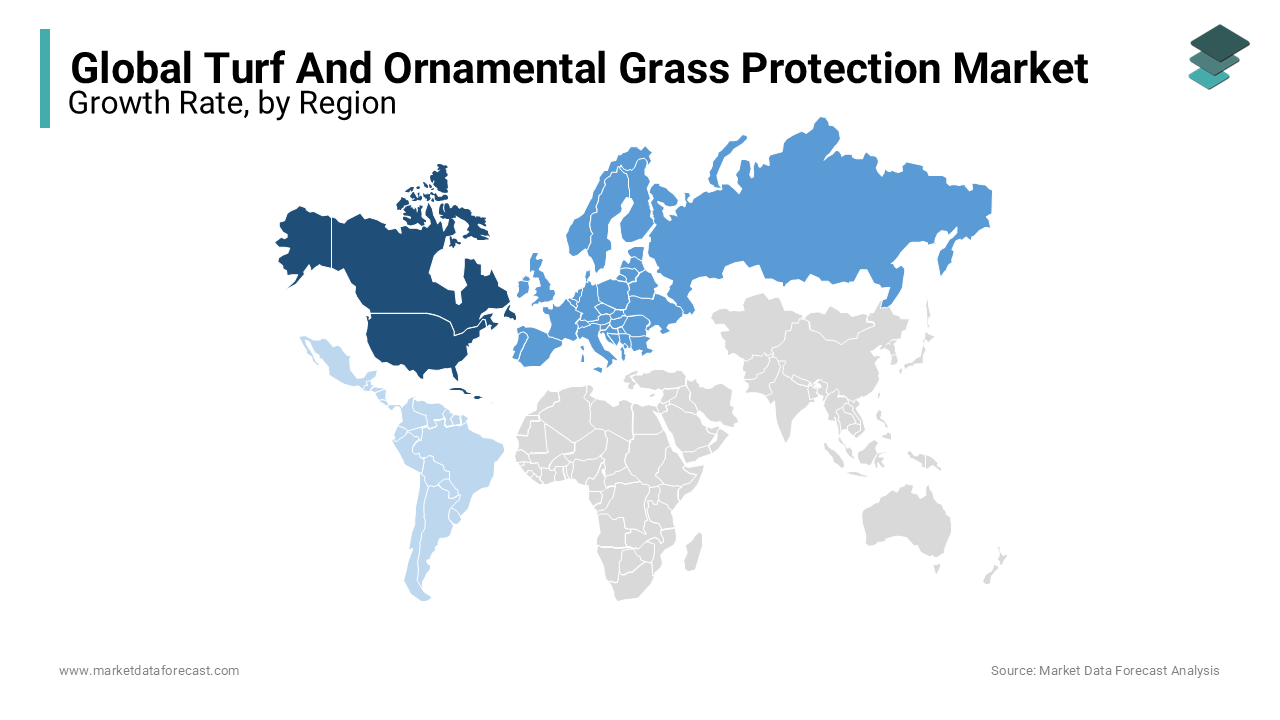

North America was the leading regional segment in the global turf and ornamental grass protection market and captured 36.2% of the global market share in 2023. The market growth in North America is primarily driven by high investment in residential landscaping, sports facilities, and public parks. The U.S. dominates the market in North America, followed by Canada, where landscaping trends are strong. Strict regulations are pushing the industry toward eco-friendly solutions, with bio-pesticides becoming increasingly popular.

Europe held a notable share of the global market in 2023 and is predicted to progress at a healthy CAGR over the forecast period. The stringent environmental regulations that encourage the use of sustainable turf protection products is promoting the European market growth. Leading countries such as Germany, France, and the U.K. are focused on adopting eco-friendly practices, which is likely to boost the market growth in Europe further. The commitment of Europe to environmental standards makes it a leader in sustainable turf care, though cost challenges remain as regulations tighten.

Asia-Pacific is the fastest-growing region and is projected to showcase a CAGR of 8.5% over the forecast period. This growth is fueled by rapid urbanization and increasing investments in landscaping across countries like China, Japan, and India. The region's rising disposable income and awareness of green spaces have bolstered demand for turf protection, with China seeing significant expansion in urban landscaping and green spaces.

Latin America holds a smaller share of the global market but continues to grow at a steady CAGR over the forecast period. Interest in sports, particularly soccer, and a strong tourism sector in countries like Brazil and Mexico drive demand for turf care products. However, economic factors limit the region's ability to adopt more costly bio-pesticide solutions widely.

The market in the Middle East and Africa is predicted to experience a moderate CAGR over the forecast period. The region's demand is concentrated in urban landscaping and tourism projects, particularly in the Gulf countries like the UAE and Saudi Arabia. Although water scarcity presents challenges, high-profile landscaping developments and smart-city initiatives are creating opportunities for turf protection solutions, especially those focused on efficiency and sustainability.

KEY MARKET PLAYERS

The main companies that are prominent in the market for turf and ornamental grass protection market are Adama Agricultural Solutions LTD, American Vanguard Corporation, AMVAC Chemical Corporation, Arysta Lifescience, Bayer CropScience AG, Bio-works Inc, Cheminova A/S, Chemtura Agro Solutions, DuPont, FMC Corporation, Syngenta International AG and Valent Biosciences Corp.

MARKET SEGMENTATION

This research report on the global turf and ornamental grass protection market is segmented and sub-segmented by type, product, and region.

By Type

- Turf

- Ornamental

By Product

- Synthetic Pesticides

- Synthetic Herbicides

- Synthetic Insecticides

- Synthetic Fungicides

- Other Synthetic Pesticides

- Bio-pesticides

- Bio-herbicides

- Bio-insecticides

- Bio-fungicides

- Other Bio-pesticides

- Other crop protection products.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global turf and ornamental grass protection market?

The current market size of the global turf and ornamental grass protection market was valued at USD 4986.37 Mn by 2025

What are the market drivers that are driving the global turf and ornamental grass protection market?

Urbanization and landscaping demand growth of the sports industry, and environmental awareness and sustainability trends are market driving in the global turf and ornamental grass protection market.

Based on region analysis which region is most dominated in the global turf and ornamental grass protection market?

North America was the leading regional segment in the global turf and ornamental grass protection market and captured 36.2% of the global market share in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com