Global Green Mining Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (Surface Mining and Underground Mining), Technology (Power Reduction, Fuel and Maintenance Reduction, Emission Reduction, Water Reduction and Others) & Region - Industry Forecast From 2024 to 2032

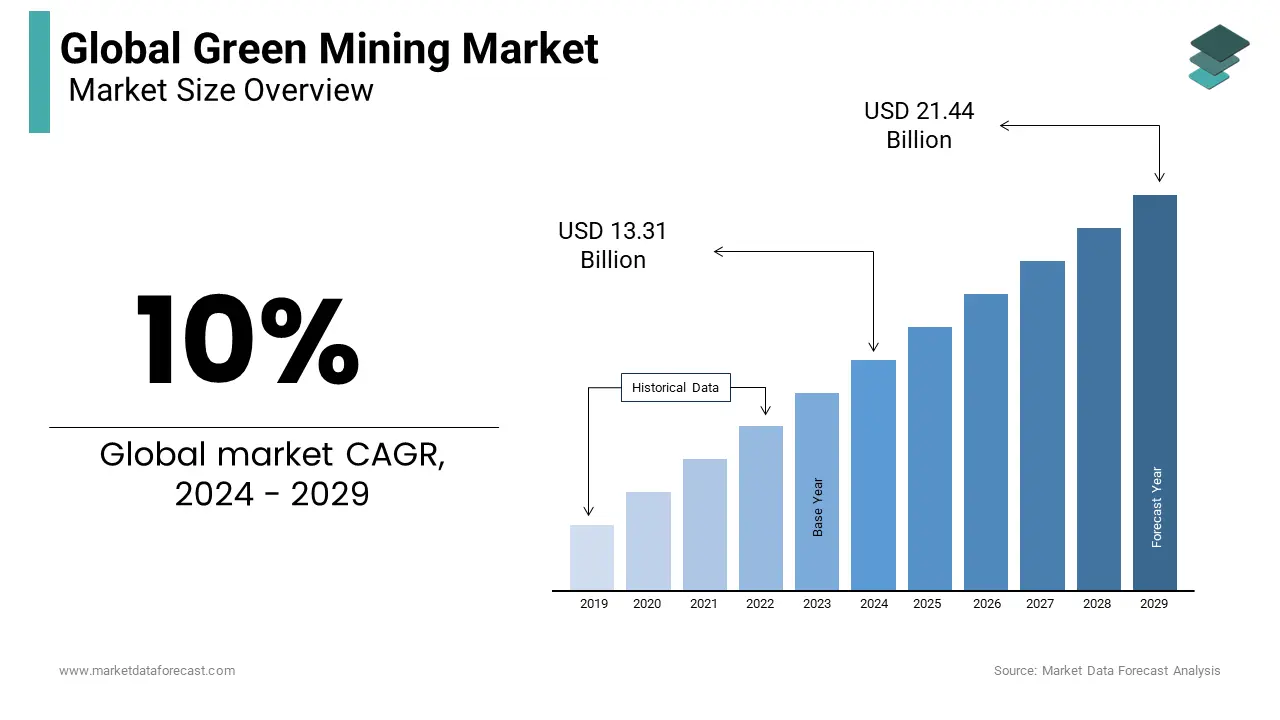

Global Green Mining Market Size (2024 to 2032)

The Global Green Mining Market was worth US$ 12.10 billion in 2023 and is anticipated to reach a valuation of US$ 28.53 billion by 2032 from US$ 13.31 billion in 2024. It is predicted to register a CAGR of 10% during the forecast period.

Current Scenario of the Global Green Mining Market

The green mining market is gaining traction due to growing legal and regulatory compliances and environmental awareness. The industry is continuously changing owing to the heightened energy demand and consumption, technological breakthroughs and social expectations. Throughout 2024, the trend of environmental, social and governance (ESG) will continue to prevail because of the rising focus on sustainability and responsible mining activities. The companies are mainly emphasizing water preservation, implementing community engagement initiatives, and reducing carbon emissions. They are also adopting unique green mining projects and efficient waste management and water programs. Currently, the supply chains in the mining industry are more decentralized. Considering the ongoing geopolitical issues, world trade policies and COVID-19 back then, its resilience is said to be the buzzword.

MARKET DRIVERS

The growing governmental funding, environmental degradation and regulatory requirements drive the green mining market growth.

For instance, in August 2023, the British government reported the formation of a partnership with Zambia over clean energy and critical and rare earth mineral supply valued at over 3.7 billion dollars or 2.91 billion euros. As part of the clean energy and green investment collaboration, the United Kingdom will target to infuse 3.1 billion dollars into the Zambian private sector for mining and renewable energy. An additional 600 million dollars will enter as the UK government-supported investment.

The year-on-year rise in consumption of minerals and metals by emerging countries like China, India and Brazil further contribute to the green mining market growth.

Thus, fuelling its exploration and production activities. In addition, there is increased lobbying for higher transparency, employing technologies such as blockchain to trace the origin of minerals and ensure ethical sourcing. Also, more mining players are predicted to deploy end-to-end supply management software which will furnish live data from acquisition to logistics. Further, the application of AI and machine learning in routine activities will improve different processes, like resource management, demand forecasting and production scheduling. Additionally, the surge in recognition of the role of mining in a circular economy by several governments worldwide also contributes to the market expansion. The path towards greater sustainability has started with implementing carbon pricing, ESG measures and the growth of biodiversity concerns.

MARKET RESTRAINTS

The requirement of substantial initial expenditure restricts the green mining market growth.

This is a major obstacle to the adoption of the latest green mining technologies. The problem gets bigger with the small project pipelines. Also, a large part of this rise in these costs will be incurred to achieve moderate growth. As the industry players switch to distant locations, the accessibility expenses for far-off resources and the development or procurement of autonomous vehicles are the other factors increasing the costs. Apart from this, clean energy equipment will need various machine usage and significant alterations to the infrastructure and facilities for the supply network. This leads to a broader range of machinery and further apparatus personalization. Therefore, the adoption of the latest technologies in mining activities is monetarily tough due to the large initial expenditure.

MARKET OPPORTUNITIES

The green mining market is expected to thrive in the future owing to the shift towards substitute fuel sources. Industry player are also searching for alternative energy sources, like solar and wind, to power their activities. Likewise, the electrical supply of mining machinery and vehicles is gaining traction, lowering reliance on fossil fuels. Decarbonization and storage technologies or upgraded depot infrastructure are in their early stages, but they possess a huge opportunity for carbon-free mining activities in the coming years. Another promising field holding immense potential is the health and safety. The integration of advanced protection technologies will greatly improve the market’s attractiveness, reduce likely hazards, and ensure business continuity. This involves collision avoidance systems, drones, wearable sensors, etc., to monitor and mitigate security concerns in real-time.

MARKET CHALLENGES

Policy gaps, decreasing ore grades, illegal operations and their ecological impact are part of the major challenges faced by the green mining market. The achievement of the world’s 2050 emission-reduction goals seems blurry as of now due to insufficient financial support, low production capacity and regulatory problems. Besides the US Inflation Reduction Act in 2022, the Net-Zero Industry Act by the European Union, and the 270-billion-dollar commitment for the Green Deal Industrial Plan by the European Commission, very few economies have taken notable measures to achieve this target, which ultimately boosts the market growth rate. Moreover, unauthorized mining activities are behind the loss of rainforests and mineral-rich soil for cultivation. This is another factor derailing the market growth trajectory and can be because of the profit-making opportunities from unregulated gold extraction and related activities in several parts of the world.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Technology, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anglo American PLC, Liebherr, Jiangxi Copper Corporation Limited, Glencore PLC, Rio Tinto Group, BHP Billiton, Dundee Precious Metals, Tata Steel Limited, VALE S.A., Boliden and Wheaton Precious Metals, Newmont, Barrick, Fortescue Metals Group, Antofagasta, and Others. |

SEGMENT ANALYSIS

Global Green Mining Market Analysis By Type

The surface mining segment is predicted to drive at a higher CAGR during the forecast period for the green mining market. This is due to its cost-effectiveness, high production rate, safety and easier implementation of technologies for environmental protection. Its productivity and affordability are mainly because of simpler logistics and the capability to rapidly extract bigger amounts of material. In addition, the significant portion of open-pit mines influenced to mass manufacturing of machinery for this. Additionally, the integration of artificial intelligence and machine learning presents a lucrative opportunity for boosting the segment’s market size. Also, several automation players are developing the Internet of Things (IoT)-based devices and equipment to link different mining sites with one another.

Global Green Mining Market Analysis By Technology

The power reduction segment is quickly gaining popularity and is anticipated to propel further during the estimation period for the green mining market. It focuses on energy conservation by utilizing modern machinery, like electric vehicles and environmentally friendly equipment. Sustainable energy sources such as solar and wind power are also being incorporated into mining activities to lower dependence on traditional ones, i.e., fossil fuels. Moreover, power-consuming methods, for example, Comminution, which is the procedure of decreasing solid matter from average to smaller material size by pressing, grinding, cutting, vibrating, or other similar processes. It is a high-powered procedure that includes both pressing and grinding. Owing to mines hardly having control over fuel prices, the comminution operation must meet the demands while utilizing as low power as possible.

REGIONAL ANALYSIS

Europe is likely to account for a substantial share of the global market in 2023.

Europe is likely to move forward significantly during the forecast period. The growth of the European market is primarily driven by the increased adoption of sustainable and ecologically friendly practices in nations like the United Kingdom, France, Russia, Germany and the rest of Europe. The continent has emerged as the biggest customer and advocate of green mining methods. According to a study, the European Union uses 25% to 30% of total metals produced worldwide despite accounting for only 6% of the global population. Also, the EU’s demand for metal is believed to rise at a slower pace, with non-metallic minerals expanding quickly. Moreover, the objective to safeguard the environment using technological developments is believed to propel the green mining market in Europe. However, the EU only considers metal ore for metal footprint measurement yet overall material extracted, involving waste rock, is substantially higher, especially in open-pit mines.

North America is expected to showcase promising growth during the forecast period.

North America holds abundant mineral reserves with several resources found across the region. Of which important ones are copper, lead, gold, iron ore, zinc and a large number of industrial minerals. Also, considering their significance for driving sustainable development in applications like electric vehicles, batteries, etc, the North America green mining market is anticipated to witness tremendous growth in the coming years. Moreover, the authorization of the Fiscal Responsibility Act in June 2023, with other elements, formulated a “lead agency” body to administer different federal organizations also engaged in allowing or approving a new mine. This is expected to improve the regulatory landscape for the market players. On the other hand, Canada is dominating regionally as well as globally in terms of environmental, social, and governance (ESG) standards for this industry, with approximately 50 percent of the total openly registered worldwide mining and mineral search players present in the country.

Asia Pacific is propelling at a rapid pace in the green mining market.

The swift urbanization and industrialization are primarily contributing to the green mining market growth in the Asia-Pacific market. In addition, the expanding APAC possesses substantial resources essential to a green energy future. For instance, the Philippines and Indonesia are known to have 27 per cent of world nickel reserves and Mongolia is predicted to hold uncommon earth components equal to 17 per cent of global deposits.

KEY PLAYERS IN THE GLOBAL GREEN MINING MARKET

Companies playing a prominent role in the global green mining market include Anglo American PLC, Liebherr, Jiangxi Copper Corporation Limited, Glencore PLC, Rio Tinto Group, BHP Billiton, Dundee Precious Metals, Tata Steel Limited, VALE S.A., Boliden and Wheaton Precious Metals, Newmont, Barrick, Fortescue Metals Group, Antofagasta, and Others.

RECENT HAPPENINGS IN THE GLOBAL GREEN MINING MARKET

- In January 2024, GMDC, a government-owned establishment, announced it received the permit to broaden the Gujrat-based Surkha lignite mine capacity with environmental clearance from the Ministry of Environment, Forest and Climate Change of India.

DETAILED SEGMENTATION OF THE GLOBAL GREEN MINING MARKET INCLUDED IN THIS REPORT

This research report on the global green mining market has been segmented and sub-segmented based on type, technology, and region.

By Type

- Surface Mining

- Underground Mining

By Technology

- Power Reduction

- Comminution Efficiency

- Utilizing Pre-concentration and Sorting

- Hydrometallurgical Processes

- Fuel and Maintenance Reduction

- Fuel Additives

- Fuel optimization

- Training Simulators

- Route Optimization

- Natural Gas Conversion

- Emission Reduction

- Decarbonization

- Dust Management

- Carbon Sequestration

- Carbon Capture Storage Technology

- Electrification in Mining

- Water Reduction

- Desalination

- Removal of Heavy Metals

- AMD Remediation

- Tailing Remediation

- Wastewater Processing

- Others

- Mine Closure

- Soil Remediation

- Bioremediation

- Interior Bioleaching

- In Situ Leaching

- Liquid Membrane Emulsion Technology

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary factors driving the growth of the green mining market?

Key drivers include the rising awareness about environmental sustainability, governmental regulations promoting eco-friendly practices, the need to reduce carbon emissions, and advancements in mining technologies that enable energy efficiency and waste reduction.

What are the most common technologies used in green mining?

Common technologies include water management systems, dust suppression systems, remote monitoring and control systems, renewable energy solutions (solar and wind), and advanced material recycling techniques. These technologies help in reducing environmental impact and improving operational efficiency.

How are governments supporting the adoption of green mining practices?

Governments globally are introducing policies and subsidies to encourage green mining practices. Examples include carbon credit schemes, grants for adopting renewable energy technologies, and strict enforcement of environmental impact assessments. Some regions also mandate the use of green technologies in mining operations.

What is the future outlook for the green mining market?

The green mining market is expected to witness robust growth as industries worldwide prioritize sustainability. Technological advancements, rising demand for minerals in clean energy sectors, and increasing pressure to achieve net-zero emissions will drive significant innovation and investment in green mining practices globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com