Global Healthcare Staffing Market Size, Share, Trends & Growth Forecast Report By Services Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Healthcare Staffing Market Size

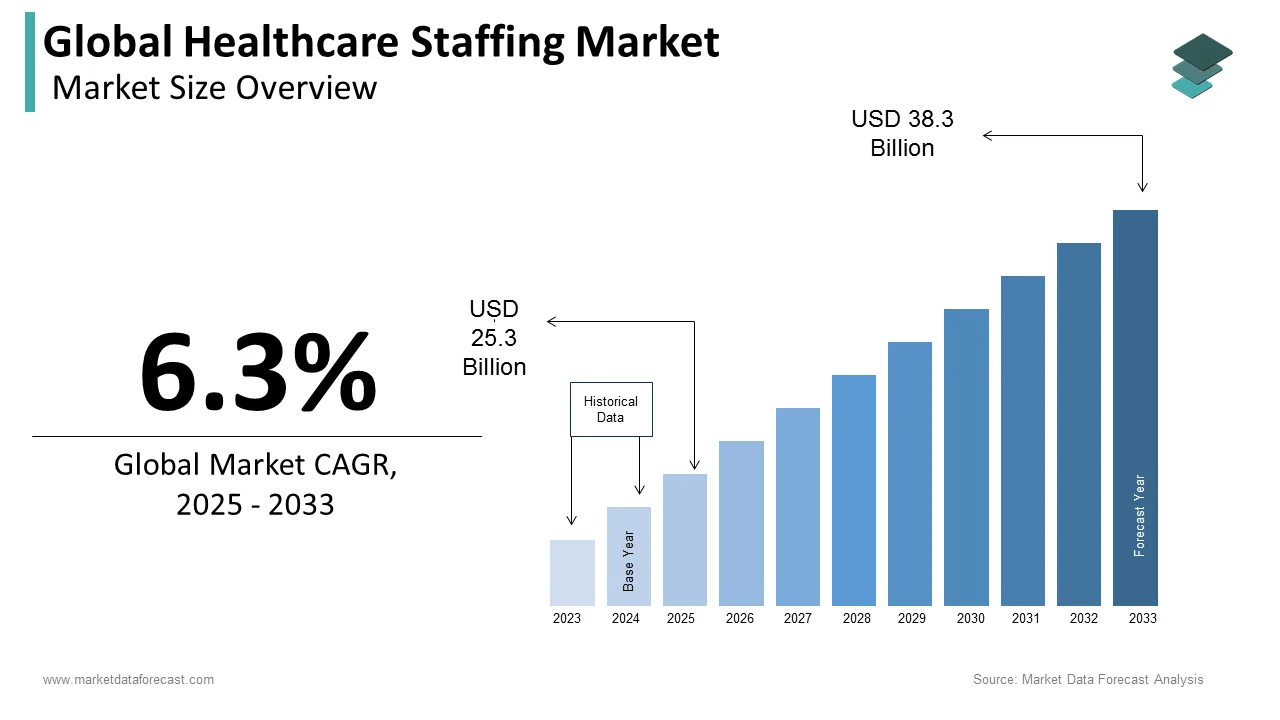

The global healthcare staffing market was worth US$ 37.21 billion in 2024 and is anticipated to reach a valuation of US$ 64.16 billion by 2033 from US$ 39.53 billion in 2025, and it is predicted to register a CAGR of 6.24% during the forecast period 2025-2033.

Healthcare staffing refers to a company, person, partnership, organization, or other business entity that provides temporary nursing services to healthcare agencies or individuals. Recruiting healthcare personnel is a lengthy process in and of itself. As a result, these healthcare facilities contact healthcare staffing companies to find the experts they need. Several agencies provide healthcare professionals, such as nurses and therapists, to healthcare organizations, such as hospitals or nursing home facilities. Healthcare providers can concentrate on other things with the help of these healthcare staffing firms. Hospitals, home care providers, nursing homes, clinics, physician practices, government agencies, pharmacy firms, colleges, and healthcare tech firms also use healthcare staffing services.

MARKET DRIVERS

The shortage of healthcare workers majorly drives the global healthcare staffing market growth.

A shortage of healthcare workers primarily drives the healthcare staffing sector. With the demand for high-quality healthcare, providers struggle to keep up with the increasing staff demand. Both caregivers and nurses are in short supply, and along with this medical lab staff and home healthcare, workers are also in short supply, affecting every part of the healthcare system. The World Health Organization (WHO) released the World's Nursing (SOWN) 2 studies in 2020, which reported a global shortage of 5.9 million nurses. According to the National Association of Locum Tenens Organizations, over 50,000 physicians (over 5% of all doctors) work locum tenens assignments each year, and 90% of US healthcare facilities employ locum tenens physicians every year. Also, according to the American Association of Medical Colleges (AAMC), a shortage of “between 42,600 and 121,300 clinicians by the end of the next decade” is expected by 2030. Similarly, the World Health Organization predicts an 18 million deficit in health workers by 2030, mostly in low- and lower-middle-income countries. As a result of this growing demand, the healthcare staffing market is expanding.

The patient satisfaction approach drives the healthcare staffing market even further.

Healthcare staffing is also driven by healthcare providers' increased focus on patient satisfaction. In hospitals and healthcare services, patient satisfaction is crucial. According to the HealthLeaders Media Industry Survey, patient satisfaction is among the top three priorities for over half of healthcare executives (54 %). Also, increased patient satisfaction is needed due to value-based reimbursements, changing patient-centered care models, and competition from other hospitals. The healthcare workforce largely determines these patient treatment experiences. Many studies have linked nurse-to-patient ratios and differences in nurse staffing and scheduling to patient satisfaction, implying that filling nursing staff positions quickly and with qualified applicants is critical. The efficacy of care also influences patient satisfaction. Patient satisfaction rises as doctors are knowledgeable in the field and function with empathy. In addition, highly pleased patients help to grow the company by referring others. With the advent of social media, hospitals can improve their reputation among current patients while also attracting new ones. As a result, hospitals must have the necessary personnel, increasing the healthcare staffing sector.

The rising demand for travel nurses would provide opportunities for the healthcare staffing sector to expand. Many hospitals are experiencing a shortage of nurse professionals; thus, travel nurses have become popular because they can work temporarily as needed. Similarly, as long as healthcare facilities and hospitals need personnel, travel nursing and other temporary work will remain popular. Travel nursing also has many advantages and incentives, including competitive pay, flexible scheduling opportunities, job experience, professional development, continuing education, and more. As a result, the travel nurse offers opportunities for advancement in the healthcare staffing sector in the near future.

MARKET RESTRAINTS

The shortage of skilled healthcare workers is the primary factor restraining the healthcare staffing market. Recruiting health workers is always challenging, particularly in rural and distant clinics. Most qualified and skilled professionals are migrating to urban areas due to the high pay scale, which is difficult in rural areas and hampering market growth. Various stringent regulations and rules in the healthcare industry, which demand the most significant number of healthcare workers, limit the market expansion. Another factor is minimal remuneration for healthcare workers, where many healthcare professionals feel underpaid, which is relevant to their time invested in the job and hinders the expansion of the healthcare staffing market. Even though various government acts are raising the pay scale, healthcare professionals are still satisfied, which may negatively impact the market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.24% |

|

Segments Covered |

By Service Type and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Adecco, AMN Healthcare, CHG Management, Syneos Health, TeamHealth (Blackstone), Accountable Healthcare Staffing, Aya Healthcare, InGenesis, Medical Solutions, Supplemental Health Care, EmCare, Almost Family, Cross Country Healthcare, Maxim Healthcare Services, Jackson Healthcare, Aureus Medical Group (C&A Industries), Favorite Healthcare Staffing, Healthcare Staffing Services, and Trustaff., and Others. |

SEGMENTAL ANALYSIS

By Service Type Insights

Based on Service Type, Allied Healthcare staffing had the greatest market share. As the global frequency of chronic diseases and healthcare issues rises, so does the demand for allied health services.

During the forecast period, however, locum tenens are predicted to increase at the fastest pace. Employer cost reductions and physicians’ preference for locum tenens work are two reasons driving category growth. According to a survey by Staff Care, an AMN Healthcare organization, the number of locum tenens physicians in the United States is steadily growing. Locum tenens providers are used by healthcare institutions across the United States, and over 50,000 physicians work on locum tenens projects each year. Over the forecast period, the market will likely rise due to a rising number of physicians opting to work as locum tenens.

On the other hand, the travel nurse staffing segment is expected to be lucrative during the forecast period. Hospitals are compelled to downsize their personnel in response to growing healthcare expenses; therefore, they turn to staff firms to ensure that nurses are accessible when demands grow.

REGIONAL ANALYSIS

Based on region, the global healthcare staffing market was controlled by North America, which had the greatest market share. This Regional market growth is fuelled by a shortage of skilled workers relative to demand, an increasing geriatric population, and the presence of important market competitors. Other factors projected to drive the growth of the healthcare staffing market in the area include well-developed healthcare infrastructure, favorable governmental regulations, and the availability of medical coverage on healthcare staffing. To increase their geographical reach and service offer, key players in this region are pursuing strategic initiatives such as mergers, acquisitions, and alliances. As a result, increasing market penetration is likely to boost regional market growth throughout the forecast period.

The Asia Pacific region has the largest market growth after North America. Rising demand for contract workforce, increased market investments, and a positive economic outlook are all factors contributing to this expansion. A rise in demand for contract employment in this region has been attributed to a number of advantages of contract staffing, including the absence of liabilities that are common with permanent hiring.

KEY MARKET PARTICIPANTS

Some of the notable companies operating in the global healthcare staffing market are Adecco, AMN Healthcare, CHG Management, Syneos Health, TeamHealth (Blackstone), Accountable Healthcare Staffing, Aya Healthcare, InGenesis, Medical Solutions, Supplemental Health Care, EmCare, Almost Family, Cross Country Healthcare, Maxim Healthcare Services, Jackson Healthcare, Aureus Medical Group (C&A Industries), Favorite Healthcare Staffing, Healthcare Staffing Services, and Trustaff.

These players focus on mergers, acquisitions, partnerships, and launch strategies.

RECENT MARKET DEVELOPMENTS

- 23 April 2021, GIFTED Healthcare has acquired Therapia Staffing, an award-winning healthcare staffing firm that offers per diem and travels nursing assignments across the United States. Medical and educational facility partners benefit from Therapia Staffing's contract nursing and related staffing, as well as permanent hire assistance.

- On 27 October 2020, Emerald Health Services, an Epic Staffing Group organization specializing in travel nursing and allied healthcare staffing, has collaborated with WorkLLama to create the Emerald EngageTM referral app for nurse and allied healthcare staffing. Emerald Health's traveling nurses and allied physicians (Travelers) may use the smartphone app to find and apply for positions, make recommendations, and access tools to help them enhance their travel experiences.

MARKET SEGMENTATION

This research report on the global healthcare staffing market has been segmented and sub-segmented based on service type and region.

By Service Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Allied Healthcare Staffing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the value of the healthcare staffing market in 2024?

The global healthcare staffing market was valued at USD 39.53 billion in 2024.

Which region held the major share of the worldwide healthcare staffing market in 2024?

The North American region occupied the major share of the global market in 2024.

Who are the major players in the healthcare staffing market?

Adecco, AMN Healthcare, CHG Management, Syneos Health, TeamHealth (Blackstone), Accountable Healthcare Staffing, Aya Healthcare, InGenesis, Medical Solutions, Supplemental Health Care, EmCare, Almost Family, Cross Country Healthcare, Maxim Healthcare Services, Jackson Healthcare, Aureus Medical Group (C&A Industries), Favorite Healthcare Staffing, Healthcare Staffing Services, and Trustaff are some of the major companies in the healthcare staffing market.

Which segment by service type held the significant share in the healthcare staffing market?

Based on service type, the allied healthcare staffing segment held the major share of the global healthcare staffing market in 2023.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com