Global Hernia Mesh Devices Market Size, Share, Trends & Growth Forecast Report By Hernia Type, Product Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Hernia Mesh Devices Market Size

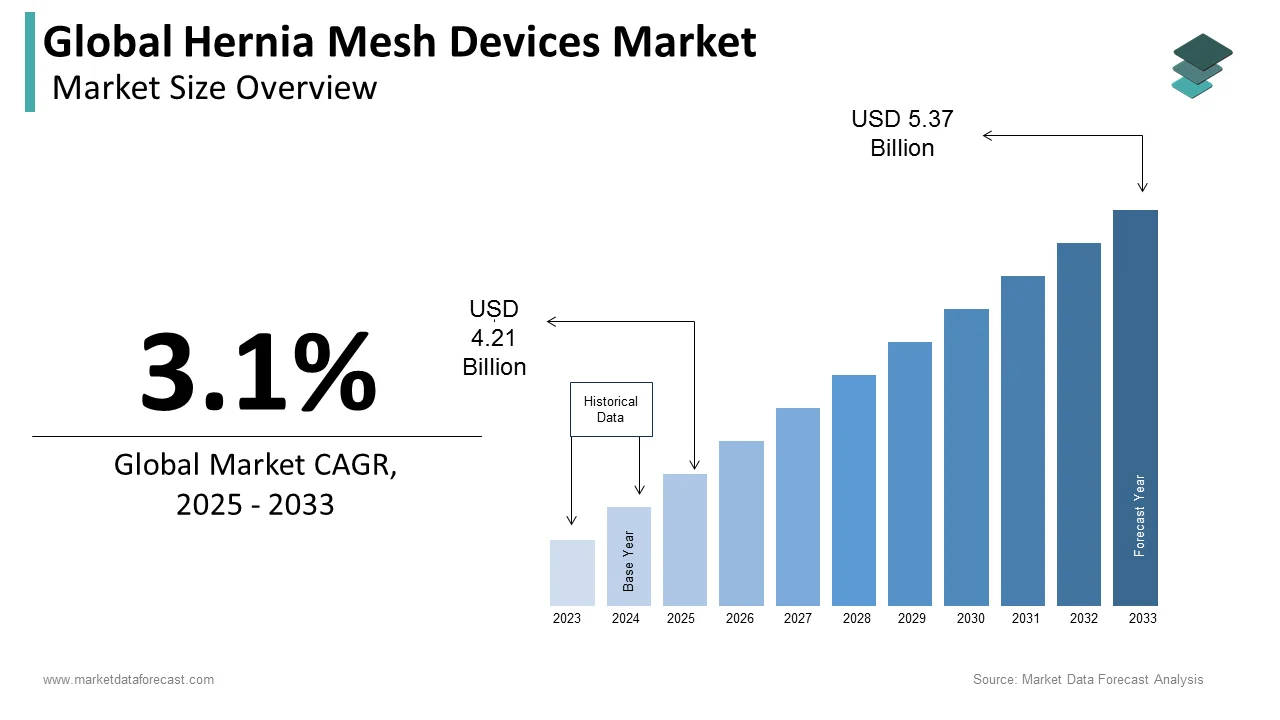

The size of the global hernia mesh devices market was worth USD 4.08 billion in 2024. The global market is anticipated to grow at a CAGR of 3.1% from 2025 to 2033 and be worth USD 5.37 billion by 2033 from USD 4.21 billion in 2025.

Hernia treatment includes terminating the weak spot present in the muscle through which the intestinal content is distended. Presently, two treatment options exist-hernia repair surgeries using sutures and hernia repair surgeries using mesh. Mending a hernia through surgery using mesh does not stress tissues or muscles; the mesh bridges the gap in the muscle/hernia orifice with a few stitches or staples. Using mesh also helps alleviate pain and reduces the chances of recurrence. Many types of mesh products are available on the market, but surgeons typically use a sterile, woven material made from synthetic plastic-like material, such as polypropylene. The mesh can be in the form of a patch that goes under or over the weakness, or it can be in the form of a plug that goes inside the hole. Mesh is very sturdy and strong, yet extremely thin.

MARKET DRIVERS

The growing global incidence of hernias primarily drives the growth of the hernia mesh devices market. The incidence of hernias, including inguinal, ventral, and incisional hernias, is on the rise worldwide.

According to HealthGrove, the mortality rate of hernia per 100,000 people is 0.5, and every year, the healthy life lost is 14.7. The growing aging population, increasing prevalence of obesity, rapid adoption of sedentary lifestyles, weak muscles and genetic predisposition major result in the diagnosis of hernias. The awareness among people regarding the hernias has improved notably in recent years and this trend is predicted to continue in the coming years and drive the market growth.

Technological advancements further promote market growth. Hernia mesh devices have experienced several technological improvements in recent years, including the development of lightweight and biocompatible materials, improved fixation techniques, and enhanced mesh designs. These technological advancements further resulted in better surgical outcomes and increased adoption of mesh devices. The shift towards minimally invasive surgical procedures, such as laparoscopic and robotic-assisted surgeries contributes to the market growth. The growing aging population worldwide favors the hernia mesh devices market growth. WHO says the population of 60 years and above will reach 2.1 billion by 2050. People who are aged are more likely to develop hernias. Likewise, the growing aging population is estimated to contribute to the rising incidence of hernias and boost the demand for hernia mesh devices.

The growing awareness about the benefits of surgical repair for hernias and rising preference from patients for hernia mesh repair due to the potential for less post-operative pain, reduced risk of hernia recurrence, and faster recovery compared to non-mesh repairs fuel the growth rate of the market. The improvement in healthcare infrastructure, particularly in emerging economies, the long-term cost benefits associated with the use of mesh devices, increasing support from regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) and continuous investments in R&D by hernia mesh device manufacturers support the market growth.

MARKET RESTRAINTS

However, factors such as inadequate reimbursement policies among the improving countries and product recall obstruct market growth. High costs associated with the surgeries and insufficient equipment and infrastructural services among developing countries are further expected to hinder the market demand. Moreover, the scarcity of trained and experienced professionals required during surgery also hampers the global market growth. Additionally, establishing and executing hernia procedures in ambulatory surgery regularly exhibit challenges to the surgeons and the patient. The difficulties and threats concerned with hernia repair surgery and mesh are significant challenges to the global hernia mesh devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Hernia Type, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic (U.S.), Ethicon, Inc. (U.S.), C.R. Bard, Inc. (U.S.), Atrium (Sweden), W.L. Gore & Associates (Germany), Lifecell Corporation (U.S.), and B. Braun Melsungen AG (Germany). |

SEGMENTAL ANALYSIS

By Hernia Type Insights

Based on hernia type, the inguinal segment is predicted to dominate the global hernia mesh devices market during the forecast period. High prevalence of inguinal hernias, the growing aging population and weakened abdominal muscles, the increasing incidence of groin hernias in men, rising awareness and early diagnosis and an increasing number of advancements in surgical techniques and mesh materials for inguinal hernia repair drive the segmental growth.

The umbilical segment is to register healthy growth during the forecast period. The growing incidence of umbilical hernias particularly in infants and overweight individuals, the rising prevalence of the obesity epidemic and weakened abdominal muscles, increasing awareness and diagnosis of umbilical hernias and growing demand for minimally invasive surgical options for umbilical hernia repair propel the growth of the umbilical segment.

The femoral segment is anticipated to account for a considerable share of the global market during the forecast period. The rising incidence of femoral hernias especially in women, genetic predisposition and weakened groin muscles, increasing aging population and elevated intra-abdominal pressure primarily drive the segmental growth. The rising awareness and improved diagnosis of femoral hernias and growing demand for effective surgical options for femoral hernia repair fuel the growth rate of the segment.

By Product Type Insights

Based on product type, the synthetic mesh segment is predicted to dominate the hernia mesh devices market during the forecast period. Synthetic mesh is the widely used and well-established mesh option for hernia repair, which is one of the key factors propelling segmental growth. The cost-effectiveness and availability of a variety of synthetic mesh materials further fuel the growth rate of the segment. Technological advancements in mesh design and manufacturing, high tensile strength and durability of synthetic mesh and the surge in demand for minimally invasive procedures utilizing synthetic mesh contribute to the segmental growth.

The biologic mesh segment is foreseen with a healthy growth rate during the forecast period. The rising demand for biologically derived and bioresorbable materials in hernia repair, reduced risk of long-term complications associated with synthetic mesh, enhanced tissue integration and reduced inflammation with biologic mesh, increasing preference for biologic mesh by surgeons in complex or contaminated hernia repairs and rising focus on patient-centered care and personalized treatment options drive the growth of biologic mesh segment.

REGIONAL ANALYSIS

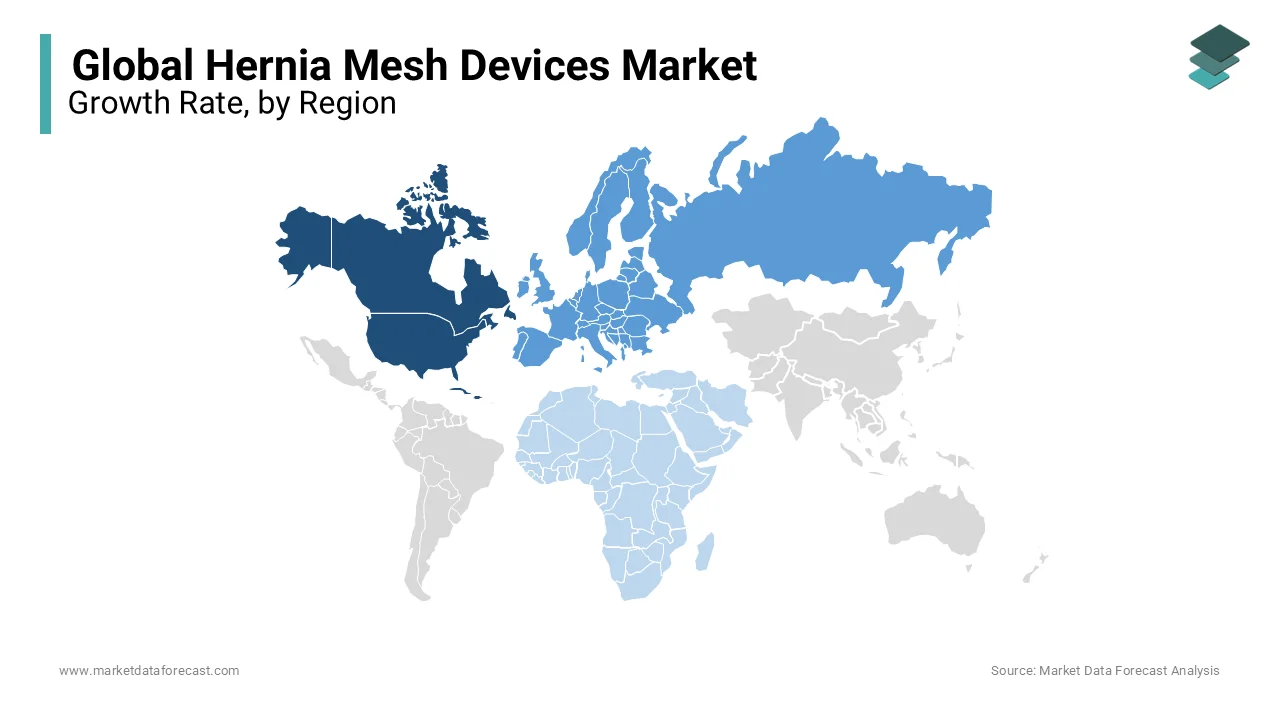

North America is predicted to continue its domination in the global market during the forecast period.

Factors such as the growing prevalence of hernias, the increasing aging population, technological advancements in hernia mesh devices, high healthcare expenditure and the presence of advanced healthcare infrastructure in North America primarily drive the growth of the North American hernia mesh devices market. The presence of favorable reimbursement policies for hernia repair procedures, rapid adoption of minimally invasive surgeries, and strong presence of key market players further fuel the growth rate of the North American market. The U.S. accounted for the major share of the North American market in 2024 and is estimated to grow at a healthy CAGR during the forecast period owing to the growing prevalence of hernias and an increasing number of hernia repairs. As per the data published by CDC, an estimated 5 million people in the U.S. undergo hernia repairs each year.

Europe had a substantial share of the global market in 2024. The European market is predicted to witness a notable CAGR during the forecast period. The growing incidence of hernias, increasing geriatric population, rising number of advancements in surgical techniques and hernia mesh materials and the growing number of initiatives from the European governments to improve healthcare infrastructure primarily drive the European hernia mesh devices market growth. The European Hernia Society says an estimated 20 million hernia repair surgeries are being performed each year in Europe. The rising awareness about hernia prevention and treatment, favorable reimbursement policies for hernia surgeries and the presence of established medical device manufacturers further contribute to the growth rate of the European market. Germany and the UK accounted for the major share of the global market in 2024.

APAC is the most lucrative regional market for hernia mesh devices and is anticipated to register the fastest CAGR during the forecast period. Factors such as the rapidly growing population, increasing healthcare spending and surge in the prevalence of hernias due to lifestyle changes and obesity majorly drive the APAC hernia mesh devices market growth. The growing number of improvements in healthcare infrastructure and access to surgical interventions, technological advancements in hernia repair techniques and growing awareness about the benefits of hernia mesh devices further propel the growth of the APAC market. China followed by India led the hernia mesh devices market in the Asia-Pacific region in 2024.

Latin America is predicted to account for a considerable share of the global market in 2024 and is estimated to register a healthy CAGR during the forecast period. The rising prevalence of hernias, particularly inguinal hernias, growing healthcare infrastructure and access to surgical treatments boost the Latin American hernia mesh devices market growth. The growing obesity rates and sedentary lifestyles contributing to hernia incidence, technological advancements and adoption of minimally invasive procedures further propel the Latin American market growth. Brazil followed by Mexico dominated the market in Latin America in 2024.

The MEA hernia mesh devices market had a moderate share of the global market in 2024 and is estimated to grow at a steady CAGR during the forecast period.

KEY MARKET PLAYERS

Companies playing a prominent role in the global hernia mesh devices market include Medtronic (U.S.), Ethicon, Inc. (U.S.), C.R. Bard, Inc. (U.S.), Atrium (Sweden), W.L. Gore & Associates (Germany), Lifecell Corporation (U.S.), and B. Braun Melsungen AG (Germany).

RECENT HAPPENINGS IN MARKET

- In October 2019, Exogenesis won FDA 510(K) clearance for its hernia mesh implant for its soft tissue repair in abdominal wall hernia and deficiencies.

MARKET SEGMENTATION

This research report on the global hernia mesh devices market has been segmented and sub-segmented based on the hernia type, product type, and region.

By Hernia Type

- Inguinal

- Umbilical

- Hiatal

- Femoral

- Incisional

By Product Type

- Synthetic Mesh

- Flat Mesh

- 3D Mesh

- Biologic Mesh

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the hernia mesh devices market?

The growth of the hernia mesh devices market is driven by factors such as the increasing prevalence of hernia, the rising adoption of minimally invasive procedures, and the development of advanced mesh materials.

Which region had the major share of the hernia mesh devices market?

North America occupied the largest share of the hernia mesh devices market, owing to the high prevalence of hernia in the region, increasing healthcare expenditure, and the presence of major players in the region.

What are the key players operating in the hernia mesh devices market?

Medtronic plc, B. Braun Melsungen AG, C.R. Bard, Inc., Johnson & Johnson, Cook Medical Inc., W.L. Gore & Associates, Inc., Integra LifeSciences Corporation, and Atrium Medical Corporation are the major players in the hernia mesh devices market.

What are the challenges faced by the hernia mesh devices market?

Some of the challenges faced by the hernia mesh devices market include the high cost of devices, the risk of complications associated with the use of mesh devices, and the availability of alternative treatments for hernia.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com