Global High-Altitude Pseudo Satellites Market Size, Share, Trends, & Growth Forecast Report Segmented, By Technology (Stratospheric Balloons, Airships and UAVs) & Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Forecast From 2025 to 2033

Global High-altitude Pseudo-Satellite (HAPS) Market Size

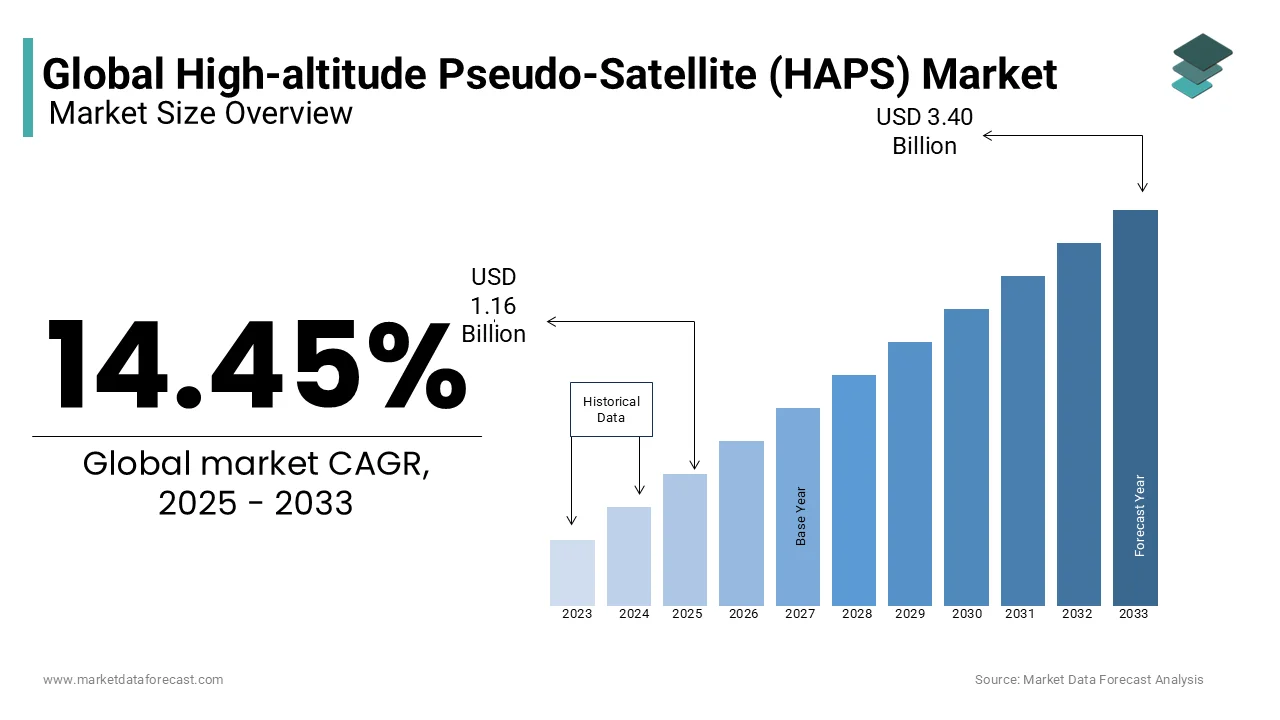

The size of the global high-altitude pseudo-satellite (HAPS) market was valued at USD 1.01 billion in 2024 and is anticipated to reach USD 1.16 billion by 2025 from USD 3.40 billion in 2033, growing at a CAGR of 14.45% during the forecast period from 2025 to 2033.

A high-altitude pseudo-satellite (HAPS) is an aircraft located at an altitude of more than 20 km for long-term flights calculated for decades in the stratosphere. This drone can be an airplane, an aircraft, or a balloon. HAPS can offer advantages and complementary applications at a relatively low cost compared to satellites, terrestrial infrastructure, and aircraft remote control systems.

MARKET DRIVERS

The performance and cost advantages of high-altitude pseudo-satellites over stationary satellites is primarily driving the global market growth.

The performance and cost benefits of HAPS for geostationary satellites will drive market growth during the forecast period. High-altitude pseudo satellite offers the same beneficial propagation features as the ability to provide potentially valuable broadband services efficiently. It can also be used as an alternative infrastructure suitable for long-term broadband access to fixed or mobile users. The high-altitude pseudo satellite platform has attracted considerable attention in the last two decades due to the potential to take advantage of the best aspects of terrestrial and satellite systems.

In addition, satellite communication services have many capacities and performance limitations in voice and video communication applications that HAPS eliminates. Also, a high-altitude pseudo satellite provides rapid deployment and flight control to meet changing communication needs, resulting in greater network flexibility and improved configuration. Therefore, performance and cost benefits for geostationary satellites will drive High-altitude pseudo satellites industry growth at an annual compound rate of more than 10% during the forecast period.

For High altitude pseudo-satellite (HAPS) market platforms such as unmanned aerial vehicles (UAVs), electric propulsion systems are integrated to increase the durability of the platform. This has led to a significant increase in R&D investments in the development of robust battery systems and high-density solar panels to improve the sustainability of the HAPS platform, making it more suitable for end-user adoption, such as telecommunications and emergency service providers.

MARKET RESTRAINTS

A high-altitude pseudo satellite is cheaper to manufacture and operate, but its durability limits the efficiency of such a platform. Also, factors such as the complexity of data management and spectrum management problems are hampering the HAPS market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.45% |

|

Segments Covered |

By Technology and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AUGUR-RosAeroSystems, Prismatic Ltd, Airbus SE, Astigan Ltd, Thales Group, Lockheed Martin Corporation, AeroVironment Inc and Loon LLC (Alphabet Inc.) |

SEGMENTAL ANALYSIS

By Technology Insights

The balloons segment was the dominant technology in the worldwide High-altitude pseudo-satellite market in 2023 and is anticipated to hold its domination in the global market during the forecast period owing to its high sustainability compared to its counterparts.

REGIONAL ANALYSIS

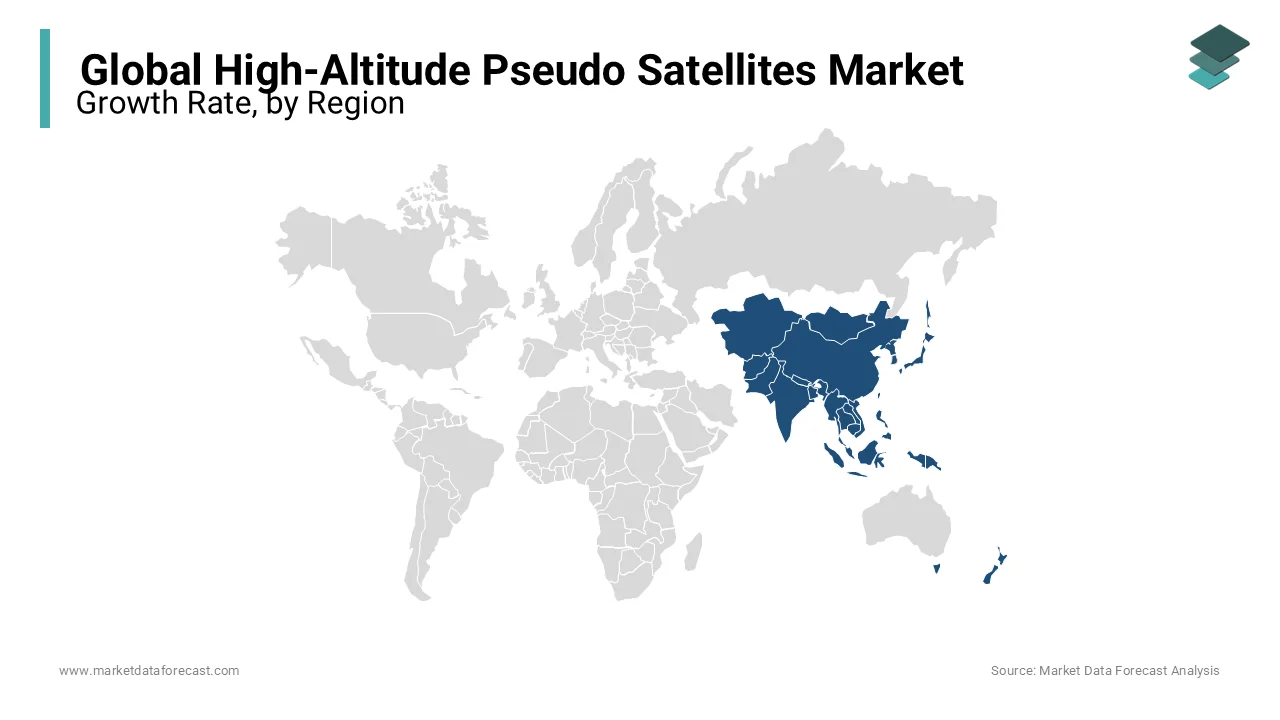

The adoption of High altitude pseudo-satellite (HAPS) market is quite high in developing countries in the Asia-Pacific and European regions because there is no significant infrastructure to guarantee communication services in remote areas. The High-altitude pseudo-satellite (HAPS) market platform is an essential tool for SAR missions (discovery and rescue), disaster relief, environmental monitoring, and precision agriculture.

Several governments, including the governments of Kenya and India, have allowed pre-HAPS tests to enable critical analysis of the viability of these systems in their countries. America Airlines has the largest high-altitude pseudo satellite market share in 2018 thanks to the mature and robust infrastructure of the region's aerospace industry. The United States will remain a market leader for the next five years. The APAC high-altitude pseudo satellite market has the smallest share in 2023 but is expected to register the most substantial growth rate during the forecast period.

KEY PLAYERS IN THE MARKET

AUGUR-RosAeroSystems, Prismatic Ltd, Airbus SE, Astigan Ltd, Thales Group, Lockheed Martin Corporation, AeroVironment Inc and Loon LLC (Alphabet Inc.) are some of the major players in the global high-altitude pseudo-satellite (HAPS) market.

RECENT HAPPENINGS IN THE MARKET

- In October 2017, Google distributed the Loon Project balloon to provide data services to residents of Puerto Rico who were affected by the hurricane.

- In November 2015, the Indian government approved the use of Loon balloons in the United States.

- Developed by Neah Power System in October 2015, Formira Hydro-On-Demand technology synthesizes hydrogen from liquid formic acid.

- Zephyr, the first drone that flies in the stratosphere, operates exclusively with solar energy instead of traditional weather and air traffic, using the sun's rays. HAPS a very similar satellite that can fly for months at a time, combining satellite altitude with the flexibility of UAVs.

MARKET SEGMENTATION

This research report on the global high-altitude pseudo-satellite (HAPS) market has been segmented and sub-segmented based on the following categories.

By Technology

- Stratospheric Balloons

- Airships

- UAVs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key applications of HAPS in the global market?

The key applications of HAPS include telecommunications (providing broadband connectivity in remote areas), disaster management (offering real-time surveillance and communication during emergencies), environmental monitoring (tracking climate change and natural resources), and defense (intelligence, surveillance, and reconnaissance).

What are the major challenges facing the HAPS market globally?

Major challenges include regulatory hurdles, high initial investment costs, technical challenges related to prolonged operation in the stratosphere, and competition from other technologies such as Low Earth Orbit (LEO) satellites and traditional geostationary satellites.

How do HAPS compare with traditional satellites in terms of cost and functionality?

HAPS generally offer a lower-cost alternative to traditional satellites, particularly for applications requiring regional coverage and flexibility. While traditional satellites incur high launch costs and have fixed orbits, HAPS can be deployed and repositioned more easily and affordably. However, HAPS are limited by their endurance and payload capacity compared to satellites, which can provide global coverage and support larger payloads.

What advancements in technology are driving the HAPS market forward?

Advancements driving the HAPS market include improvements in solar panel efficiency, lightweight materials, autonomous flight systems, and high-altitude endurance capabilities. Innovations in battery storage and energy management systems also play a critical role in extending the operational lifespan of HAPS.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com